California Visiting Professor Agreement - Self-Employed Independent Contractor

Description

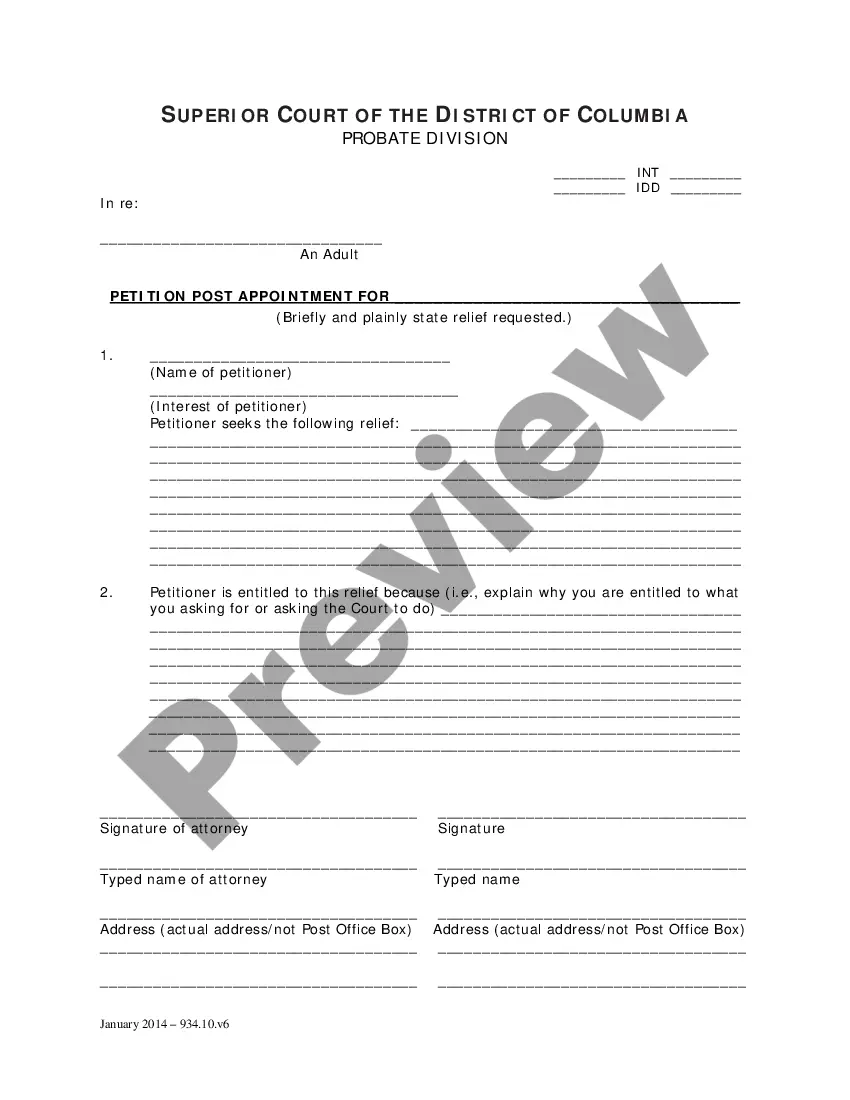

How to fill out Visiting Professor Agreement - Self-Employed Independent Contractor?

You might spend hours online looking for the legal document template that satisfies the state and federal requirements you need.

US Legal Forms offers a vast selection of legal documents that are verified by professionals.

It is easy to obtain or print the California Visiting Professor Agreement - Self-Employed Independent Contractor from the platform.

If available, utilize the Preview button to view the document template as well. If you wish to find another version of the form, use the Search field to locate the template that meets your needs and requirements. Once you have found the template you want, click Purchase now to proceed. Choose the payment plan you prefer, enter your details, and sign up for an account on US Legal Forms. Complete the transaction. You can use your credit card or PayPal account to purchase the legal document. Select the format of the document and download it to your device. Make adjustments to your document if necessary. You can complete, modify, sign, and print the California Visiting Professor Agreement - Self-Employed Independent Contractor. Obtain and print numerous document templates using the US Legal Forms website, which offers the largest variety of legal forms. Utilize professional and state-specific templates to address your business or personal needs.

- If you already have a US Legal Forms account, you can Log In and click the Obtain button.

- Next, you can complete, modify, print, or sign the California Visiting Professor Agreement - Self-Employed Independent Contractor.

- Every legal document template you acquire is yours indefinitely.

- To retrieve another copy of any purchased form, go to the My documents tab and click the corresponding button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure you have chosen the correct document template for your desired area/city.

- Review the form details to confirm you have selected the right one.

Form popularity

FAQ

The new freelance law in California, set to take effect in 2025, introduces further regulations for freelance workers. This law outlines how independent contractors are compensated and the rights they hold. For those in academia, utilizing the California Visiting Professor Agreement - Self-Employed Independent Contractor can help ensure compliance with the emerging frameworks.

AB5 redefines the criteria for classifying workers as independent contractors in California. It requires that individuals meet specific standards to be classified as independent, significantly impacting many sectors, including education. Consulting a California Visiting Professor Agreement - Self-Employed Independent Contractor can guide you in understanding your rights and obligations under AB5.

California has enacted laws that define the classification of independent contractors more strictly. These laws aim to protect workers by preventing misclassification as independent contractors when they should be treated as employees. Understanding the California Visiting Professor Agreement - Self-Employed Independent Contractor can help you navigate these regulations.

Legal requirements for independent contractors include providing a written agreement and fulfilling tax obligations. Independent contractors should also comply with state regulations, such as those outlined in the California Visiting Professor Agreement - Self-Employed Independent Contractor. This agreement helps ensure that you meet all requirements to operate legally in California.

Filling out an independent contractor agreement involves specifying the terms of the work arrangement. Typically, you will include details such as the scope of work, payment terms, and duration. For those using a California Visiting Professor Agreement - Self-Employed Independent Contractor, ensure that it clearly outlines your responsibilities and compensation.

The new federal rule clarifies the classification of independent contractors. It aims to ensure that workers are correctly determined as employees or independent contractors based on their actual work conditions. To navigate these regulations, reviewing a California Visiting Professor Agreement - Self-Employed Independent Contractor can be beneficial.

Yes, adjunct professors often work as independent contractors under a California Visiting Professor Agreement - Self-Employed Independent Contractor. This arrangement allows universities to hire educators on a flexible basis. These professors typically determine their schedule and teaching methods, providing a level of autonomy not found in traditional roles.

Yes, physicians can operate as independent contractors in California, typically under specific contractual agreements. The California Visiting Professor Agreement - Self-Employed Independent Contractor can serve as a model when considering such arrangements for medical teaching roles. This contractor status allows physicians more autonomy in their work. However, it's essential to ensure compliance with state regulations to avoid misclassification issues.

In California, independent contractors are not classified as employees, and they do not receive employee benefits. The California Visiting Professor Agreement - Self-Employed Independent Contractor clearly outlines this relationship, helping to define responsibilities and tax obligations. It's important for contractors to understand their rights and limitations under state law. For more information, using resources like uslegalforms can provide clarity on your situation.

Professors can be classified as either employees or independent contractors, depending on their agreements with the educational institution. The California Visiting Professor Agreement - Self-Employed Independent Contractor is often utilized for independent professorships, allowing more flexibility in work arrangements. This distinction is crucial for tax implications and benefits eligibility. If you're uncertain about your status, consider reviewing your agreement or consulting with a legal expert.