California Partnership Agreement

Description

How to fill out Partnership Agreement?

Are you currently in a place that you will need paperwork for possibly organization or person functions almost every day time? There are a variety of lawful papers themes accessible on the Internet, but discovering versions you can rely on isn`t straightforward. US Legal Forms gives a huge number of kind themes, like the California Partnership Agreement, which are published to satisfy state and federal specifications.

When you are currently informed about US Legal Forms internet site and get a free account, merely log in. Next, you can down load the California Partnership Agreement design.

Should you not have an account and wish to start using US Legal Forms, follow these steps:

- Obtain the kind you want and ensure it is to the correct area/state.

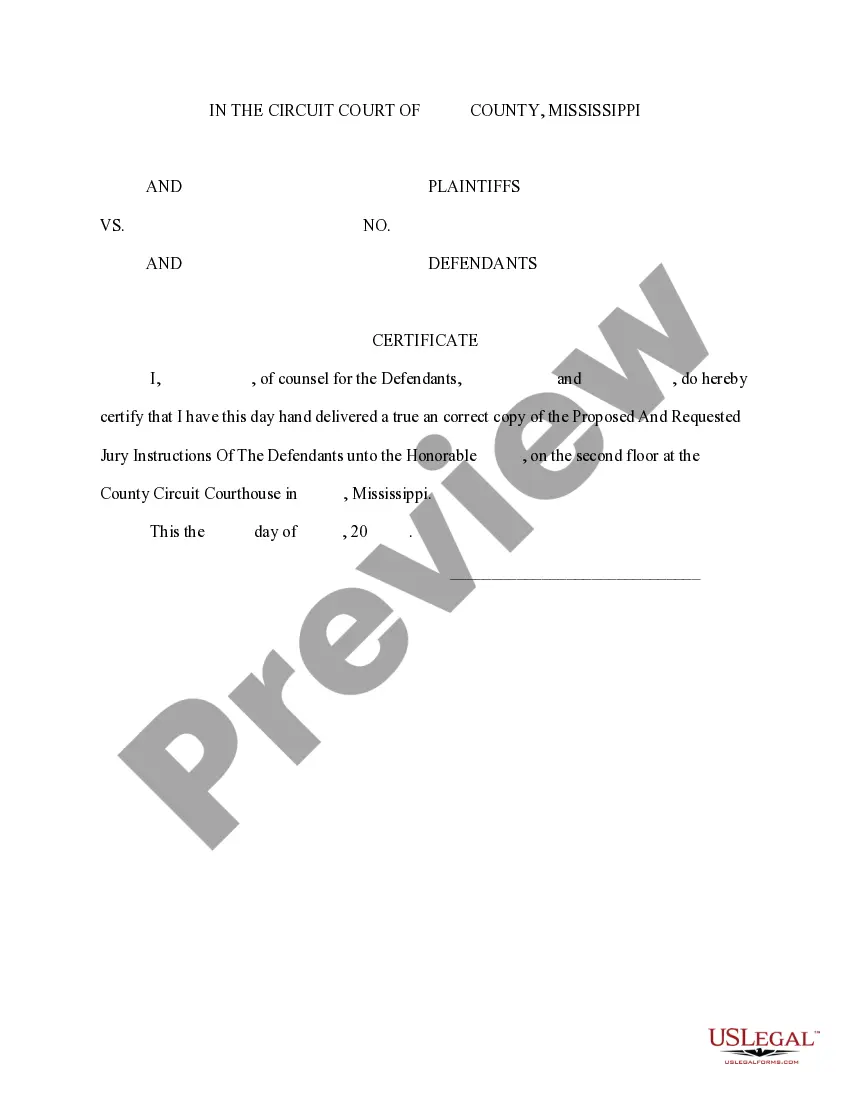

- Utilize the Review switch to examine the shape.

- See the explanation to actually have chosen the correct kind.

- If the kind isn`t what you are looking for, take advantage of the Lookup discipline to find the kind that meets your needs and specifications.

- Once you obtain the correct kind, simply click Get now.

- Select the rates prepare you want, submit the required details to produce your account, and pay for your order using your PayPal or charge card.

- Choose a hassle-free paper structure and down load your duplicate.

Find each of the papers themes you might have bought in the My Forms food list. You can aquire a extra duplicate of California Partnership Agreement whenever, if required. Just click the essential kind to down load or produce the papers design.

Use US Legal Forms, by far the most substantial assortment of lawful kinds, to save time as well as steer clear of mistakes. The support gives appropriately produced lawful papers themes which can be used for an array of functions. Generate a free account on US Legal Forms and begin making your life a little easier.

Form popularity

FAQ

How to Write a Business Partnership Agreement name of the partnership. goals of the partnership. duration of the partnership. contribution amounts of each partner (cash, property, services, future contributions) ownership interests of each partner (assets) management roles and terms of authority of each partner. How to Write a Business Partnership Agreement - Rocket Lawyer rocketlawyer.com ? legal-guide ? how-to-wr... rocketlawyer.com ? legal-guide ? how-to-wr...

Your partnership must file a Partnership Return of Income (Form 565). Each partner will also need to file a Partner's Share of Income, Deductions, Credits, etc. (Schedule K-1 Form 565). Because a partnership is a pass-through entity, each partner is responsible for paying their share of the partnership taxes. How to Start a Partnership in California - Nolo Nolo ? legal-encyclopedia ? how-esta... Nolo ? legal-encyclopedia ? how-esta...

A partnership (including REMICs classified as partnerships) that engages in a trade or business in California or has income from a California source must file Form 565.

Here are the five steps you'll need to follow to file business taxes for your partnership. Prepare Form 1065, U.S. Return of Partnership Income. ... Prepare Schedule K-1. ... File Form 1065 and copies of the K-1 Forms. ... File state tax returns. ... File personal tax returns.

A partnership must file an annual information return to report the income, deductions, gains, losses, etc., from its operations, but it does not pay income tax. Instead, it "passes through" profits or losses to its partners.

Each partner in the partnership must lodge their individual tax return to declare their share of the partnership's net income or loss. The partner needs to do this whether or not they actually receive their share of the net income or loss. However, a partnership must lodge a partnership tax return to report its: income.

How to Write a Partnership Agreement Outline Partnership Purpose. ... Document Partner's Name and Business Address. ... Document Ownership Interest and Partner Shares. ... Outline Partner Responsibilities and Liabilities. ... Consult With a Lawyer. How to Write a Partnership Agreement (Step-by-Step Guide) - OnBoard onboardmeetings.com ? blog ? partnership-... onboardmeetings.com ? blog ? partnership-...

General Partnership (GP) Profits are taxed as personal income for the partners. To register a GP at the state level, a Statement of Partnership Authority (Form GP?1) must be filed with the California Secretary of State's office. Note: Registering a GP at the state level is optional. Starting a Business ? Entity Types - California Secretary of State ca.gov ? business-entities ? types ca.gov ? business-entities ? types