California Accredited Investor Representation Letter

Description

To become an accredited investor the (SEC) requires certain wealth, income or knowledge requirements. The investor must fall into one of three categories. Firms selling unregistered securities must put investors through their own screening process to determine if investors can be considered an accredited investor.

The Verifying Individual or Entity should take reasonable steps to verify and determined that an Investor is an "accredited investor" as such term is defined in Rule 501 of the Securities Act, and hereby provides written confirmation. This letter serves to help the Entity determine status."

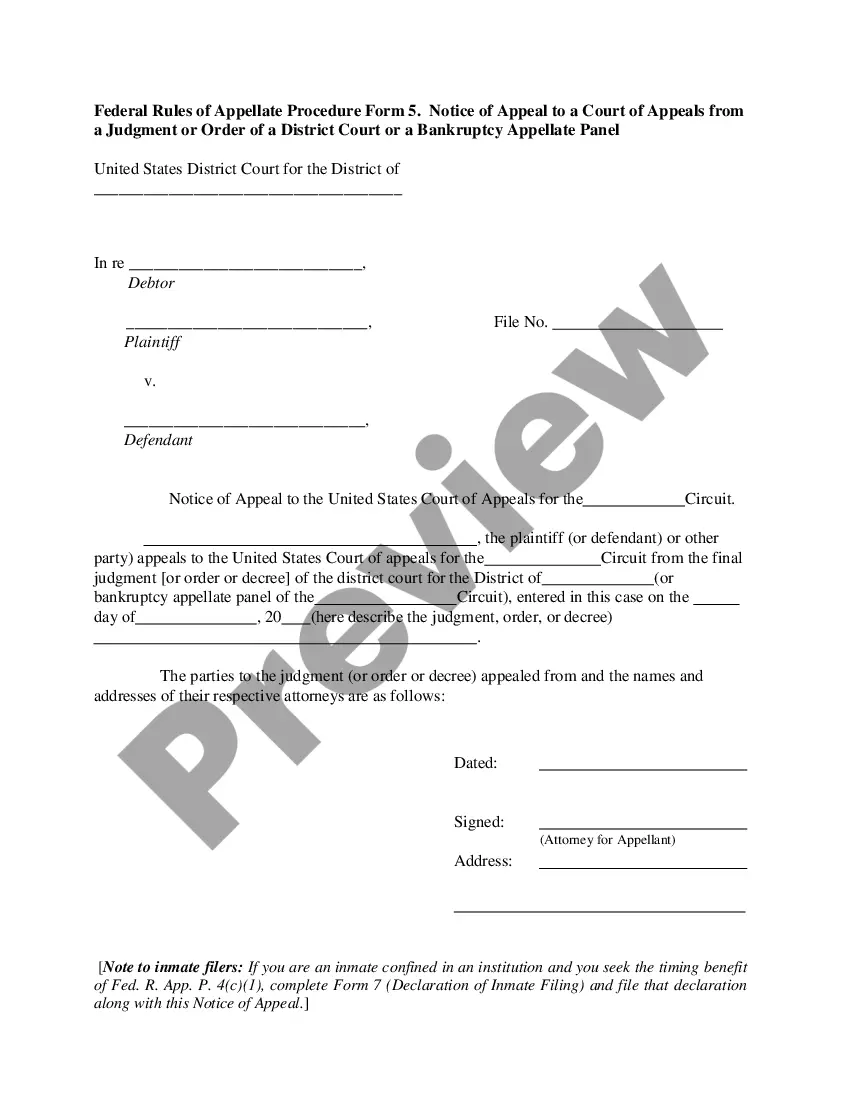

How to fill out Accredited Investor Representation Letter?

If you want to complete, acquire, or print authorized papers templates, use US Legal Forms, the greatest assortment of authorized varieties, that can be found on-line. Take advantage of the site`s basic and handy search to obtain the paperwork you want. A variety of templates for company and personal uses are categorized by classes and suggests, or keywords. Use US Legal Forms to obtain the California Accredited Investor Representation Letter with a few clicks.

Should you be already a US Legal Forms client, log in to your profile and click the Download key to get the California Accredited Investor Representation Letter. Also you can gain access to varieties you in the past downloaded from the My Forms tab of your own profile.

If you use US Legal Forms for the first time, follow the instructions under:

- Step 1. Be sure you have chosen the form for the appropriate town/nation.

- Step 2. Use the Preview choice to look over the form`s content. Don`t neglect to learn the explanation.

- Step 3. Should you be unhappy using the develop, make use of the Lookup field near the top of the display screen to get other models from the authorized develop web template.

- Step 4. When you have identified the form you want, select the Buy now key. Pick the prices plan you choose and add your qualifications to register for an profile.

- Step 5. Procedure the deal. You can utilize your Мisa or Ьastercard or PayPal profile to perform the deal.

- Step 6. Find the formatting from the authorized develop and acquire it on your system.

- Step 7. Full, change and print or indication the California Accredited Investor Representation Letter.

Every single authorized papers web template you get is your own property forever. You have acces to each and every develop you downloaded in your acccount. Go through the My Forms segment and choose a develop to print or acquire once again.

Contend and acquire, and print the California Accredited Investor Representation Letter with US Legal Forms. There are millions of specialist and express-specific varieties you may use to your company or personal needs.

Form popularity

FAQ

Hear this out loud PauseA broker-dealer registered with the Securities and Exchange Commission. An investment advisor registered with the Securities and Exchange Commission. A licensed attorney who is in good standing under the laws of the jurisdictions in which he or she is admitted to practice law.

To confirm their status as an accredited investor, an investor can submit official documents for net worth and income verification, including: Tax returns. Pay stubs. Financial statements. IRS forms. Credit report. Brokerage statements. Tax assessments.

Hear this out loud PauseYou can provide a letter from your own licensed CPA, licensed attorney, or registered wealth advisor attesting to your status as an accredited investor. The uploaded letter must: Be signed and dated by a qualified third-party; AND.

To qualify as accredited, an individual investor must have a net worth (excluding his or her primary residence) of at least $1 million dollars or an annual income of over $200,000 (or over $300,000 in joint income with a spouse) for the two most recently completed years with a reasonable expectation of achieving the ...

Hear this out loud PauseCPA Accredited Investor Letter The letter proves that you have the financial resources to become accredited. Additionally, these letters can serve as verification of your accreditation themselves. Also, these CPA letters are enough to prove your accreditation for most private real estate syndications and funds.

The simplest way to attain ?accredited investor? status is to ask for a 3rd party verification letter from a registered broker dealer, an attorney or a certified public accountant.

Individuals who want to become accredited investors must fall into one of three categories: have a net worth exceeding $1 million on your own or with a spouse or its equivalent; have earned an income surpassing $200,000 ($300,000 if combined with a spouse or its equivalent) during the last two years and prove an ...