California Share Exchange Agreement between ZC Acquisition Corp., Zefer Corp. and the stockholders of Zefer Corp.

Description

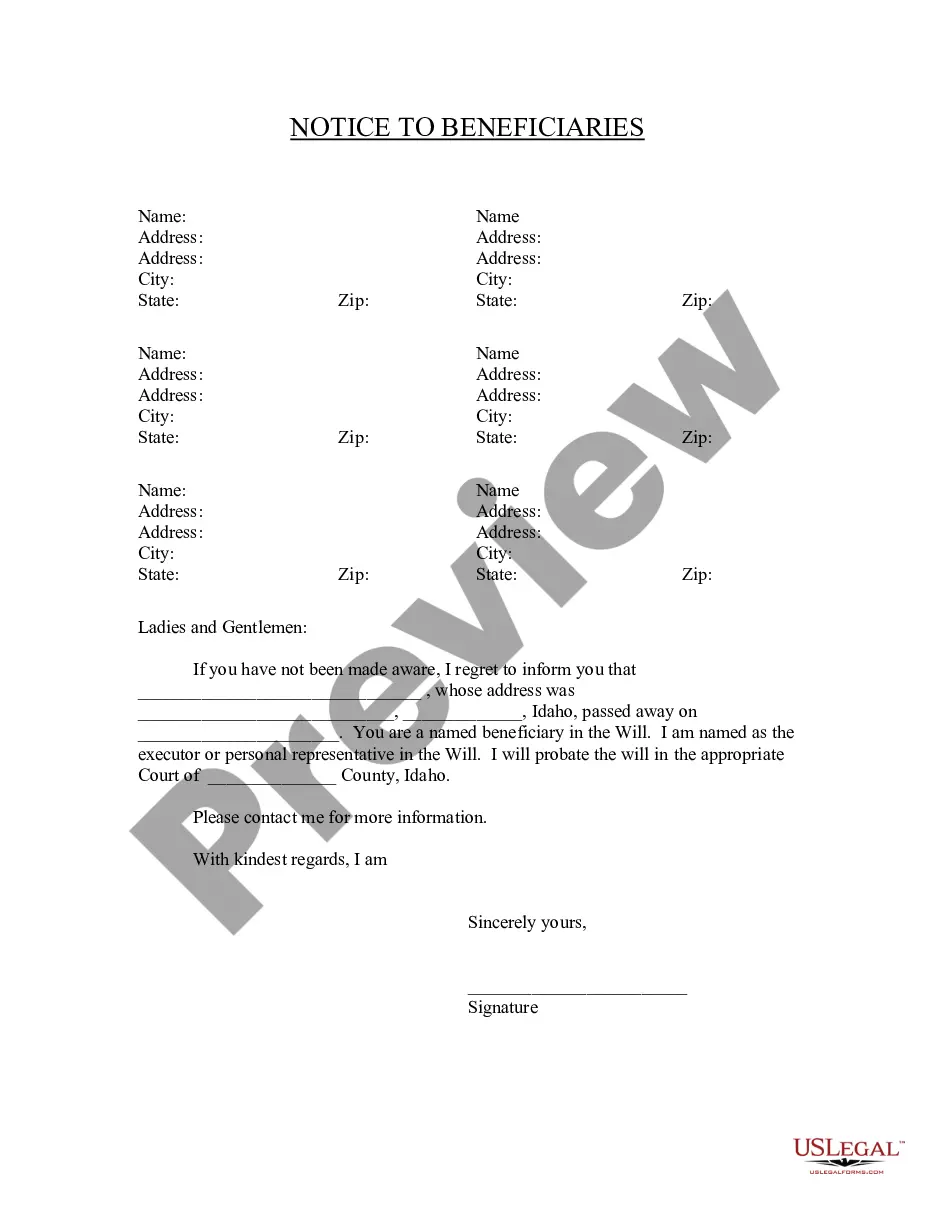

How to fill out Share Exchange Agreement Between ZC Acquisition Corp., Zefer Corp. And The Stockholders Of Zefer Corp.?

Are you in a placement where you need to have paperwork for possibly company or individual functions virtually every working day? There are a variety of authorized papers templates available on the net, but discovering types you can rely on isn`t simple. US Legal Forms provides thousands of form templates, just like the California Share Exchange Agreement between ZC Acquisition Corp., Zefer Corp. and the stockholders of Zefer Corp., which are published to satisfy federal and state specifications.

Should you be previously knowledgeable about US Legal Forms website and possess your account, simply log in. After that, it is possible to obtain the California Share Exchange Agreement between ZC Acquisition Corp., Zefer Corp. and the stockholders of Zefer Corp. template.

Unless you offer an profile and need to start using US Legal Forms, adopt these measures:

- Obtain the form you need and ensure it is to the appropriate metropolis/county.

- Take advantage of the Preview switch to review the shape.

- See the information to actually have selected the correct form.

- In case the form isn`t what you are looking for, make use of the Search discipline to get the form that suits you and specifications.

- Whenever you obtain the appropriate form, just click Acquire now.

- Pick the costs prepare you desire, fill out the necessary details to generate your money, and pay money for the transaction using your PayPal or Visa or Mastercard.

- Choose a convenient file formatting and obtain your version.

Find all the papers templates you possess purchased in the My Forms food list. You can obtain a further version of California Share Exchange Agreement between ZC Acquisition Corp., Zefer Corp. and the stockholders of Zefer Corp. at any time, if required. Just click on the necessary form to obtain or printing the papers template.

Use US Legal Forms, the most substantial collection of authorized varieties, to save time as well as prevent errors. The service provides skillfully made authorized papers templates that can be used for an array of functions. Make your account on US Legal Forms and commence making your lifestyle easier.

Form popularity

FAQ

A share for share exchange occurs where a company (company B) acquires the shares in another company (company A) and in exchange issues its own shares to the shareholders of company A.

It is possible for shareholders to swap shares and not trigger any tax charges. Share for share exchanges are used for a wide variety of commercial reorganisations and mergers and acquisitions. It is possible for shareholders to swap shares and not trigger any tax charges.

A common example of this is where a new holding company B is put on top of existing company A. Shareholders give their shares in the old company A to company B in exchange for shares in company B.

A share for share exchange involves the transfer of shares in an existing company to the shareholders of a new holding company. The shareholders can be the same in the old and new companies or new shareholders can be introduced.

For the clearance to be valid the application must be made and dealt with before the new shares or debentures are issued. The information provided in support of the application must fully and accurately disclose all the relevant facts. If it does not the clearance may be void.

By Practical Law Corporate. This standard document is a short form agreement intended for use in an intra-group share purchase transaction where the consideration is to be satisfied by an issue of shares by the buyer to the seller.