California Deposit Agreement

Description

How to fill out Deposit Agreement?

Are you within a position in which you require paperwork for sometimes business or person purposes nearly every day time? There are plenty of authorized papers layouts available online, but finding versions you can trust isn`t simple. US Legal Forms gives a large number of form layouts, just like the California Deposit Agreement, that happen to be created to satisfy state and federal requirements.

Should you be already knowledgeable about US Legal Forms site and also have a merchant account, merely log in. Next, you may download the California Deposit Agreement template.

Should you not come with an account and want to begin to use US Legal Forms, follow these steps:

- Get the form you want and make sure it is for the appropriate area/state.

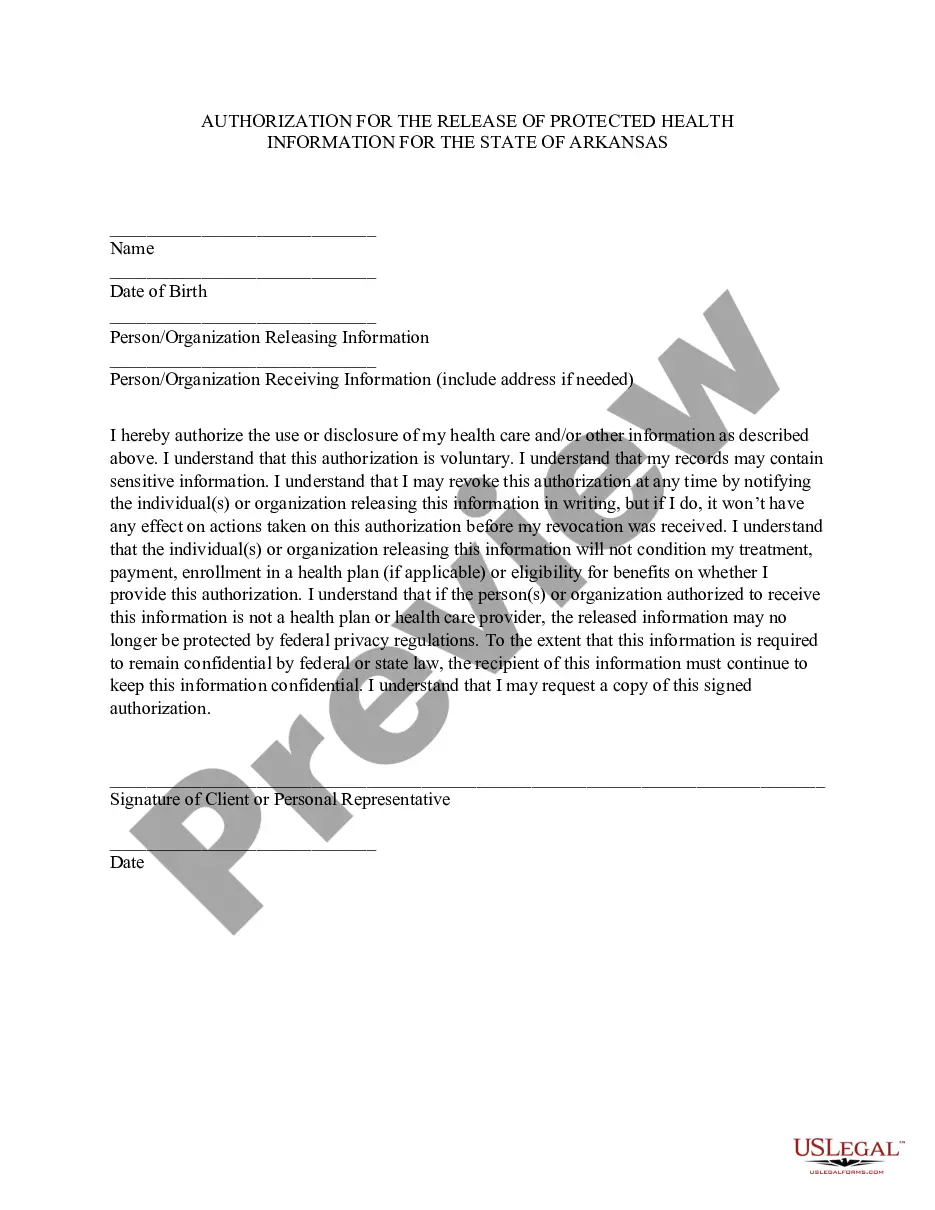

- Utilize the Review button to check the shape.

- Browse the information to actually have chosen the correct form.

- If the form isn`t what you are searching for, make use of the Research industry to obtain the form that meets your needs and requirements.

- Once you find the appropriate form, click Acquire now.

- Choose the costs plan you need, fill in the specified info to generate your account, and pay for the transaction with your PayPal or bank card.

- Select a convenient file file format and download your backup.

Locate all the papers layouts you have purchased in the My Forms food selection. You can get a extra backup of California Deposit Agreement anytime, if possible. Just go through the essential form to download or produce the papers template.

Use US Legal Forms, by far the most substantial collection of authorized forms, to save lots of some time and prevent errors. The support gives skillfully manufactured authorized papers layouts which can be used for a variety of purposes. Generate a merchant account on US Legal Forms and commence generating your life a little easier.

Form popularity

FAQ

Even if the landlord spent money ?deep cleaning? the place [whatever that means], if you left it clean, no deduction is permitted. The expenses of cleaning must also be reasonable. Generally, a professional cleaning company can clean an empty unit for $200, including shampooing the carpet.

Based on these, it is the landlord's responsibility to clean the carpets in a rental, as long as the rug only suffers from normal wear-and-tear. However, if the damage is deemed to be the result of a tenant's negligence, the tenant must pay for the cleaning of the carpet.

When Can a Landlord Charge for Carpet Cleaning? A landlord may only withhold from a tenant's security deposit for carpet cleaning where there is "unusual damage" caused by "tenant abuse" ATCP 134.06(3)(c).

Gavin Newsom signed Assembly Bill 12 into law, which states that security deposits can't be any larger than one month's rent, on Oct. 11. The law is slated to take effect on July 1, 2024.

A landlord can only deduct certain items from a security deposit. The landlord can deduct for: Cleaning the rental unit when a tenant moves out, but only to make it as clean as when the tenant first moved in. Repairing damage, other than normal wear and tear, caused by the tenant and the tenant's guests.

In California, tenants enjoy specific rights regarding carpet maintenance. They are not liable for ordinary wear and tear on carpets, which encompasses the natural deterioration of carpet due to regular usage, aging, and furniture impressions.

A new California law will soon change how much landlords can charge renters for their security deposit. Among the many bills Gov. Gavin Newsom recently signed is Assembly Bill 12. It states that security deposits can be no more than one month's rent.

A landlord can only deduct certain items from a security deposit. The landlord can deduct for: Cleaning the rental unit when a tenant moves out, but only to make it as clean as when the tenant first moved in. Repairing damage, other than normal wear and tear, caused by the tenant and the tenant's guests.