California Plan of Merger between Berkshire Energy Resources, Energy East Corporation and Mountain Merger, LLC

Description

How to fill out Plan Of Merger Between Berkshire Energy Resources, Energy East Corporation And Mountain Merger, LLC?

Discovering the right legitimate file web template can be a have a problem. Of course, there are tons of themes available on the Internet, but how will you find the legitimate develop you need? Use the US Legal Forms site. The support delivers a large number of themes, including the California Plan of Merger between Berkshire Energy Resources, Energy East Corporation and Mountain Merger, LLC, which can be used for organization and private needs. Each of the kinds are checked by pros and fulfill federal and state specifications.

If you are currently registered, log in in your account and click the Download button to get the California Plan of Merger between Berkshire Energy Resources, Energy East Corporation and Mountain Merger, LLC. Utilize your account to look throughout the legitimate kinds you possess bought earlier. Go to the My Forms tab of your account and get another duplicate in the file you need.

If you are a fresh user of US Legal Forms, listed below are straightforward instructions so that you can comply with:

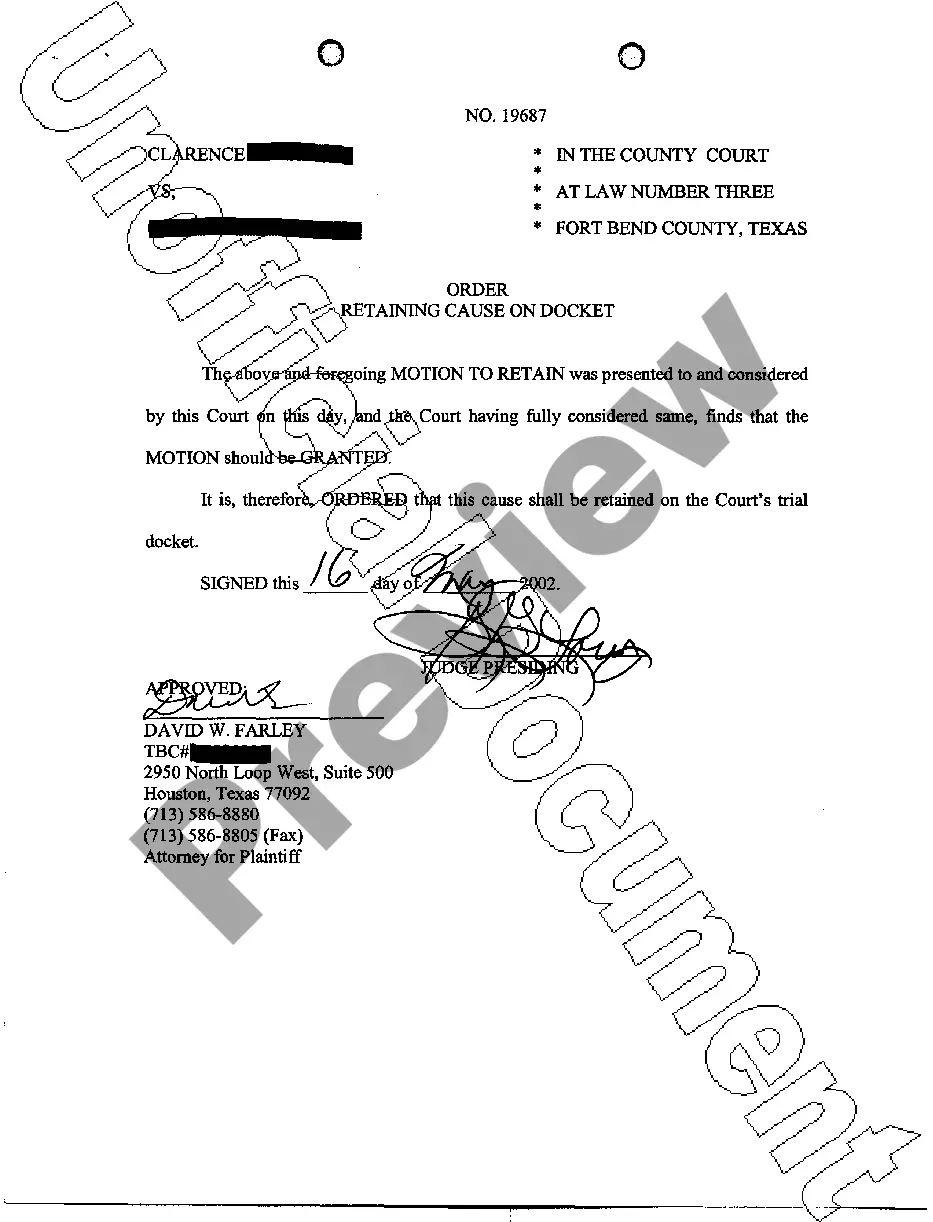

- Initial, be sure you have chosen the correct develop for your personal town/county. It is possible to check out the form using the Review button and study the form description to guarantee it will be the best for you.

- In the event the develop fails to fulfill your expectations, use the Seach area to obtain the correct develop.

- When you are certain that the form would work, go through the Acquire now button to get the develop.

- Opt for the rates plan you want and enter in the necessary information and facts. Design your account and purchase your order utilizing your PayPal account or Visa or Mastercard.

- Choose the document format and down load the legitimate file web template in your system.

- Total, revise and print out and indicator the received California Plan of Merger between Berkshire Energy Resources, Energy East Corporation and Mountain Merger, LLC.

US Legal Forms is definitely the biggest collection of legitimate kinds that you can discover numerous file themes. Use the service to down load expertly-produced files that comply with condition specifications.