California Joint Filing of Rule 13d-1(f)(1) Agreement

Description

How to fill out Joint Filing Of Rule 13d-1(f)(1) Agreement?

Are you currently within a position in which you will need papers for both enterprise or person reasons just about every working day? There are a lot of lawful file layouts accessible on the Internet, but getting kinds you can depend on isn`t effortless. US Legal Forms offers a huge number of develop layouts, much like the California Joint Filing of Rule 13d-1(f)(1) Agreement, that are created to fulfill federal and state requirements.

Should you be currently acquainted with US Legal Forms site and have your account, basically log in. Following that, you are able to acquire the California Joint Filing of Rule 13d-1(f)(1) Agreement format.

Unless you provide an bank account and need to begin using US Legal Forms, abide by these steps:

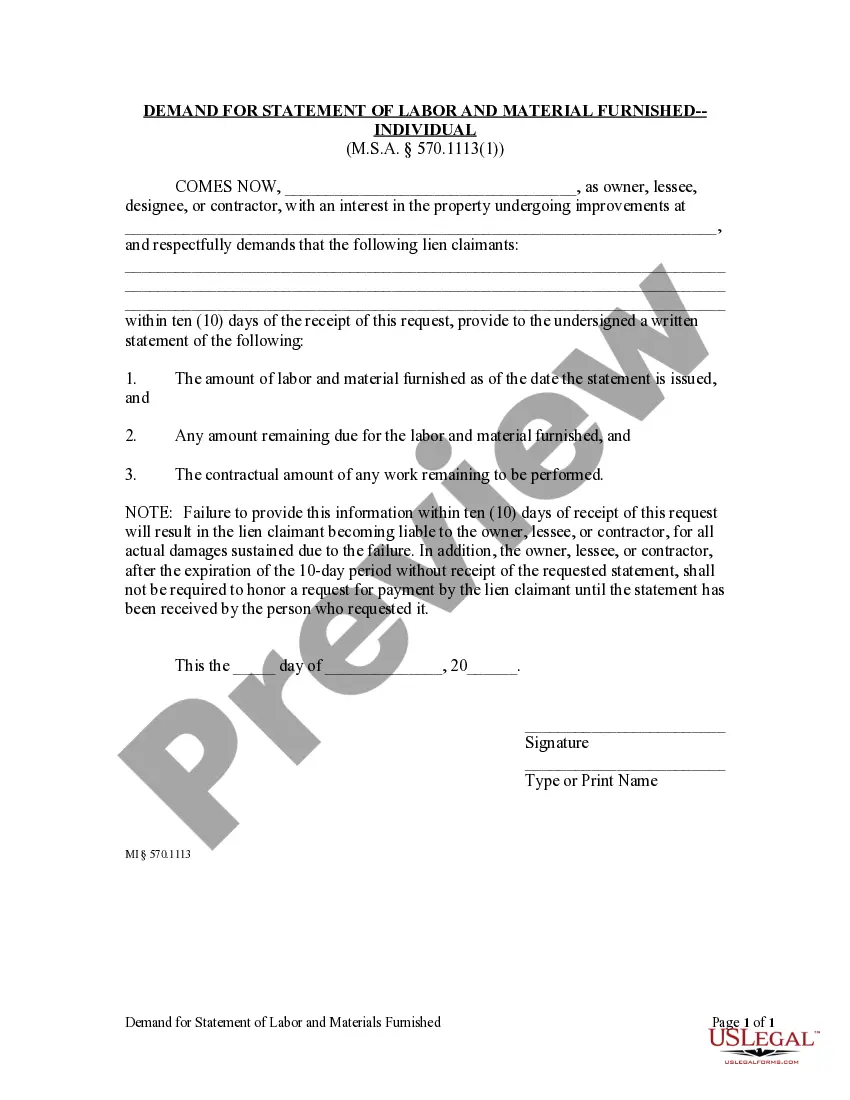

- Find the develop you require and make sure it is for the correct town/region.

- Make use of the Review switch to analyze the shape.

- Look at the outline to ensure that you have chosen the right develop.

- When the develop isn`t what you`re searching for, utilize the Look for discipline to discover the develop that suits you and requirements.

- Once you discover the correct develop, just click Buy now.

- Choose the rates program you desire, submit the desired details to create your money, and pay for the transaction using your PayPal or Visa or Mastercard.

- Choose a hassle-free file formatting and acquire your copy.

Discover all of the file layouts you possess bought in the My Forms food selection. You can aquire a further copy of California Joint Filing of Rule 13d-1(f)(1) Agreement any time, if needed. Just select the essential develop to acquire or print out the file format.

Use US Legal Forms, by far the most comprehensive collection of lawful forms, in order to save some time and stay away from errors. The service offers expertly created lawful file layouts that can be used for an array of reasons. Make your account on US Legal Forms and begin producing your life a little easier.

Form popularity

FAQ

Joint filings are typically used by groups of affiliated stockholders such as venture capital funds and their general partners and managing entities, but can be used by unrelated stockholders as well. An agreement to file jointly can apply to more than one filing.

Schedule 13G is a shorter version of Schedule 13D with fewer reporting requirements. Schedule 13G can be filed in lieu of the SEC Schedule 13D form as long as the filer meets one of several exemptions.

An investor with control intent must file Schedule 13D, while ?Exempt Investors? and investors without a control intent, such as ?Qualified Institutional Investors? and ?Passive Investors,? file Schedule 13G.

Form 13Ds are similar to 13Fs but are more stringent; an investor with a large stake in a company must report all changes in that position within just 10 days of any action, meaning that it's much easier for outsiders to see what's happening much closer to real time than in the case of a 13F.

Schedule 13D is a form that must be filed with the U.S. Securities and Exchange Commission (SEC) when a person or group acquires more than 5% of a voting class of a company's equity shares. Schedule 13D must be filed within 10 days of the filer reaching a 5% stake.