California Stock Option Grants and Exercises and Fiscal Year-End Values

Description

How to fill out Stock Option Grants And Exercises And Fiscal Year-End Values?

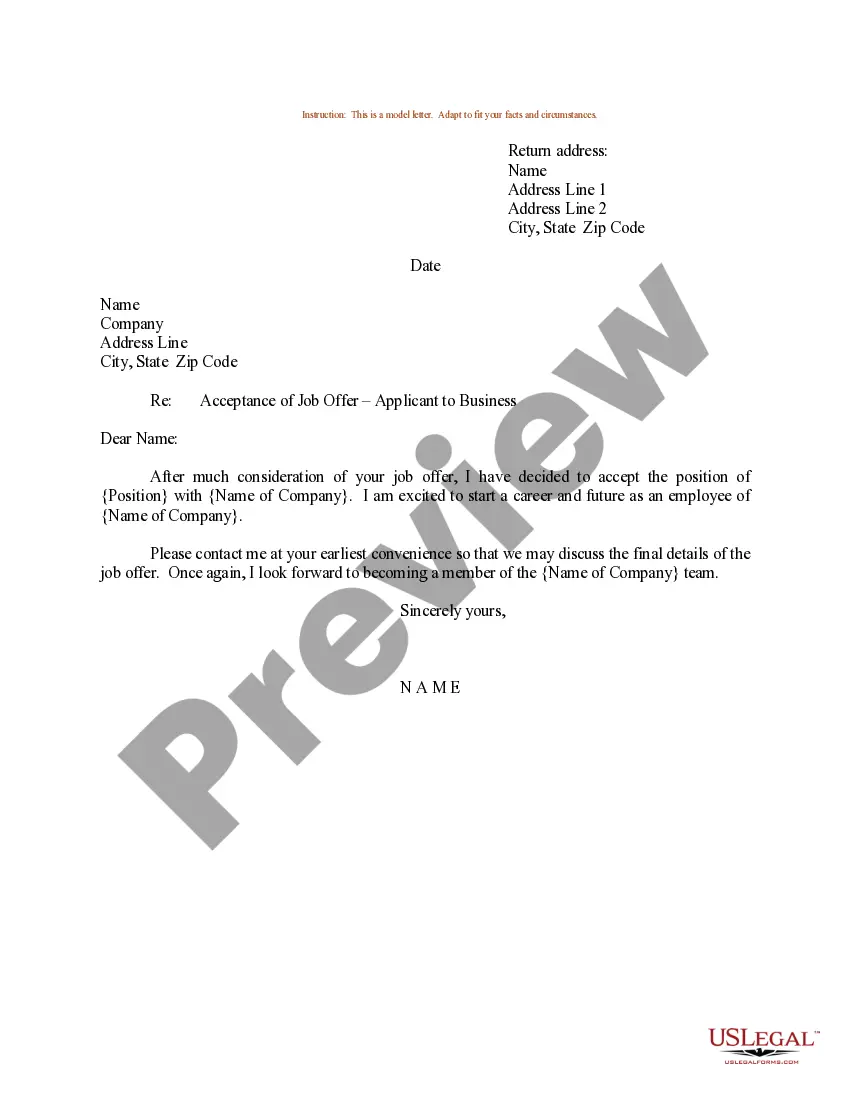

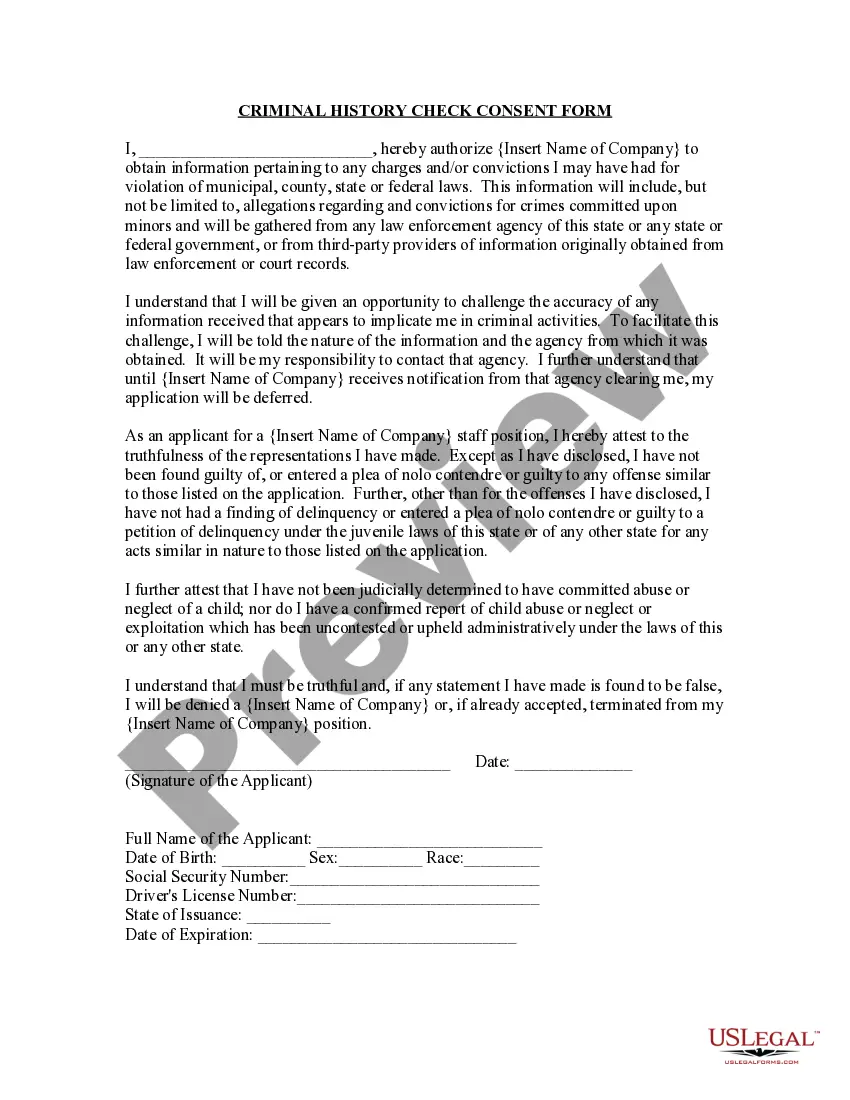

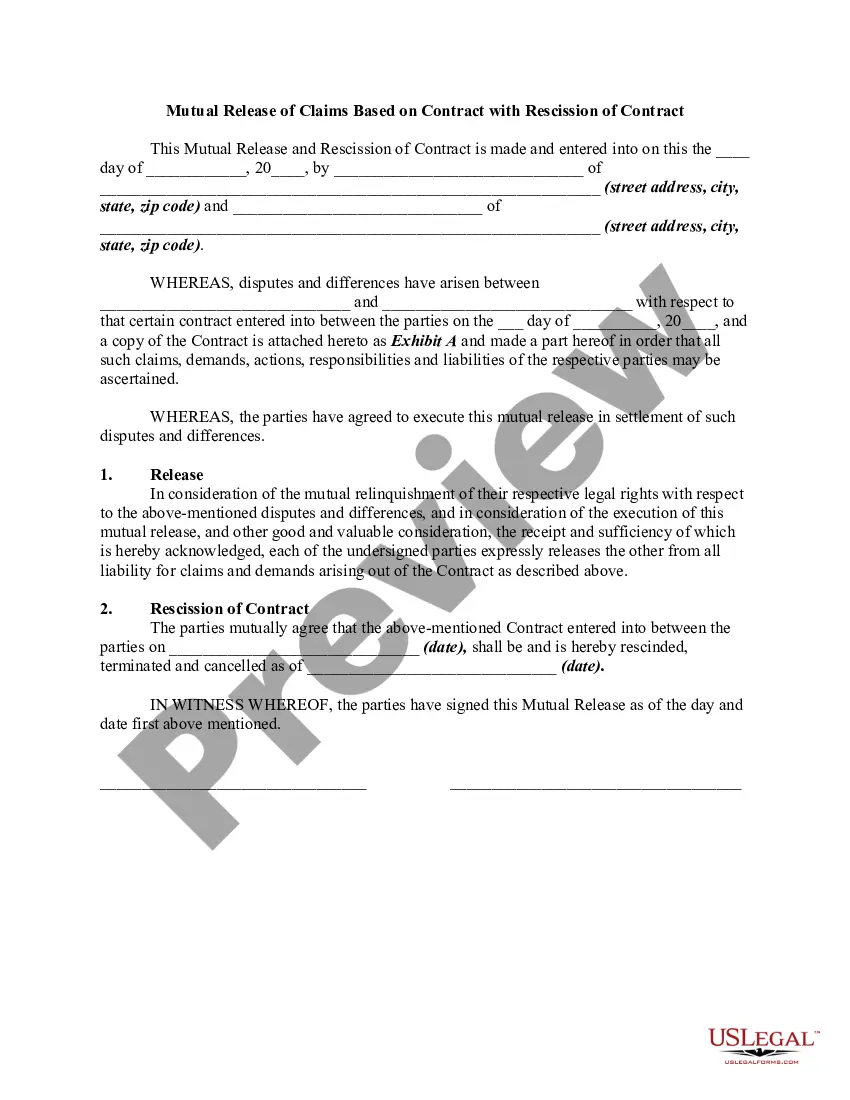

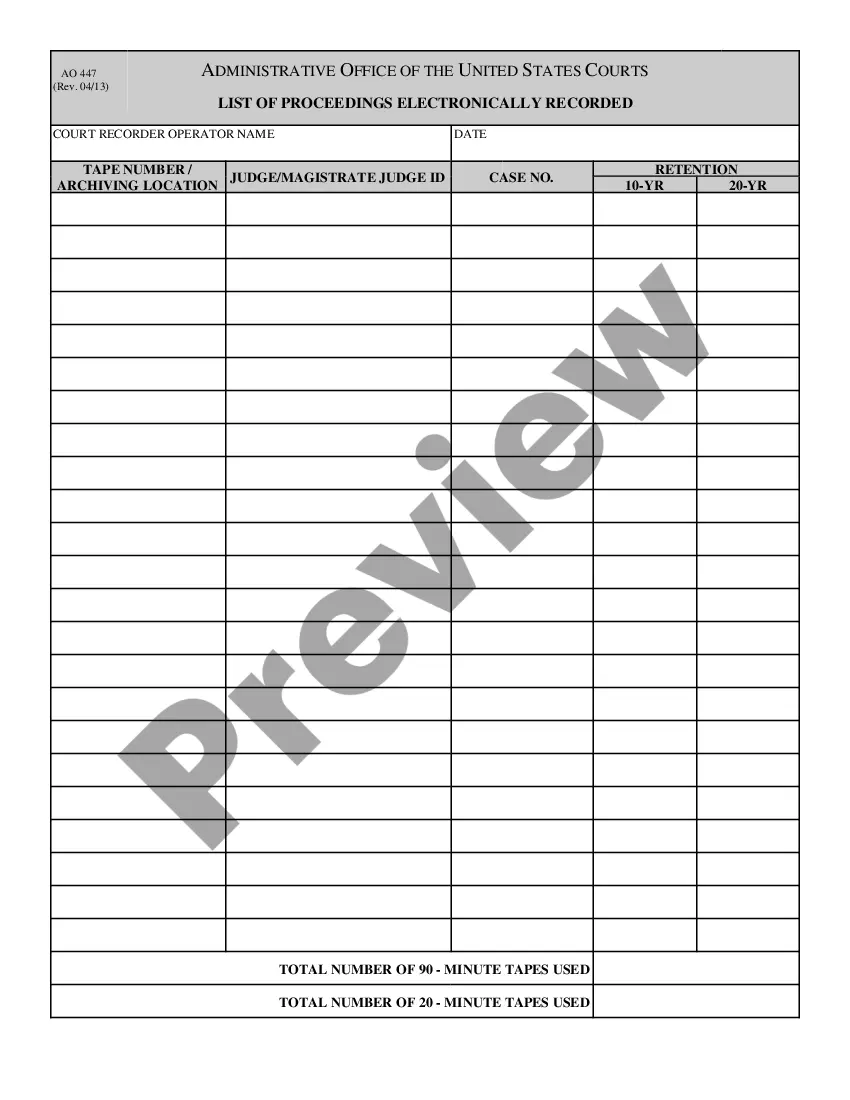

Choosing the best legal papers design could be a have a problem. Obviously, there are plenty of layouts available on the net, but how do you find the legal type you will need? Make use of the US Legal Forms internet site. The support delivers thousands of layouts, such as the California Stock Option Grants and Exercises and Fiscal Year-End Values, that can be used for organization and personal demands. All the forms are checked by experts and meet federal and state specifications.

Should you be presently signed up, log in to your bank account and click on the Obtain key to find the California Stock Option Grants and Exercises and Fiscal Year-End Values. Utilize your bank account to look through the legal forms you may have ordered earlier. Proceed to the My Forms tab of your own bank account and have an additional backup of the papers you will need.

Should you be a whole new customer of US Legal Forms, listed below are basic instructions for you to adhere to:

- First, make certain you have chosen the right type for the area/region. It is possible to check out the shape making use of the Preview key and read the shape information to make sure it is the best for you.

- If the type will not meet your needs, take advantage of the Seach industry to discover the correct type.

- Once you are positive that the shape is suitable, select the Buy now key to find the type.

- Select the costs plan you want and enter in the essential information. Build your bank account and buy the order using your PayPal bank account or bank card.

- Opt for the data file format and acquire the legal papers design to your gadget.

- Complete, revise and print out and indicator the received California Stock Option Grants and Exercises and Fiscal Year-End Values.

US Legal Forms will be the most significant collection of legal forms where you can see a variety of papers layouts. Make use of the service to acquire appropriately-produced documents that adhere to express specifications.

Form popularity

FAQ

You're not liable for income tax until your stock grant vests, at which point you must report income equal to the value of the stock you received.

When you exercise nonqualified stock options, your employer will most likely withhold a flat 22% for federal income taxes. However, you might be under-withheld if you're in the 32%, 35%, or 37% tax bracket. Stock options can be advantageous but can also create unexpected tax consequences.

Stock options are typically taxed at two points in time: first when they are exercised (purchased) and again when they're sold. You can unlock certain tax advantages by learning the differences between ISOs and NSOs.

In some cases, your RSUs may be taxed twice. The good news is that you will not owe taxes on your RSUs right away at grant. They do not have any real value until they vest, which can be years down the road depending on the company you work for and if they are public or private.

Every stock option has an exercise price, also called the strike price, which is the price at which a share can be bought. In the US, the exercise price is typically set at the fair market value of the underlying stock as of the date the option is granted, in order to comply with certain requirements under US tax law.

If this amount is not included in Box 1 of Form W-2, you still must add it to the amount of compensation income that you report on your 2023 Form 1040, line 7. You also must report the sale of the stock on your 2023 Schedule D, Part II as a long-term sale.

For nonstatutory options without a readily determinable fair market value, there's no taxable event when the option is granted but you must include in income the fair market value of the stock received on exercise, less the amount paid, when you exercise the option.

How Are Stock Options Taxed? Stock options are taxed or the loss is deducted when the holder of the stock sells the stock they bought when they exercised their stock option. The gain will usually be taxed at a capital gains tax rate.