California Approval of director stock program

Description

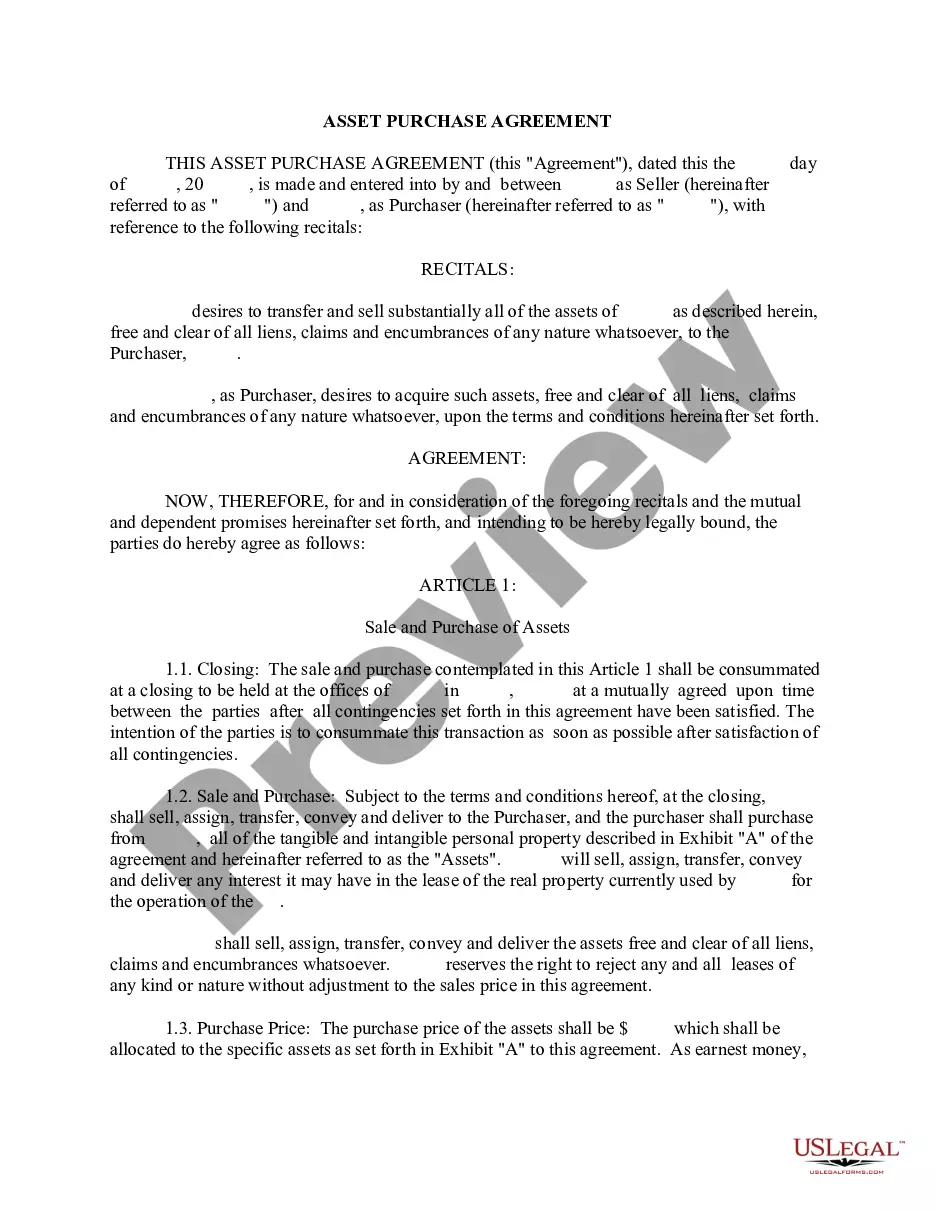

How to fill out Approval Of Director Stock Program?

Are you in a placement the place you need to have documents for sometimes company or person uses virtually every time? There are a variety of legitimate file web templates available online, but locating types you can rely isn`t simple. US Legal Forms provides thousands of form web templates, just like the California Approval of director stock program, which can be written to meet federal and state specifications.

If you are previously familiar with US Legal Forms website and get a merchant account, basically log in. Afterward, it is possible to download the California Approval of director stock program design.

Unless you provide an accounts and wish to start using US Legal Forms, adopt these measures:

- Find the form you will need and make sure it is to the right town/region.

- Utilize the Preview switch to check the shape.

- Look at the explanation to ensure that you have chosen the right form.

- If the form isn`t what you are seeking, utilize the Lookup discipline to discover the form that meets your needs and specifications.

- Once you discover the right form, click on Purchase now.

- Pick the costs program you would like, fill out the specified info to make your bank account, and pay money for an order making use of your PayPal or Visa or Mastercard.

- Pick a handy paper structure and download your copy.

Find all the file web templates you might have purchased in the My Forms menu. You can get a further copy of California Approval of director stock program at any time, if possible. Just click on the needed form to download or printing the file design.

Use US Legal Forms, by far the most extensive selection of legitimate kinds, to conserve some time and prevent errors. The assistance provides professionally manufactured legitimate file web templates that you can use for a selection of uses. Produce a merchant account on US Legal Forms and begin creating your lifestyle easier.

Form popularity

FAQ

The statutes generally provide that a board of directors may consist of one or more individuals. The number of directors the corporation will have, or a minimum and maximum number of directors that the corporation may have, are set forth in the articles of incorporation or bylaws.

The out-of-state business entity (a ?foreign? business entity) must register with the state, file tax returns, and (most important to the state) pay taxes to California.

Any active corporation that is registered with the California Secretary of State can file this Form 1505 to become authorized to be a corporate agent for service of process for other business entities that are registered with the Secretary of State.

The number or minimum number of directors shall not be less than three. Alternate directors may be permitted, in which event, the bylaws shall specify the manner and times of their election and the conditions to their service in place of a director.

Section 9222 - Removal of directors (a) Except as provided in the articles or bylaws and subject to subdivision (b) of this section, any or all directors may be removed without cause if the removal is approved by the members (Section 5034).

Most states require a minimum of three directors, but there are a few states that require only two. However, regardless of the state requirements, it is generally advisable to have at least three directors on the board.

California law requires that each corporation must have a president, a secretary, and a chief financial officer.

Corporations are required to have not less than three directors unless (1) shares have not been issued, then the number can be one or two, (2) the corporation has one shareholder, then the number can be one or two, or (3) the corporation has two shareholders, then the number can be two.