California Restructuring Agreement

Description

How to fill out Restructuring Agreement?

Are you currently in the situation where you need documents for sometimes organization or personal purposes almost every working day? There are a lot of legitimate record templates available on the Internet, but getting ones you can rely on isn`t effortless. US Legal Forms provides thousands of form templates, such as the California Restructuring Agreement, which are published to meet state and federal demands.

In case you are presently knowledgeable about US Legal Forms website and also have your account, just log in. Next, you can download the California Restructuring Agreement design.

Should you not offer an account and wish to begin using US Legal Forms, abide by these steps:

- Discover the form you require and make sure it is for the correct city/area.

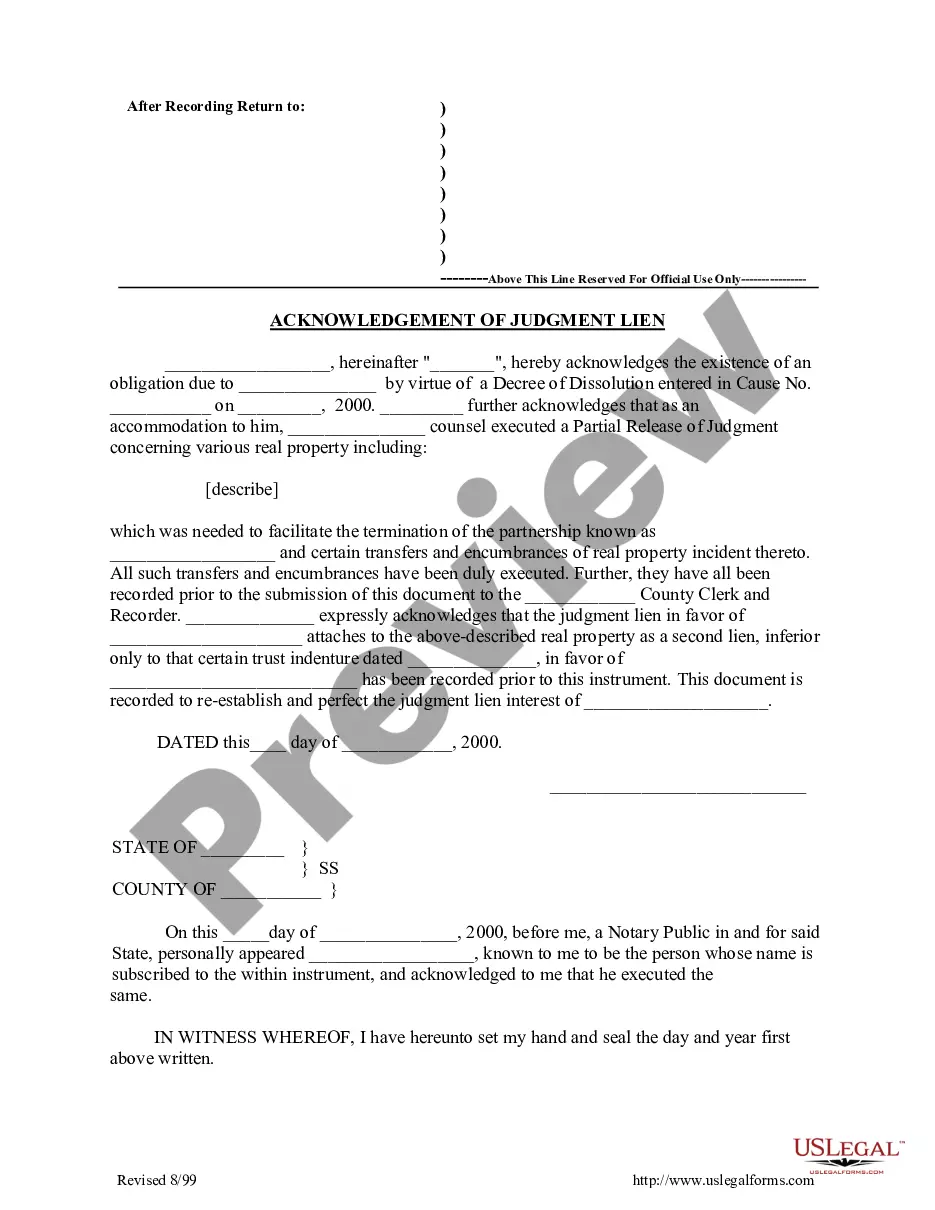

- Take advantage of the Preview option to check the form.

- Look at the explanation to ensure that you have selected the right form.

- When the form isn`t what you are seeking, utilize the Search field to obtain the form that meets your requirements and demands.

- When you get the correct form, simply click Acquire now.

- Opt for the costs strategy you would like, submit the desired information to produce your money, and buy the order using your PayPal or Visa or Mastercard.

- Pick a convenient document format and download your copy.

Find all of the record templates you may have purchased in the My Forms food list. You can obtain a more copy of California Restructuring Agreement at any time, if required. Just click the needed form to download or printing the record design.

Use US Legal Forms, by far the most considerable assortment of legitimate types, in order to save some time and steer clear of blunders. The support provides skillfully made legitimate record templates which can be used for a range of purposes. Produce your account on US Legal Forms and initiate creating your lifestyle a little easier.

Form popularity

FAQ

The debt restructuring process typically involves getting lenders to agree to reduce the interest rates on loans, extend the dates when the company's liabilities are due to be paid, or both. These steps improve the company's chances of paying back its obligations and staying in business.

Restructuring normally is accomplished in three ways: via an extension, a composition, or a debt-for-equity swap. An extension occurs when creditors agree to lengthen the debtor firm's repayment period. Creditors often agree to suspend temporarily both interest and principal repayments.

Furthermore, debt restructuring can have some negative impacts on the debtor. Some of these negative impacts include lower credit rating, higher borrowing costs or dilution of ownership.

The RSA allows the parties involved to negotiate and agree upon the terms of the treatment of claims and the course of the bankruptcy process before the commencement of the case and to memorialize those agreements in the form of a written agreement.

Strategic Debt Restructuring Scheme, or SDR from the RBI, enables banks that have issued loans to corporates and entities to convert a part of the total outstanding loan amount and interest into major shareholding equity in the company.

The exact impact of a debt settlement on your credit score will depend on factors like the amount of debt. A debt settlement can stay on your credit report for seven years and your score could drop by more than 100 points.

Restructuring support agreements are valuable tools for both debtors and creditors in Chapter 11 bankruptcy cases. For debtors, RSAs provide a level of certainty.

An agreement entered into by a borrower and its lenders in the course of a restructuring of the borrower's debts. The agreement sets out the basis on which those lenders will continue to lend to the borrower and may, for example, consolidate all the outstanding lending arrangements into one master agreement.