California Qualifying Event Notice Information for Employer to Plan Administrator

Description

How to fill out Qualifying Event Notice Information For Employer To Plan Administrator?

Are you in a circumstance where you require paperwork for either business or personal purposes almost every day.

There are numerous legal document templates available online, but finding ones you can rely on isn't straightforward.

US Legal Forms provides a vast array of form templates, such as the California Qualifying Event Notice Information for Employer to Plan Administrator, designed to comply with federal and state regulations.

Once you locate the correct form, click Purchase now.

Choose the payment plan you prefer, enter the required information to create your account, and pay for the order using your PayPal or credit card. Select a suitable file format and download your copy. You can find all the form templates you have purchased in the My documents menu. You can obtain another copy of California Qualifying Event Notice Information for Employer to Plan Administrator anytime if needed. Click the necessary form to download or print the document template. Use US Legal Forms, the most extensive collection of legal forms, to save time and avoid errors. The service offers professionally designed legal document templates that you can utilize for a variety of purposes. Create an account on US Legal Forms and start making your life easier.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- After that, you can download the California Qualifying Event Notice Information for Employer to Plan Administrator template.

- If you do not have an account and wish to begin using US Legal Forms, follow these steps.

- Obtain the form you need and ensure it is for the appropriate state/area.

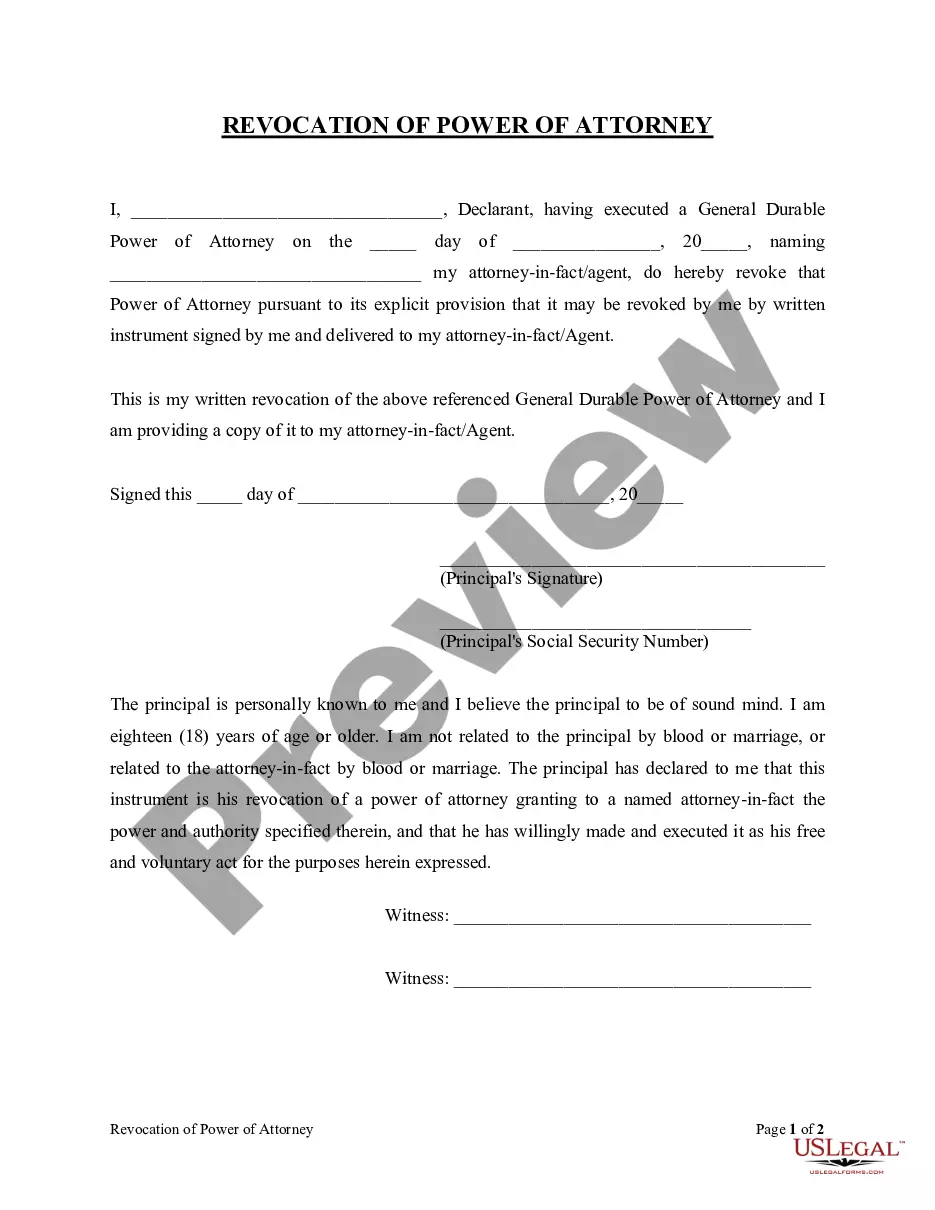

- Utilize the Review option to examine the form.

- Read the description to make sure you have selected the correct form.

- If the form isn’t what you are looking for, use the Search field to find the form that suits your needs.

Form popularity

FAQ

The required documents for a qualifying event generally depend on the type of event and can include forms such as marriage certificates, divorce decrees, or birth certificates. Gathering the correct documents in advance streamlines the process of updating your health benefits. This aligns with the guidance provided in California Qualifying Event Notice Information for Employer to Plan Administrator, ensuring you comply with all necessary procedures. If you are unsure, consulting U.S. Legal Forms can offer clarity and assistance in gathering the right paperwork.

Proof of a qualifying life event is documentation that verifies the occurrence of such an event. This could include marriage certificates, divorce decrees, or birth certificates, among other documents. Providing adequate proof is necessary for your employer to process changes in your health plan, as highlighted in California Qualifying Event Notice Information for Employer to Plan Administrator. Always keep this documentation handy to facilitate smooth transitions in your benefits.

Cal-COBRA applies to employers with 2-19 employees, whereas federal COBRA applies to employers with more than 20 employees. Cal-COBRA offers coverage for up to 36 months, while federal COBRA offers coverage for 18 months for the former employee and up to 36 months for any dependents.

Covered Employers Under federal COBRA, employers with 20 or more employees are usually required to offer COBRA coverage. COBRA applies to plans maintained by private-sector employers (including self-insured plans) and those sponsored by most state and local governments.

Cal-COBRA applies to employers with 2-19 employees, whereas federal COBRA applies to employers with more than 20 employees. Cal-COBRA offers coverage for up to 36 months, while federal COBRA offers coverage for 18 months for the former employee and up to 36 months for any dependents.

Cal-COBRA administration requires four basic compliance components: Notifying all eligible group health care participants of their Cal-COBRA rights. Providing timely notice of Cal-COBRA eligibility, enrollment forms, and notice of the duration of coverage and terms of payment after a qualifying event has occurred.

Covered EmployersGroup health plans for employers with 20 or more employees on more than 50 percent of their typical business days in the previous calendar year are subject to COBRA. Both full-time and part-time employees are counted to determine whether a plan is subject to COBRA.

Employers do not have to offer COBRA coverage to: Employees who are not yet eligible for a group health plan. Eligible employees who declined to participate in a group health plan. Individuals who are enrolled for benefits under Medicare.

COBRA Qualifying Event Notice The employer must notify the plan if the qualifying event is: Termination or reduction in hours of employment of the covered employee, 2022 Death of the covered employee, 2022 Covered employee becoming entitled to Medicare, or 2022 Employer bankruptcy.

To be eligible for COBRA, your group policy must be in force with 20 or more employees covered on more than 50 percent of its typical business days in the previous calendar year.