Statutory Guidelines [Appendix A(7) IRC 5891] regarding rules for structured settlement factoring transactions.

California Structured Settlement Factoring Transactions

Description

How to fill out Structured Settlement Factoring Transactions?

Choosing the best legal record web template can be quite a have difficulties. Needless to say, there are plenty of templates available on the Internet, but how do you find the legal type you need? Utilize the US Legal Forms web site. The service gives a huge number of templates, for example the California Structured Settlement Factoring Transactions, which can be used for company and personal requirements. All the types are checked by experts and meet state and federal requirements.

If you are currently listed, log in in your profile and click on the Down load option to get the California Structured Settlement Factoring Transactions. Use your profile to appear with the legal types you may have ordered earlier. Go to the My Forms tab of your respective profile and obtain yet another copy of the record you need.

If you are a fresh end user of US Legal Forms, here are simple instructions that you should adhere to:

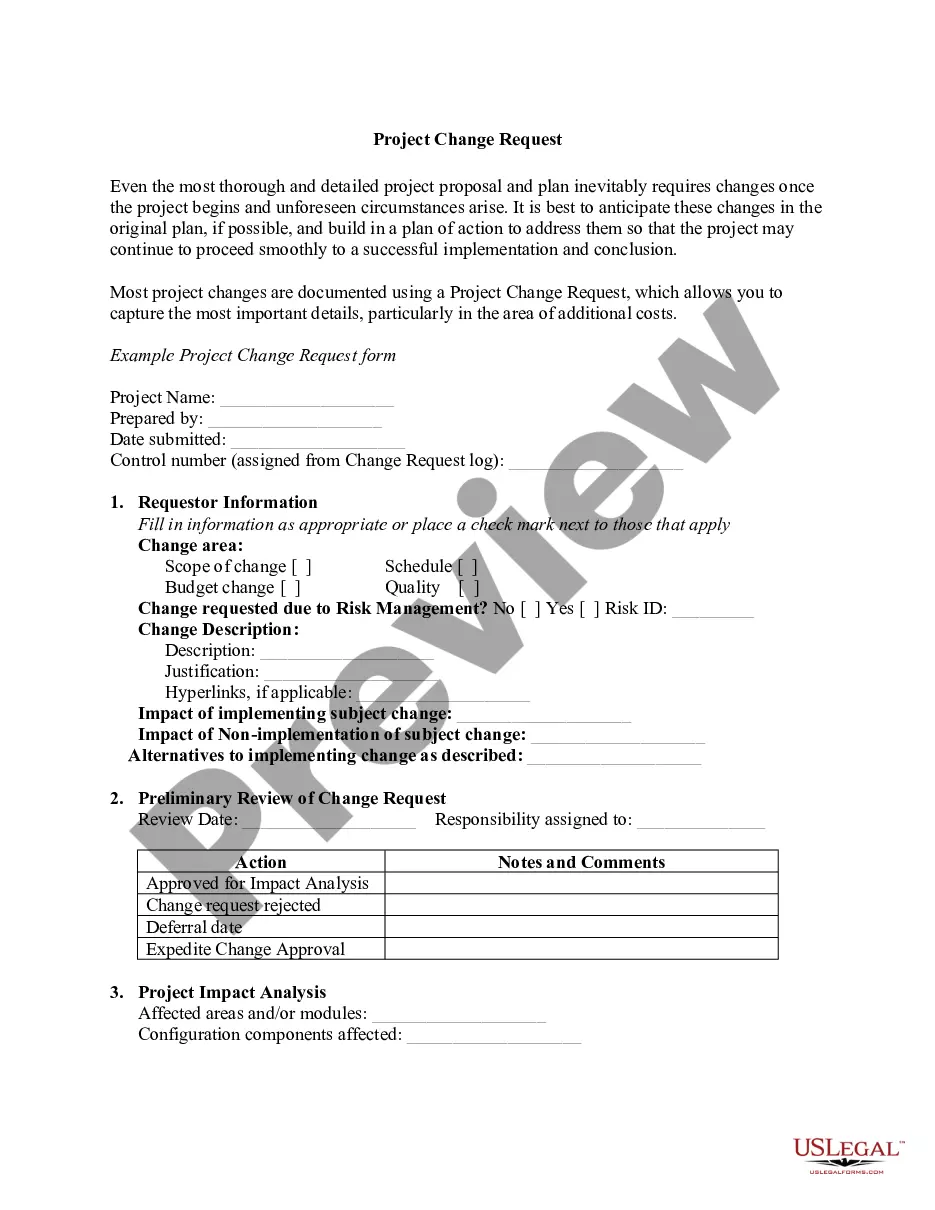

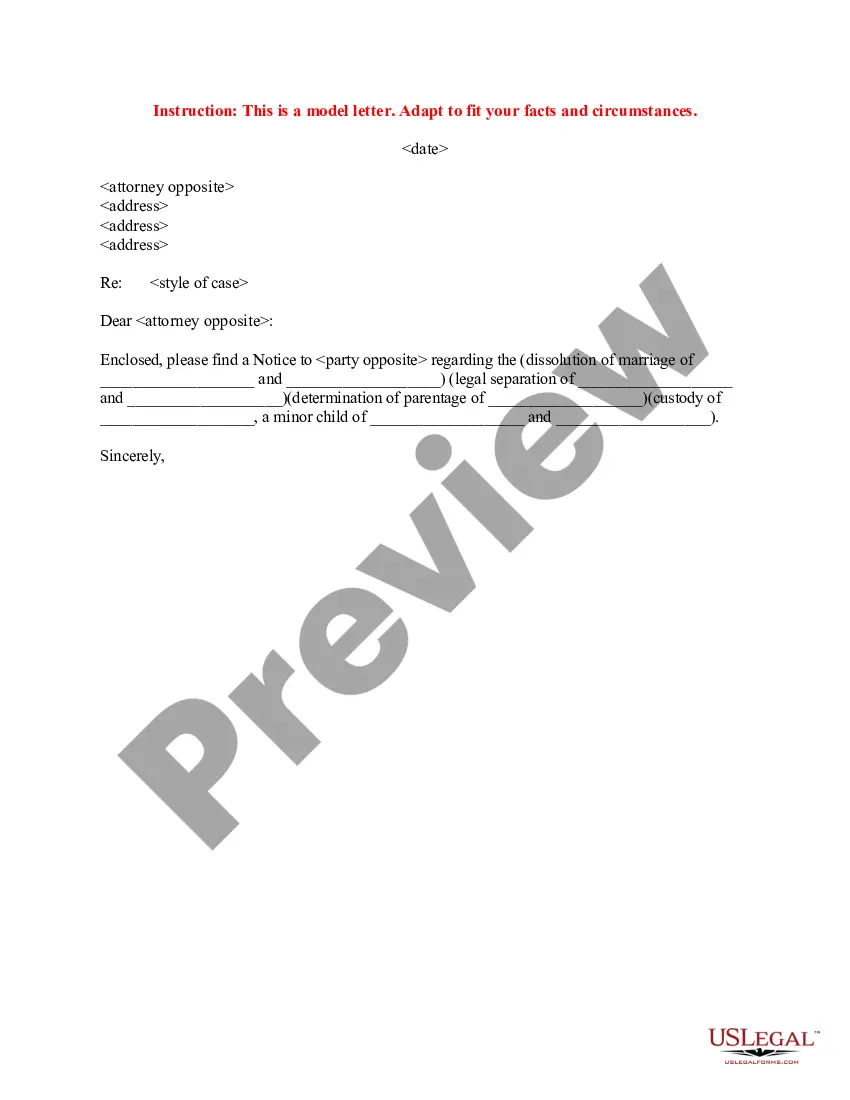

- First, make sure you have selected the proper type for the area/state. You can check out the form while using Review option and study the form information to make certain it will be the best for you.

- If the type fails to meet your requirements, take advantage of the Seach area to get the appropriate type.

- Once you are certain the form is suitable, click on the Purchase now option to get the type.

- Pick the rates program you need and enter the needed information. Create your profile and purchase the order using your PayPal profile or bank card.

- Select the file format and acquire the legal record web template in your product.

- Complete, revise and print and indicator the attained California Structured Settlement Factoring Transactions.

US Legal Forms may be the greatest collection of legal types where you can see various record templates. Utilize the company to acquire appropriately-made documents that adhere to condition requirements.

Form popularity

FAQ

Cashing in a structured settlement typically requires working with settlement buyers or factoring companies. These companies specialize in buying settlements and providing a lump sum cash payout.

What is a Structured Settlement? A structured settlement annuity (?structured settlement?) allows a claimant to receive all or a portion of a personal injury, wrongful death, or workers' compensation settlement in a series of income tax-free periodic payments.

The term ?structured settlement factoring transaction? means a transfer of structured settlement payment rights (including portions of structured settlement payments) made for consideration by means of sale, assignment, pledge, or other form of encumbrance or alienation for consideration.

Structured settlements can provide long-term monthly payments in workers' compensation/medical malpractice cases. With a structured settlement annuity, there's no risk of outliving the money. Future payments can last for the claimant's lifetime.

Pre-settlement funding in 5 steps Contact JG Wentworth. Either fill out our quick online form, or call and talk to one of our representatives. ... The company contacts your attorney. ... Your attorney receives an agreement. ... Review and sign the agreement. ... Claim your cash.

Structured Settlement calls people on old and expired debts, to get your Debit or Credit Card and make payments that are usually outside the statute of limitations.

Cashing out a structured settlement can be a good way to access a significant amount of cash. But before making such a significant decision, review all of the costs carefully. If you decide to proceed with a sale, get offers from at least two to three different buyers to ensure you're getting the best deal possible.

Can you borrow against a settlement? You cannot borrow against your structured settlement, but you can sell all or a portion of it for a lump sum of cash. You can also seek pre-settlement funding or lawsuit advances to cover legal bills prior to a lawsuit settlement.