California Resident Information Sheet

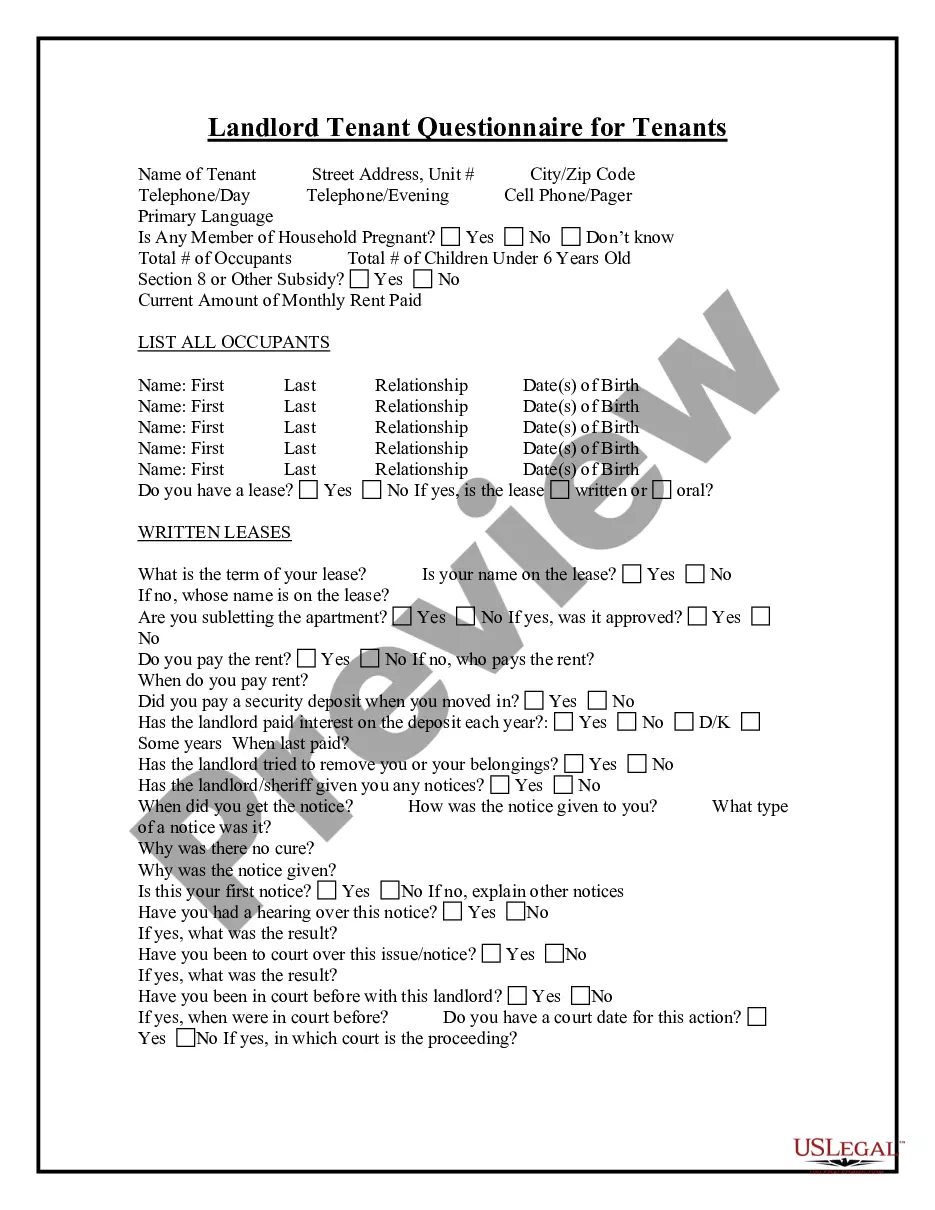

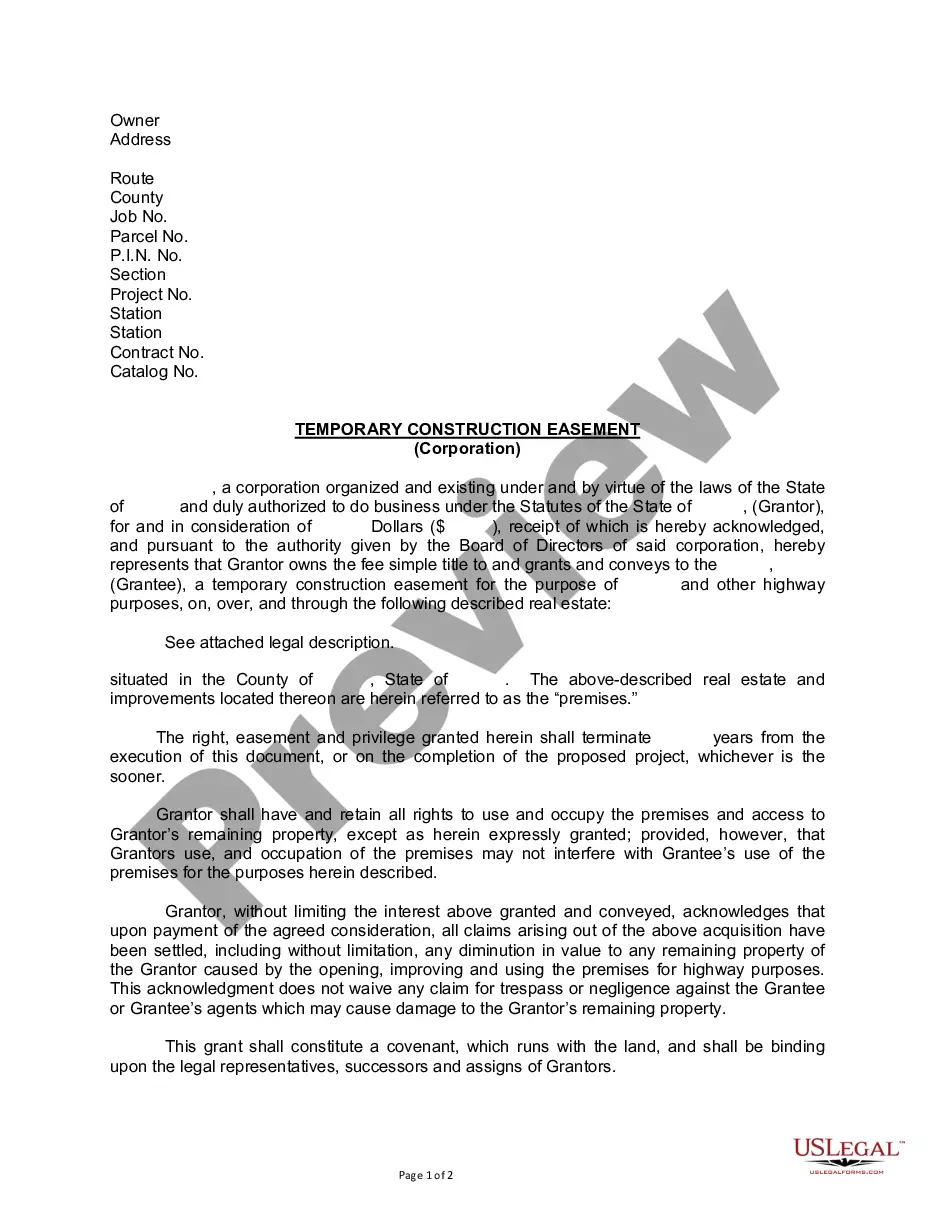

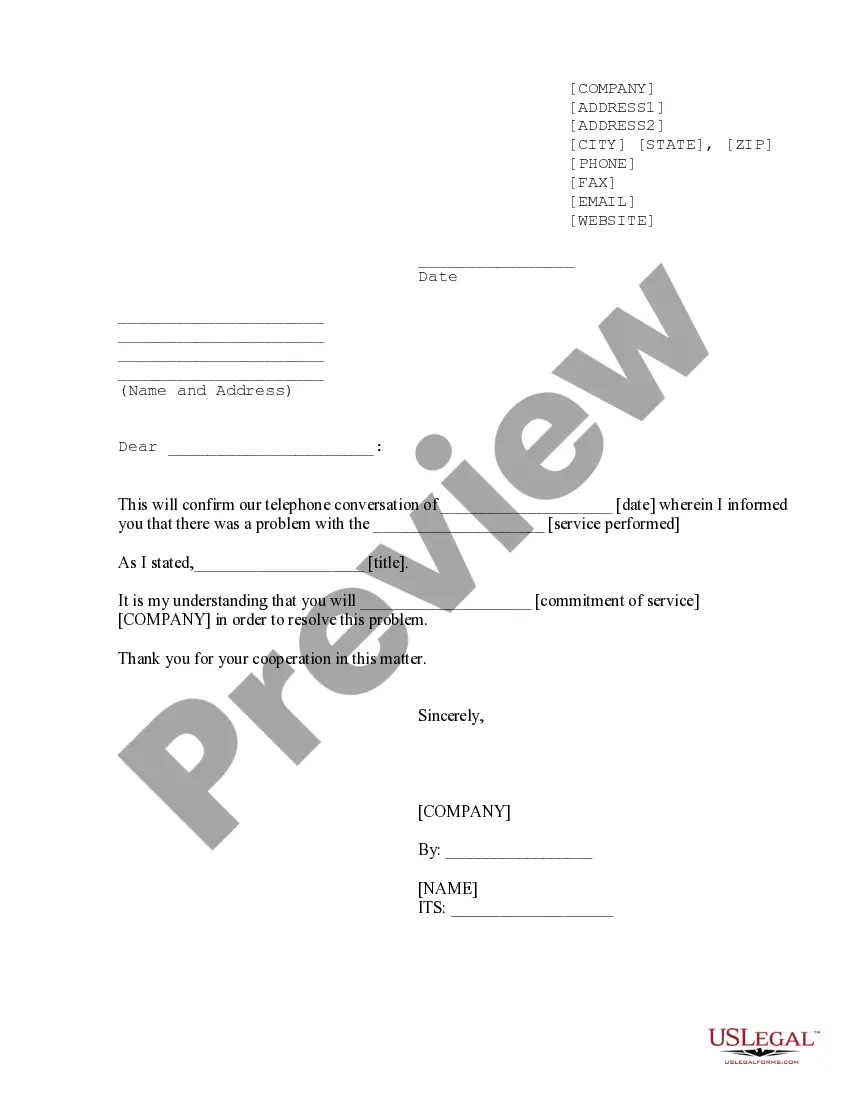

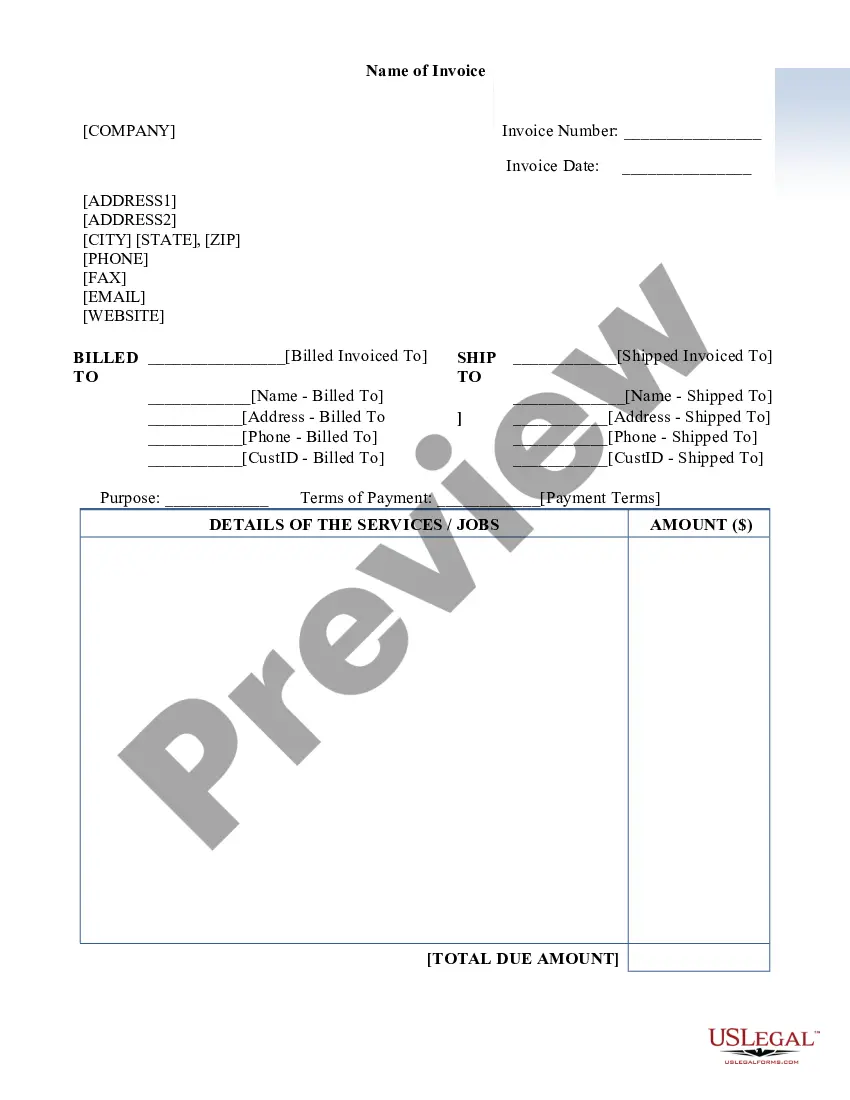

Description

How to fill out Resident Information Sheet?

Are you presently in a circumstance where you require paperwork for either business or personal reasons almost every day.

There are numerous legal document templates available online, however, locating reliable ones is not easy.

US Legal Forms offers thousands of form templates, including the California Resident Information Sheet, designed to comply with federal and state regulations.

Once you find the appropriate form, click Get now.

Select your payment plan, enter the required details to create your account, and purchase the order using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you may download the California Resident Information Sheet template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Choose the form you need and ensure it is for your correct area/region.

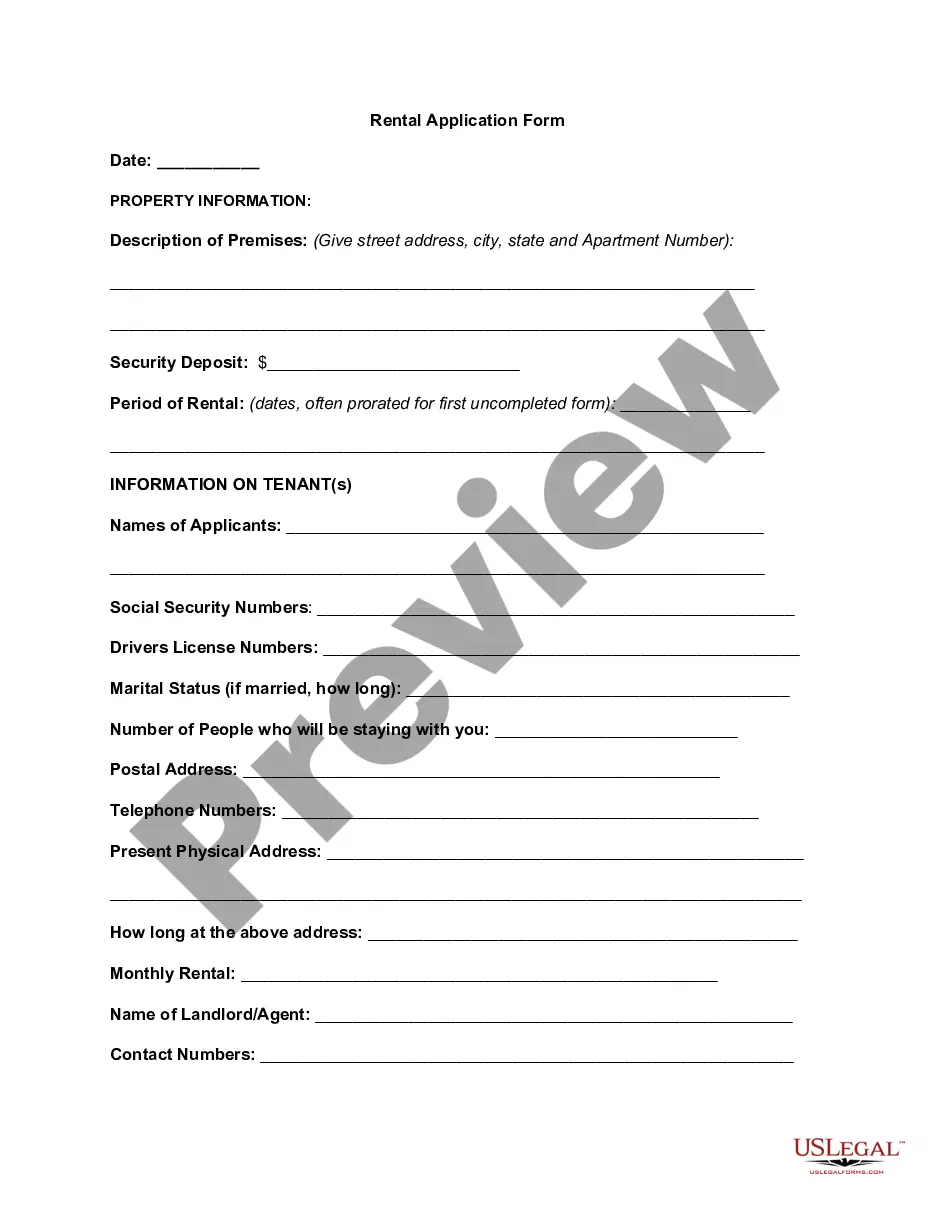

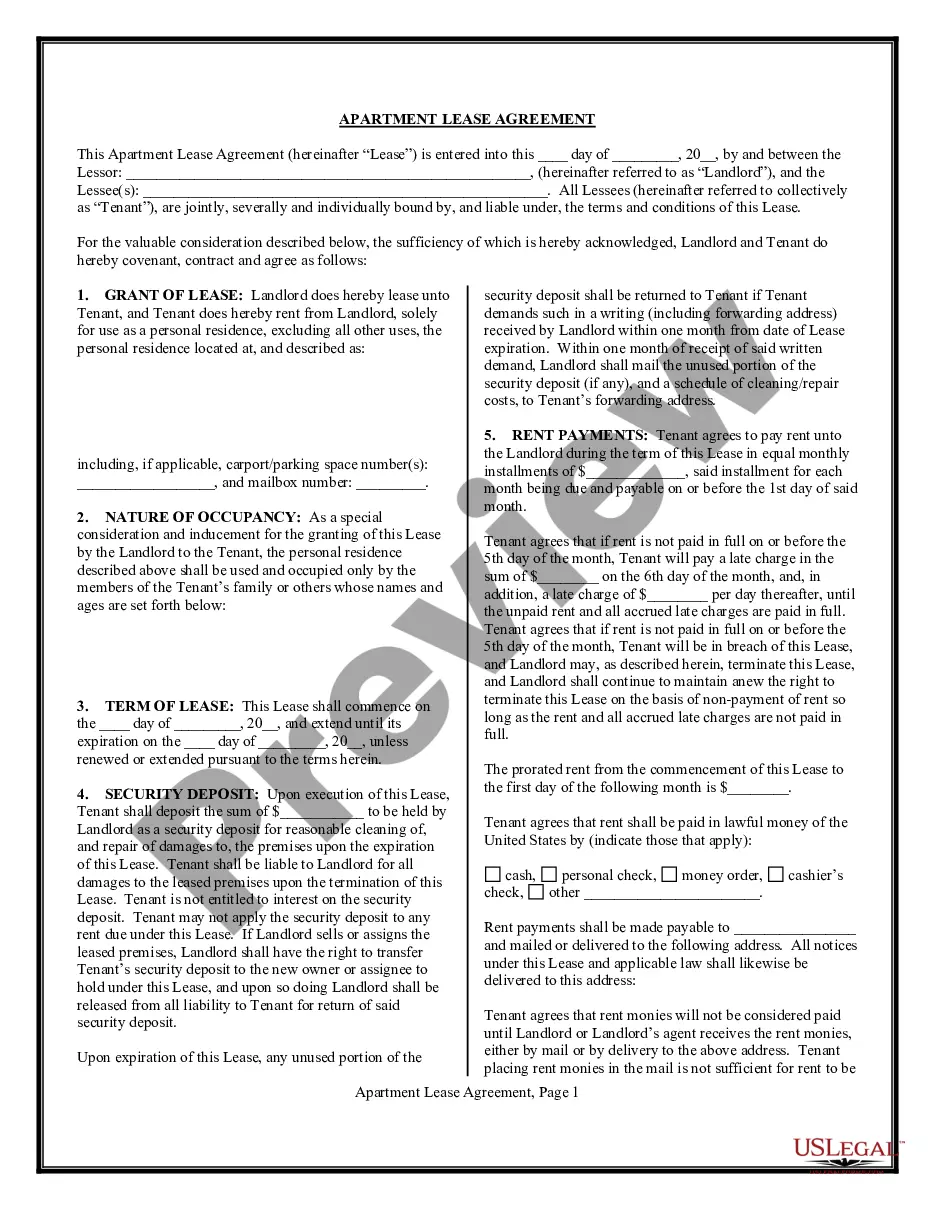

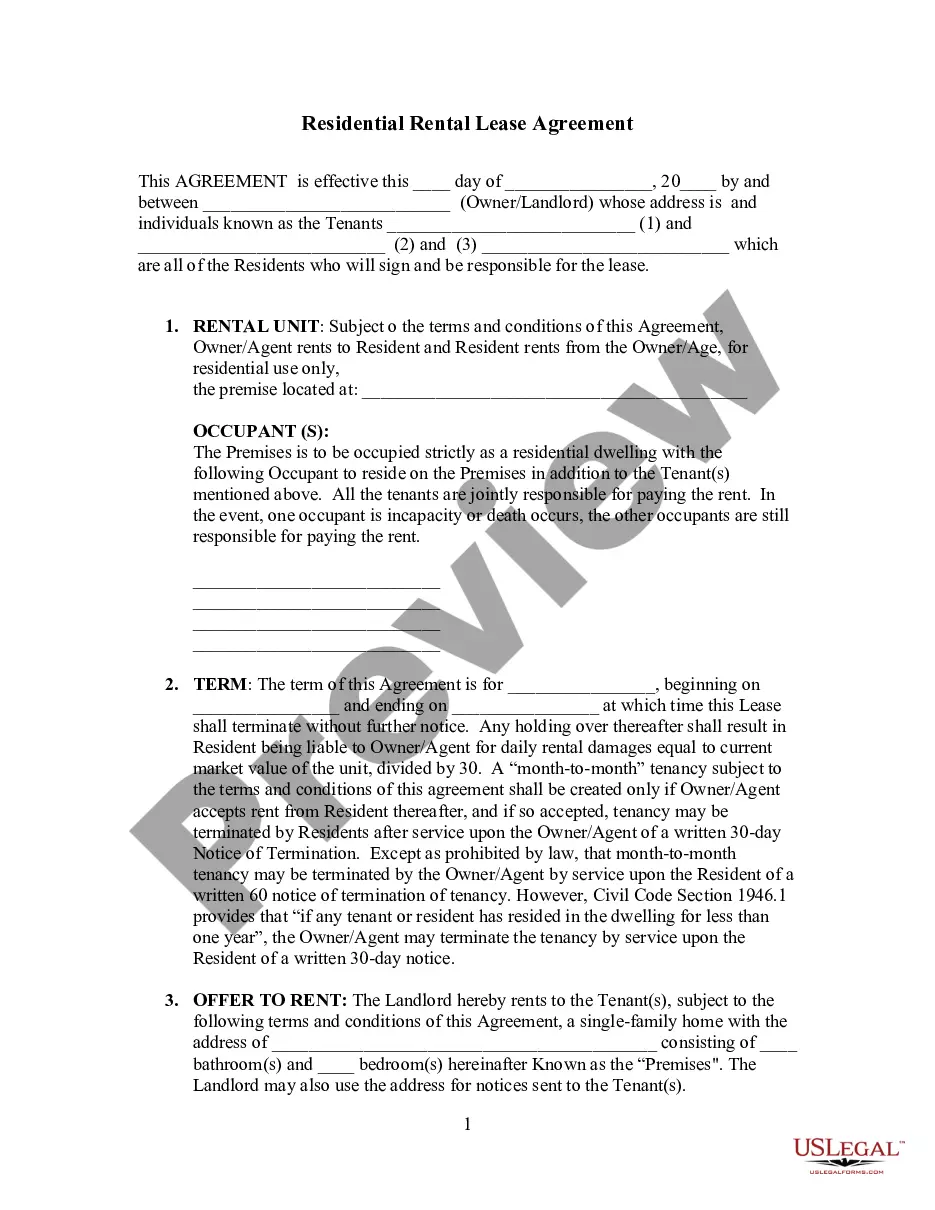

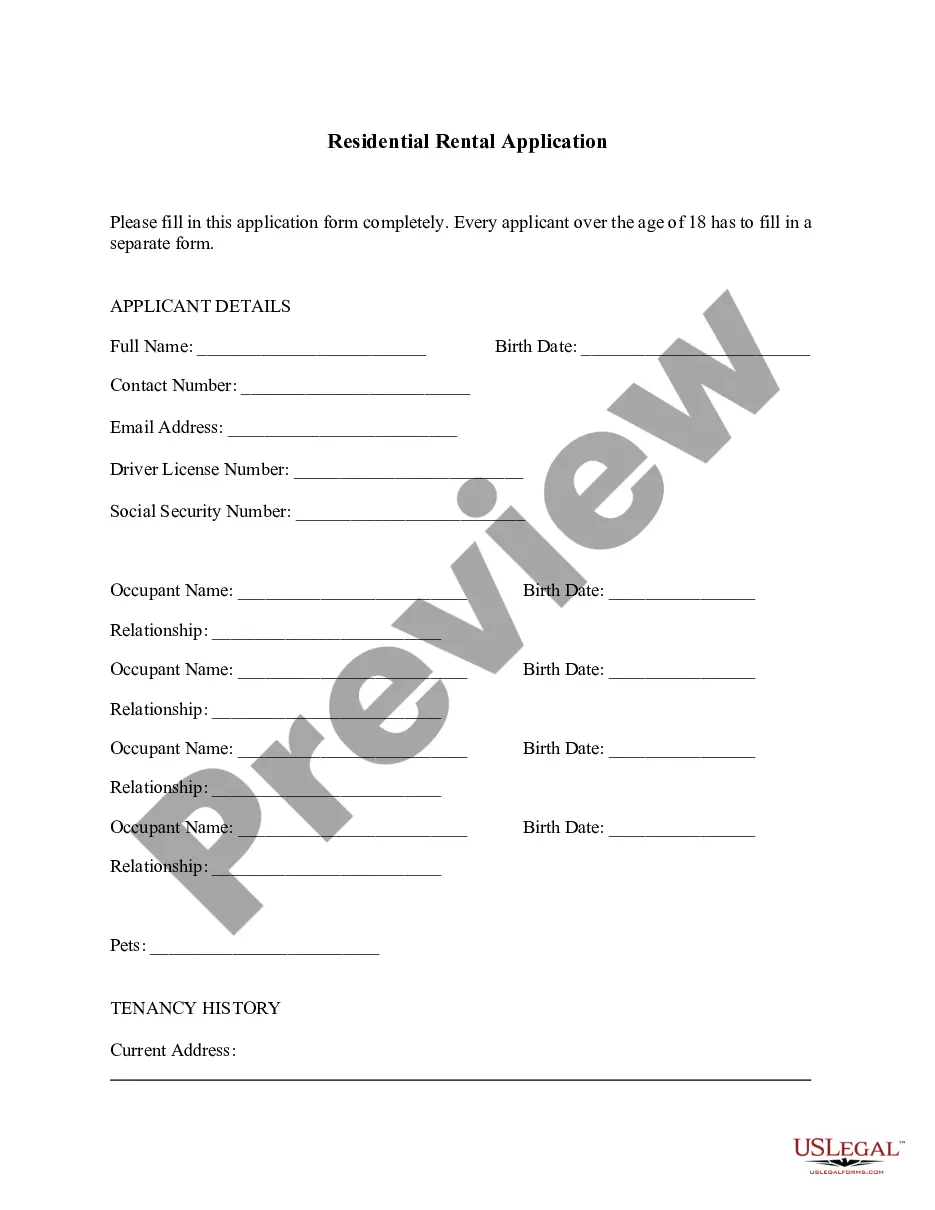

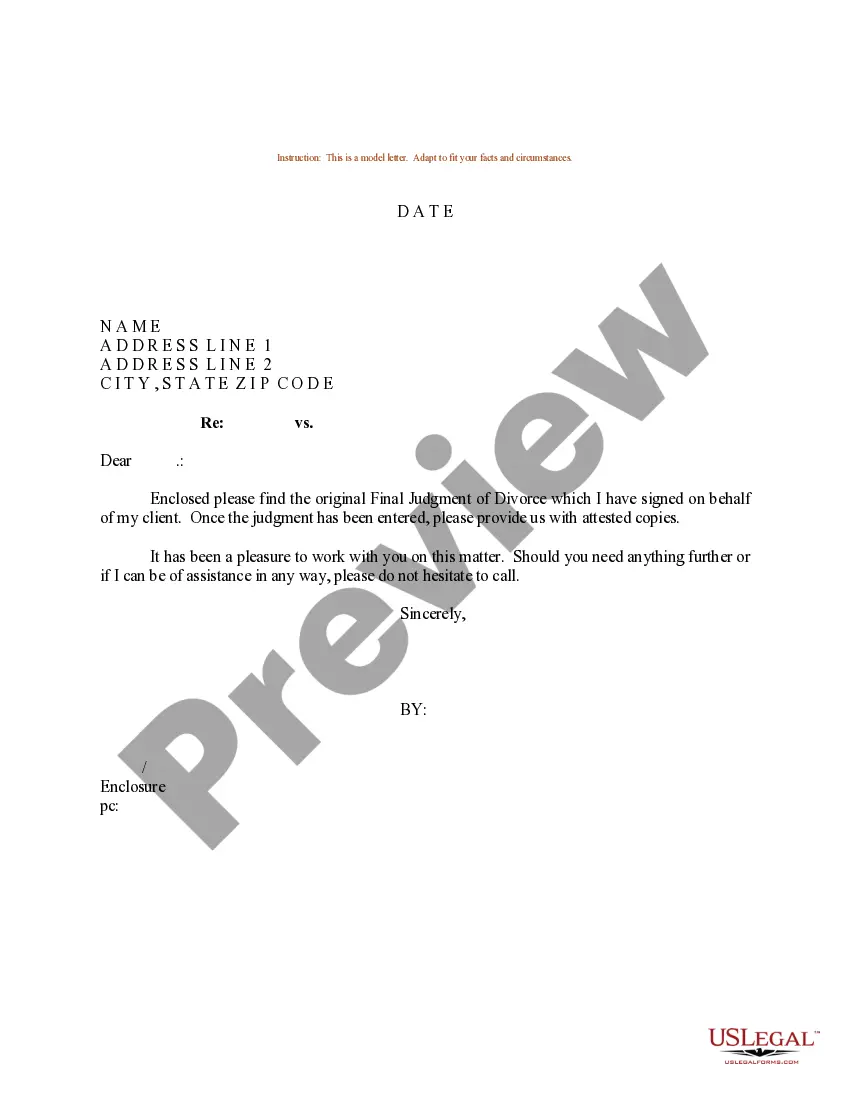

- Use the Preview button to review the form.

- Check the description to ensure you have selected the right form.

- If the form is not what you’re looking for, use the Search section to find the form that suits you and your needs.

Form popularity

FAQ

You can spend more than 6 months in California without becoming a resident, but you should plan carefully to make sure an extended stay plus other contacts don't result in an audit or unfavorable residency determination.

The six-month presumption is really a 183-day presumption. Second, you have to be a domiciliary of another state and have a permanent home there (owned or rented). Domicile differs from residency as a legal concept.

1. Physical presence. You must be continuously physically present in California for more than one year (366 days) immediately prior to the residence determination date of the term for which you request resident status.

Generally, what triggers a state tax audit is a tax return with an error or discrepancy. Some of the most common ones are mathematical mistakes, incomplete information and mismatches between what the taxpayer reported and data the government has in its database.

Any activity that raises a red flag with the FTB can trigger a residency audit. It can be something as simple as living in another state and having a second home in California, to a tip-off from the IRS or another third party.

How long does it take to establish residency in California? You are typically considered a California resident when you live in the state for 6+ months within a 12-month period and intend to remain in the state. There are exceptions, however.

If you truly want to establish that you are a non-resident of California, it means that there are a number of steps you can take (such as getting out-of-State driver's licenses, joining churches and country clubs, and registering to vote) to substantiate the fact that you are not a California resident.

A California resident includes an individual who is either (1) in California for other than a temporary or transitory purpose, or (2) domiciled in California, but outside California for a temporary or transitory purpose. Cal. Rev. & Tax.

Residency is more likely to be broken if your new facts and circumstances mirror those of your life as it had been while you were living in California. Continuing to have too many personal connections to California could give the Franchise Tax Board sufficient evidence to continue to declare you a resident.