California General Partnership Agreement - version 1

Description

How to fill out General Partnership Agreement - Version 1?

Are you presently in a situation where you need documents for both business and personal purposes almost every day.

There are numerous legal document templates available online, but finding ones you can trust isn’t simple.

US Legal Forms provides a vast array of form templates, such as the California General Partnership Agreement - version 1, designed to comply with federal and state regulations.

Once you find the right form, click on Get now.

Choose the payment plan you want, input the required details to create your account, and pay for the order with PayPal or a credit card. Select a convenient document format and download your copy.

- If you are already familiar with the US Legal Forms website and hold an account, simply Log In.

- After that, you can download the California General Partnership Agreement - version 1 template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Locate the form you need and ensure it is for the correct city/region.

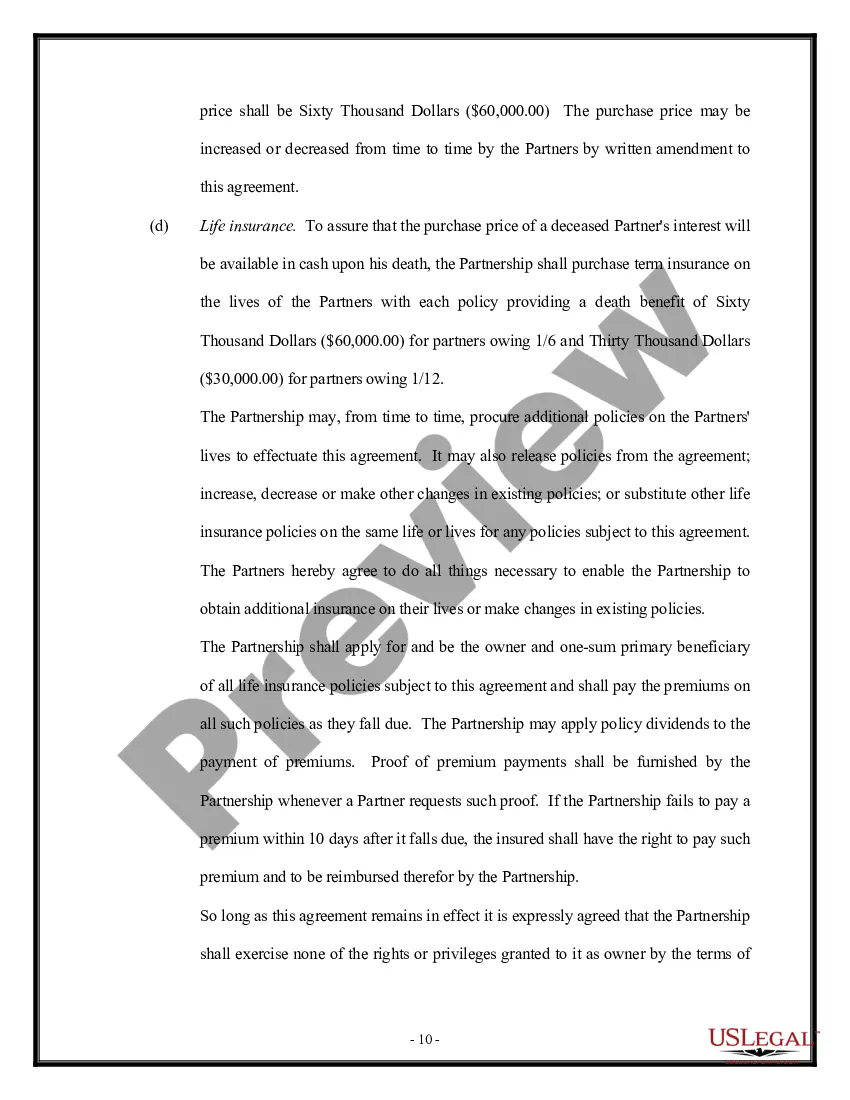

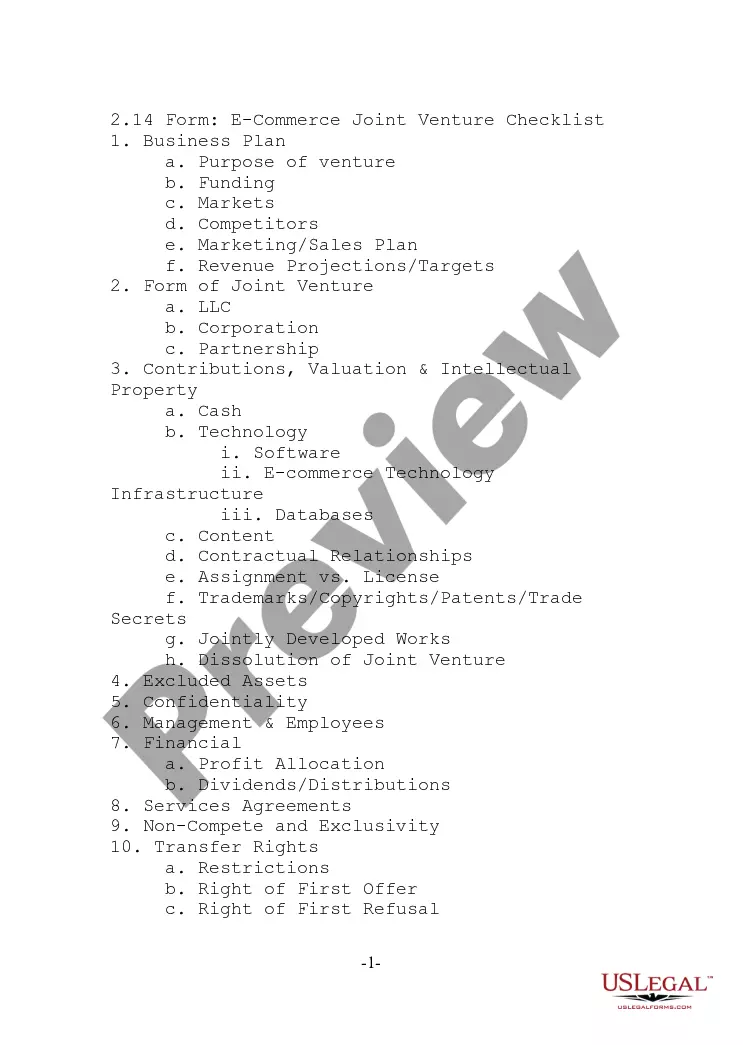

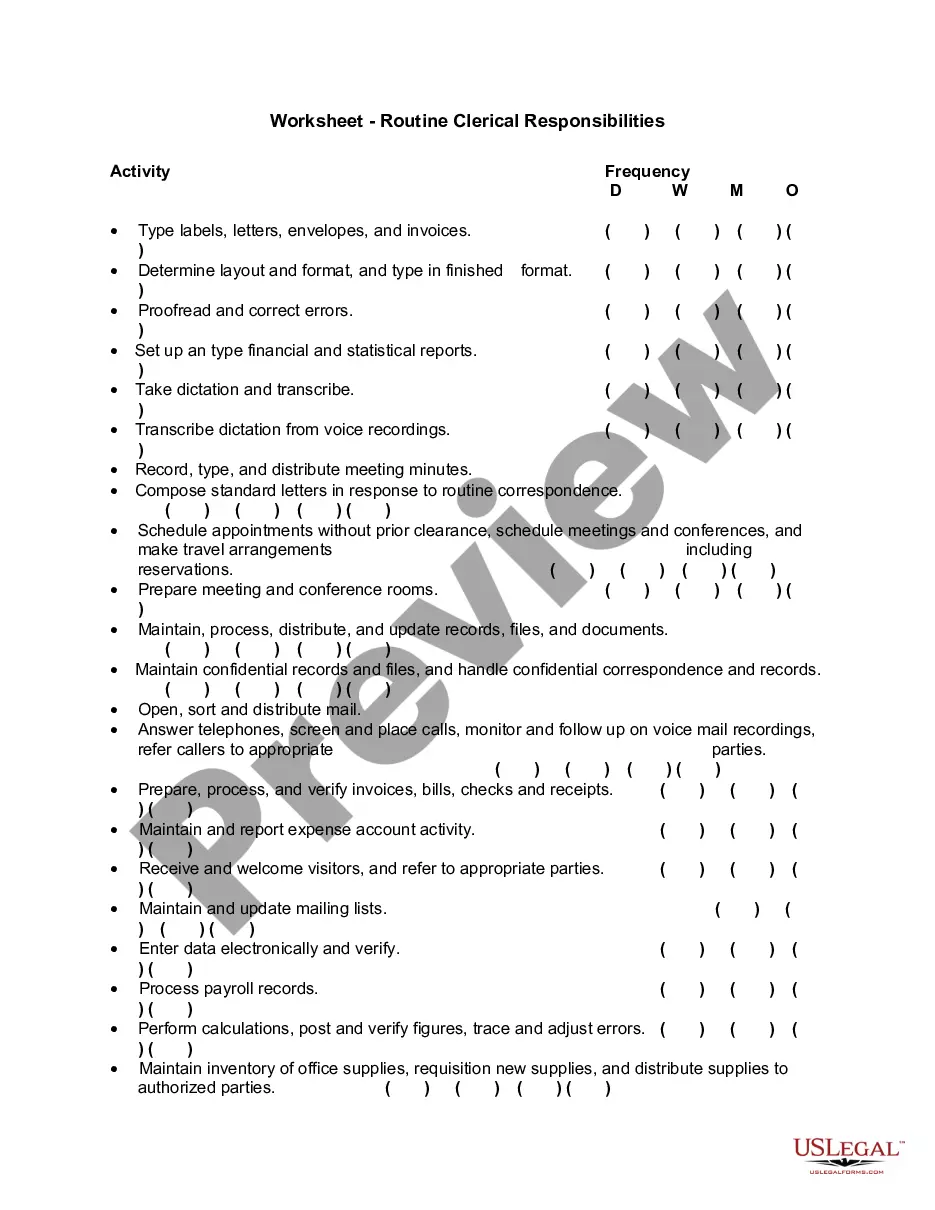

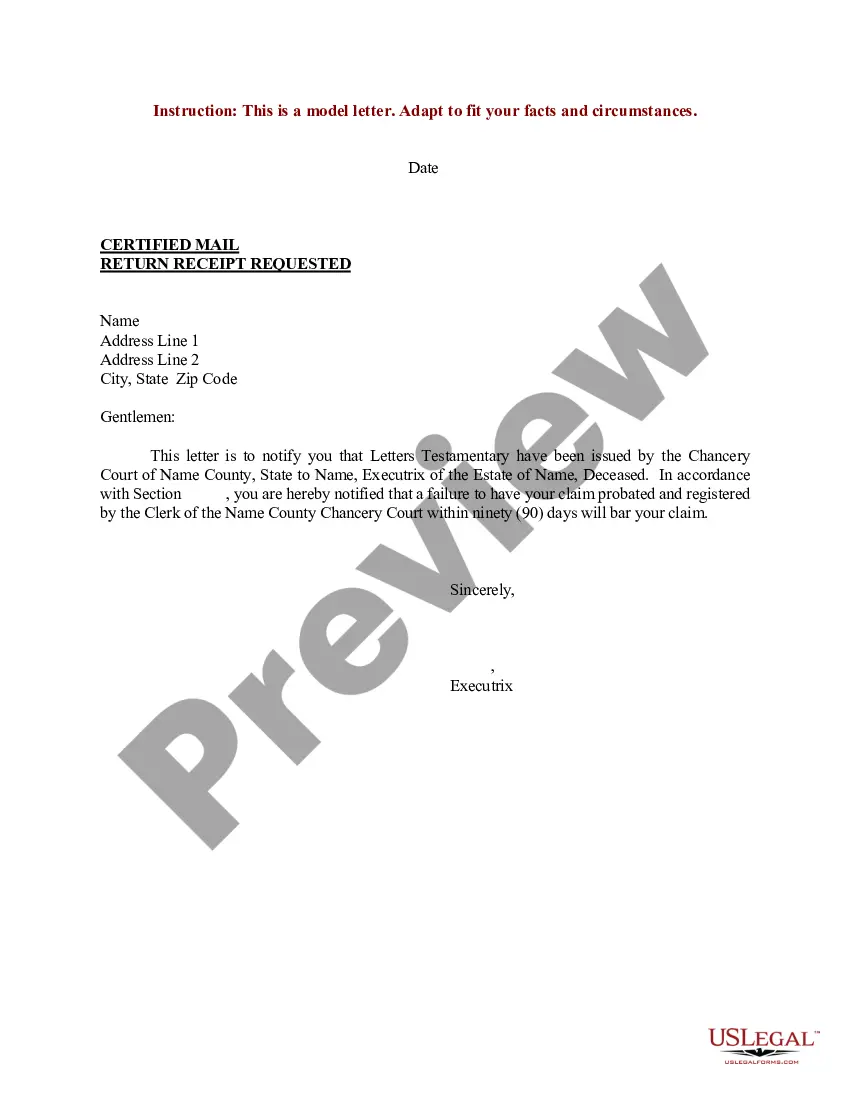

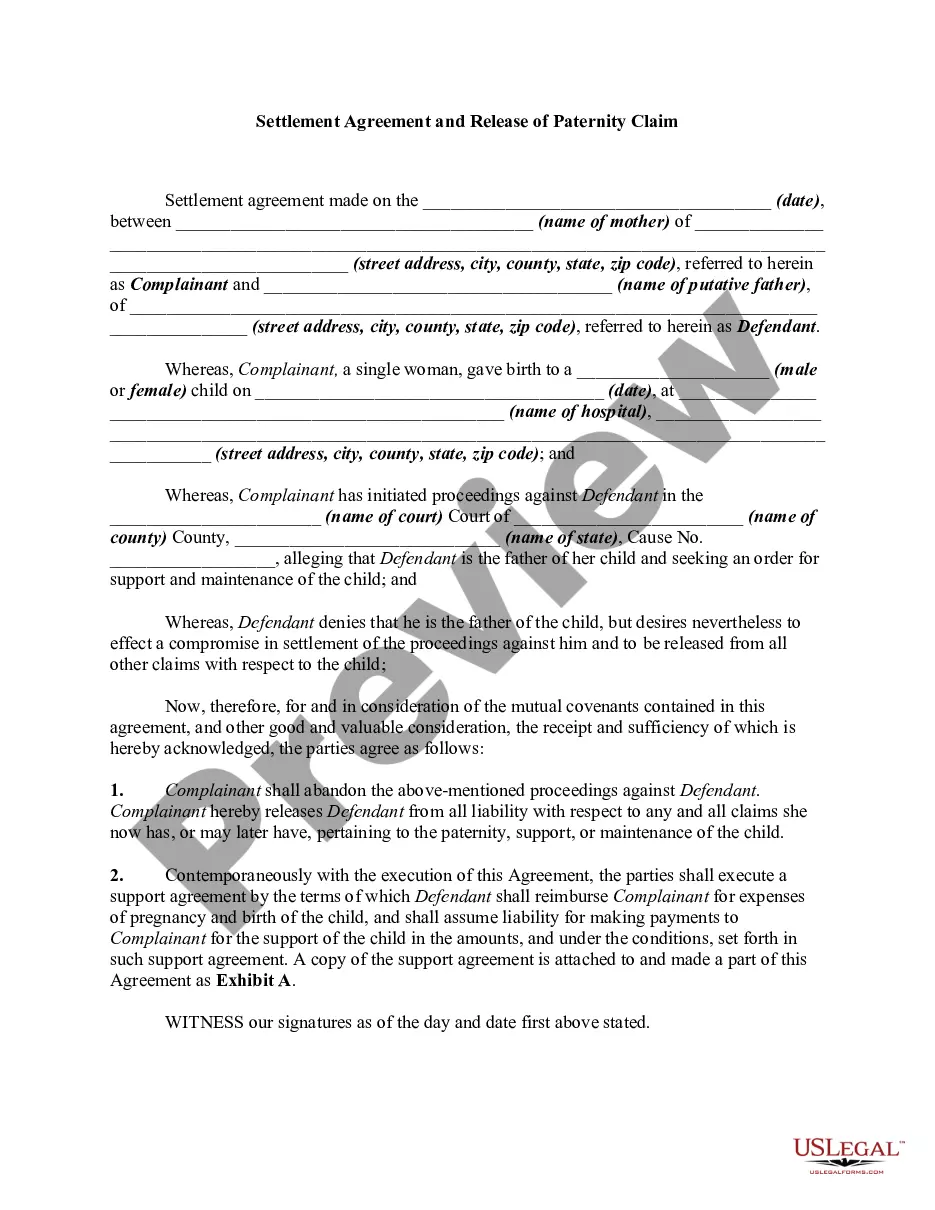

- Use the Review button to inspect the form.

- Verify the information to ensure that you have selected the correct document.

- If the form isn’t what you are looking for, use the Search field to find the form that fits your needs and requirements.

Form popularity

FAQ

Registering to Do Business in CaliforniaAll foreign limited partnerships doing business in California must register with the California Secretary of State. Domestic partnerships that do not register with the Secretary of State are not limited partnerships.

To have a general partnership, two conditions must be true:The company must have two or more owners.All partners must agree to have unlimited personal responsibility for any debts or legal liabilities the partnership might incur.

If you are a business owner, looking to draft your own partnership agreement, you can do so using free templates available online. It is advisable to contact a business lawyer or a partnership agreement lawyer to ensure that the agreement follows the federal, state and local laws.

A general partnership has no separate legal existence distinct from the partners. Unlike a private limited company or limited liability partnership, it does not need to be registered at or make regular filings to Companies House, which can help keep things simple.

General Partnership (GP)To register a GP at the state level, a Statement of Partnership Authority (Form GP1) must be filed with the California Secretary of State's office. Note: Registering a GP at the state level is optional.

A general partnership in the state of California is the collective entity that is formed when two or more individuals and/or entities engage in a trade or business. The intent of all shared activities is to share profits as well as losses.

General Partnership (GP) Profits are taxed as personal income for the partners. To register a GP at the state level, a Statement of Partnership Authority (Form GP1) must be filed with the California Secretary of State's office. Note: Registering a GP at the state level is optional.

General Partnership - Statement of Partnership Authority (Form GP-1)

Partners. Each partner must use a Partner's Share of Income Deductions, Credits, etc. (Schedule K-1 565) to report share of partnership's income, deductions, credits, property, payroll, and sales. General partnerships do not pay annual tax; however, limited partnerships are subject to the annual tax of $800.

To establish a partnership in California, here's everything you need to know.Choose a business name.File a fictitious business name statement with the county clerk.Draft and sign a partnership agreement.Obtain licenses, permits, and zoning clearances.Obtain an Employer Identification Number.