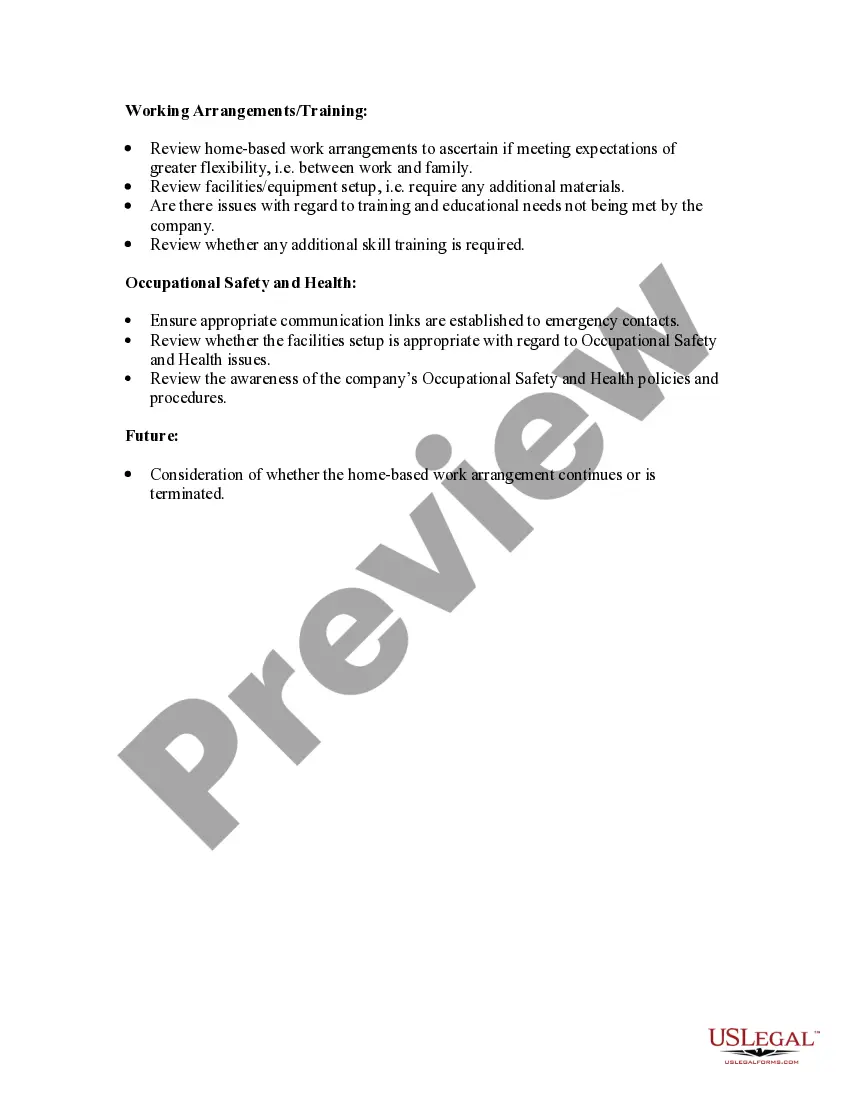

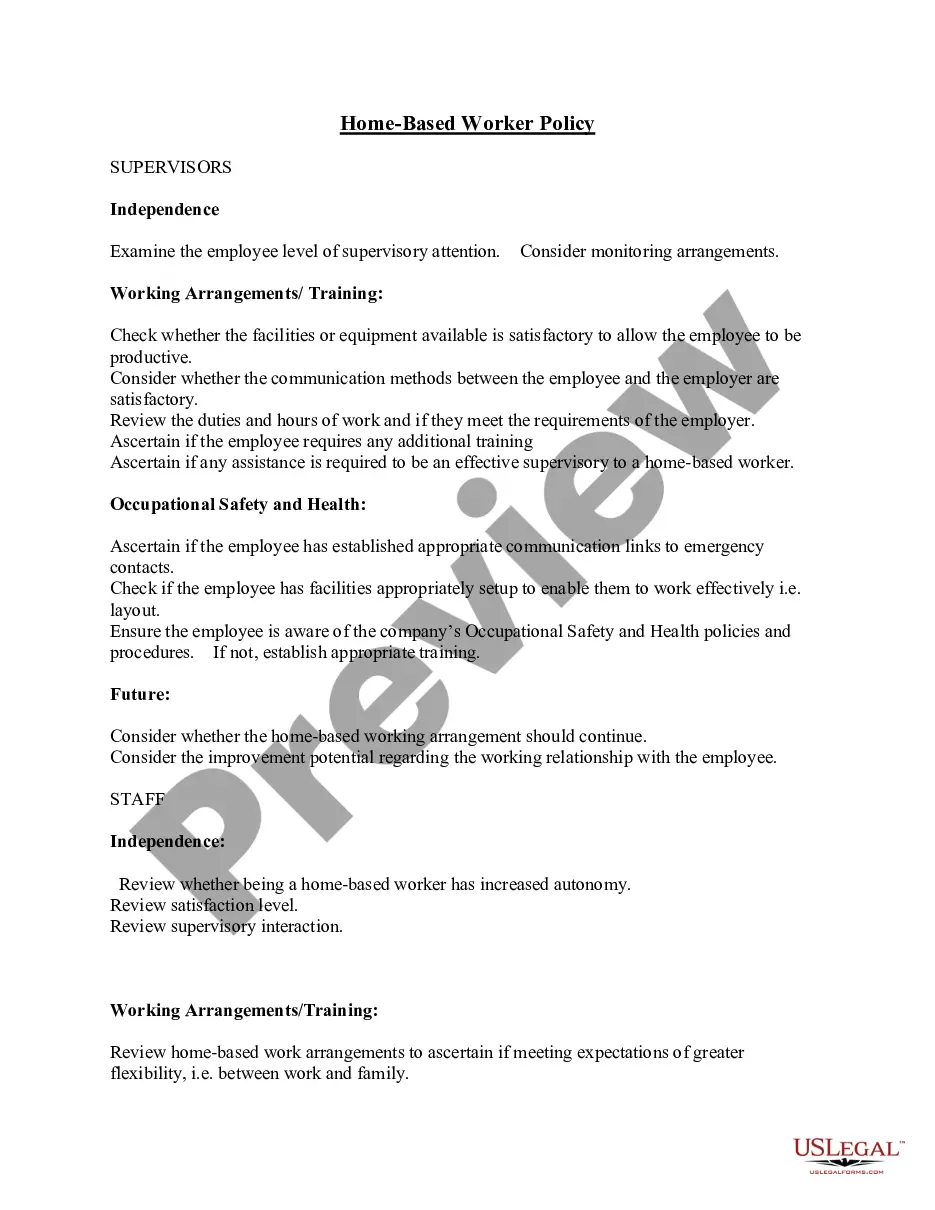

California Home Based Worker Policy

Description

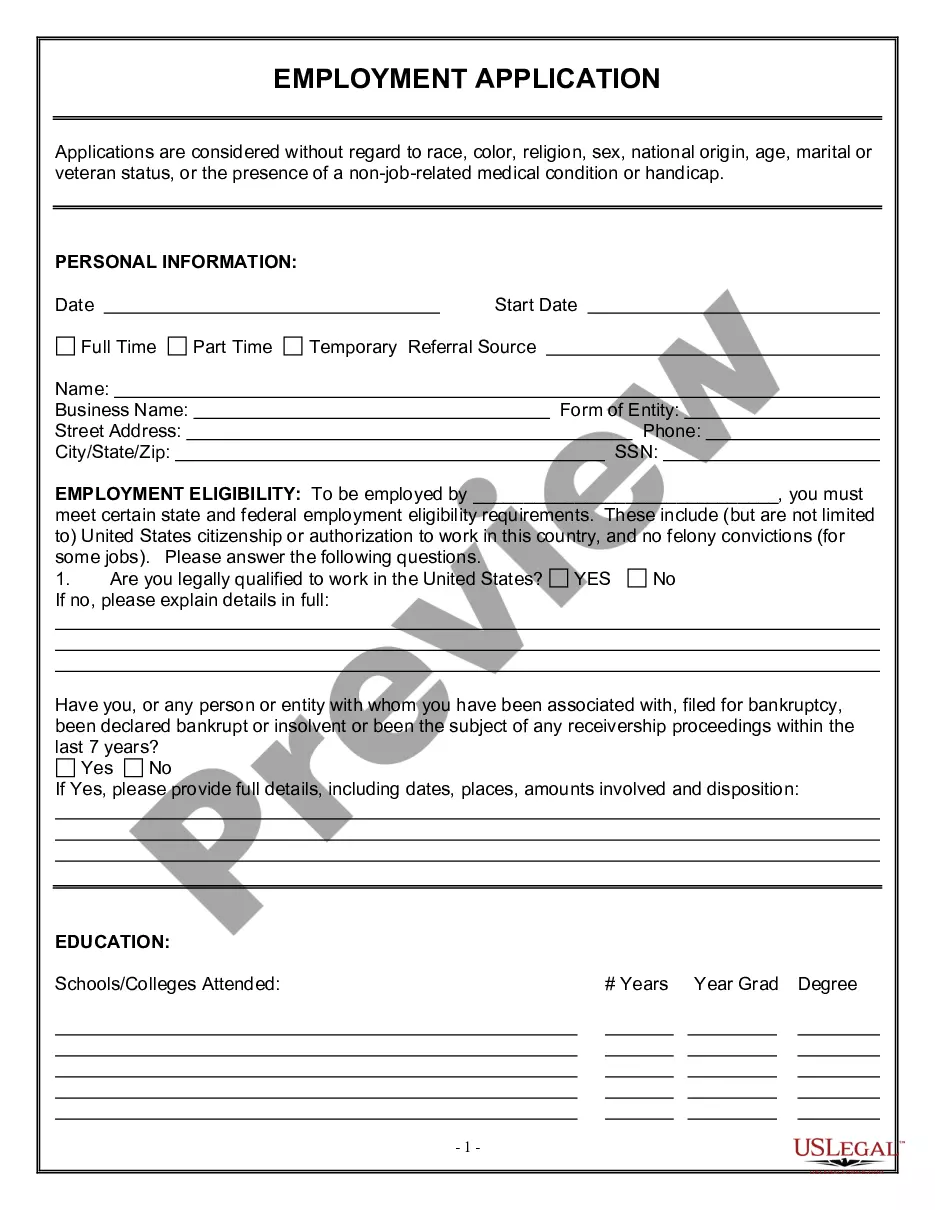

How to fill out Home Based Worker Policy?

Locating the appropriate sanctioned document template can be a challenge.

Certainly, there exists a selection of templates accessible online, but how can you obtain the legal form you require.

Utilize the US Legal Forms website.

If you are already a member, Log In to your account and click the Download button to acquire the California Home-Based Worker Policy.

- The service offers a multitude of templates, including the California Home-Based Worker Policy, suitable for both business and personal purposes.

- All documents are reviewed by experts and comply with federal and state regulations.

Form popularity

FAQ

Remote Work in California: The BasicsIt is legal to work remotely in California, but it is important for the employer and employee to mutually agree upon a set of rules and expectations for this kind of work especially as it is becoming more common during the pandemic.

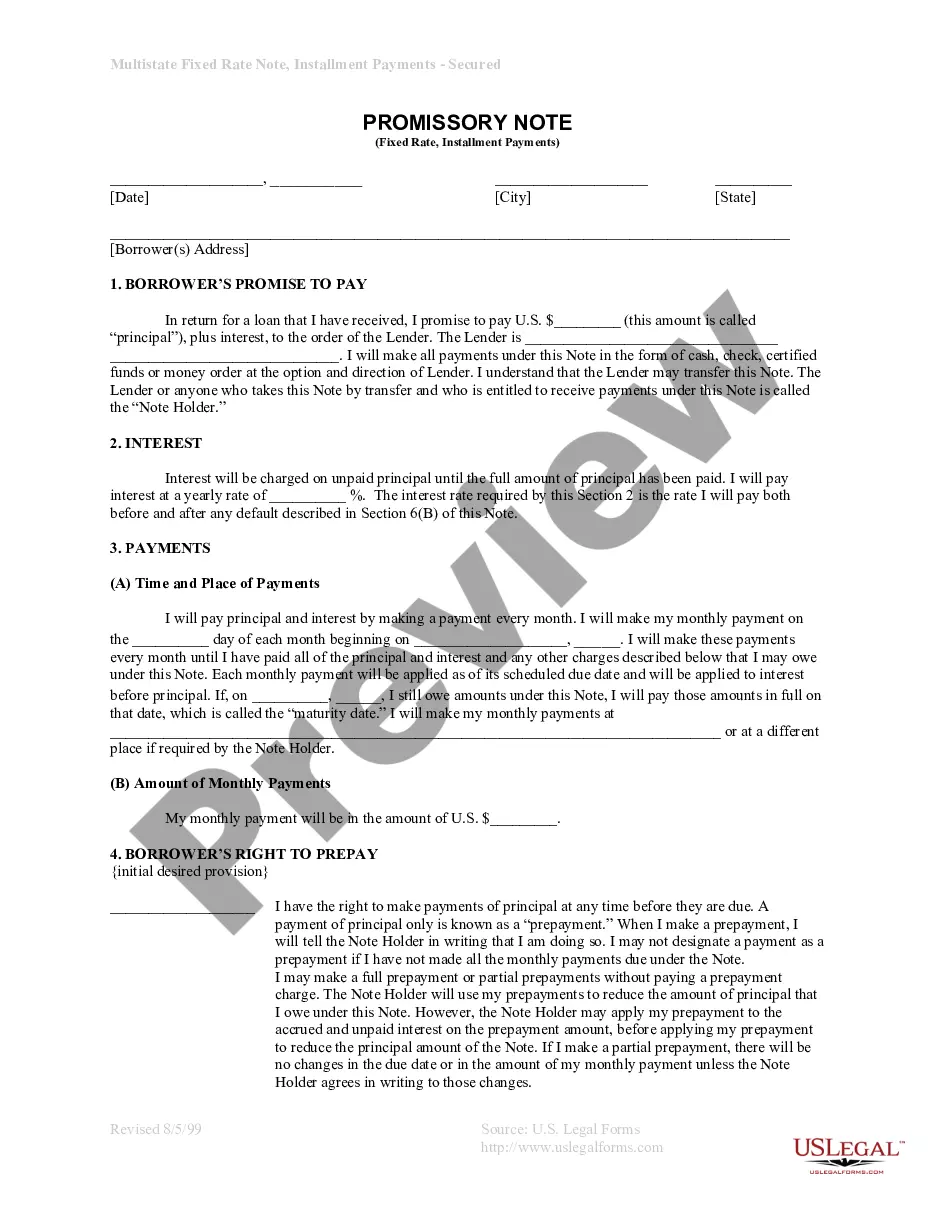

While not mandatory in every state, California employers are required to reimburse their employees for reasonable business expenses. This means employers must pay back employees who spend their own money for business-related expenses. Various California labor and tax laws outline the types of reimbursable expenses.

Can an employer refuse to reimburse expenses? Yes, an employer may refuse to reimburse an employee for his or her work-related expenses if they believe that the losses incurred by the employee are not necessary or reasonable.

Among people who believe employers should cover home internet costs, 26% believed employers should pay some of the bill directly, 40% believed employers should pay the full bill directly and 34% felt this should be covered via a routine stipend.

Many people who work remotely in California wonder if the same wage and hour laws apply to them that apply to on-site employees. The answer is yes. But you must be a non-exempt employee. You have the right to be paid at least minimum wage, overtime pay rates for overtime, and standard meals and rest breaks.

A recent ruling by the California Supreme Court has changed the ways in which wage and hour laws will be applied in cases involving out-of-state employees working in the state of California. As a result of the ruling, California overtime laws now apply to any out-of-state employees while they are working in California.

Is my employer required to cover my expenses if I work from home? The federal Fair Labor Standards Act (FLSA) generally does not require that an employee be reimbursed for expenses incurred while working from home. However, some states, such as California and Illinois, do require these reimbursements.

Do employers need to provide homeworkers with equipment to use at home? There is no general legal obligation on employers to provide the equipment necessary for homeworking. However, if homeworking is to be a success, it is important for employees to have the equipment they need to perform their role.

The Telework Flexibility Act (Assembly Bill No. 1028) would provide employers and employees with the flexibility required for remote work. If passed, this bill would adjust the parameters of a given workweek, which currently stands at 8 hours per day and 40 hours per week with paid overtime.

When remote work is mandatory even if ordered by California or local authorities employees must be reimbursed for the necessary expenses they incur while working at home.