California Exempt Survey

Description

How to fill out Exempt Survey?

Finding the appropriate official document template can be challenging.

Indeed, there are numerous templates available online, but how do you locate the official form you require.

Utilize the US Legal Forms website. This service offers thousands of templates, including the California Exempt Survey, for both business and personal purposes.

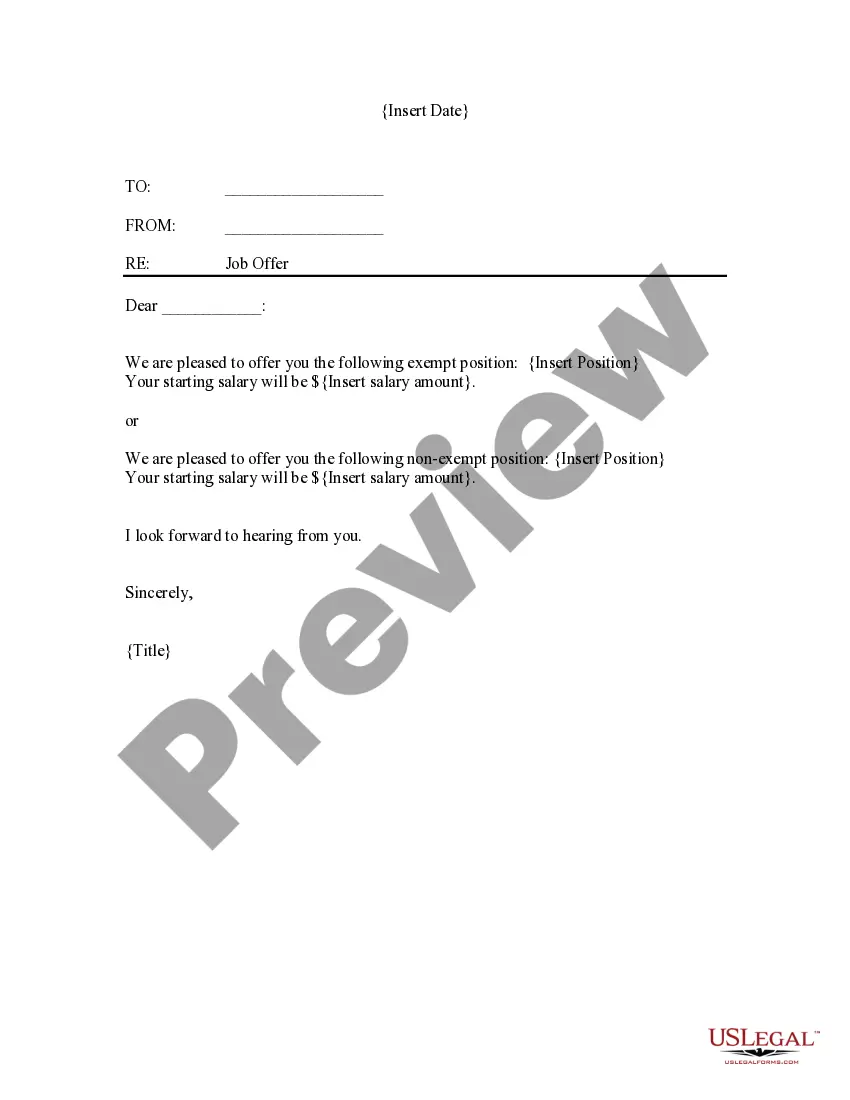

You can preview the form using the Review button and read the form description to confirm it is suitable for you.

- All forms are evaluated by experts and conform to federal and state regulations.

- If you are already registered, Log In to your account and click the Download button to retrieve the California Exempt Survey.

- Use your account to access the legal forms you've acquired previously.

- Navigate to the My documents section of your account to download another copy of the document you require.

- For new users of US Legal Forms, here are simple instructions for you to follow.

- First, make sure you have chosen the correct form for your region/state.

Form popularity

FAQ

Projects not eligible for an exempt review may be eligible for an expedited review. Expedited does not mean that the review is less rigorous or happens more quickly than convened review. It refers, instead, to certain types of research considered to involve minimal risk.

In order to qualify as an exempt employee in California in 2021, an employee working for a company with 26 or more employees must earn $1,120 per week, or $58,240 annually; an employee working for a company with fewer than 26 employees must earn $1,040 per week, or $54,080 annually, exclusive of board, lodging, and

The FLSA includes these job categories as exempt: professional, administrative, executive, outside sales, and computer-related. The details vary by state, but if an employee falls in the above categories, is salaried, and earns a minimum of $684 per week or $35,568 annually, then they are considered exempt.

Exempt research are human subjects studies that present no greater than minimal risk to subjects and fit into one or more exempt categories (as described below).

No full board review: An exempt protocol does not need full board review; modifications do not need to be reviewed at a full board meeting unless the protocol modifications change the exemption status.

Under California labor law, three requirements determine whether an employee is exempt or non-exempt: Minimum salary, White-collar duties, and. Independent judgment.

Research can qualify for an exemption if it is no more than minimal risk and all of the research procedures fit within one or more of the exemption categories in the federal IRB regulations. Studies that qualify for exemption must be submitted to the IRB for review before starting the research.

The Minimum Required Salary Amount260d This means that the minimum salary for exempt employees in 2022 is either: $4,853.34 per month (or $58,240.00 annually) if the employee works for an employer of 25 or fewer people, or. $5,200.00 per month (or $62,400202c.

Exempt human subjects research is a sub-set of research involving human subjects that does not require comprehensive IRB review and approval because the only research activity involving the human subjects falls into one or more specific exemption categories as defined by the Common Rule.

Exempt Categories:Education research.Surveys, interviews, educational tests, public observations (that do not involve children)Benign behavioral interventions.Analysis of previously-collected, identifiable info/specimens.Federal research/demonstration projects.Taste and food evaluation studies.