California Resolution of Meeting of LLC Members to Specify Amount of Annual Disbursements to Members of the Company

Description

How to fill out Resolution Of Meeting Of LLC Members To Specify Amount Of Annual Disbursements To Members Of The Company?

US Legal Forms - among the many largest collections of legal forms in the United States - offers a vast selection of legal document templates that you can download or print.

By utilizing the website, you can access thousands of forms for business and personal purposes, organized by categories, states, or keywords. You can find the latest versions of forms, such as the California Resolution of Meeting of LLC Members to Specify Amount of Annual Disbursements to Members of the Company in just minutes.

If you already have an account, Log In and download the California Resolution of Meeting of LLC Members to Specify Amount of Annual Disbursements to Members of the Company from the US Legal Forms library. The Download button will appear on each form you view. You can access all previously downloaded forms in the My documents section of your account.

Process the payment. Use your Visa or Mastercard or PayPal account to finalize the purchase.

Choose the format and download the form to your device. Edit. Complete, modify, print, and sign the downloaded California Resolution of Meeting of LLC Members to Specify Amount of Annual Disbursements to Members of the Company.

Every template you save in your account does not expire and is yours indefinitely. Therefore, to download or print another version, simply navigate to the My documents section and click on the form you need.

Access the California Resolution of Meeting of LLC Members to Specify Amount of Annual Disbursements to Members of the Company with US Legal Forms, the most extensive library of legal document templates. Utilize thousands of professional and state-specific templates that cater to your business or personal requirements.

- Make sure you have selected the correct form for your city/region.

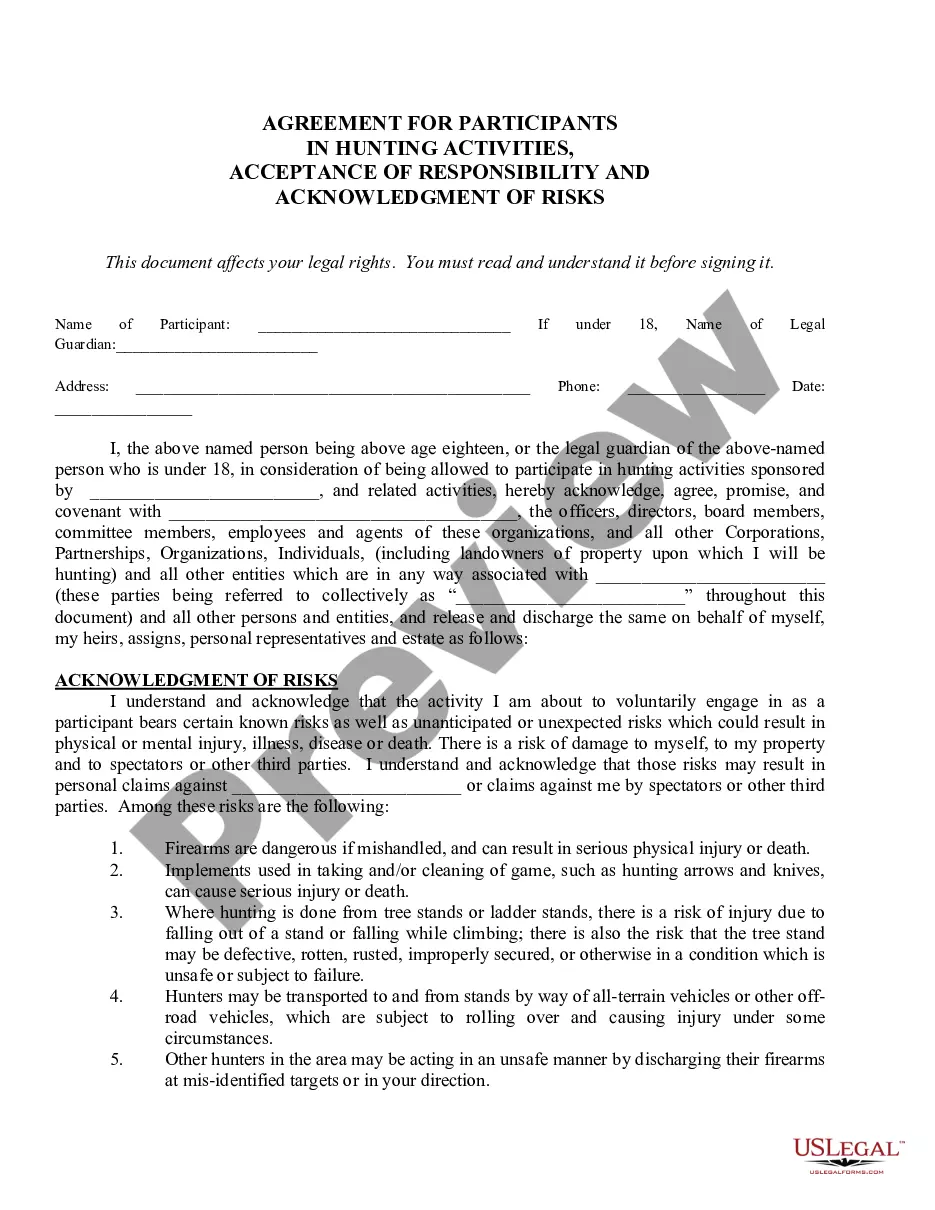

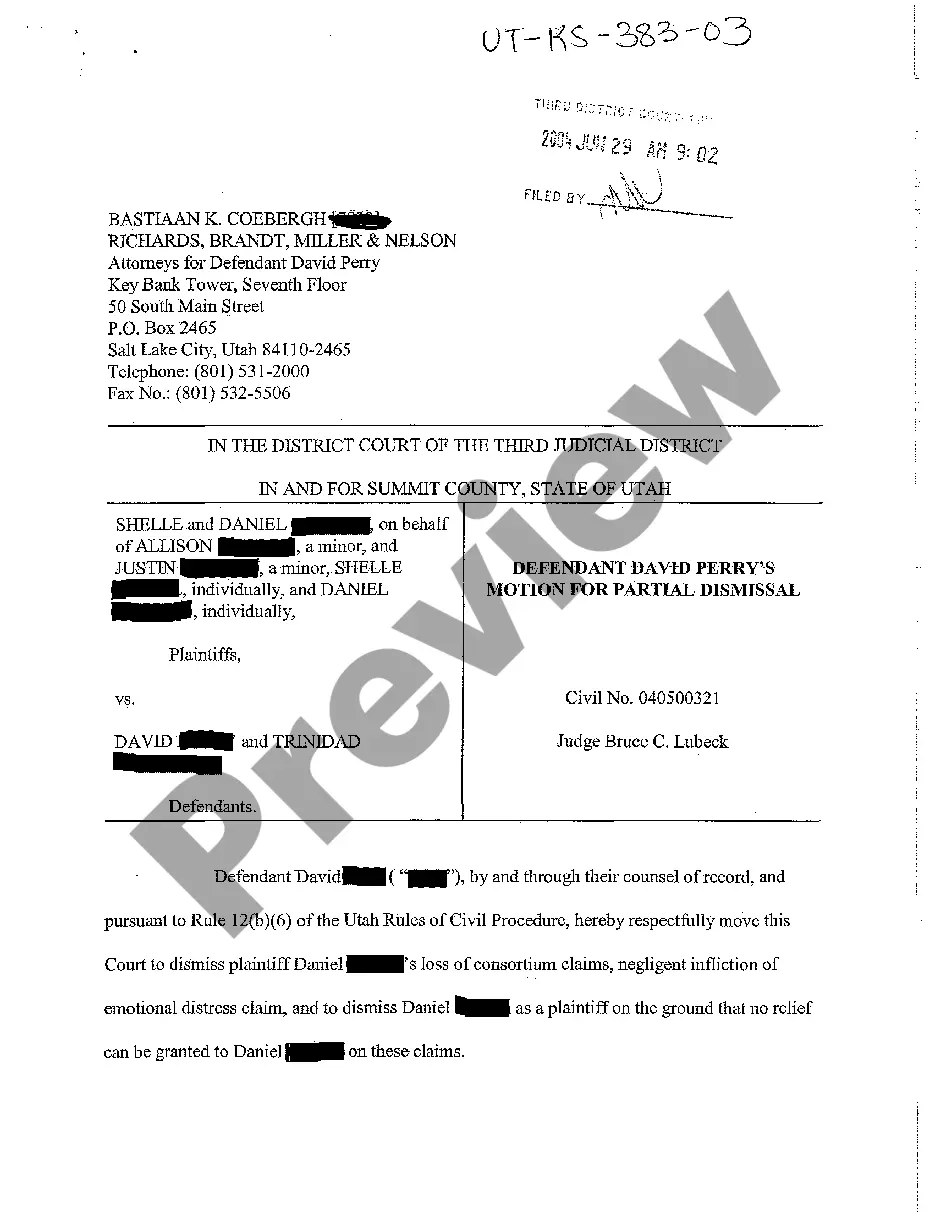

- Click the Preview button to review the content of the form.

- Check the form description to ensure you have chosen the right one.

- If the form does not suit your needs, use the Search field at the top of the screen to find one that does.

- If you are satisfied with the form, confirm your choice by clicking the Purchase now button.

- Then, select the pricing plan you prefer and provide your details to register for an account.

Form popularity

FAQ

An operating agreement serves as the foundational document that outlines the structure, management, and operational procedures of an LLC. In contrast, a resolution is a specific decision made during a meeting and documented for record-keeping. Consider incorporating the California Resolution of Meeting of LLC Members to Specify Amount of Annual Disbursements to Members of the Company as a resolution to detail financial agreements within the framework established by the operating agreement.

To maintain an LLC in California, you must comply with state regulations, which include filing Statements of Information, paying annual fees, and keeping accurate records. Additionally, having a clear operating agreement and resolutions, like the California Resolution of Meeting of LLC Members to Specify Amount of Annual Disbursements to Members of the Company, can help solidify the management structure and decision-making processes of your LLC.

Types of Corporate Resolutions A resolution might outline the officers that are authorized to act (trade, assign, transfer or hedge securities and other assets) on behalf of the corporation. The resolution would outline who is authorized to open a bank account, withdraw money, and write checks.

File Form 568. Pay an annual tax of $800 (refer to Annual Tax Section); and. Pay an annual LLC fee based on total income from all sources derived from or attributable to California.

How To Write a Corporate Resolution Step by StepStep 1: Write the Company's Name.Step 2: Include Further Legal Identification.Step 3: Include Location, Date and Time.Step 4: List the Board Resolutions.Step 5: Sign and Date the Document.

Every LLC that is doing business or organized in California must pay an annual tax of $800. This yearly tax will be due, even if you are not conducting business, until you cancel your LLC. You have until the 15th day of the 4th month from the date you file with the SOS to pay your first-year annual tax.

This form lets you do business under a name other than the one listed in your LLC's Articles of Organization. You must renew this statement every five years and you expect to pay a renewal fee.

How to fill in California Form 568Line 1Total income from Schedule IW. Enter the total income.Line 2Limited liability company fee. Enter the amount of the LLC fee. The LLC must pay a fee if the total California income is equal to or greater than $250,000.

This document keeps the state updated with your LLC's contact details. You'll need to file your first Statement of Information within 90 days after the state approves your California LLC. Afterwards, you must submit it once every 2 years to keep your business in good standing.

To generate Form 568, line 7Go to Screen 37, Miscellaneous Information.Select California from the top-left panel St. Misc. Info.Scroll to the Limited Partnership Tax/LLC Annual Tax/Administrative Adjustment section.Enter the amount in either: Overpayment from a prior year credited to tax, or.