California Purchase Invoice

Description

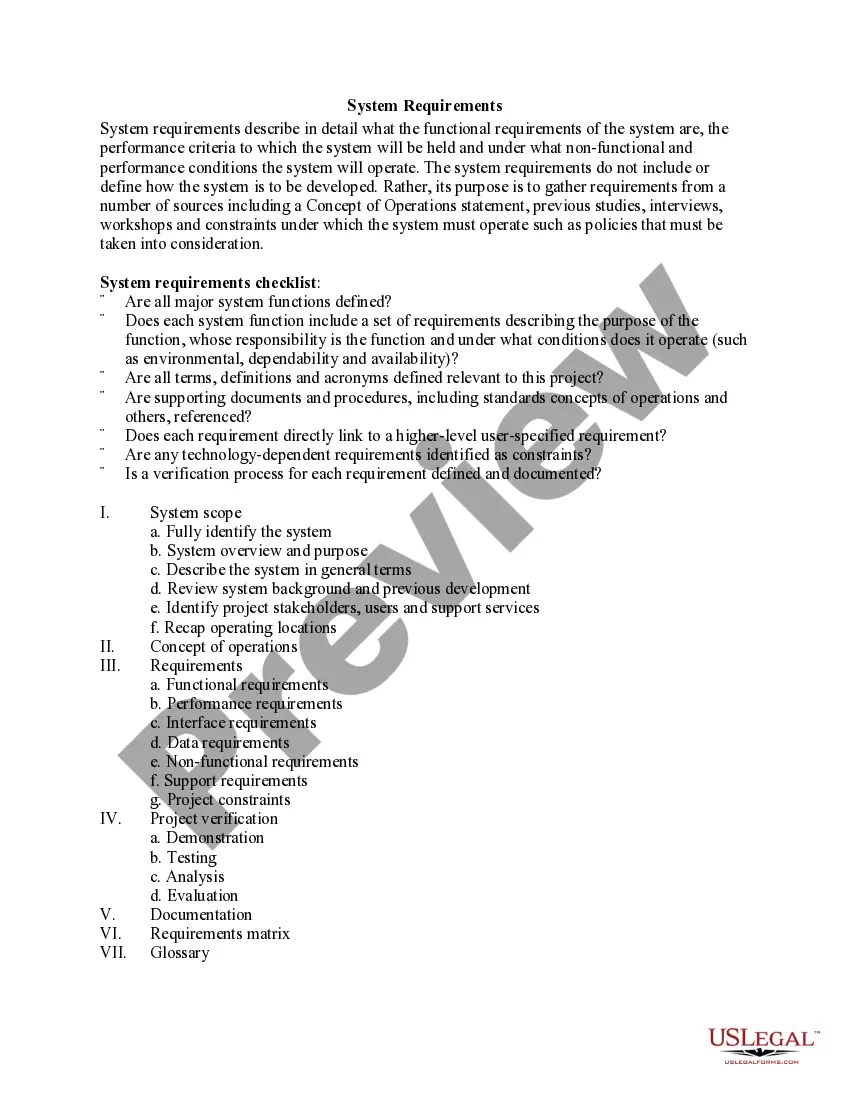

How to fill out Purchase Invoice?

If you desire to complete, acquire, or print authorized document templates, utilize US Legal Forms, the largest collection of official forms available online.

Leverage the website's user-friendly search feature to locate the documents you need.

Various templates for business and personal purposes are categorized by type and state, or keywords.

Step 4. Once you have found the form you need, click the Buy now button. Choose the pricing plan that suits you and enter your information to register for an account.

Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the purchase.

- Employ US Legal Forms to find the California Purchase Invoice in just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and hit the Download button to obtain the California Purchase Invoice.

- You can also access forms you have previously obtained under the My documents tab of your account.

- If you are using US Legal Forms for the first time, follow the guidelines below.

- Step 1. Ensure you have selected the form for your specific region/country.

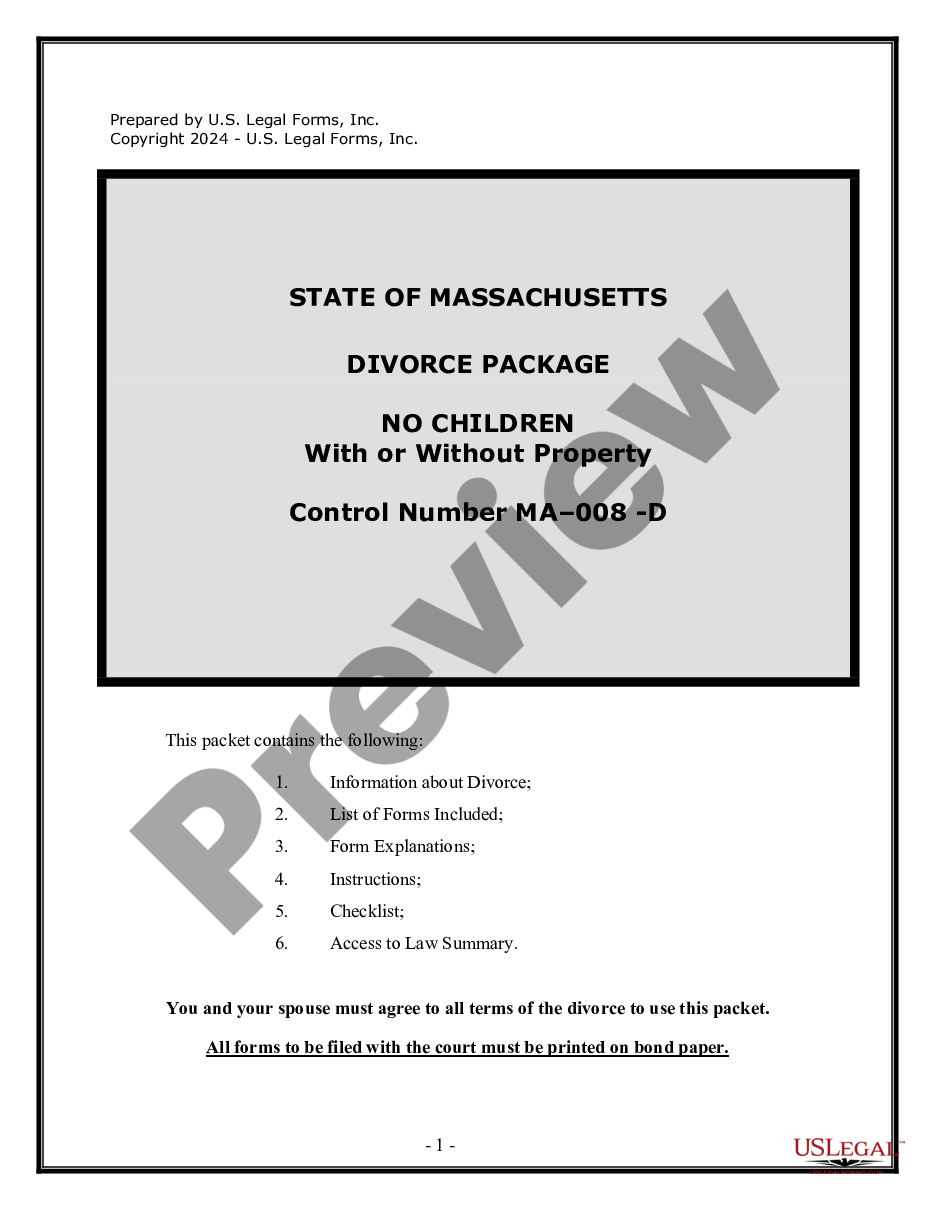

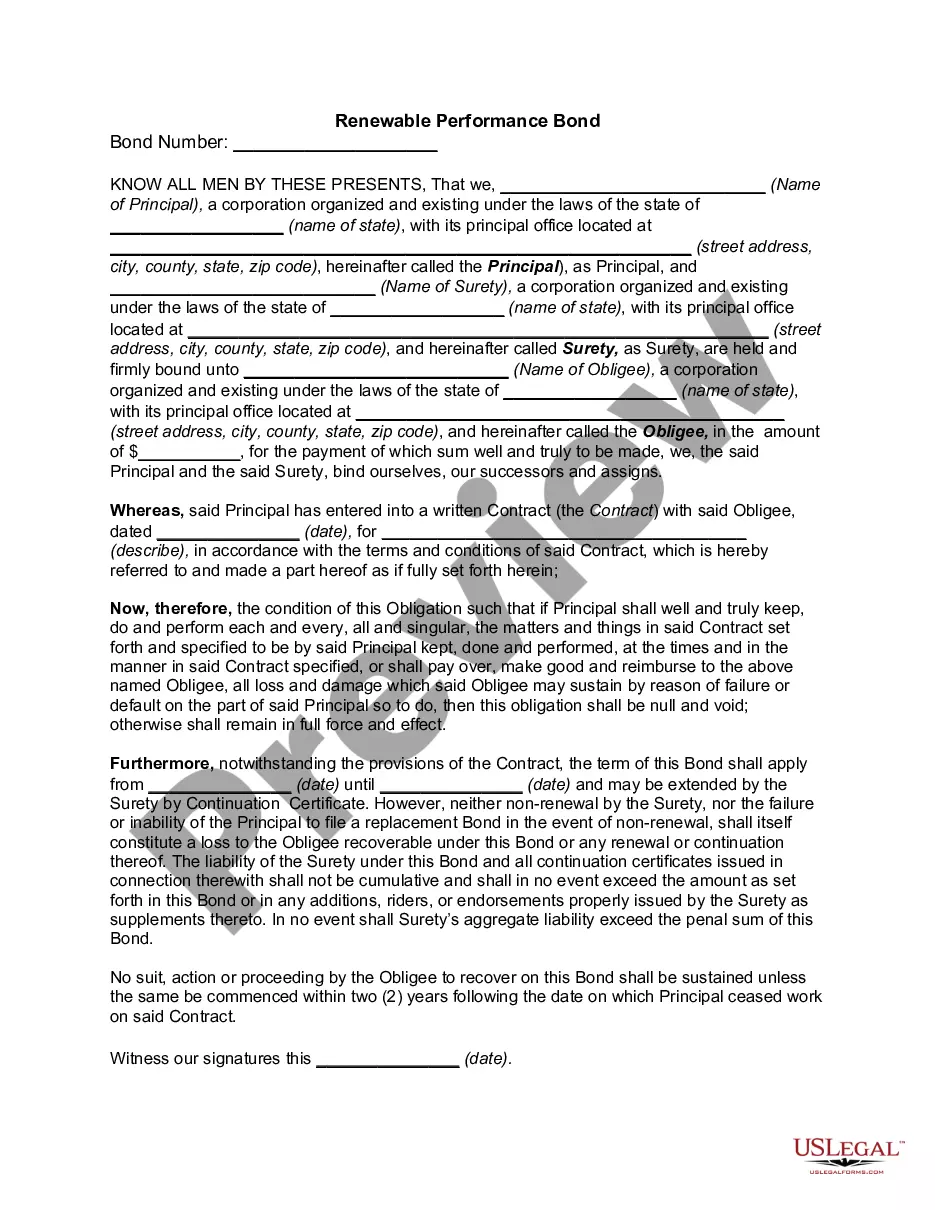

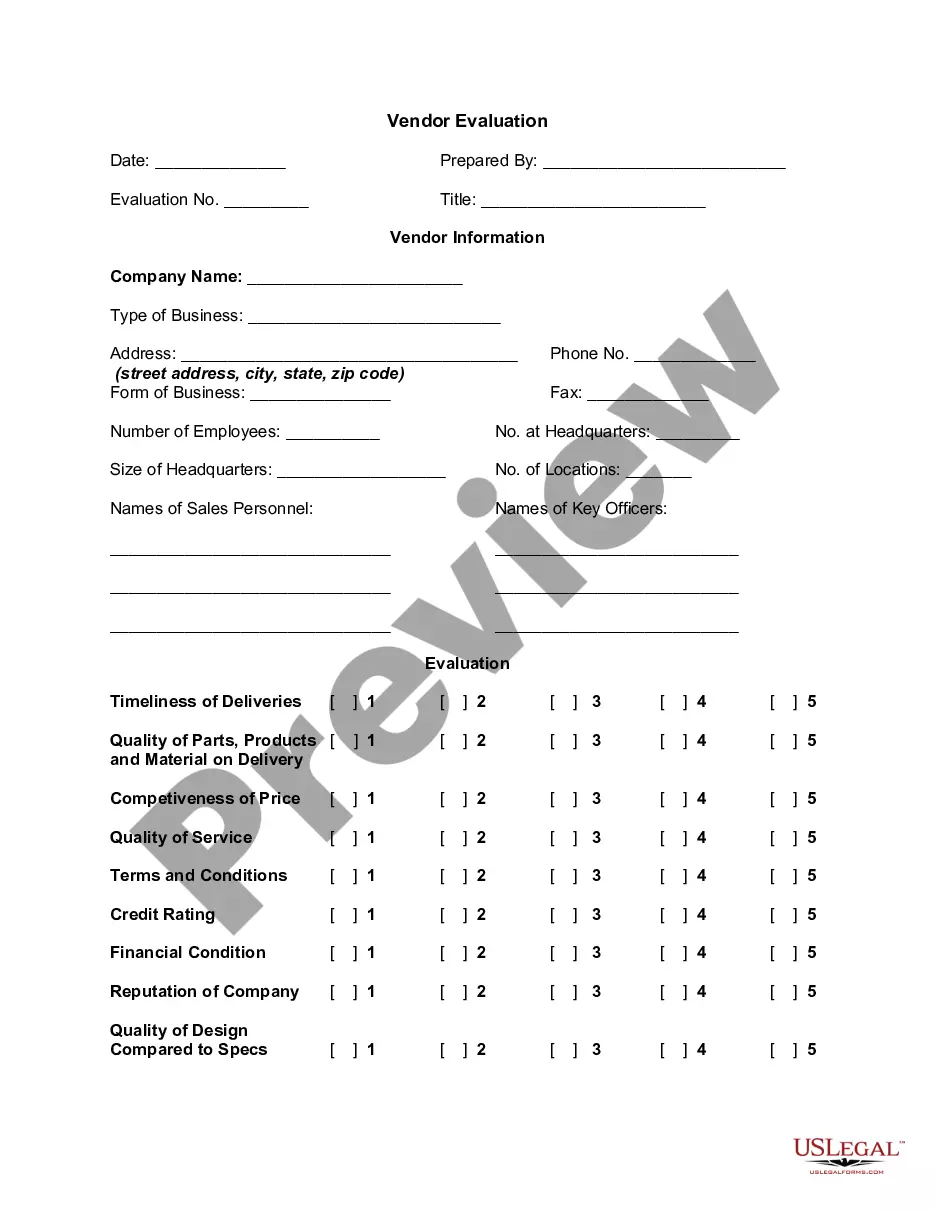

- Step 2. Use the Review option to check the form's details. Remember to read the description.

- Step 3. If you are not satisfied with the form, utilize the Search field at the top of the screen to find other versions of the document template.

Form popularity

FAQ

California does not impose value-added tax (VAT) as it is commonly known outside the U.S. Instead, the state utilizes a sales tax structure. When preparing a California Purchase Invoice, remember to apply the appropriate sales tax instead of VAT. For specific inquiries about tax responsibilities, our US Legal Forms platform provides resources and documents to guide you through the invoicing process.

California sales tax was 6% during specific periods in the past, notably before the statewide increase that took effect in 2009. The changes in the California Purchase Invoice requirements reflect adjustments in state tax policies over time. Tracking these historical rates can aid businesses in understanding tax trends. Always refer to current tax guidelines for the most accurate invoicing practices.

Yes, international tourists may qualify for a refund of California sales tax on certain purchases. When tourists present a California Purchase Invoice, they may apply for a tax refund through the necessary channels. However, specific rules and procedures govern this process, so it’s essential to check the latest guidelines. By doing so, tourists can maximize their financial benefits from shopping in California.

The invoice tax in California generally refers to the sales tax applied to goods and services sold within the state. When you create a California Purchase Invoice, it’s important to include the relevant sales tax based on the transaction's location. As of now, the statewide base sales tax is 7.25%, but local jurisdictions may impose additional taxes. Understanding these rates ensures compliance and accuracy in your invoicing process.

Yes, if you reside in California or have income from California sources, you may need to file a state income tax return. Moreover, filing a California Purchase Invoice helps you keep accurate records of your transactions, which can streamline the tax process. It's essential to review your income levels and specific circumstances, as they dictate your filing requirements. For tailored advice, consider consulting a tax professional or utilizing resources available on uslegalforms.

Filing invoices, including the California Purchase Invoice, requires a clear process. First, create a dedicated folder, either digitally or physically, where you store all invoices. Ensure you label invoices consistently and consider using a document management system like US Legal Forms to enhance organization and keep track of all outstanding payments.

The best way to file accounts payable invoices, such as the California Purchase Invoice, involves organizing them systematically. Start by categorizing invoices based on vendor names or invoice dates. Utilize digital platforms like US Legal Forms, which streamline invoice storage and retrieval, ensuring that you can quickly access any invoice when needed.

Properly filling out an invoice requires attention to detail. Start by entering your business name and contact info, followed by the client's details, date, and invoice number. Clearly outline each product or service along with the costs. Using a California Purchase Invoice can provide guidance and ensure that nothing important is overlooked.

Writing a proper invoice starts with a professional format that features your logo and business details. Clearly list each item or service provided, along with corresponding prices. Include payment terms, such as due dates and late fees, to clarify expectations. For smooth transactions, utilizing a California Purchase Invoice can enhance clarity and boost professionalism.

To properly fill out a commercial invoice, include accurate sender and receiver information, a detailed description of the goods or services, and their value. Specify the terms of sale and payment methods accepted. You may also need to include shipping details and any applicable international tariffs, especially if exporting. Using a California Purchase Invoice template can help streamline this process.