California Re-Hire Employee Information Form

Description

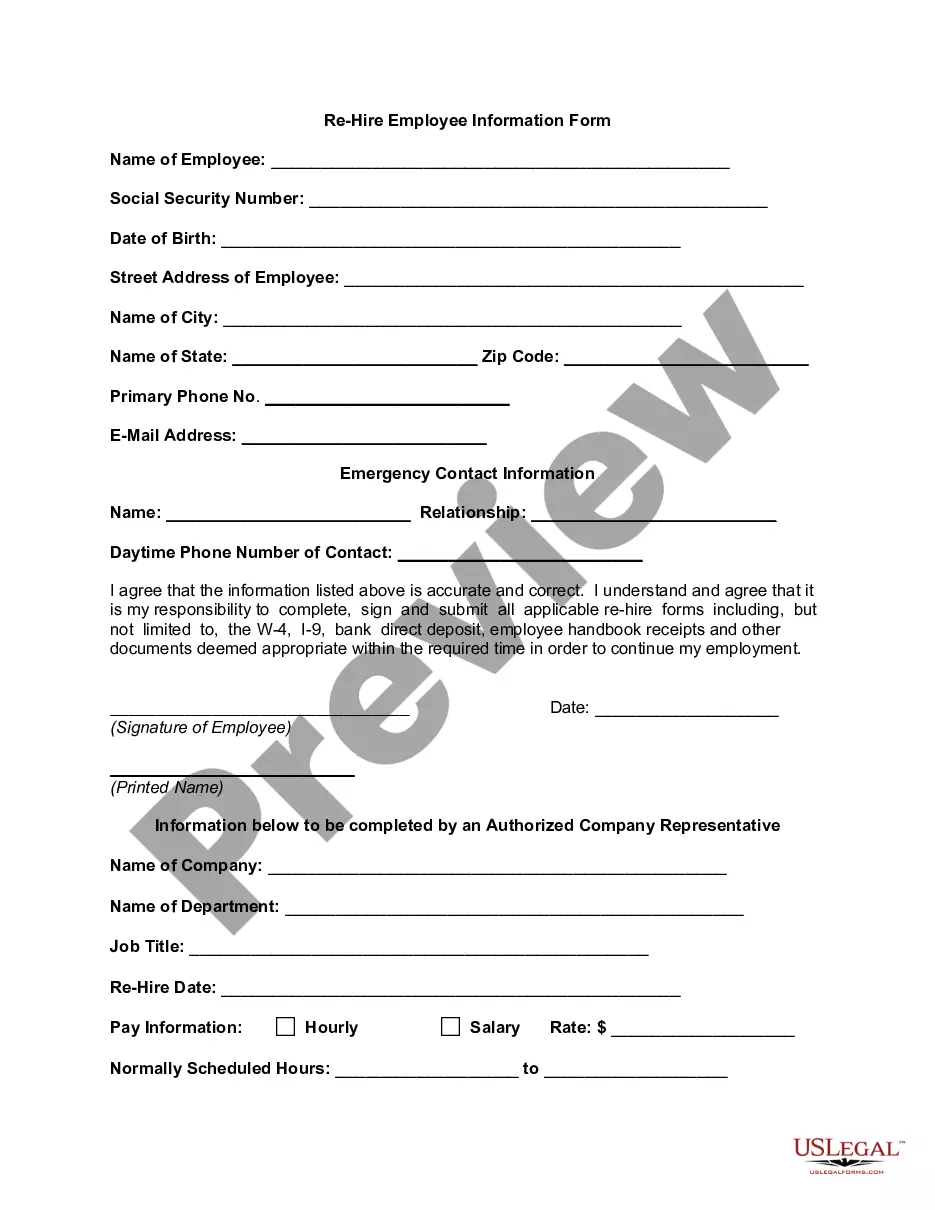

How to fill out Re-Hire Employee Information Form?

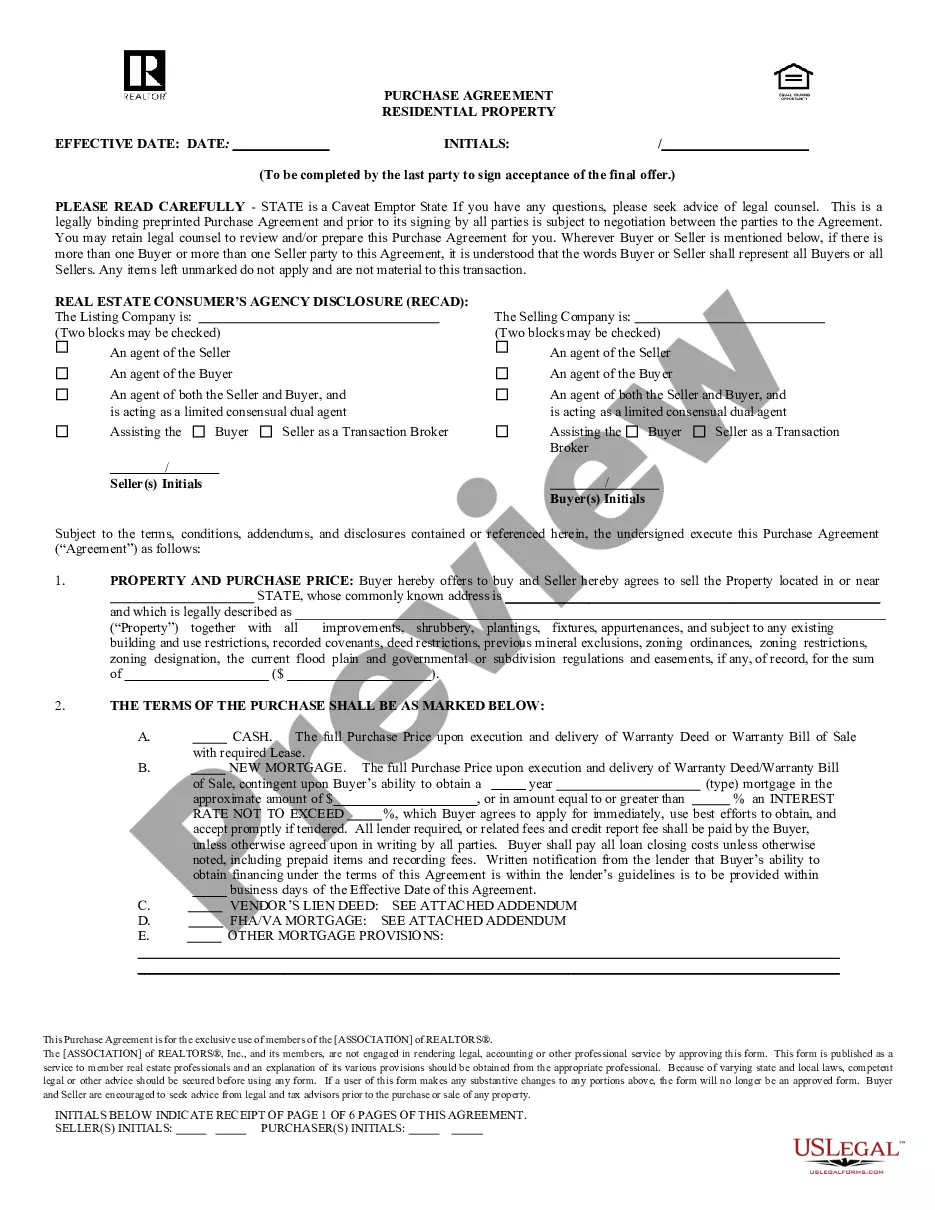

If you want to compile, download, or create authentic document formats, utilize US Legal Forms, the largest selection of official templates, which are accessible online.

Take advantage of the site’s straightforward and effective search to obtain the documents you need.

Various templates for business and personal purposes are categorized by types and states, or keywords.

Step 4. Once you have located the form you need, click the Buy now button. Choose your preferred pricing plan and enter your information to register for an account.

Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the payment.

- Utilize US Legal Forms to acquire the California Re-Hire Employee Information Form in just a few clicks.

- If you are an existing US Legal Forms user, sign in to your account and then hit the Download button to retrieve the California Re-Hire Employee Information Form.

- You can also access forms you have previously downloaded in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow these steps below.

- Step 1. Ensure you have selected the form for the correct city/state.

- Step 2. Use the Review option to verify the form's details. Be sure to read the description.

- Step 3. If you are not satisfied with the form, use the Search box at the top of the screen to find other versions of the official form template.

Form popularity

FAQ

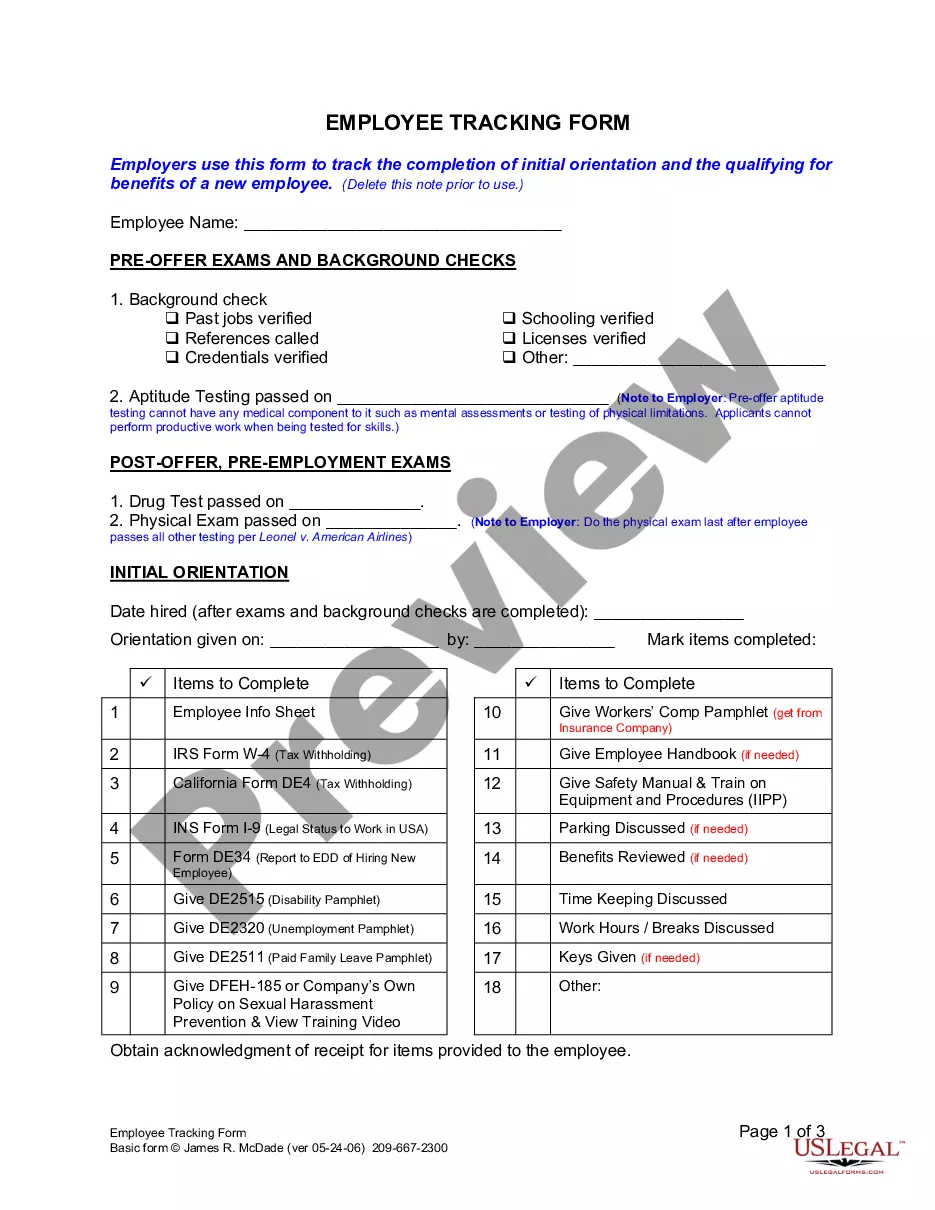

California employers must provide the following documents for example: I-9 Employment Eligibility Verification completed. W-4 federal and state tax withholding forms completed. Workers' Compensation Time of Hire Pamphlet: Personal Chiropractor or Acupuncturist Designation Form and Personal Physician Designation Form.

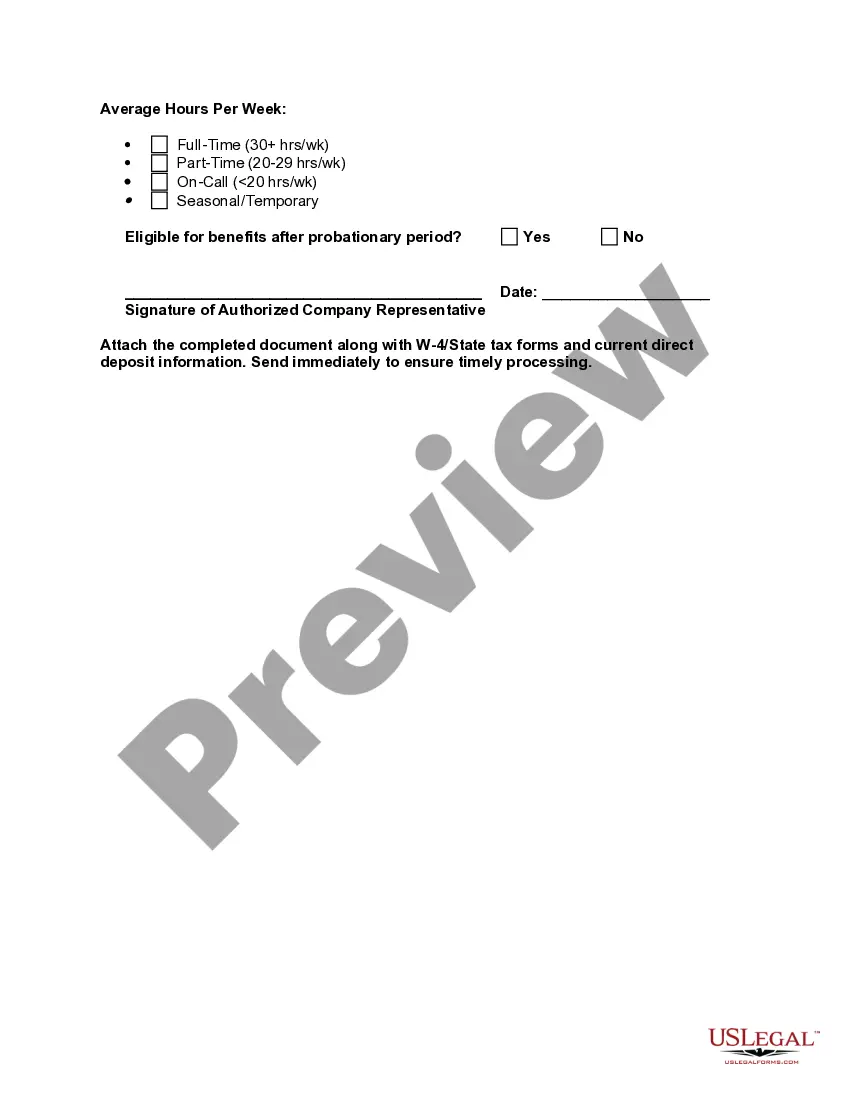

The federal requirement was implemented by California effective July 1, 1998. California employers are required to report information on newly hired or rehired employees who work in California to the EDD's New Employee Registry (NER).

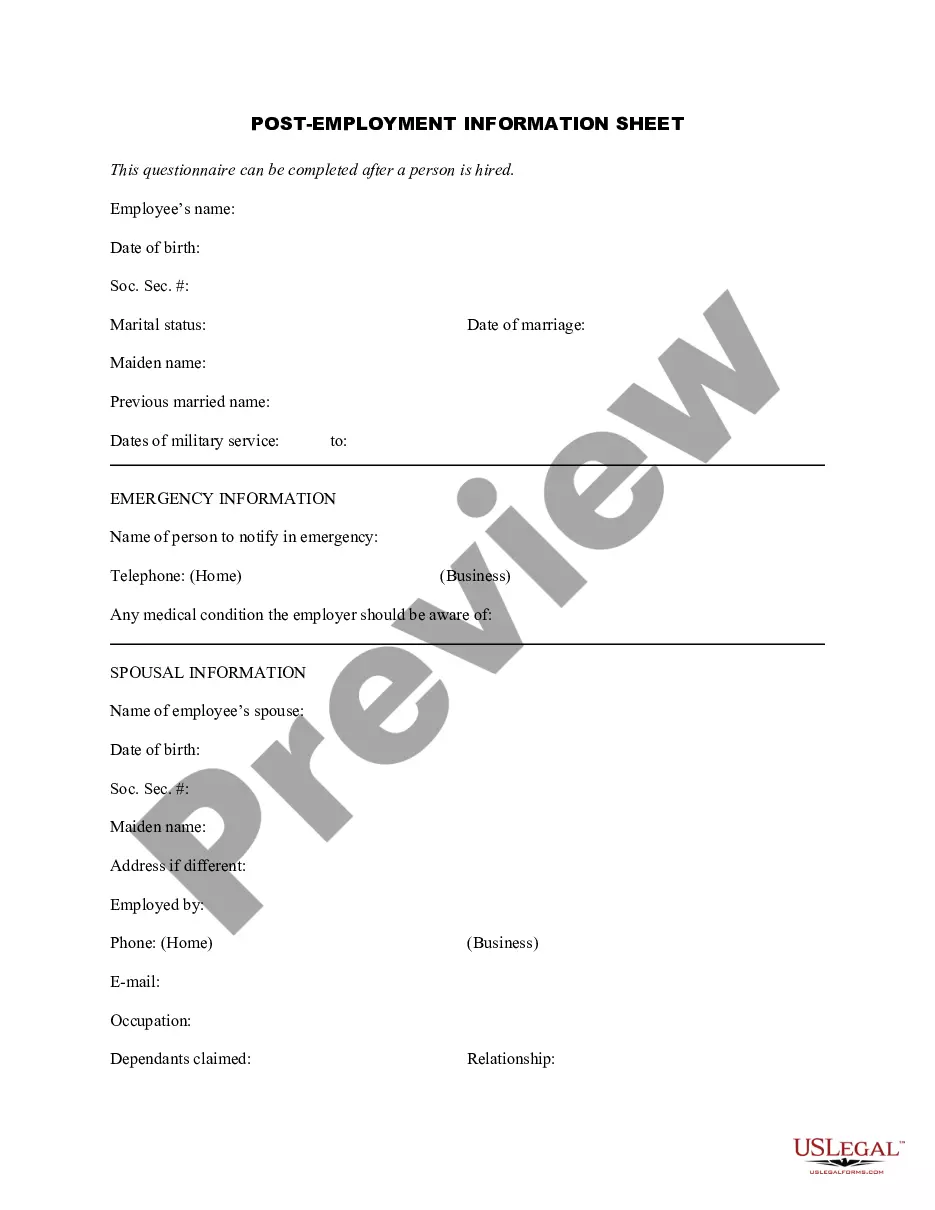

4 form (or 9 for contractors) I9 Employment Eligibility Verification form. State Tax ithholding form. Direct Deposit form....An employment contract should include:Job information (job title, department)ork schedule.Length of employment.Compensation and benefits.Employee responsibilities.Termination conditions.

Employers report their newly hired employees to the Registry. California matches New Employee Registry reports against child support records to help locate parents in order to establish wage withholding orders or enforce existing orders.

California Form DE 34 Information California Form DE 34 is used to report a new employee(s). Federal law requires all employers to report to EDD within 20 days of start of work all employees who are newly hired or rehired.

All California employers must report all of their new or rehired employees who work in California to the New Employee Registry within 20 days of their start-of-work date, which is the first day of work. Any employee who is rehired after a separation of at least 60 consecutive days must also be reported within 20 days.

Required Employment Forms in California for new hiresSigned Job Offer Letter.W2 Tax Form.I-9 Form and Supporting Documents.Direct Deposit Authorization Form (Template)Federal W-4 Form.DE 4 California Payroll Tax Form.Employee Personal Data Form (Template)Company Worker's Compensation Insurance Policy Forms.More items...

California employers must provide the following documents for example: I-9 Employment Eligibility Verification completed. W-4 federal and state tax withholding forms completed. Workers' Compensation Time of Hire Pamphlet: Personal Chiropractor or Acupuncturist Designation Form and Personal Physician Designation Form.

The most common types of employment forms to complete are:W-4 form (or W-9 for contractors)I-9 Employment Eligibility Verification form.State Tax Withholding form.Direct Deposit form.E-Verify system: This is not a form, but a way to verify employee eligibility in the U.S.

Here's what you'll need to have them sign:An official offer letter.A personal data form.An I-9 Employment Eligibility Verification form that verifies their right to work in the United States.A W-2 tax form.A W-4 tax form.A DE 4 California Payroll Tax Form.Any insurance forms.More items...