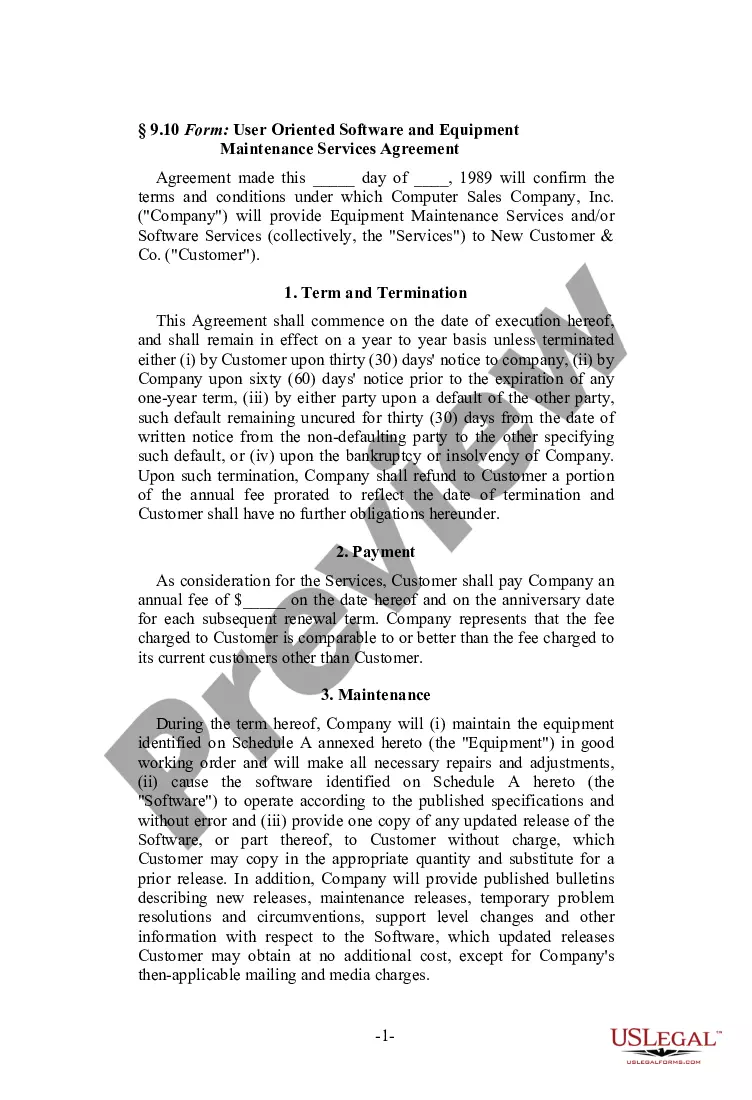

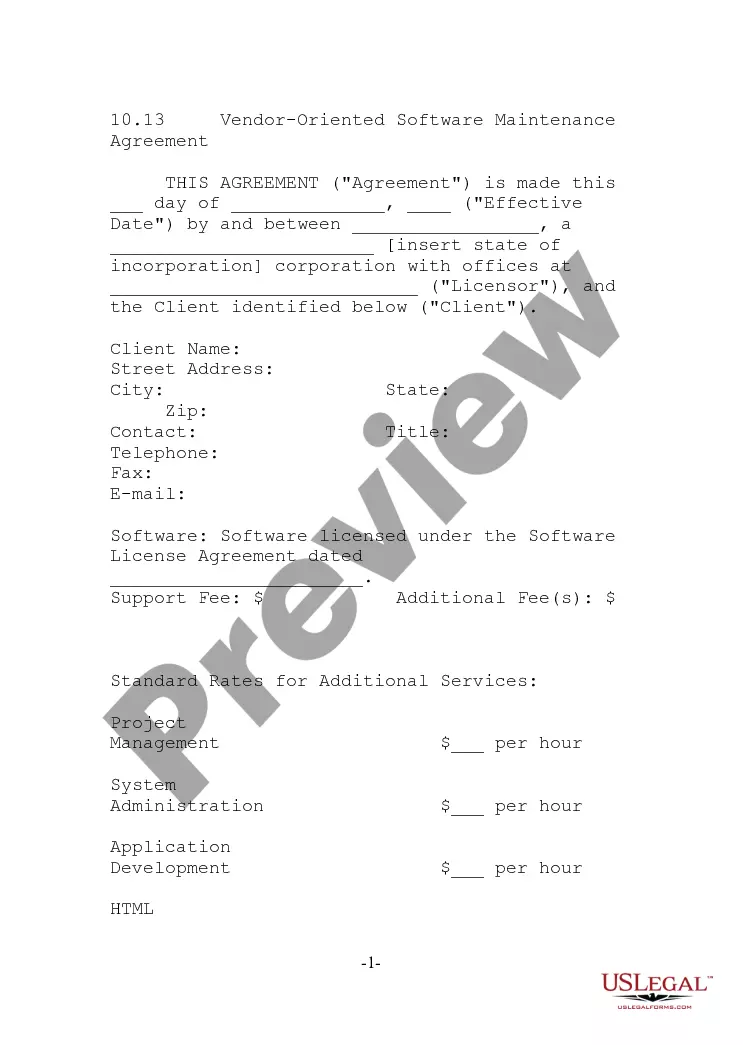

California User Oriented Software and Equipment Maintenance Services Agreement

Description

How to fill out User Oriented Software And Equipment Maintenance Services Agreement?

You can spend several hours online looking for the valid document template that meets the state and federal requirements you need.

US Legal Forms offers thousands of valid forms that can be assessed by experts.

You can effortlessly download or print the California User Oriented Software and Equipment Maintenance Services Agreement from my support.

If available, use the Preview option to review the document template as well.

- If you already possess a US Legal Forms account, you may Log In and select the Obtain option.

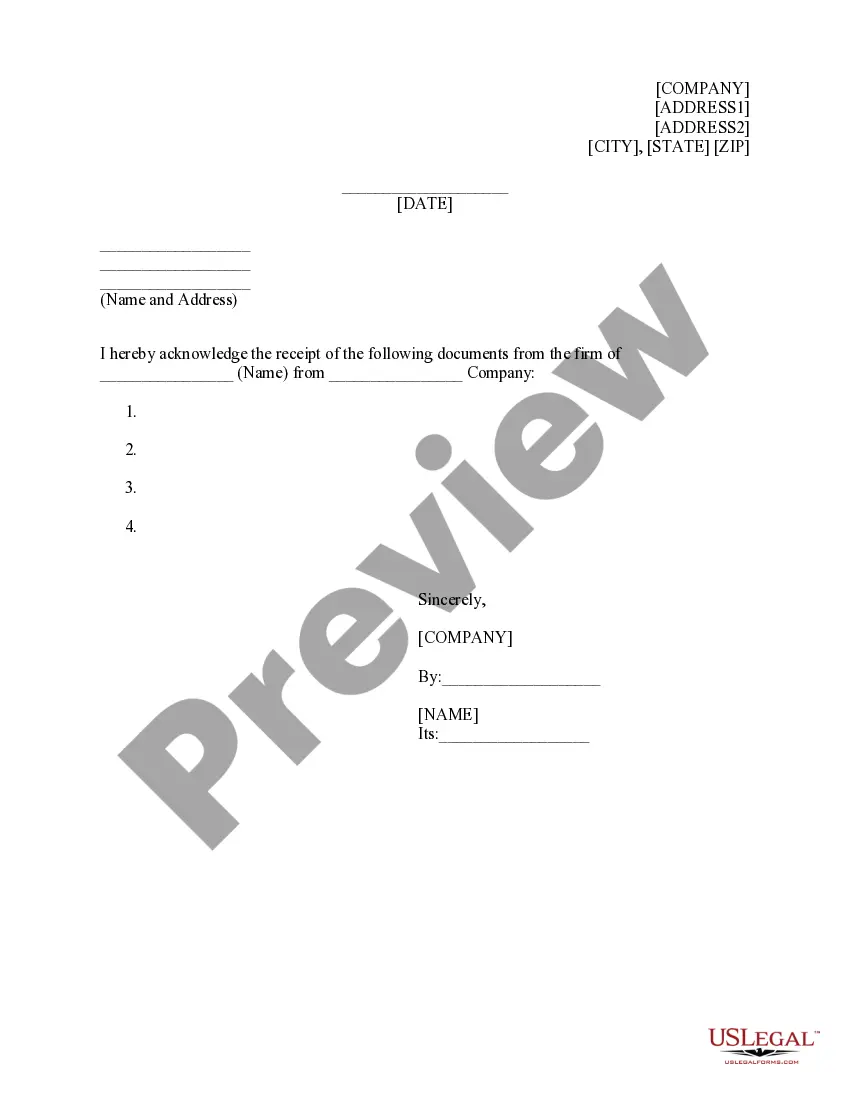

- Next, you may complete, modify, print, or sign the California User Oriented Software and Equipment Maintenance Services Agreement.

- Each valid document template you acquire is yours to keep indefinitely.

- To obtain another copy of a purchased form, navigate to the My documents tab and select the appropriate option.

- If you are using the US Legal Forms website for the first time, follow the simple guidelines below.

- First, ensure that you have selected the correct document template for the state/region of your choice.

- Review the form details to confirm that you have picked the right document.

Form popularity

FAQ

Yes. Retail sales tax applies to a service contract or warranty sold to a consumer (WAC 458-20-257).

A software maintenance agreement, or SMA, is a legal contract that obligates the software vendor to provide technical support and updates for an existing software product for their customers. It may also extend the expiration date of certain features, such as new releases or upgrades.

Sales of custom software - delivered on tangible media are exempt from the sales tax in California. Sales of custom software - downloaded are exempt from the sales tax in California.

Under California sales tax rules, cleaning or janitorial services are exempt from having to charge sales tax even when certain products (cleaning products and supplies) are used incidentally in connection with the services.

Software maintenance as a product does NOT include the creation, design, implementation, integration, etc. of a software package. These examples are considered software maintenance as a service.

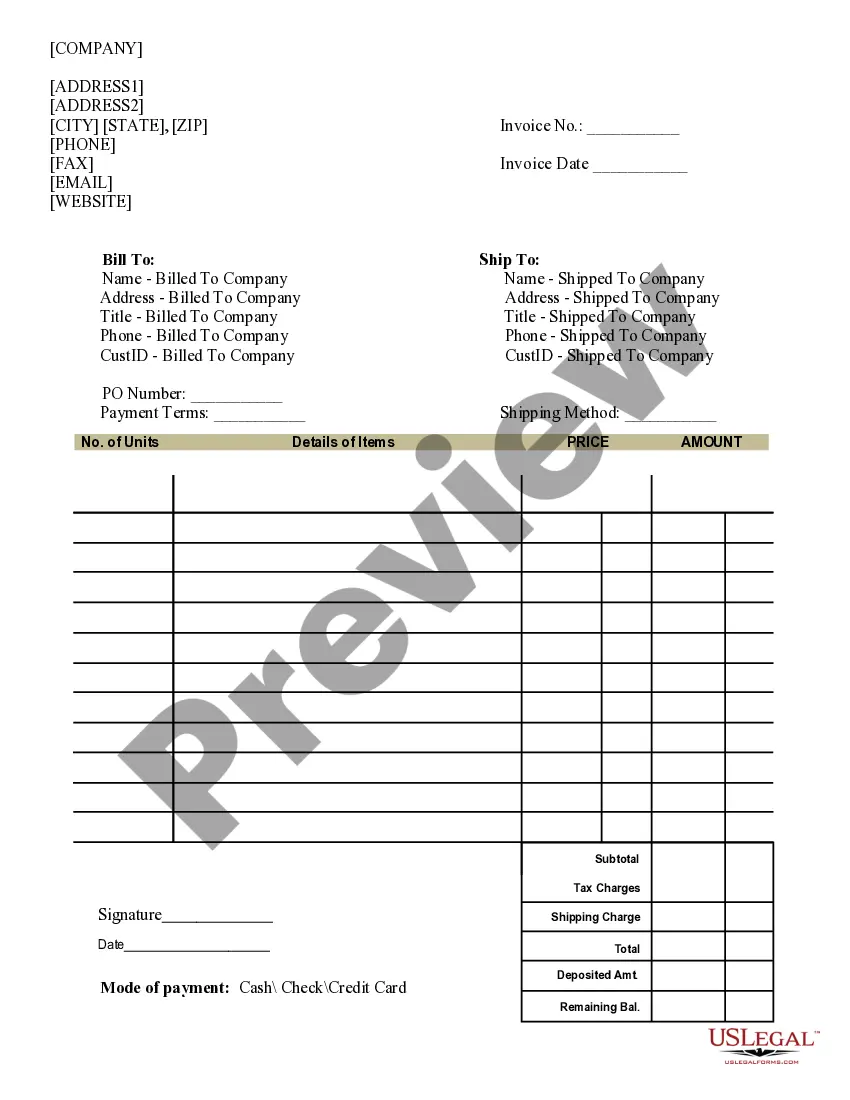

Sales of are exempt from the sales tax in California. Sales of parts purchased for use in performing service under optional maintenance contracts are subject to sales tax in California.

Entities (including consumers) in California are taxed on their purchases or consumption of various physical products, such as cleaning supplies, clothing, school supplies, and so on. However, they don't pay taxes for using the services of a lawyer, a dentist, or a plumber.

Tax does not apply to charges for parts used for the repair. Although the repairer will charge the manufacturer for the parts used in the repair, those parts are considered a sale for resale and are not subject to tax under a mandatory warranty.

The charge for a software maintenance contract, which provides updates and future releases, is a contract for the sale of tangible personal property and is taxable.

Unlike many other states, California does not tax services unless they are an integral part of a taxable transfer of property.