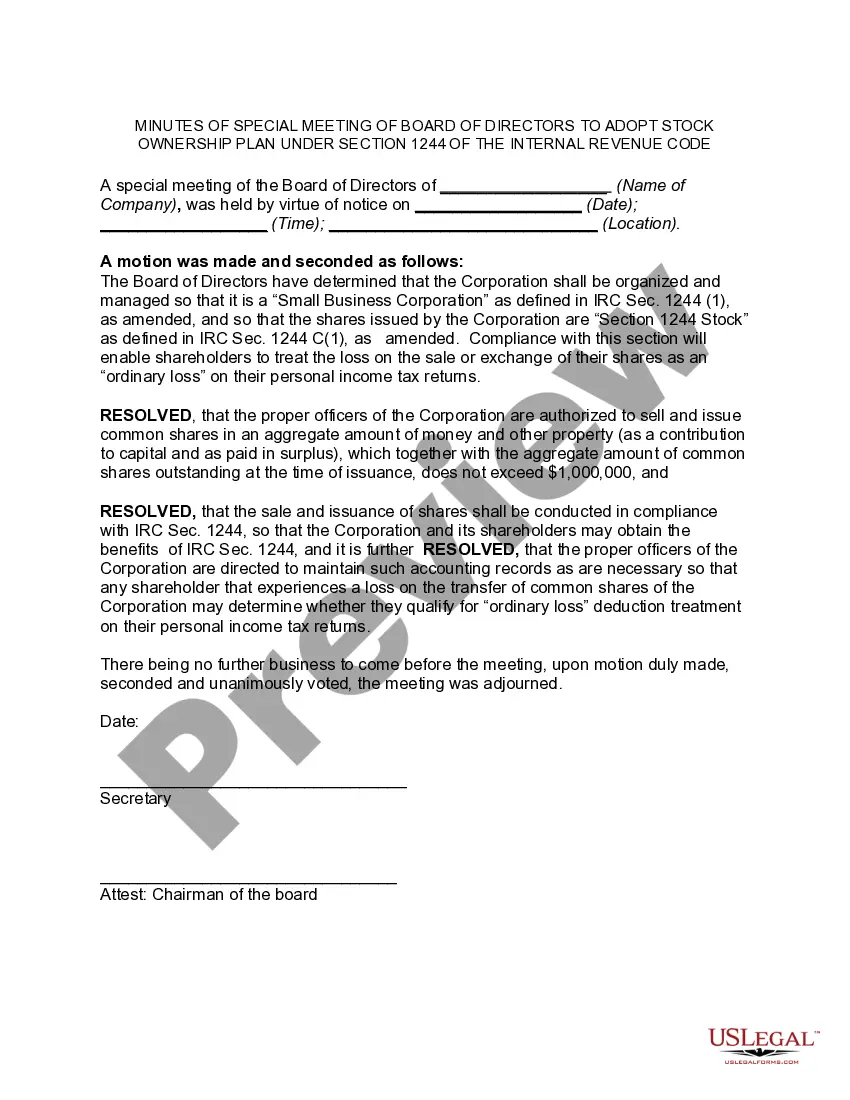

California Minutes of Special Meeting of the Board of Directors of (Name of Corporation) to Adopt Stock Ownership Plan under Section 1244 of the Internal Revenue Code

Description

How to fill out Minutes Of Special Meeting Of The Board Of Directors Of (Name Of Corporation) To Adopt Stock Ownership Plan Under Section 1244 Of The Internal Revenue Code?

Locating the appropriate legal document template can be quite challenging.

Of course, there are numerous templates available online, but how do you find the legal document you need.

Utilize the US Legal Forms website. This platform provides thousands of templates, such as the California Minutes of Special Meeting of the Board of Directors of (Name of Corporation) to Adopt Stock Ownership Plan under Section 1244 of the Internal Revenue Code, suitable for both business and personal uses.

Firstly, ensure you have selected the correct form for your area/region. You can review the form using the Preview button and read the form description to confirm it meets your needs.

- All documents are reviewed by professionals and adhere to state and federal guidelines.

- If you are already registered, Log In to your account and click the Acquisition button to download the California Minutes of Special Meeting of the Board of Directors of (Name of Corporation) to Adopt Stock Ownership Plan under Section 1244 of the Internal Revenue Code.

- Use your account to browse the legal documents you have previously purchased.

- Visit the My documents section of your account to retrieve another copy of the documents you require.

- If you are a new user of US Legal Forms, here are simple steps for you to follow.

Form popularity

FAQ

To qualify under Section 1244, these five requirements must be adhered to:The stock must be acquired in exchange for cash or property contributed to the corporation.The corporation must issue the stock directly to the investors.The corporation must be an actual, operating company.More items...?

Under Section 1244, an individual stockholder of a corporation can claim an ordinary (rather than capital) loss of up to $50,000 per year (or $100,000 for on a joint return) from the sale or worthlessness of Section 1244 stock. For most stockholders, an ordinary loss is much more beneficial than a capital loss.

Section 1244 stock refers to the tax treatment of qualified restricted shares. Section 1244 stock allows firms to report certain capital losses as ordinary losses for tax purposes. This lets new or smaller companies take advantage of lower effective tax rates and increased deductions.

Section 1244 stock is common or preferred stock issued for money or other property by a domestic small business corporation (which can be a C or S corporation) that meets a gross receipts test.

The determination of whether stock qualifies as Section 1244 stock is made at the time of issuance. Section 1244 stock is common or preferred stock issued for money or other property by a domestic small business corporation (which can be a C or S corporation) that meets a gross receipts test.

Section 1244 of the Internal Revenue Code allows eligible shareholders of domestic small business corporations to deduct a loss on the disposal of such stock as an ordinary loss rather than a capital loss. Eligible investors include individuals, partnerships and LLCs taxed as partnerships.

1244 losses are allowed for NOL purposes without being limited by nonbusiness income. An annual limitation is imposed on the amount of Sec. 1244 ordinary loss that is deductible. The maximum deductible loss is $50,000 per year ($100,000 if a joint return is filed) (Sec.

Section 1244 stock is a stock transaction pursuant to the Internal Revenue Code provision that allows shareholders of an eligible small business corporation to treat up to $50,000 of losses (or, in the case of a husband and wife filing a joint return, $100,000) from the sale of stock as ordinary losses instead of

Section 1244 stock is a stock transaction pursuant to the Internal Revenue Code provision that allows shareholders of an eligible small business corporation to treat up to $50,000 of losses (or, in the case of a husband and wife filing a joint return, $100,000) from the sale of stock as ordinary losses instead of

Qualifying for Section 1244 StockThe stock must be issued by U.S. corporations and can be either a common or preferred stock.The corporation's aggregate capital must not have exceeded $1 million when the stock was issued and the corporation cannot derive more than 50% of its income from passive investments.More items...