California Release and Indemnification of Personal Representative by Heirs and Devisees

Description

How to fill out Release And Indemnification Of Personal Representative By Heirs And Devisees?

Selecting the optimal legal document format can be challenging. It’s important to note that there’s an abundance of templates accessible online, but how can you locate the legal form you need.

Visit the US Legal Forms website. This service offers thousands of templates, including the California Release and Indemnification of Personal Representative by Heirs and Devisees, suitable for both business and personal purposes. All templates are reviewed by professionals to meet federal and state regulations.

If you are already registered, Log In to your account and click the Download button to obtain the California Release and Indemnification of Personal Representative by Heirs and Devisees. Use your account to browse the legal forms you have purchased in the past. Visit the My documents section of your account to retrieve another copy of the document you need.

Complete, modify, print, and sign the obtained California Release and Indemnification of Personal Representative by Heirs and Devisees. US Legal Forms is the largest collection of legal forms where you can find various document templates. Use the service to download correctly crafted documents that comply with state requirements.

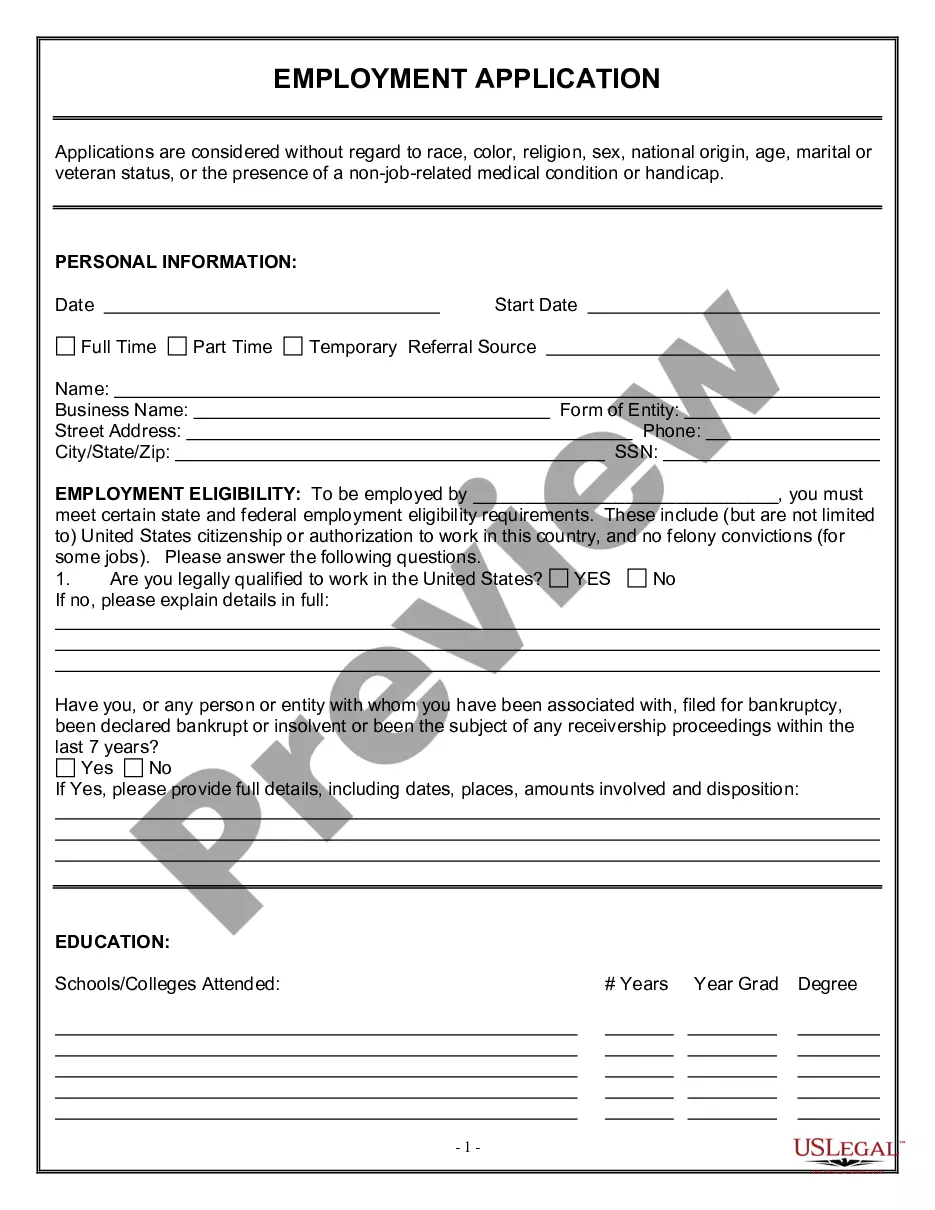

- If you are a new user of US Legal Forms, here are simple steps to follow.

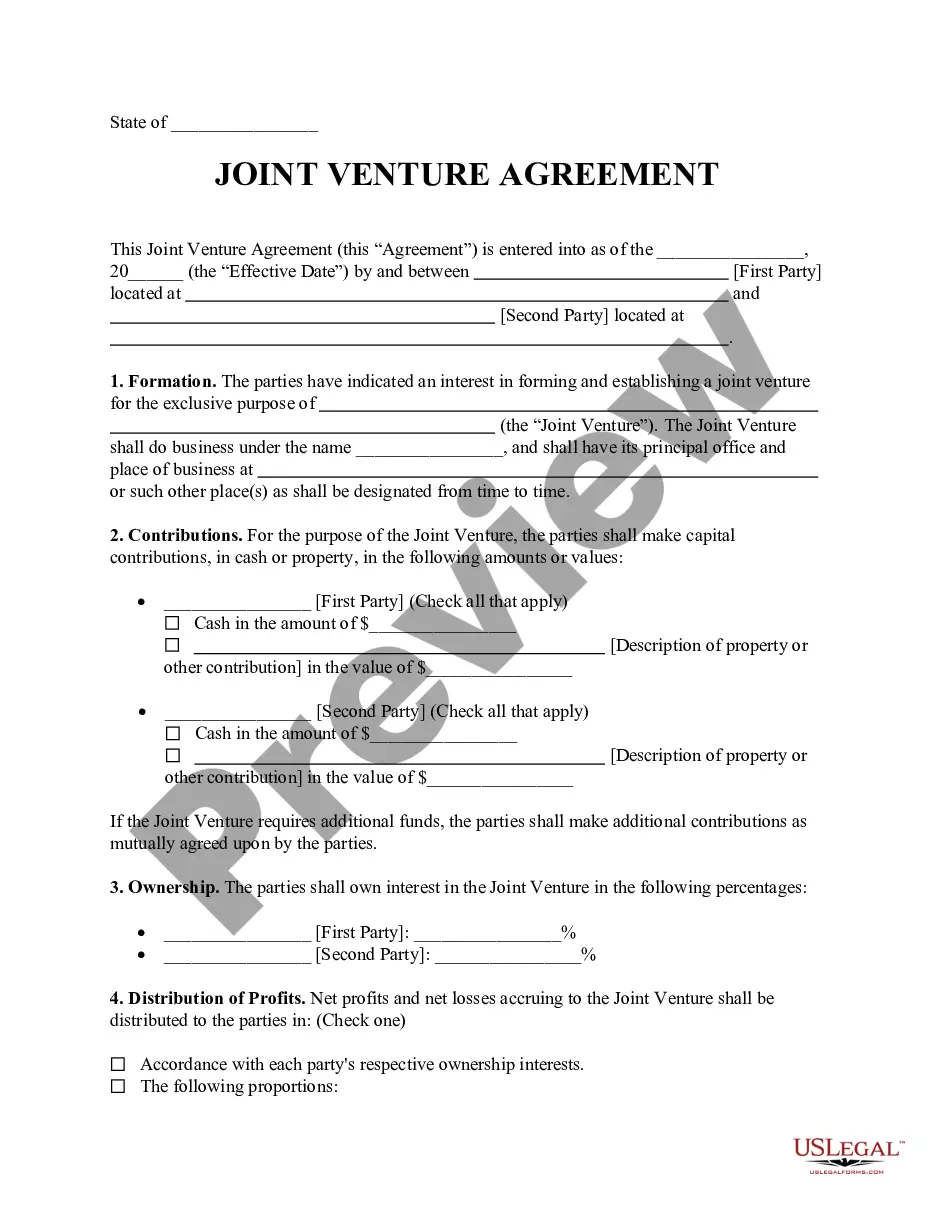

- First, confirm that you have selected the correct form for your area/county. You can preview the form using the Review option and read the form description to ensure it is the right one for you.

- If the form does not meet your expectations, utilize the Search feature to find the correct form.

- Once you are confident that the form is accurate, click the Buy now button to purchase the form.

- Choose the pricing plan you prefer and enter the required information. Create your account and complete the payment using your PayPal account or credit card.

- Select the document format and download the legal document template to your device.

Form popularity

FAQ

The executor can sell property without getting all of the beneficiaries to approve. However, notice will be sent to all the beneficiaries so that they know of the sale but they don't have to approve of the sale.

A beneficiary of an estate or a trust has the right to review the actions of the executor or trustee by asking for an accounting. To be prudent, an executor or trustee should provide the beneficiary with updates on the status of the estate or trust.

Follow these steps:Obtain and complete the California small estate affidavit. You must obtain the form used by the probate court in the county where the deceased was a resident.Include attachments.Obtain other signatures.Get the documents notarized.Transfer the property.

Upon death of the transferor, the beneficiary must file a Change in Ownership Statement with the county assessor within 150 days of date of death in accord with Revenue and Taxation Code section 480(b).

Although providing accounting information is not initially a legal requirement, the executor will need to provide the information upon request. Not doing so is a breach of their fiduciary duty. For this reason, the executor should always issue the accounting report when asked to do so.

Generally speaking, the only people who are entitled to see Estate Accounts during Probate are the Residuary Beneficiaries of the Estate.

An affidavit or declaration signed under penalty of perjury at least 40 days after the death can be used to collect the assets for the beneficiaries or heirs of the estate. No documents are required to be filed with the Superior Court if the small estates law (California Probate Code Sections 13100 to 13116) is used.

California statutory law requires a trustee to account annually to current trust beneficiaries, i.e., those who are currently entitled to receive distributions of income and principal during the accounting period. Any trustee, other than the settlor(s) who established the trust, has a duty to account.

Use the Court Locator and find the probate court where the decedent was a resident. The State filing fee is $435.

For savings accounts, checking accounts and CDs, the state of California allows payable-on-death designations whereby you control the money until you die, then your payable-on-death beneficiary inherits whatever is in the account with no probate required.