California New Employee Survey

Description

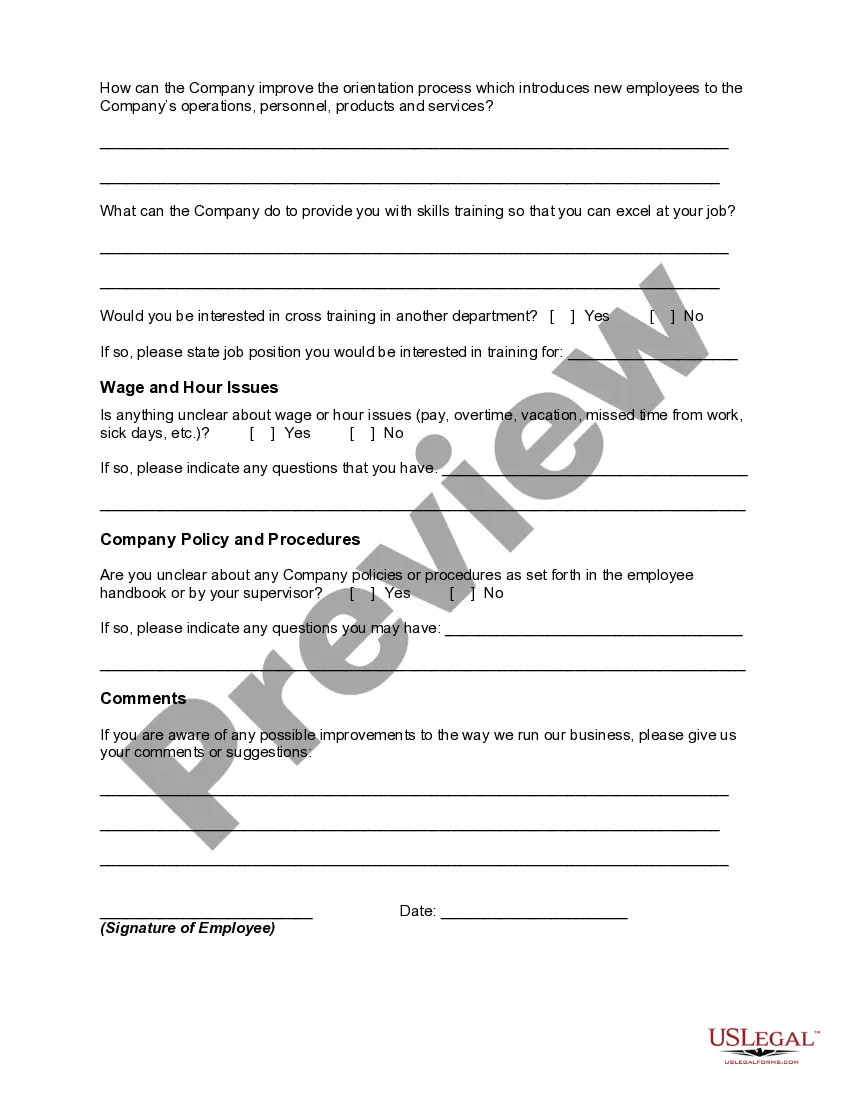

New employee surveys can be done for many purposes. One of them is the new employee orientation survey. This survey is generally done after a few days of orientation to determine any potential issues relating to productivity, turnover, attitudes and other aspects. It would also help the management to understand the productivity of the orientation or training program that the new employee went through in the initial days. The employee's experiences in the early days of employment are also important determinants, since they represent the company's image through the eyes of a new person.

Another kind of new employee survey can be undertaken to know whether the employee has completely understood all the aspects of the new job or not. This can include the job analysis and description, the basics of the job, the most enjoyable and least enjoyable parts of the job, and so on. New employee survey can include information relating to corporate culture, training, supervisor relations, work environment, pay and benefits, communications, feedback, leadership, corporate vision, and overall satisfaction.

How to fill out New Employee Survey?

You might spend hours online searching for the proper document template that satisfies the federal and state requirements you require.

US Legal Forms offers thousands of legal templates that have been reviewed by experts.

You can easily download or print the California New Employee Survey from their service.

If available, use the Review button to browse through the document template as well. To obtain another version of the form, use the Search field to find the template that fits you and your needs.

- If you already have a US Legal Forms account, you can Log In and click the Download button.

- After that, you can fill out, edit, print, or sign the California New Employee Survey.

- Each legal document template you acquire is yours permanently.

- To download another copy of the purchased form, go to the My documents tab and click the corresponding button.

- If you are using the US Legal Forms website for the first time, follow the simple directions below.

- First, ensure that you have chosen the right document template for the region/area that you select.

- Check the form description to confirm that you have selected the appropriate template.

Form popularity

FAQ

Provide required forms and pamphlets.I-9 Employment Eligibility Verification completed. W-4 federal and state tax withholding forms completed. Workers' Compensation Time of Hire Pamphlet: Personal Chiropractor or Acupuncturist Designation Form and Personal Physician Designation Form.

Required Employment Forms in California for new hiresSigned Job Offer Letter.W2 Tax Form.I-9 Form and Supporting Documents.Direct Deposit Authorization Form (Template)Federal W-4 Form.DE 4 California Payroll Tax Form.Employee Personal Data Form (Template)Company Worker's Compensation Insurance Policy Forms.More items...

As such, all prospective employees should fill out the following documents to get the onboarding process into motion.Job application form.Offer letter and/or employment contract.Drug testing records.Direct deposit form.Benefits forms.Mission statement and strategic plan.Employee handbook.More items...?

7 Steps to Improve Your Employee Onboarding Process1) Prepare colleagues for the new employee.2) Have the new employee's workstation ready to go.3) Make sure your new employee has access to any necessary programs.4) Make introductions.5) Plan a team lunch.6) Allow plenty of time for training.More items...?

OnlineDownload a fill-in DE 34 form.Order the DE 34 form from our Online Forms and Publications.Use our Print Specifications to use computer or laser generated alternate forms.Call the Taxpayer Assistance Center at 1-888-745-3886 to get a form.Visit your nearest Employment Tax Office to pick up a form.More items...?

The federal requirement was implemented by California effective July 1, 1998. California employers are required to report information on newly hired or rehired employees who work in California to the EDD's New Employee Registry (NER).

Make sure you and new hires complete employment forms required by law.W-4 form (or W-9 for contractors)I-9 Employment Eligibility Verification form.State Tax Withholding form.Direct Deposit form.E-Verify system: This is not a form, but a way to verify employee eligibility in the U.S.

Federal law requires all employers to report all newly hired employees, who work in California, to the Employment Development Department (EDD) within 20 days of their start-of-work date, which is the first day of work.

Online. Use e-Services for Business to submit a Report of New Employee(s) (DE 34). Submit a paper report of new employees by mail or fax using one of the following options:Mail. Mail or fax your paper DE 34 to: Employment Development Department.Fax. Fax your form to 1-916-319-4400. Additional Resources.

Taking the new hire around the office and introducing him/her to other employees. Taking the new hire out to lunch on their first day. Checking in with the new hire regularly.