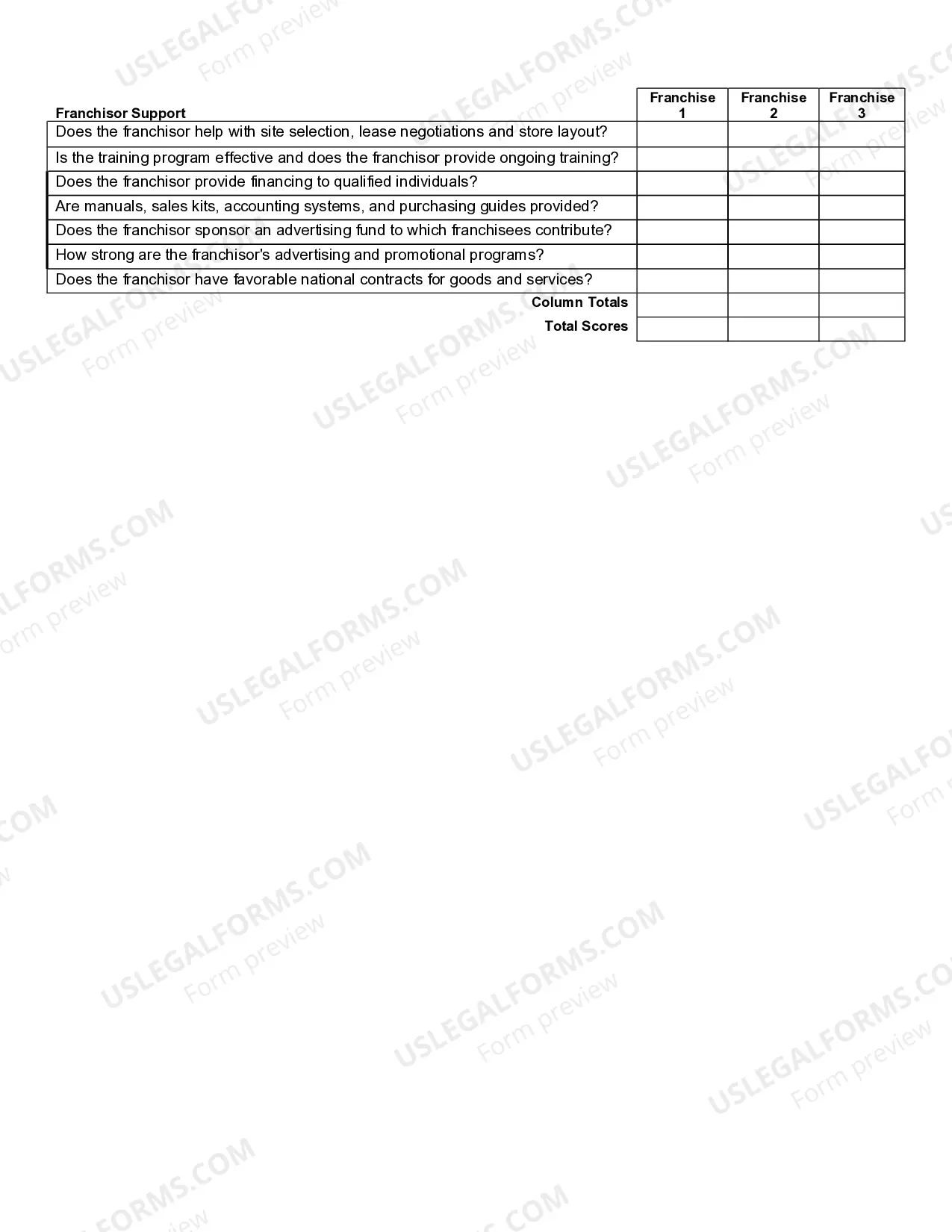

California Franchise Comparison Worksheet

Description

How to fill out Franchise Comparison Worksheet?

Are you presently in the place the place you need paperwork for possibly business or specific purposes just about every day time? There are a lot of legal papers web templates available on the net, but discovering types you can rely on isn`t effortless. US Legal Forms delivers a large number of kind web templates, such as the California Franchise Comparison Worksheet, which are written in order to meet federal and state needs.

When you are already knowledgeable about US Legal Forms web site and possess your account, just log in. Following that, you can obtain the California Franchise Comparison Worksheet template.

Should you not offer an accounts and wish to start using US Legal Forms, adopt these measures:

- Obtain the kind you will need and ensure it is to the appropriate city/state.

- Use the Preview button to check the shape.

- Browse the information to actually have chosen the proper kind.

- If the kind isn`t what you are trying to find, make use of the Look for industry to obtain the kind that meets your needs and needs.

- Whenever you obtain the appropriate kind, click Buy now.

- Pick the rates strategy you desire, fill out the required info to create your account, and buy an order using your PayPal or Visa or Mastercard.

- Choose a convenient file formatting and obtain your version.

Discover every one of the papers web templates you have bought in the My Forms menus. You can obtain a more version of California Franchise Comparison Worksheet anytime, if needed. Just click the essential kind to obtain or print the papers template.

Use US Legal Forms, the most substantial variety of legal forms, in order to save some time and avoid blunders. The services delivers professionally created legal papers web templates which you can use for a selection of purposes. Generate your account on US Legal Forms and begin producing your daily life easier.

Form popularity

FAQ

If an LLC fails to file the form on time, they will need to pay a late fee. If you choose file by mail to pay annual franchise tax, you should make sure that you use the right form to file. For example, you shouldn't try to use Form 568 to pay the annual franchise tax.

Purpose. Use Schedule D (565), Capital Gain or Loss, to report the sale or exchange of capital assets, by the partnership, except capital gains (losses) that are specially allocated to any partners. Do not use this form to report the sale of business property.

A partnership (including REMICs classified as partnerships) that engages in a trade or business in California or has income from a California source must file Form 565.

The FTB will generally consider an offer in compromise if you can prove that you have no way to pay your outstanding taxes, and when the amount offered is ?the most the Franchise Tax Board can expect to collect within a reasonable period of time.? In this case ?reasonable amount of time? is five-to-seven years.

The FTB has the statutory authority, pursuant to California Revenue and Taxation Code section 19441 , to enter into closing agreements with a taxpayer to help resolve a dispute with respect to any tax, penalty, and/or interest assessment.

The California Franchise Tax rates depend on your business's tax classification: C corporations: 8.84% S corporations: 1.5% Partnerships (such as LLCs, LPs, LLPs, LLLPs): $800.

Use Form 568 to: Determine the amount of the LLC fee (including a disregarded entity's fee) based on total California income. Report the LLC fee. Report the annual tax.

Form 565 is used by LLCs classified as corporations for federal tax purposes, whereas Form 568 is for LLCs classified as partnerships or disregarded entities. Determining your LLC's federal tax classification is essential to determine which form to use.

Every LLC that is doing business or organized in California must pay an annual tax of $800. This yearly tax will be due, even if you are not conducting business, until you cancel your LLC. You have until the 15th day of the 4th month from the date you file with the SOS to pay your first-year annual tax.

The FTB will generally consider an offer in compromise if you can prove that you have no way to pay your outstanding taxes, and when the amount offered is ?the most the Franchise Tax Board can expect to collect within a reasonable period of time.? In this case ?reasonable amount of time? is five-to-seven years.