California Equipment Lease Checklist

Description

How to fill out Equipment Lease Checklist?

If you need to detailed, obtain, or produce legal document templates, utilize US Legal Forms, the largest selection of legal forms available online.

Leverage the website's user-friendly and convenient search feature to find the documents you require.

Numerous templates for business and personal purposes are organized by categories and jurisdictions, or keywords.

Every legal document template you acquire is yours forever. You have access to every form you downloaded in your account.

Stay competitive and obtain, print the California Equipment Lease Checklist with US Legal Forms. There are millions of professional and state-specific forms you can use for your business or personal needs.

- Utilize US Legal Forms to obtain the California Equipment Lease Checklist in just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click the Acquire button to access the California Equipment Lease Checklist.

- You can also access the forms you previously downloaded in the My documents tab of your account.

- If you are using US Legal Forms for the first time, follow the instructions provided.

- Step 1. Ensure you have selected the form for your specific city/state.

- Step 2. Utilize the Review option to examine the form's content. Remember to read the summary.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find alternative versions of the legal form template.

- Step 4. Once you have found the form you need, click the Buy now button. Choose the pricing plan you prefer and enter your details to register for an account.

- Step 5. Complete the purchase process. You can use your credit card or PayPal account to finalize the transaction.

- Step 6. Select the format of your legal form and download it to your device.

- Step 7. Complete, modify, print, or sign the California Equipment Lease Checklist.

Form popularity

FAQ

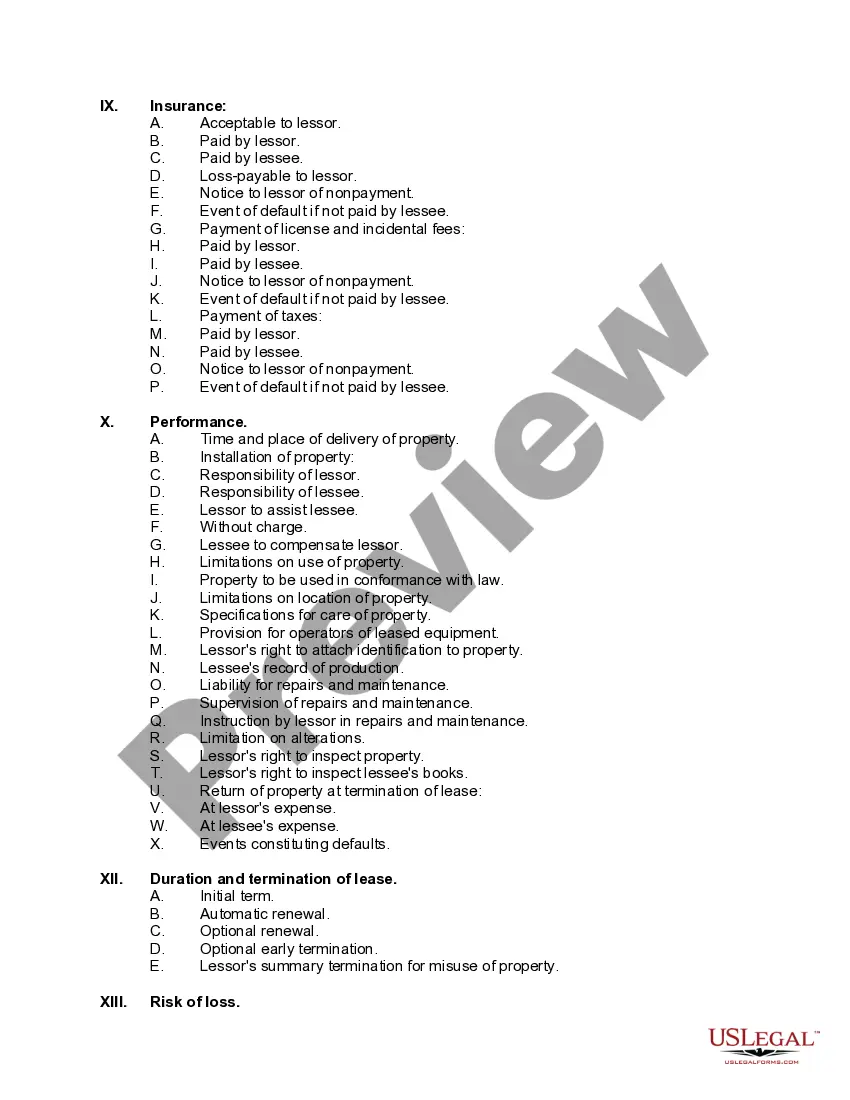

Filling out a commercial lease agreement involves providing specific details about the lease, including the parties involved, lease duration, payment terms, and responsibilities. It's essential to review each section carefully to ensure accuracy and compliance with local regulations. A California Equipment Lease Checklist can serve as a helpful guide in this process. This tool simplifies your lease agreement, ensuring you don’t overlook critical details.

A good equipment lease rate in California depends on various factors, including the type of equipment, credit score, and lease term. Generally, lease rates can range from 5% to 20% of the equipment's value. To determine your rate more precisely, it's useful to refer to a California Equipment Lease Checklist that considers these elements. This approach helps you evaluate better options and negotiate favorable terms.

When recording leased equipment in accounting, you'll need to establish the asset and corresponding liability based on the lease agreement. The California Equipment Lease Checklist provides steps and considerations for proper financial documentation. Periodic reviews will help you stay compliant with accounting standards and portray an accurate financial position.

To record leased equipment, document the asset and the lease liability in your accounting software or ledger. Following the California Equipment Lease Checklist ensures you capture all necessary details, including payment terms and any initial payment actions. Regularly updating these records helps you maintain financial accuracy.

Typically, a credit score of 650 or above is recommended to secure favorable lease terms for equipment. Lenders consider your credit score when referencing the California Equipment Lease Checklist, and a higher score can lead to better financing options. Always review your credit standing before pursuing a lease to understand your options better.

Yes, leased equipment is generally capitalized under certain conditions. If the lease meets specific criteria detailed in the California Equipment Lease Checklist, it must be reflected as an asset on your balance sheet. This capitalization allows for better tracking of your assets and liabilities, providing a clearer understanding of your business's financial health.

The journal entry for a lease typically involves debiting the leased asset account and crediting the lease liability account. This approach aligns with the California Equipment Lease Checklist, which guides business owners through their lease accounting. Ensure you document all lease payments accurately to maintain clarity in your financial records.

To account for leased assets, you start by recognizing the lease on your balance sheet, following the guidelines in the California Equipment Lease Checklist. This involves recording both the leased asset and the corresponding lease liability. By tracking these financial elements, you can maintain an accurate view of your company's financial position and ensure compliance with accounting standards.

Under ASC 842, there are two primary lease classifications: finance leases and operating leases. Your California Equipment Lease Checklist will help you assess the terms and conditions to identify which classification applies to your lease. Understanding these classifications is crucial for proper accounting, as they determine how leases impact your financial statements. Employing this knowledge leads to better business decisions and financial accuracy.

Indeed, equipment leases do fall under ASC 842, which sets the standards for lease accounting. This regulation requires lessees to recognize most leases on their balance sheets, transforming how equipment is reported. By following your California Equipment Lease Checklist, you can ensure compliance with ASC 842 and accurately report leased equipment. Proper adherence protects your business from potential compliance issues.