California Demand Promissory Note

Description

How to fill out Demand Promissory Note?

US Legal Forms - one of the largest collections of legal documents in the United States - offers a wide range of legal form templates you can download or print.

With the website, you can discover numerous forms for business and personal purposes, organized by categories, states, or keywords. You can find the latest versions of forms such as the California Demand Promissory Note in just a few moments.

If you have a monthly subscription, Log In and download the California Demand Promissory Note from your US Legal Forms library. The Download button will appear on every form you view. You have access to all previously downloaded forms within the My documents section of your account.

Process the payment. Use your credit card or PayPal account to complete the transaction.

Select the format and download the form to your device. Make modifications. Fill out, edit, print, and sign the downloaded California Demand Promissory Note.

- If you are using US Legal Forms for the first time, here are easy steps to get started.

- Make sure you have selected the correct form for your area/region. Click the Review button to examine the form's content.

- Read the form description to ensure you have picked the right one.

- If the form does not meet your needs, use the Search field at the top of the screen to find one that does.

- If you are satisfied with the form, confirm your choice by clicking the Purchase now button.

- Then, choose your pricing plan and provide your details to sign up for the account.

Form popularity

FAQ

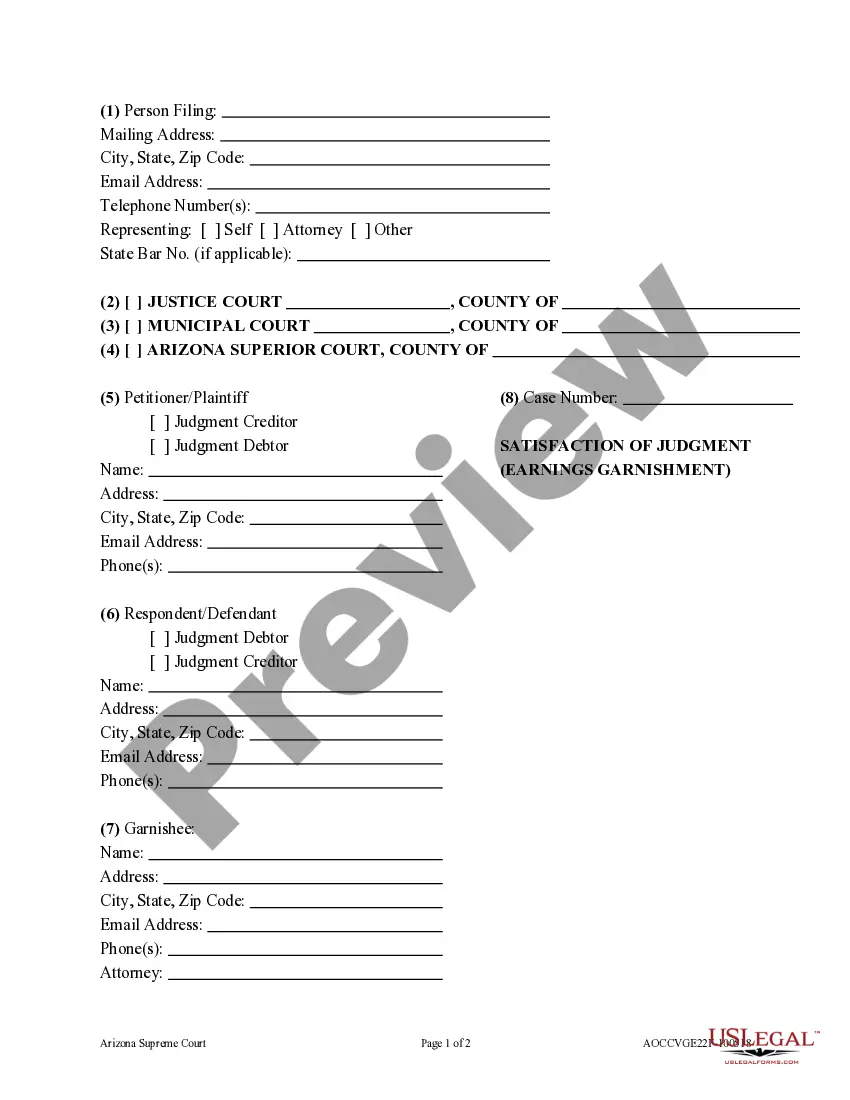

Filling out a California Demand Promissory Note involves recording essential details such as the full names and addresses of both the borrower and lender. Specify the principal amount, and if relevant, include interest rates and repayment terms. Be sure to include a signature section for both parties to sign and date the note. For assistance, consider using US Legal Forms, which offers user-friendly templates that simplify the process significantly.

To fill a demand promissory note effectively, begin by entering the basic details, such as the date, lender, and borrower information. Clearly state the amount borrowed and any applicable terms, including interest and maturity. Finally, ensure that both parties sign the document to affirm their agreement. You can streamline this process by accessing templates on US Legal Forms, which guide you through each step.

Writing a demand letter for a payment on a California Demand Promissory Note requires clarity and professionalism. Start with your contact information and the borrower's details, then state the amount owed and the original due date. Be direct in your request for payment and include a deadline for response to encourage prompt action.

Yes, a California Demand Promissory Note can be designed to be payable on demand. This means the lender can request payment at any time without a set repayment schedule. It's important to specify the 'demand' aspect clearly in the note to avoid confusion.

Yes, a properly executed California Demand Promissory Note can stand up in court if it fulfills all legal requirements. The note must include clear terms regarding repayment, signatures from both parties, and the date it was created. If challenged, you will need to provide the documentation and evidence supporting the validity of the note.

Legally enforcing a promissory note involves demonstrating that you have a valid and signed California Demand Promissory Note. Start by sending a demand letter to the borrower, outlining the amount owed and your request for payment. If this does not yield results, you can pursue legal action to recover the owed amount.

To enforce a California Demand Promissory Note, the note must be clearly written and signed by the borrower. If the borrower fails to repay, you can file a lawsuit against them in a California court. It's advisable to gather all necessary documentation, including the promissory note itself and any evidence of attempts to collect payment.

A promissory note is valid in California if it is written, signed by the borrower, and includes all necessary terms such as amount, interest rate, and repayment schedule. The document must comply with California law, ensuring clarity and fairness in the agreement. When you choose a California Demand Promissory Note, you create a sound legal foundation for your financial transaction, protecting both your interests and those of the other party.

In California, a promissory note must state the date of issuance, the amount being borrowed, and the interest rate if applicable. It should also include the payment schedule and the maturity date. Moreover, both the borrower and lender must sign the document for it to be legally binding. By utilizing a California Demand Promissory Note, you ensure all essential details are included to protect both parties.

A promissory note can be considered invalid in California if it lacks essential elements like a clear amount to be repaid, the signature of the borrower, or if it violates state laws. If the terms are ambiguous or unfair, this can also lead to invalidation. Hence, it is wise to draft your California Demand Promissory Note carefully, potentially utilizing platforms like uslegalforms to ensure legal compliance.