California Assignment of Accounts Receivable

Description

How to fill out Assignment Of Accounts Receivable?

You can invest hours online looking for the legal document template that satisfies the state and federal requirements you desire.

US Legal Forms provides a vast array of legal documents that are vetted by experts.

It is easy to download or print the California Assignment of Accounts Receivable from my service.

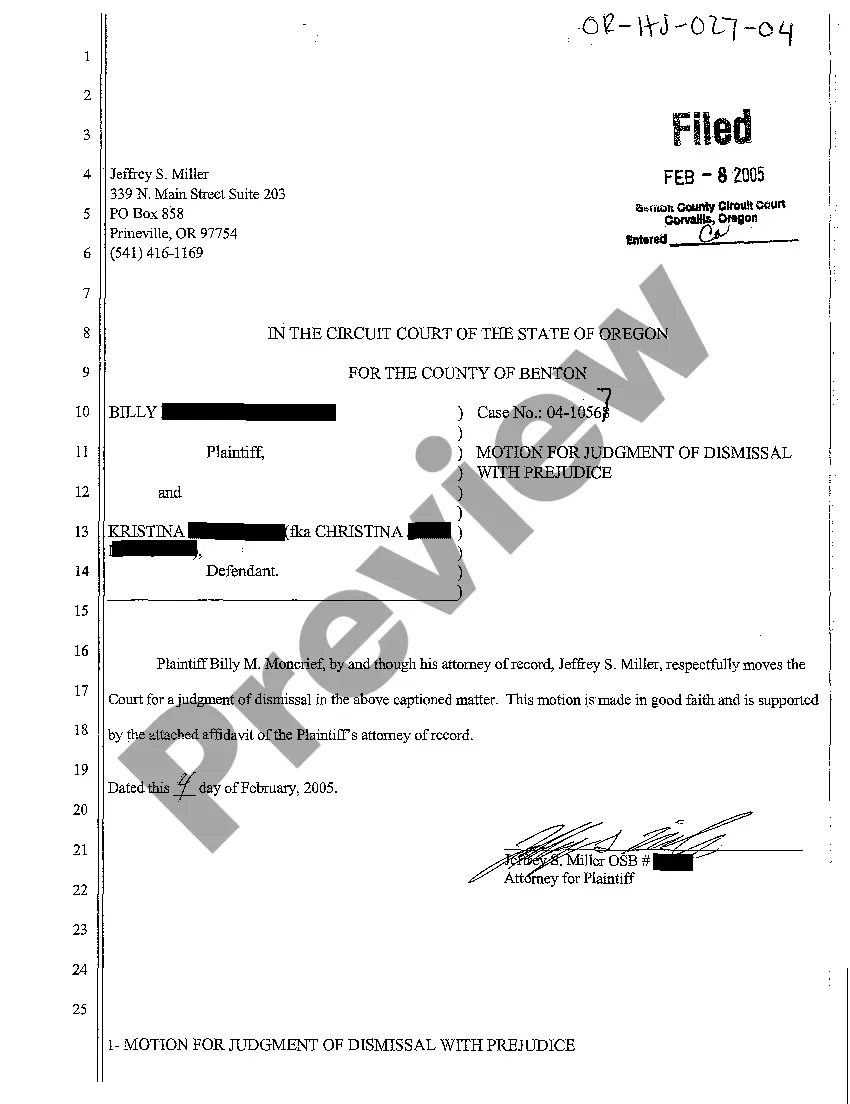

If available, use the Review button to examine the document template as well.

- If you already have a US Legal Forms account, you can Log In and click the Download button.

- Then, you can complete, edit, print, or sign the California Assignment of Accounts Receivable.

- Every legal document template you acquire is yours permanently.

- To obtain an additional copy of the downloaded form, go to the My documents tab and click the corresponding button.

- If you use the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure that you have selected the correct document template for the area/town of your choice.

- Review the form description to confirm you have chosen the right document.

Form popularity

FAQ

The duties and responsibilities of accounts receivable include managing customer accounts, sending invoices promptly, and collecting payments on time. This role is critical for maintaining the financial health of a business. Additionally, ensuring accuracy in recording transactions is vital, especially when dealing with California Assignment of Accounts Receivable.

The assignment of bills receivable refers to the process of transferring unpaid invoices for goods or services to another party for collection. This practice can increase your organization's liquidity and provide faster funding options. When considering the California Assignment of Accounts Receivable, it’s essential to ensure proper documentation and compliance with regulations. Uslegalforms can assist you in crafting the necessary documents to facilitate this assignment effectively.

The difference hinges on ownership and method of collection. Factoring involves selling the receivables to a third party for a discount, thereby transferring ownership and collection rights. On the other hand, an assignment of accounts receivable allows a business to retain ownership while delegating the collection process, which keeps control within the original business.

The key difference lies in ownership and the collection process. With factoring, the financial institution takes ownership of the receivables and is responsible for collecting payments. In contrast, an assignment of receivables allows the original business to retain ownership while granting a third party the authority to collect on its behalf.

An assignment of receivables involves legally transferring the right to collect payments on outstanding invoices to another party. This can serve as a financing option, where your receivables act as collateral. In the context of a California Assignment of Accounts Receivable, this process helps businesses secure necessary funding while retaining control over customer relationships. It’s important to structure these assignments correctly to avoid complications.

What is the Assignment of Accounts Receivable? Under an assignment of accounts receivable arrangement, a lender pays a borrower in exchange for the borrower assigning certain of its receivable accounts to the lender. If the borrower does not repay the loan, the lender has the right to collect the assigned receivables.

Deed of Assignment means one or more general deed of assignment in respect of any Charterparty, to be executed by the relevant Borrower in favour of the Security Agent (on behalf of the Finance Parties and the Hedging Banks), in form and substance acceptable to the Security Agent (on behalf of the Finance Parties and

Assignment of accounts receivable is a lending agreement whereby the borrower assigns accounts receivable to the lending institution. In exchange for this assignment of accounts receivable, the borrower receives a loan for a percentage, which could be as high as 100%, of the accounts receivable.

Follow these tips to ensure efficient and effective accounts receivable management.Use Electronic Billing & Payment.Outline Clear Billing Procedures.Set Credit & Collection Policies and Stick to Them.Be Proactive.Set up Automations.Make It Easy for Customers.Use the Right KPIs.Involve All Teams in the Process.06-May-2021

You can raise cash fast by assigning your business accounts receivables or factoring your receivables. Assigning and factoring accounts receivables are popular because they provide off-balance sheet financing.