In this form, the Buyer is assuming the indebtedness on a loan used to purchase a vehicle. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

California Conditional Sales Agreement of Automobile between Individuals and Assumption of Outstanding Indebtedness

Description

How to fill out Conditional Sales Agreement Of Automobile Between Individuals And Assumption Of Outstanding Indebtedness?

Have you found yourself in a scenario where you require documents for either business or personal purposes on a daily basis.

There are numerous legal document templates accessible online, but finding reliable ones can be challenging.

US Legal Forms provides thousands of form templates, such as the California Conditional Sales Agreement of Automobile between Individuals and Assumption of Outstanding Indebtedness, crafted to satisfy both state and federal regulations.

Once you locate the accurate form, click Purchase now.

Select the pricing plan you desire, complete the required information to create your account, and place the order using your PayPal or credit card. Choose a convenient document format and download your copy.

- If you are already acquainted with the US Legal Forms website and have an account, simply sign in.

- Then, you can download the California Conditional Sales Agreement of Automobile between Individuals and Assumption of Outstanding Indebtedness template.

- If you do not possess an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for the correct city/state.

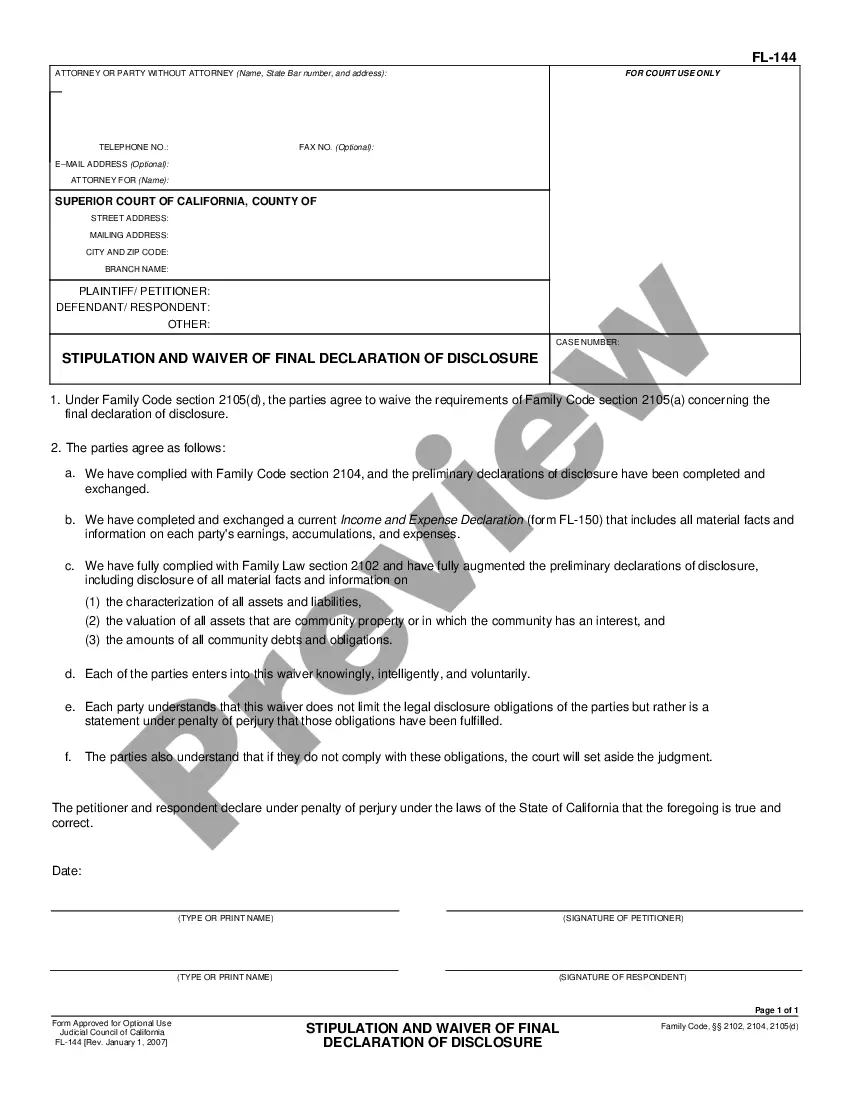

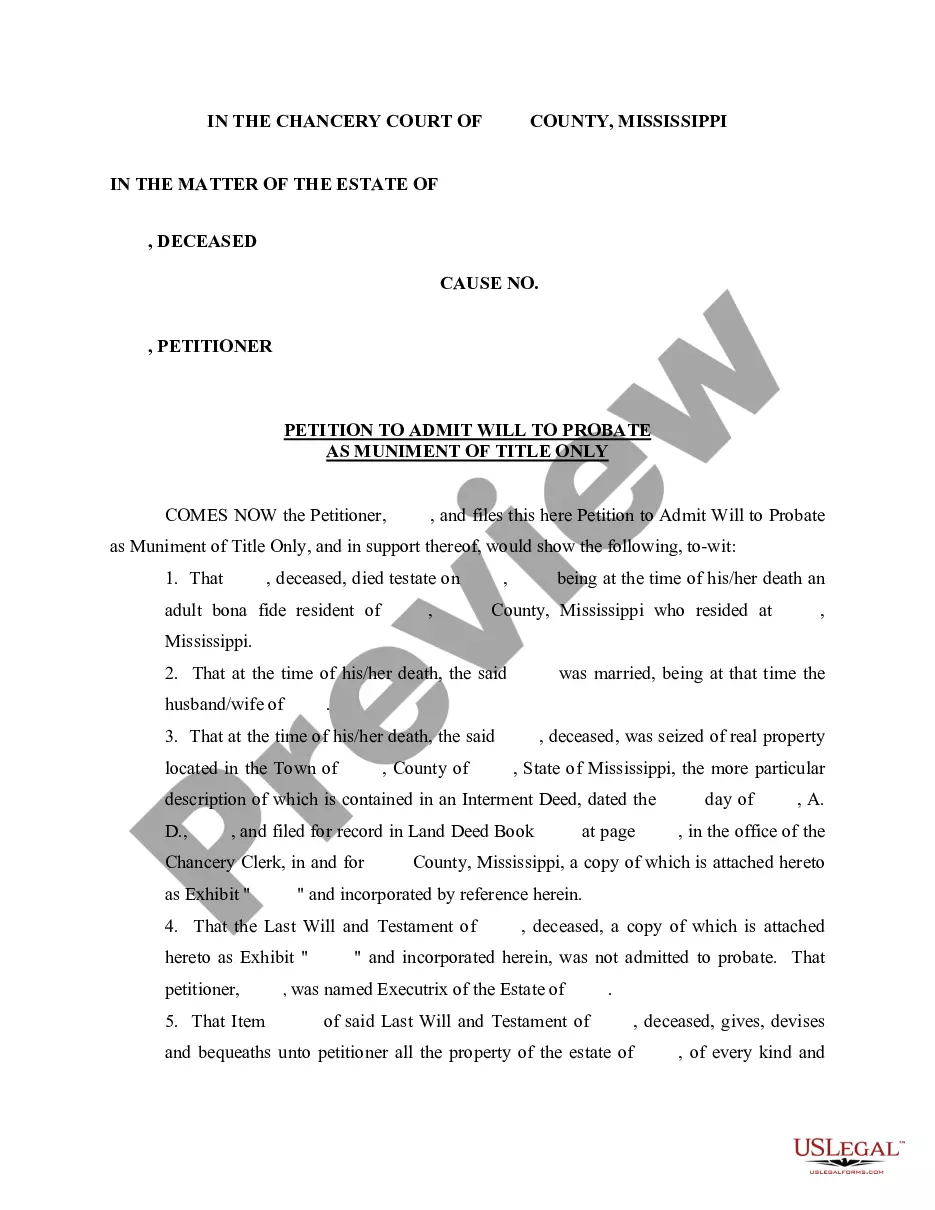

- Utilize the Preview button to assess the form.

- Review the description to ensure you have selected the correct form.

- If the form is not what you’re looking for, use the Search box to discover the form that suits your needs.

Form popularity

FAQ

The 10-day rule for car dealers in California mandates that dealers must adhere to specific guidelines regarding customer contracts within ten days of signing. This rule ensures dealers operate fairly, thereby protecting the interests of buyers. When entering a California Conditional Sales Agreement of Automobile between Individuals and Assumption of Outstanding Indebtedness, understanding this rule can ensure a smoother purchasing experience.

The 10-day rule for auto financing in California allows buyers to review their financing terms for up to ten days after signing. If you find better financing options during this period, you may have the ability to refinance. It's important to consider how this rule applies to your California Conditional Sales Agreement of Automobile between Individuals and Assumption of Outstanding Indebtedness for the best possible outcome.

Once you sign a car deal in California, backing out depends on specific circumstances. Typically, you have limited options unless a cooling-off period is written into your agreement. Understanding your rights under the California Conditional Sales Agreement of Automobile between Individuals and Assumption of Outstanding Indebtedness is essential, as it can impact your ability to cancel the deal.

Contracts for conditional sales often include conditions related to payment terms, maintenance obligations, and ownership transfer. They may also detail provisions for default scenarios and vehicle storage during the sale. These conditions help clarify the expectations for both buyers and sellers. For those considering a California Conditional Sales Agreement of Automobile between Individuals and Assumption of Outstanding Indebtedness, understanding these types of conditions is essential for a smooth transaction.

In California, a dealership can reclaim a vehicle under specific circumstances even after you have signed a California Conditional Sales Agreement of Automobile between Individuals and Assumption of Outstanding Indebtedness. They may do this if there was a breach of contract or if the financing does not get approved. It's crucial to understand your rights and obligations within the agreement. If you need assistance navigating these situations, consider using the resources from US Legal Forms, which can provide clarity on your legal options.

To obtain a copy of your car contract, start by checking any paperwork you received during the sale. If you can't find it, contact the seller or dealership and request another copy, mentioning your California Conditional Sales Agreement of Automobile between Individuals and Assumption of Outstanding Indebtedness. Utilizing platforms like uslegalforms can also offer you a clear path to re-access any prior documents. Don't hesitate to request assistance if you encounter challenges.

When asking for a copy of your contract, it’s best to contact the seller directly. Politely explain your request and mention the specific document, like the California Conditional Sales Agreement of Automobile between Individuals and Assumption of Outstanding Indebtedness. Providing details, such as the vehicle's make and model, can also expedite the process. Most sellers appreciate straightforward communication.

You can usually find a copy of your contract by reviewing your personal records or reaching out to the seller or dealer. If you used a platform like uslegalforms to create your California Conditional Sales Agreement of Automobile between Individuals and Assumption of Outstanding Indebtedness, login to your account for easy access. If all else fails, you may need to request if the seller can provide another copy.

Typically, you do not receive a copy of the title when you lease a car. Since leasing means you do not own the vehicle, the title remains with the leasing company. However, understanding the terms of your lease can help you navigate any obligations or rights related to the automobile. Review your California Conditional Sales Agreement of Automobile between Individuals and Assumption of Outstanding Indebtedness for clarity on your situation.

Yes, you can pursue legal action against a private seller in California if they misrepresented the condition of the car. Under the California Conditional Sales Agreement of Automobile between Individuals and Assumption of Outstanding Indebtedness, sellers must disclose known issues. If you find significant undisclosed problems, you may have grounds for a lawsuit. It's wise to gather documentation and consult with a legal expert for advice.