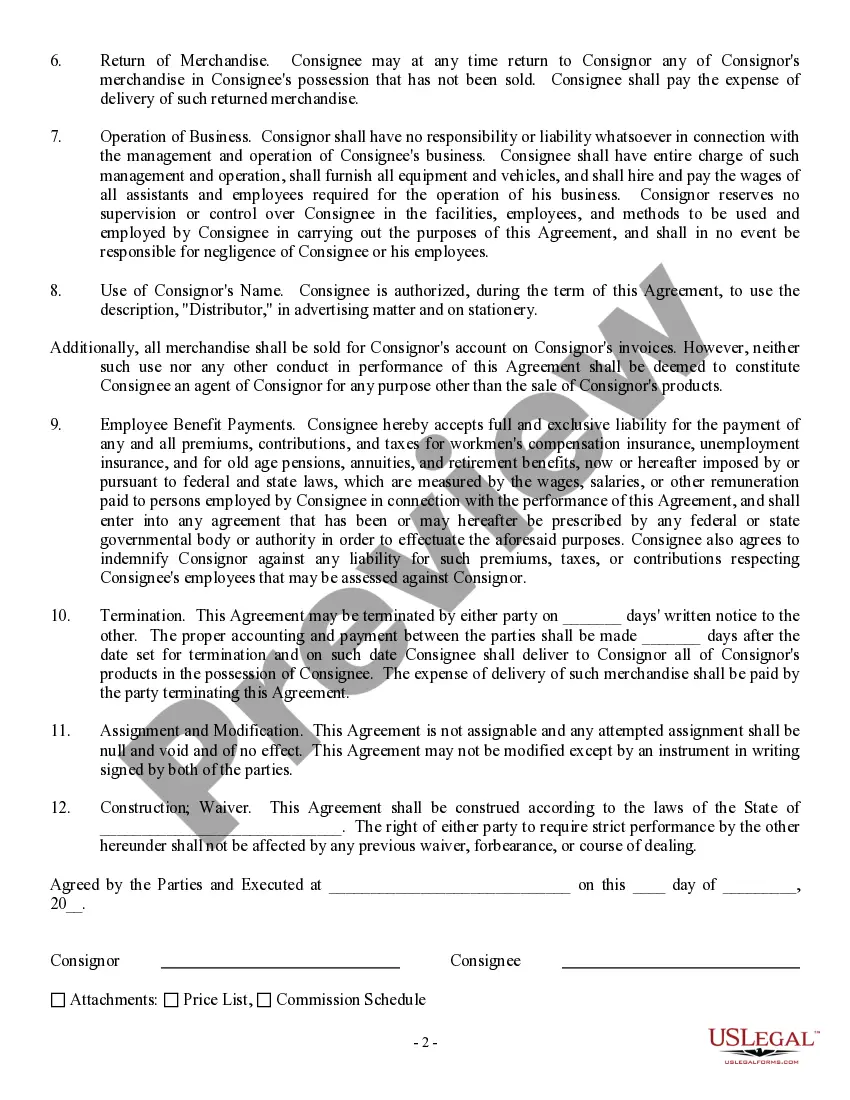

California Contract for Sale of Goods on Consignment

Description

How to fill out Contract For Sale Of Goods On Consignment?

US Legal Forms - one of the largest collections of legal documents in the United States - provides a variety of legal form templates that you can download or create.

Using the site, you can access thousands of forms for business and personal purposes, categorized by groups, states, or keywords.

You can find the latest versions of forms such as the California Contract for Sale of Goods on Consignment in just a few seconds.

Check the form details to confirm that you have selected the right form.

If the form does not meet your specifications, utilize the Search field at the top of the page to find one that does.

- If you have a subscription, Log In and download the California Contract for Sale of Goods on Consignment from your US Legal Forms library.

- The Download button will be visible on each form you view.

- You can access all previously saved forms in the My documents section of your account.

- To use US Legal Forms for the first time, follow these simple steps.

- Ensure you have chosen the correct form for your location/state.

- Click on the Preview button to review the form’s content.

Form popularity

FAQ

To write a consignment agreement, start by clearly outlining the roles of the seller and consignee, including payment terms and product descriptions. Ensure to include time frames for the consignment period and what happens to unsold goods. Utilizing a template for a California Contract for Sale of Goods on Consignment can streamline this process and help you cover essential elements for both parties.

While selling on consignment can offer advantages, it may also lead to complications, such as overstock issues and lack of control over how your goods are marketed. If a consignee does not promote your items effectively, your goods may not sell. Consider the terms and potential pitfalls outlined in a California Contract for Sale of Goods on Consignment before making your decision.

Consignment sales may require a 1099 if the seller earns a certain amount from sales through a consignment arrangement. It is important to consult with a tax professional to determine your specific reporting requirements. Keeping clear records and contracts, like a California Contract for Sale of Goods on Consignment, can make this process smoother.

A typical consignment agreement outlines the terms under which goods are sold, including the responsibilities of both the seller and the consignee. This agreement often includes details such as the duration of the consignment, payment terms, and provisions for unsold goods. Utilizing a California Contract for Sale of Goods on Consignment ensures that both parties are protected and understand their obligations.

Yes, goods sold on consignment can usually be returned to the seller if an agreement allows for it. The terms regarding returns should be clearly defined in the California Contract for Sale of Goods on Consignment to avoid misunderstandings. Always review the return policy before entering into any consignment agreement.

Goods sold on consignment refer to items that a seller places in a retail setting while still retaining ownership until the items are sold. The retailer sells the goods on behalf of the seller, often under a California Contract for Sale of Goods on Consignment. This arrangement can be advantageous for both parties, as it allows for flexibility in sales and inventory management.

Yes, consignment sales should be reported to the IRS, just like any other income. As a seller, you must include income from consignment sales in your tax filings. It is wise to keep accurate records of sales made under a California Contract for Sale of Goods on Consignment to ensure compliance with tax regulations.

When dealing with consignment sales, you generally do not issue a 1099 for the actual sale of goods. This is because you only report income once the sale occurs under the California Contract for Sale of Goods on Consignment. Thus, no reporting requirement exists until you reach certain thresholds. Understanding these guidelines helps you stay compliant with tax regulations.

Vendors exempt from 1099 reporting typically include corporations, unless they provide legal or medical services. Under the California Contract for Sale of Goods on Consignment, many goods sold may not necessitate a 1099 if the vendor structure follows these guidelines. It’s essential to keep accurate records of your transactions to determine reporting obligations fully. Always consult a tax professional for specific scenarios.

To account for consignment sales under the California Contract for Sale of Goods on Consignment, you should recognize income only when the goods are sold to end customers. Keep detailed records of goods sent and sold. This ensures that you can accurately report the transactions for financial statements. Additionally, using accounting software can streamline this process.