California Sample Letter for Compromise on a Debt

Description

How to fill out Sample Letter For Compromise On A Debt?

Are you currently in a situation where you require documents for either business or personal reasons every day.

There are numerous legal document templates available online, but finding ones you can trust isn’t simple.

US Legal Forms offers thousands of template forms, including the California Sample Letter for Compromise on a Debt, designed to satisfy state and national requirements.

Utilize US Legal Forms, the most extensive collection of legal forms, to save time and prevent errors.

The service provides expertly crafted legal document templates that you can utilize for various purposes. Create an account on US Legal Forms and start making your life a bit easier.

- If you are already familiar with the US Legal Forms site and possess an account, simply Log In.

- After that, you can download the California Sample Letter for Compromise on a Debt template.

- If you lack an account and wish to start using US Legal Forms, follow these guidelines.

- Obtain the document you need and ensure it corresponds to the correct city/state.

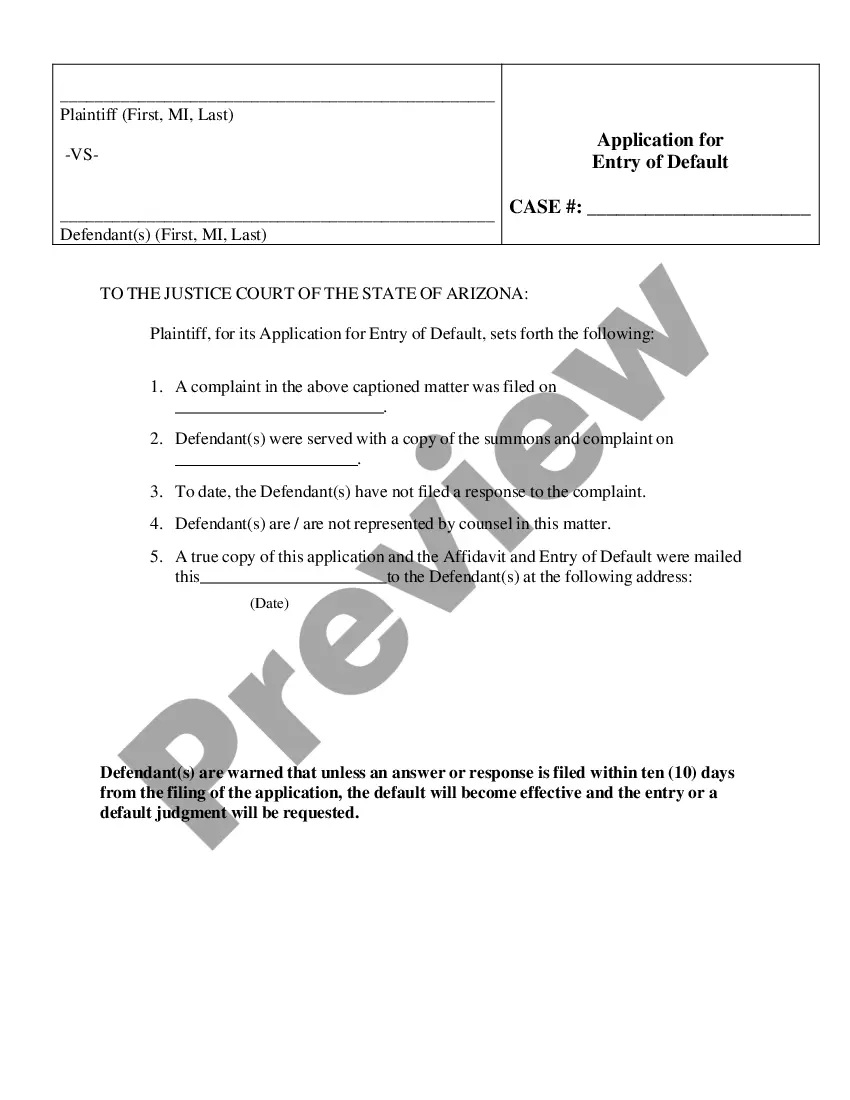

- Utilize the Preview button to examine the form.

- Review the description to confirm you have selected the right document.

- If the document isn’t what you are looking for, employ the Search field to find the form that meets your requirements.

- Once you identify the correct document, click Purchase now.

- Choose your pricing plan, fill in the necessary information to create your account, and complete the purchase using your PayPal or credit card.

- Select a convenient file format and download your copy.

- Access all the document templates you have purchased in the My documents menu.

- You can obtain an additional copy of the California Sample Letter for Compromise on a Debt at any time if needed.

- Click the necessary document to download or print the template.

Form popularity

FAQ

When negotiating a debt settlement, be clear about your financial situation and the maximum amount you can offer. Using phrases like, 'I am prepared to make a fair offer,' can set a positive tone. Referencing a California Sample Letter for Compromise on a Debt can also be helpful to ensure you are covering all essential points. It's important to listen actively to the collector's responses and be flexible in finding a mutually acceptable solution.

Writing a debt collection dispute letter involves clearly explaining why you believe the debt is inaccurate or unfair. Start by stating your dispute and the reasons behind it, using evidence to support your claims. A California Sample Letter for Compromise on a Debt can be a useful template to ensure your letter is structured properly and includes all necessary details. Remember to keep copies of your correspondence and request a confirmation of receipt from the collector.

In California, debt collectors can legally pursue old debts for up to four years from the date of the last payment. After this period, the debt becomes time-barred, meaning that collectors cannot take legal action to collect it. However, proactively addressing your financial situation with a California Sample Letter for Compromise on a Debt can prevent issues before they escalate.

Yes, California does tax the cancellation of debt under certain circumstances. If a debt is canceled, forgiven, or discharged, it may be treated as income, and you might be required to report it on your tax return. To navigate this complex area, consider using a California Sample Letter for Compromise on a Debt to address potential tax implications effectively.

California can generally collect taxes from you for up to 20 years from the date the tax due was assessed. This means that if you have outstanding debts, the state can pursue collection activities during this timeframe. It’s essential to address these debts proactively and a California Sample Letter for Compromise on a Debt may be a strategic way to negotiate a resolution.

Disputing a debt collection in California involves formally challenging the legitimacy of the debt. You can send a California Sample Letter for Compromise on a Debt to articulate your dispute and request verification from the collector. It's important to keep copies of all correspondence, as this documentation can support your case if the issue escalates. Additionally, using tools from uSlegalforms can help guide you through the dispute process effectively.

To defend yourself against a debt collector, start by understanding your rights under the Fair Debt Collection Practices Act. Collectors must prove the validity of the debt they claim you owe. You can use a California Sample Letter for Compromise on a Debt to propose a settlement that may resolve the issue amicably. Moreover, keep records of all communications, as this can strengthen your position.

The 777 rule for debt collectors refers to a consumer protection regulation in California that aims to prevent abusive practices. It stipulates that debt collectors must follow ethical guidelines when contacting individuals about debts. By understanding this rule, you can leverage it in your California Sample Letter for Compromise on a Debt to strengthen your position during negotiations.

To write a good debt settlement letter, start by clearly stating your intention to negotiate a compromise on the debt. Include specific details about the debt, such as the amount owed and the reason for your financial difficulties. A well-crafted California Sample Letter for Compromise on a Debt should also propose your settlement offer and include a request for a written agreement once terms are accepted.

The 777 rule establishes guidelines for debt collectors in California, allowing them to pursue debts more effectively while ensuring consumer protection. Under this rule, collectors must refrain from harassing consumers and must provide clear and honest information. Knowing how this rule applies can help you when drafting a California Sample Letter for Compromise on a Debt, as it emphasizes your rights in negotiations.