This type of form may be used in connection with a credit counseling seminar which also includes individual credit counseling. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

California Privacy and Confidentiality Policy for Credit Counseling Services

Description

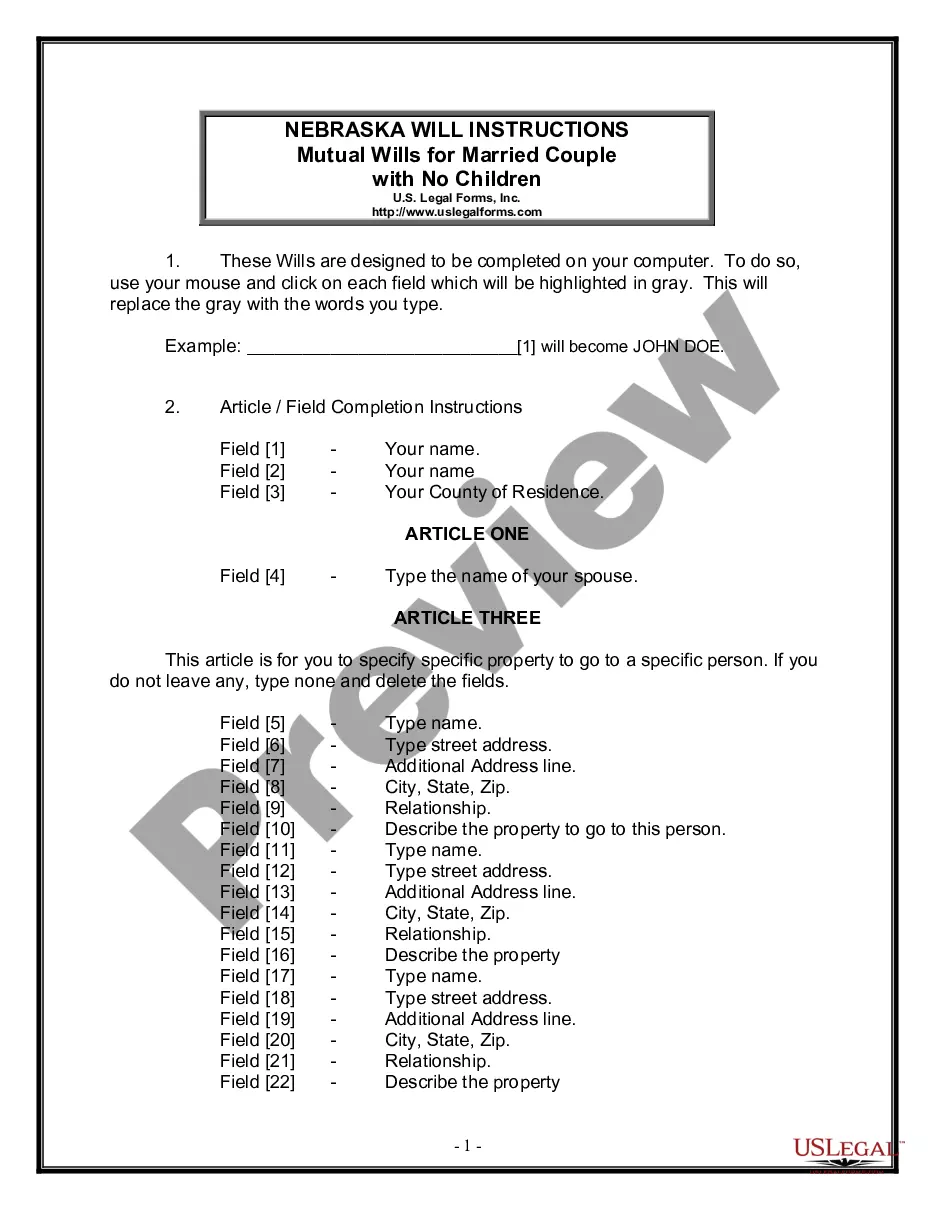

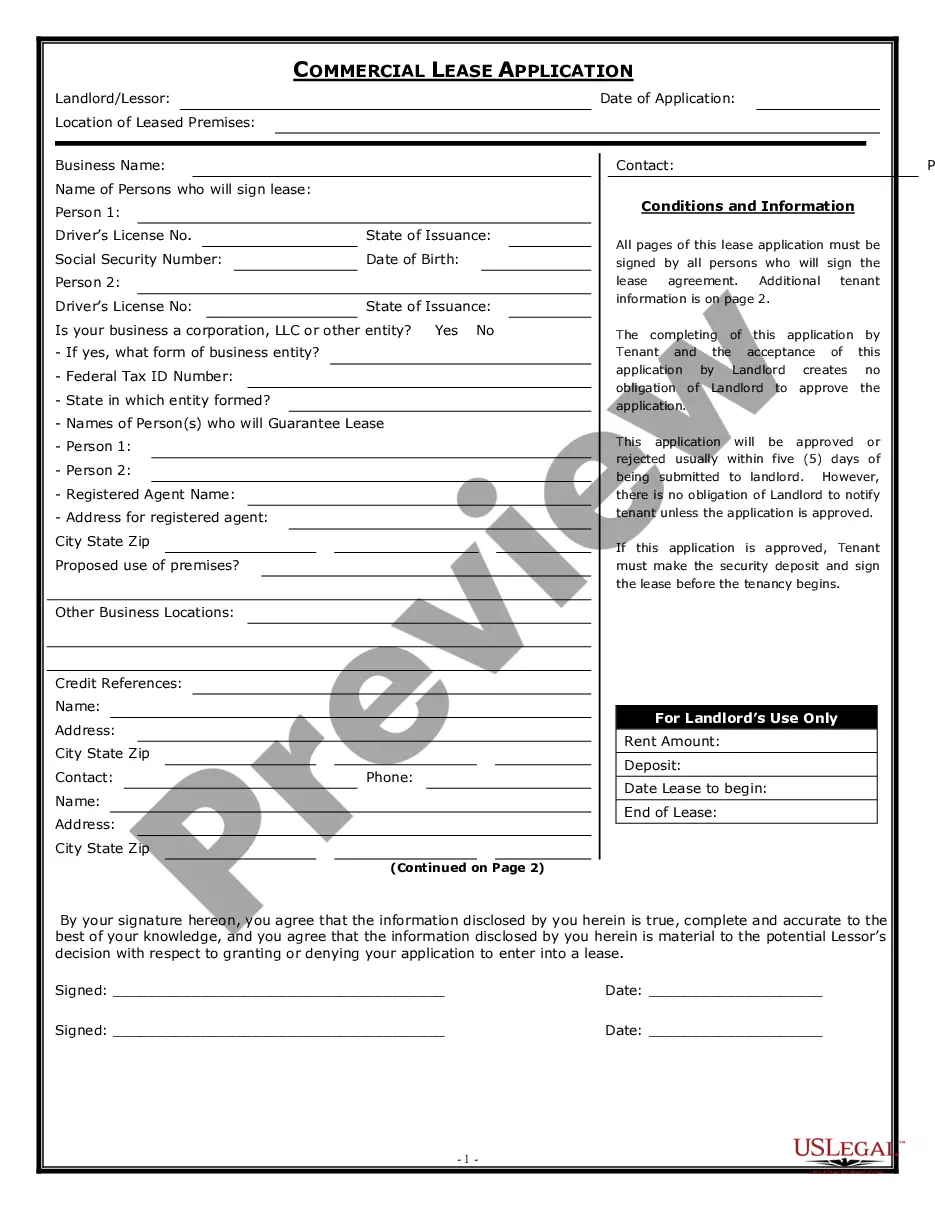

How to fill out Privacy And Confidentiality Policy For Credit Counseling Services?

US Legal Forms - one of the largest collections of legal templates in the United States - provides a variety of legal document formats that you can download or print.

By using the site, you can access thousands of forms for business and personal purposes, categorized by types, states, or keywords. You will find the latest versions of forms like the California Privacy and Confidentiality Policy for Credit Counseling Services in just a few minutes.

If you already have a monthly subscription, Log In and download the California Privacy and Confidentiality Policy for Credit Counseling Services from the US Legal Forms library. The Download button will appear on every form you view. You can access all previously acquired forms in the My documents section of your account.

Process the purchase. Use your Visa or Mastercard or PayPal account to complete the transaction.

Select the format and download the form to your device. Make edits. Complete, modify, print, and sign the obtained California Privacy and Confidentiality Policy for Credit Counseling Services. Each template added to your account has no expiration date and is yours permanently. Therefore, if you wish to download or print another copy, simply go to the My documents section and click on the form you desire. Access the California Privacy and Confidentiality Policy for Credit Counseling Services with US Legal Forms, the most extensive library of legal document templates. Utilize numerous professional and state-specific templates that meet your business or personal needs and specifications.

- If you wish to use US Legal Forms for the first time, here are simple steps to get started.

- Ensure you have selected the correct form for your jurisdiction/region.

- Click the Preview button to review the form's details.

- Check the form description to confirm that you have chosen the right one.

- If the form does not meet your needs, utilize the Search bar at the top of the page to find the suitable one.

- If you are happy with the form, confirm your selection by clicking the Buy now button.

- Then, select your preferred pricing plan and provide your information to register for an account.

Form popularity

FAQ

Under the California Consumer Privacy Act (CCPA), a consumer is defined as a resident of California who is a natural person. This includes individuals who provide personal information to businesses for commercial purposes. Understanding this definition is crucial for businesses to properly align with the California Privacy and Confidentiality Policy for Credit Counseling Services and ensure compliance with the law.

Implementing the California Consumer Privacy Act (CCPA) involves several key steps. First, businesses should conduct a thorough inventory of the personal information they collect and the purposes of this data. Next, they should update their privacy policies to include information about consumers' rights and establish processes for handling data requests. Utilizing the resources and tools provided by platforms like uslegalforms can simplify the compliance process with the California Privacy and Confidentiality Policy for Credit Counseling Services.

There are two primary criteria that would subject a business to California consumer privacy law under the CCPA. First, the business must either have an annual gross revenue exceeding $25 million or collect the personal information of 50,000 or more consumers, households, or devices annually. If a business meets either of these conditions, it becomes imperative to follow the California Privacy and Confidentiality Policy for Credit Counseling Services.

The California Consumer Privacy Act (CCPA) applies to any for-profit business that collects personal information from California residents. This includes businesses that operate in California or offer goods or services to California residents. The CCPA specifically targets companies that exceed the set thresholds of data collection and revenue, ensuring that they uphold the California Privacy and Confidentiality Policy for Credit Counseling Services.

A business may be subjected to California consumer privacy law if it meets at least one of two criteria under the CCPA. Firstly, the business must collect personal data of 50,000 or more consumers, households, or devices annually. Secondly, the business generates over $25 million in annual revenue or derives 50% or more of its annual revenue from selling consumers' personal information. Meeting either of these criteria necessitates adherence to the California Privacy and Confidentiality Policy for Credit Counseling Services.

The California Privacy and Confidentiality Policy for Credit Counseling Services outlines several key requirements under the California Consumer Privacy Act (CCPA). Businesses must inform consumers about the categories of personal information collected and the purposes for which this information is used. Additionally, companies must provide consumers with the right to access, delete, and opt-out of the sale of their personal information. Compliance with these requirements is essential for protecting consumer rights and maintaining trust.

Financial institutions are bound by various privacy laws aimed at protecting consumer data, including the Gramm-Leach-Bliley Act and the Fair Credit Reporting Act. These laws establish stringent guidelines on how financial entities collect, handle, and share personal information. To ensure compliance and protect your interests, it is crucial to consider the California Privacy and Confidentiality Policy for Credit Counseling Services alongside these federal laws.

Any consumer who is a resident of California has the right to make a CCPA request. This means that if you have provided personal information to a business, you can ask for details on how that information is used. Making such a request can help you understand the extent of your data's use and is integral to your rights under the California Privacy and Confidentiality Policy for Credit Counseling Services.

Yes, financial institutions are often exempt from the CCPA due to the existing regulations they already comply with, such as the Gramm-Leach-Bliley Act. These laws provide their own privacy protections which might render the CCPA unnecessary for them. However, businesses handling sensitive financial data must still align with the California Privacy and Confidentiality Policy for Credit Counseling Services to ensure best practices in privacy management.

The CCPA does not apply to all entities, specifically smaller businesses that meet certain criteria regarding annual revenue or data processing activities. For instance, businesses that earn less than $25 million in revenue or handle less than 50,000 personal consumer records are often not subject to its provisions. By knowing the applicability of the CCPA, you can ensure compliance with the California Privacy and Confidentiality Policy for Credit Counseling Services.