California Sample Letter for Tax Deeds

Description

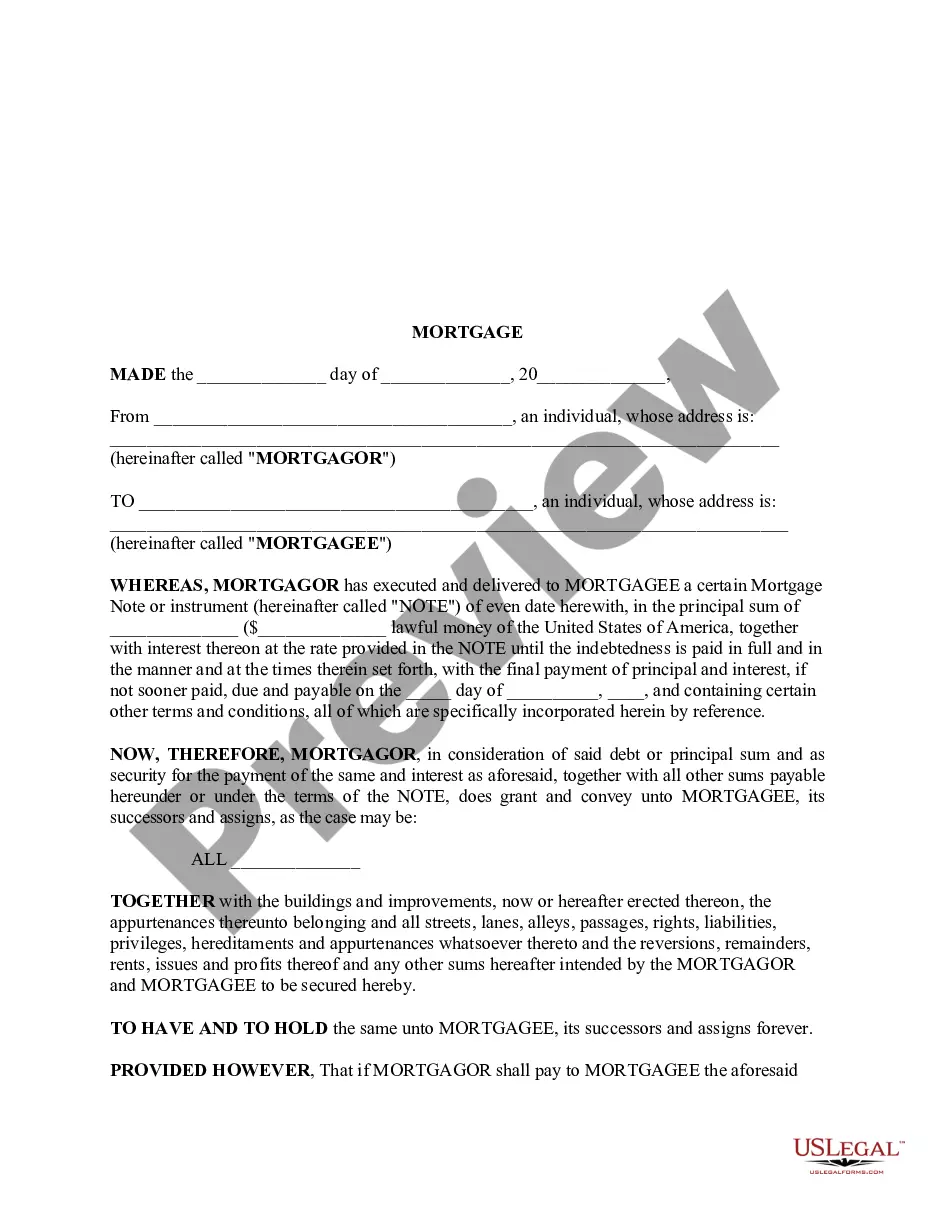

How to fill out Sample Letter For Tax Deeds?

US Legal Forms - one of the most prominent collections of legal documents in the United States - offers a range of legal paperwork templates that you can download or print. By using the website, you can access thousands of forms for business and personal purposes, organized by categories, states, or keywords. You can find the latest versions of forms like the California Sample Letter for Tax Deeds in just a few minutes.

If you already have a monthly subscription, Log In and download the California Sample Letter for Tax Deeds from the US Legal Forms collection. The Download button will appear on each form you view. You can access all previously downloaded forms in the My documents section of your account.

To use US Legal Forms for the first time, here are simple steps to get started: Ensure you have selected the correct form for your city/region. Click the Review button to examine the form's content. Check the form details to confirm that you have selected the right form. If the form does not meet your needs, use the Search field at the top of the screen to find one that does. Once you're satisfied with the form, confirm your choice by clicking the Get now button. Then, choose the pricing plan you prefer and provide your details to sign up for an account. Complete the transaction. Use your Visa or Mastercard or PayPal account to finalize the transaction. Select the format and download the form to your device. Make edits. Fill out, modify, print, and sign the downloaded California Sample Letter for Tax Deeds. Each template you added to your account has no expiration date and is yours indefinitely. Therefore, if you wish to download or print another copy, simply go to the My documents section and click on the form you need.

- Access the California Sample Letter for Tax Deeds with US Legal Forms, the most comprehensive library of legal document templates.

- Utilize a vast array of professional and state-specific templates that meet your business or personal needs and requirements.

- Download forms quickly and efficiently for various legal purposes.

- Ensure compliance with state laws by using the accurate and up-to-date forms available.

- Manage your documents easily with a user-friendly interface.

- Enjoy unlimited access to your downloaded forms at any time.

Form popularity

FAQ

California is a tax deed state where the owner has 5 years to pay back property taxes before the property is seized by the county and sold at a public auction to the highest bidder.

Keep it simple: Include phrasing that indicates the letter is a ?formal notice of protest.? List the account number or numbers you plan to protest. State the reason(s) for protesting. ... Sign it and send it.

This is the legal document that gives the government body the right to sell a home to collect the delinquent taxes it's owed. Once the government agency has its tax deed, it can put the home up for sale during a public auction. The county will usually set a minimum bid for the homes it is selling.

During this time, the delinquent taxes, interest, and penalties are accumulating until they are all redeemed. At the end of the 5-years for residential properties and 3-years for non-residential commercial properties, if the tax is not redeemed, the TTC has the power to sell the property.

Annual property tax bills are mailed every year in October to the owner of record as of January 1 of that year. If you do not receive the original bill by November 1, contact the County Tax Collector or Assessor for a duplicate bill.

If someone makes a payment in error, that person can submit a request for a refund to the county. However, if someone pays someone else's property taxes on purpose, the beneficiary of that payment may be expected to report that as taxable income, said Steve Gill, an accountancy professor at San Diego State University.

When you owe tax debt, we automatically have a statutory lien that attaches to all California real or personal property you own or have rights to. If you don't respond to our letters, pay in full, or set a payment plan, we may record and/or file a Notice of State Tax Lien against you.