The Fair Credit Reporting Act regulates the use of information on a consumer's personal and financial condition. The most typical transaction which this Act would cover would be where a person applies for a personal loan or other consumer credit. Consumer credit is credit for personal, family, or household use, and not for business or commercial transactions. The purpose of the Act is to insure that consumer information obtained and used is done in such a way as to insure its confidentiality, accuracy, relevancy and proper utilization. Credit reporting bureaus are not permitted to disclose information to persons not having a legitimate use for this information. It is a federal crime to obtain or to furnish a credit report for an improper purpose.

California Complaint by Consumer against Wrongful User of Credit Information

Description

How to fill out Complaint By Consumer Against Wrongful User Of Credit Information?

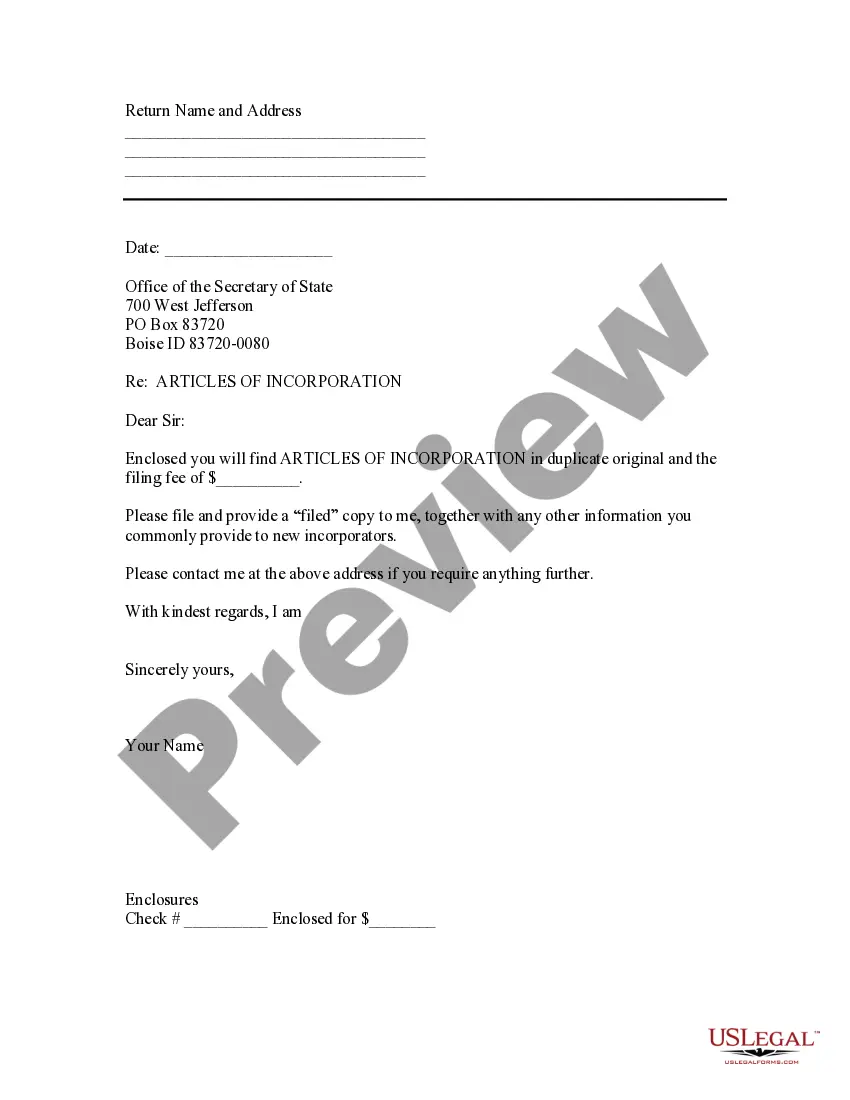

Selecting the finest official document template can be quite a challenge. Naturally, there are numerous templates available online, but how can you find the official form you need? Utilize the US Legal Forms website. The service offers a plethora of templates, such as the California Complaint by Consumer against Unauthorized Use of Credit Information, that you can use for both business and personal purposes. All the forms are vetted by professionals and comply with federal and state regulations.

If you are already registered, Log In to your account and click on the Obtain button to retrieve the California Complaint by Consumer against Unauthorized Use of Credit Information. Use your account to review the legal forms you have purchased previously. Navigate to the My documents section of your account and download another copy of the document you need.

If you are a new user of US Legal Forms, here are straightforward instructions for you to follow: First, ensure you have chosen the correct form for your specific area/region. You can preview the document using the Preview button and review the form summary to confirm this is the suitable one for you. If the form does not meet your expectations, utilize the Search field to locate the right form. Once you are confident that the document is appropriate, click the Purchase now button to acquire the form. Select the pricing plan you prefer and enter the necessary information. Create your account and complete the payment for the order using your PayPal account or Visa or Mastercard. Choose the document format and download the official document template to your device. Fill out, modify, and print and sign the acquired California Complaint by Consumer against Unauthorized Use of Credit Information.

Make the most of US Legal Forms to efficiently manage your legal documentation needs.

- US Legal Forms is indeed the largest repository of official forms where you can explore various document templates.

- Utilize the service to obtain professionally designed documents that conform to state regulations.

- The site is user-friendly and provides easy navigation for finding the required forms.

- All documents are legally vetted, ensuring they meet necessary legal standards.

- You can access a wide range of templates for different legal needs.

- The platform supports various payment methods for your convenience.

Form popularity

FAQ

The Consumer Financial Protection Act of 2010 is an amendment to the National Bank Act. Its role is to increase oversight and help to protect consumers with financial transactions. The act resulted in the creation of the Consumer Financial Protection Bureau (CFPB).

If you believe your privacy rights, or someone else's, have been violated, you can submit a complaint using the California Privacy Protection Agency's Complaint Form. The California Privacy Protection Agency (Agency) enforces the California Consumer Privacy Act (CCPA) and its implementing regulations.

Examples of these rights include: If you fall into arrears, a regulated creditor must issue a default notice and give you time to bring your account up to date before they can take any further action. All regulated creditors must hold a licence, and it's a criminal offence for them to trade without one.

Credit Protection Laws: The Consumer Credit Protection Act The Truth in Lending Act ensures that creditors provide complete and honest information. The Fair Credit Reporting Act regulates credit reports. The Equal Credit Opportunity Act prevents creditors from discriminating against individuals.

Filing a Complaint Department of Consumer Affairs. File a complaint online at .dca.ca.gov or call 800.952. 5210 to have a complaint form mailed to you. California Attorney General's Office.

You can file a complaint about your bank or lender with the Attorney General's Public Inquiry Unit. Complaints are used by the Attorney General's Office to get information about misconduct and to determine whether to investigate a company.

The Act (Title VI of the Consumer Credit Protection Act) protects information collected by consumer reporting agencies such as credit bureaus, medical information companies and tenant screening services. Information in a consumer report cannot be provided to anyone who does not have a purpose specified in the Act.

How to File a Complaint with the California Attorney General By Phone: 916-322-3360. Toll-Free Phone Number: 1-800-952-5225. By Mail: Download, fill out, and mail this form to P.O Box 944255, Sacramento 94244. By FAX: Download, fill out, and fax this form): (916) 323-5341. Online: Submit complaint using their Online Form.

DCA works with professions throughout California to guard licensees against unfair competition and to protect consumers from unlicensed practitioners. We protect California consumers by providing a safe and fair marketplace through oversight, enforcement, and licensure of professions.

The CCPA requires that the total cost of a loan or credit product be disclosed, including how interest is calculated and any fees involved. It also prohibits discrimination when considering a loan applicant and bans misleading advertising practices.