California Sample Letter for Withheld Delivery

Description

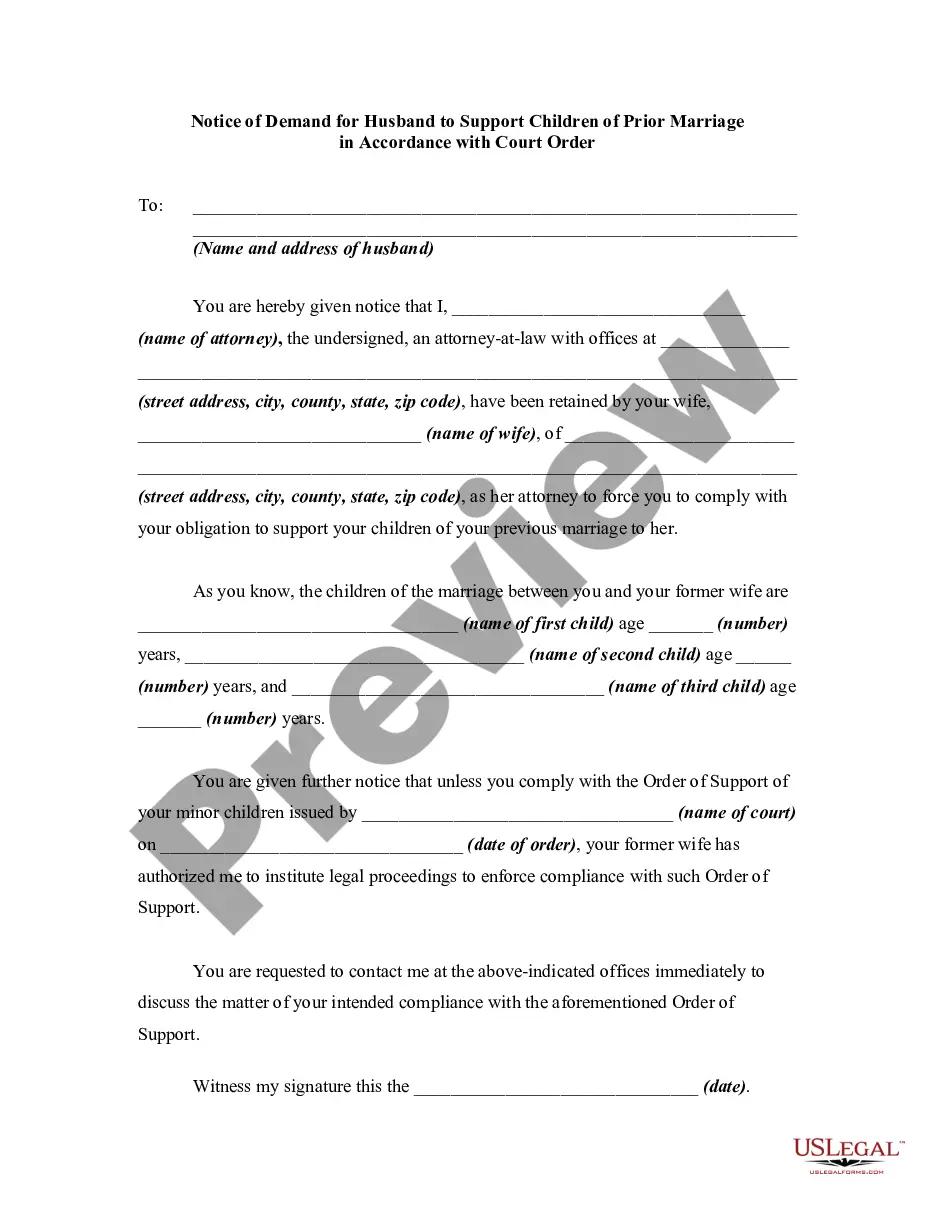

How to fill out Sample Letter For Withheld Delivery?

Finding the appropriate official document template can be challenging.

Undoubtedly, there are numerous templates accessible online, but how do you find the official form you require.

Use the US Legal Forms website. This platform provides thousands of templates, such as the California Sample Letter for Withheld Delivery, which you can use for business and personal needs.

You can view the form using the Preview button and read the form description to confirm it is suitable for you.

- All forms are reviewed by experts and comply with federal and state regulations.

- If you are currently registered, sign in to your account and click the Download button to obtain the California Sample Letter for Withheld Delivery.

- Utilize your account to search for the official forms you have purchased previously.

- Visit the My documents tab of your account and retrieve an additional copy of the document you need.

- If you are a new user of US Legal Forms, here are easy steps for you to follow.

- First, ensure you have selected the correct form for your region/area.

Form popularity

FAQ

California form 593 PDF is typically filled out by individuals involved in real estate transactions that require withholding. This includes buyers and sellers who meet certain criteria established by California tax laws. If you're uncertain about how to properly complete this form, consider legal resources or platforms to guide you effectively. A California Sample Letter for Withheld Delivery may also assist in this context.

You send your submissions to the address specified by the California Franchise Tax Board depending on the form type you are filing. Check the latest guidelines on their official website to ensure that you use the correct mailing address. Properly addressing your envelopes helps avoid delays in processing. It’s also wise to verify submission deadlines.

You can file form 593 by mailing it to the California Franchise Tax Board along with any required supporting documents. It’s essential to provide complete and accurate information to avoid any issues. If you have uncertainty about the submission process, consider using reliable legal platforms like UsLegalForms for help. They can guide you through the necessary steps efficiently.

CA form 593 is provided by the California Franchise Tax Board. This form is critical for reporting real estate withholding and must be used correctly to comply with tax laws. You can find it available for download on the California Franchise Tax Board's website. Make sure to review all instructions carefully while filling out the form.

To claim exemption from California withholding, you must complete the appropriate forms to verify your exemption status and provide supporting documentation. It's essential to carefully follow instructions and submit this information to the relevant authorities. Consulting a tax professional can simplify the process while ensuring that you meet all necessary requirements. Utilizing a California Sample Letter for Withheld Delivery can also enhance your request.

Yes, California returns can often be electronically filed, making it convenient for taxpayers. You can submit most individual and business tax returns through the California Franchise Tax Board's online services. Ensure that you have all supporting documents ready for submission. This method often expedites the processing time significantly.

Indeed, form 592 can be filed electronically, which is a time-saving option. You must ensure that you follow the California Franchise Tax Board's electronic filing procedures. Double-checking for any necessary attachments is essential for smooth processing. This method helps maintain digital records and streamlines compliance.

You can become subject to California withholding through various scenarios, including receiving income types that require it, such as rent or payments for services rendered in the state. A solid understanding of your income situation is vital for compliance. If interesting situations arise, using a California Sample Letter for Withheld Delivery could be beneficial to express your concerns directly.

Form 1120-F can be filed electronically in certain circumstances, making the filing process easier. You need to use approved e-filing software or services that comply with IRS requirements. Always check for any specific eligibility criteria before filing electronically. This approach is aligned with modern digital convenience and enhances efficiency.

You should mail California form 3533 to the California Franchise Tax Board at the address specified on the form instructions. This ensures that your form reaches the appropriate department for processing. Make sure to send it through a reliable postal method, especially if you need confirmation of the mail. Keeping a copy of the completed form is a smart way to track your submissions.