California Contract with Consultant as Self-Employed Independent Contractor with Limitation of Liability Clause

Description

How to fill out Contract With Consultant As Self-Employed Independent Contractor With Limitation Of Liability Clause?

Have you ever found yourself in a situation where you require documents for either professional or personal purposes almost constantly.

There are numerous legitimate document templates available online, but finding reliable ones can be challenging.

US Legal Forms provides a vast selection of form templates, such as the California Contract with Consultant as Self-Employed Independent Contractor with Limitation of Liability Clause, which can be crafted to meet federal and state requirements.

Once you have obtained the correct form, click Purchase now.

Select the payment plan you want, complete the necessary information to create your account, and finalize your purchase using PayPal or a credit card.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the California Contract with Consultant as Self-Employed Independent Contractor with Limitation of Liability Clause template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for the correct state/county.

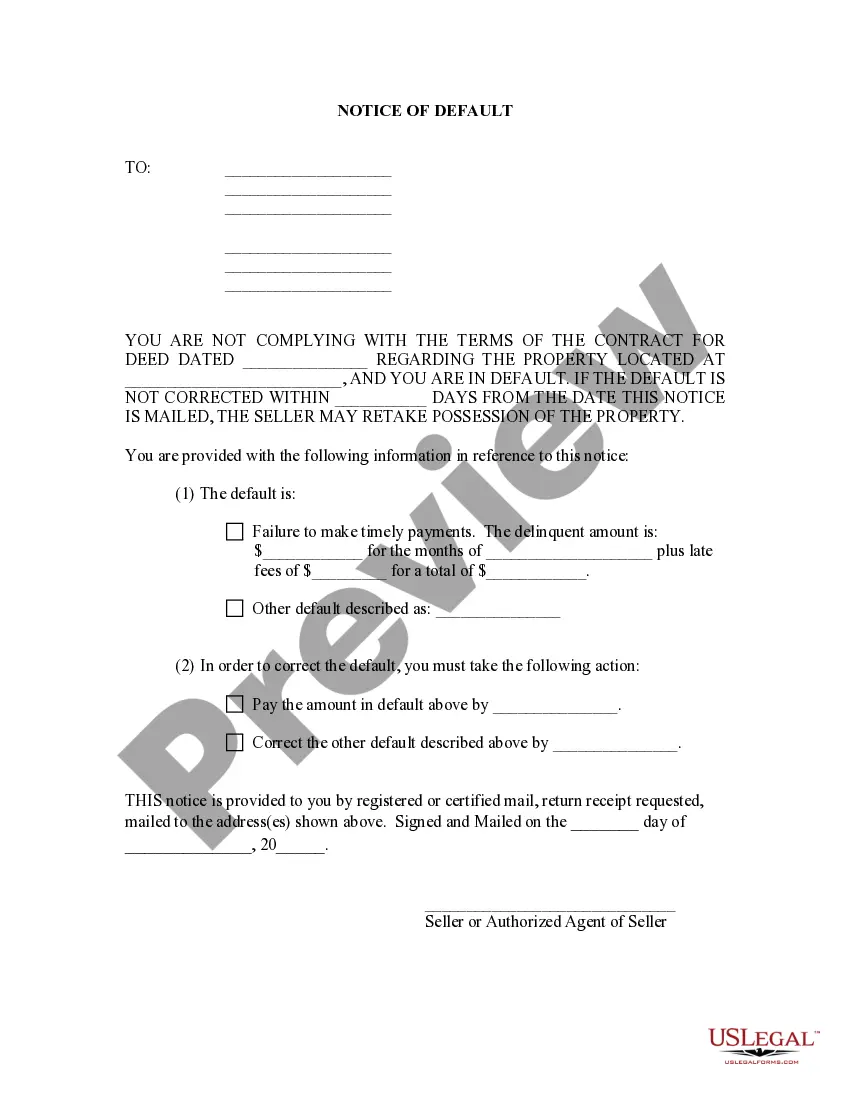

- Use the Preview feature to examine the document.

- Review the description to make sure you have selected the correct form.

- If the form does not meet your needs, utilize the Search function to find the form that suits your needs and requirements.

Form popularity

FAQ

Yes, as an independent contractor in California, you typically need a business license, especially if your work falls under the California Contract with Consultant as Self-Employed Independent Contractor with Limitation of Liability Clause. The exact requirements can vary based on your location and the nature of your work. It’s best to consult local business regulations to ensure compliance and avoid fines.

While some contractors may operate without a license in California, it is generally risky and can lead to penalties. Under the California Contract with Consultant as Self-Employed Independent Contractor with Limitation of Liability Clause, specific trades do not require a license, but most professional services do. Therefore, it is essential to understand the legal requirements before starting work to avoid complications.

In California, various businesses, including those operating under a California Contract with Consultant as Self-Employed Independent Contractor with Limitation of Liability Clause, may require a business license. Typically, businesses that engage in service delivery, retail sales, or any activity generating revenue fall under this requirement. Always check local regulations, as specific licensing can vary from one city or county to another.

In California, 1099 employees, or independent contractors, must meet specific criteria defined by the California Contract with Consultant as Self-Employed Independent Contractor with Limitation of Liability Clause. The state uses the ABC test to determine contractor status, ensuring that workers are truly independent. Moreover, contractors are responsible for managing their taxes, including self-employment tax, and must maintain proper documentation for their services.

As of 2025, California aims to enhance clarity regarding independent contractor classification. This includes potential adjustments to existing laws like AB5 to protect both workers and businesses. Keeping abreast of changes is beneficial when negotiating a California Contract with Consultant as Self-Employed Independent Contractor with Limitation of Liability Clause. Staying informed enables you to meet future legal requirements confidently.

AB5, or Assembly Bill 5, is a law in California that sets stricter criteria for classifying workers as independent contractors. This law requires a three-prong test to determine a worker’s status, significantly affecting many industries. If you are considering a California Contract with Consultant as Self-Employed Independent Contractor with Limitation of Liability Clause, knowing AB5 is critical to avoid legal consequences and ensure proper classification.

An independent contractor agreement in California is a legal document outlining the relationship between the contractor and the client. This agreement details the scope of work, payment terms, and rights and obligations of both parties. When creating a California Contract with Consultant as Self-Employed Independent Contractor with Limitation of Liability Clause, including specific provisions can protect both parties and clarify expectations.

The new freelance law in California primarily refers to Assembly Bill 5 (AB5), which redefined the criteria for classifying workers. Under this law, many freelancers may now be considered independent contractors, thus impacting their rights and benefits. It's essential to review this law closely when drafting a California Contract with Consultant as Self-Employed Independent Contractor with Limitation of Liability Clause. This ensures compliance and protection for both parties.

In California, a worker is classified as an independent contractor when they maintain control over how they complete their work. Key factors include having their tools, setting their hours, and being able to work for multiple clients. This is crucial when entering into a California Contract with Consultant as Self-Employed Independent Contractor with Limitation of Liability Clause. Understanding this distinction helps avoid misclassification issues.

In California, whether a 1099 contractor needs a business license depends on their specific area and industry. Generally, many cities require independent contractors to obtain a business license to operate legally. This is also applicable for those entering a California Contract with Consultant as Self-Employed Independent Contractor with Limitation of Liability Clause. Always check local regulations to ensure compliance.