California Office Space Lease Agreement

Description

How to fill out Office Space Lease Agreement?

Are you presently within an establishment where you often require documents for either business or personal reasons nearly every day.

There is a multitude of legal document templates accessible online, yet locating reliable forms is not straightforward.

US Legal Forms offers an extensive selection of document templates, such as the California Office Space Lease Agreement, designed to comply with federal and state regulations.

Once you find the appropriate document, click Get now.

Choose the pricing plan you prefer, enter the required information to create your account, and finalize your purchase using PayPal or a credit card.

- If you are already acquainted with the US Legal Forms website and possess an account, simply Log In.

- After that, you can download the California Office Space Lease Agreement template.

- If you lack an account and wish to start using US Legal Forms, follow these steps.

- Identify the form you need and verify it is applicable to the correct city/county.

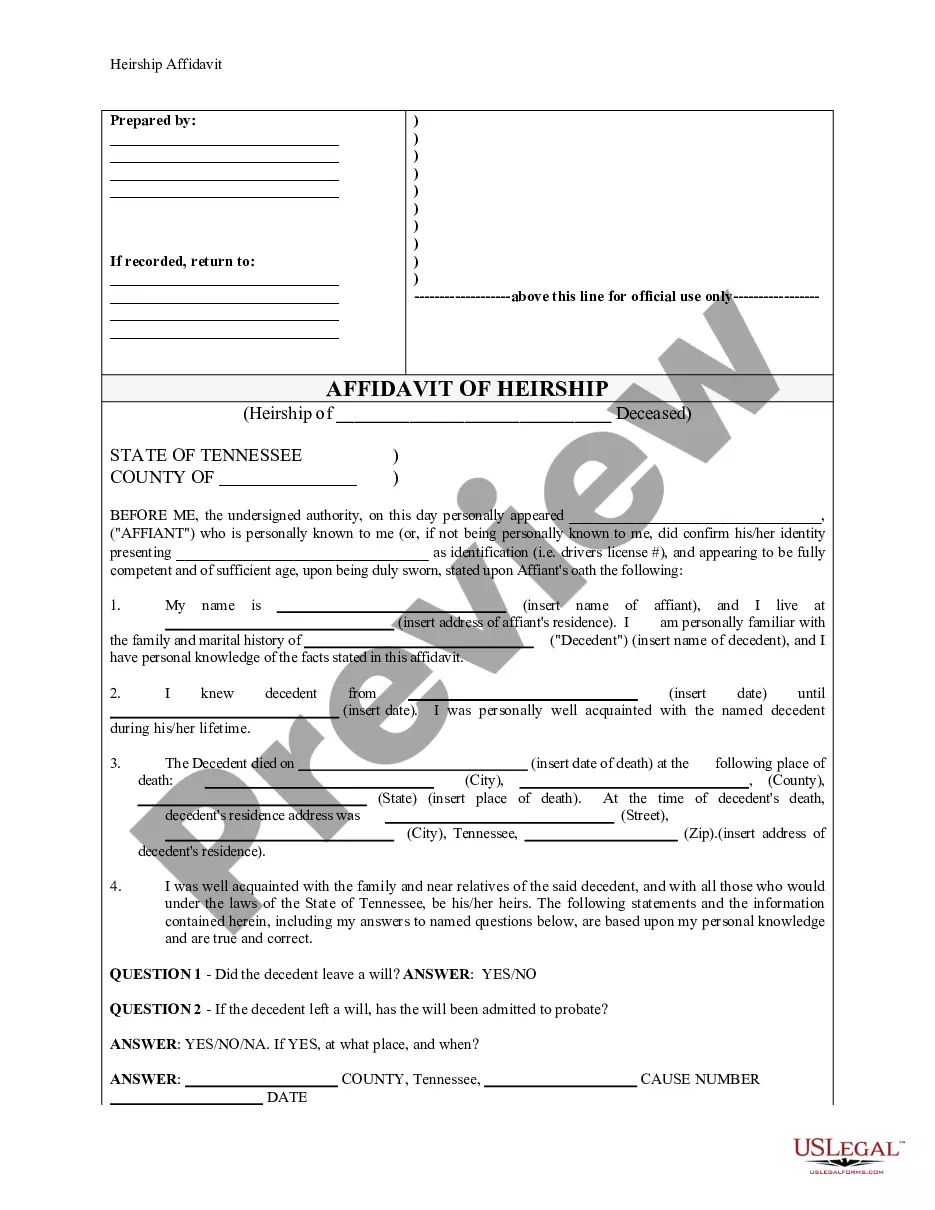

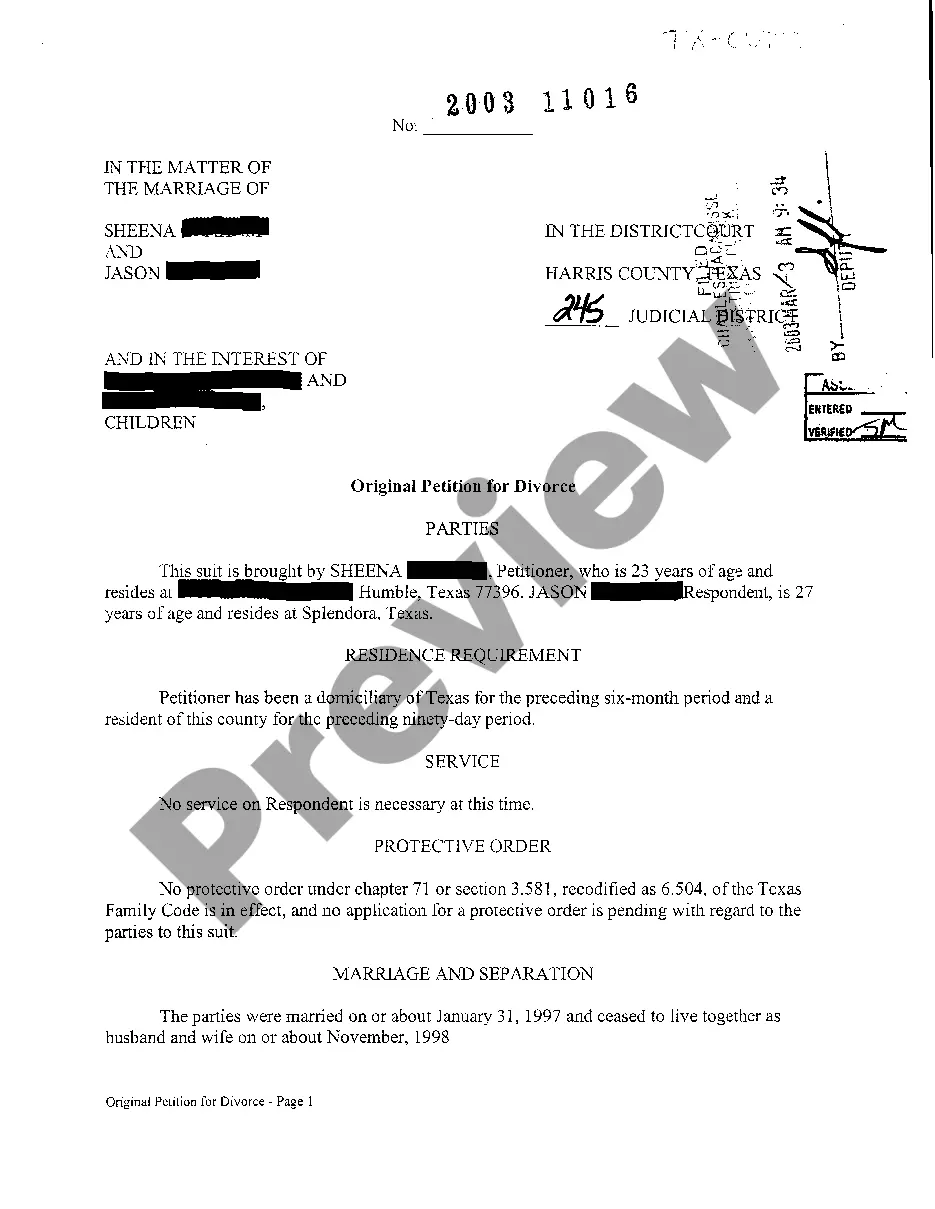

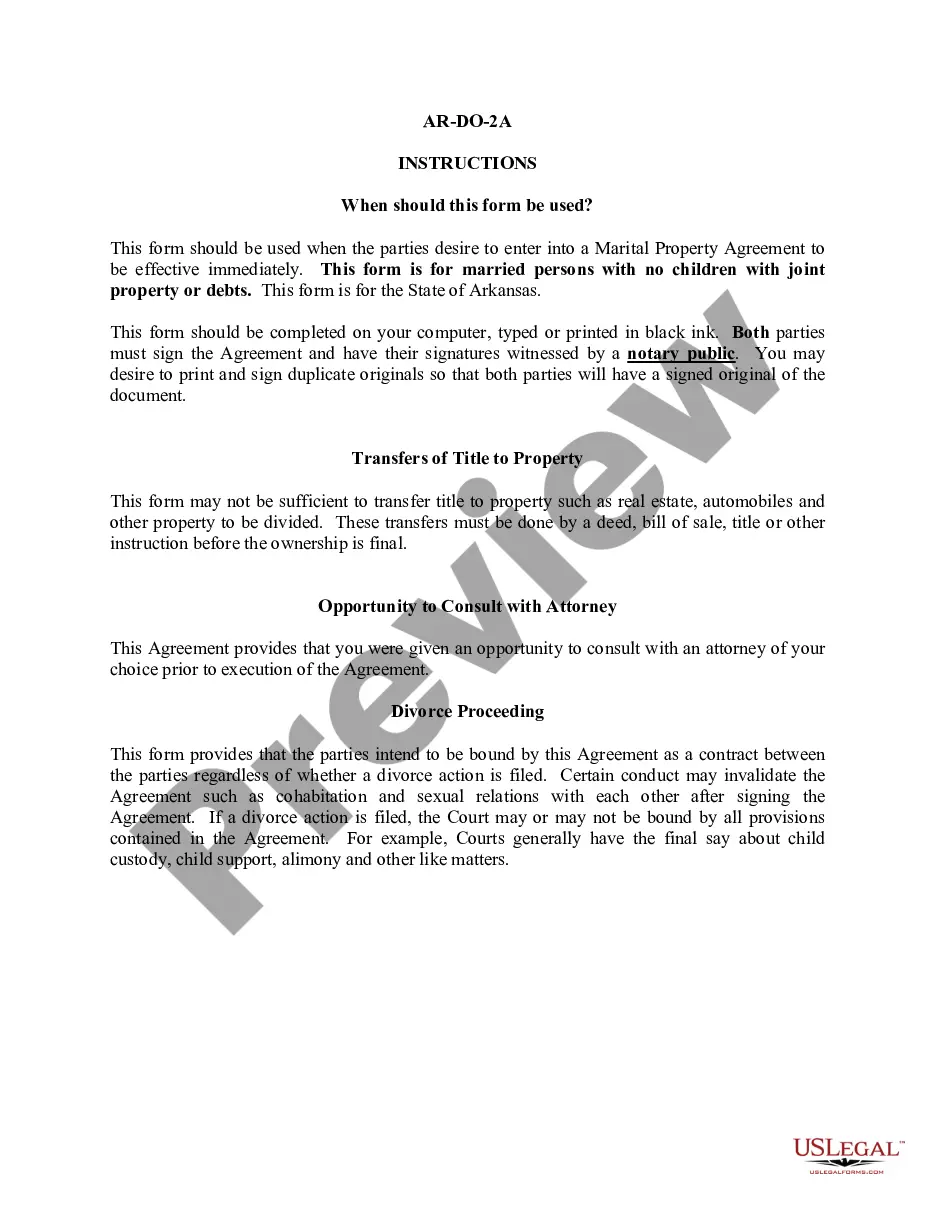

- Use the Review button to examine the form.

- Read the description to ensure you have selected the correct document.

- If the document isn’t what you are looking for, utilize the Search field to find the form that suits your needs.

Form popularity

FAQ

A California commercial lease agreement acts as a binding contract between the landlord and a business tenant who is renting the space for non-residential use, such as retail, office space, industrial, or hospitality.

Six costs to consider before leasing a business premisesRent for business premises.Building insurance for business premises.Service charges for business premises.Costs when requesting a landlord's permission.VAT payable on business premises.Other costs when leasing business premises.

This lease structure makes the tenant responsible for the majority of costs. Specifically, the tenant pays the base rent, property but also taxes, insurance, utilities, and maintenance. This even includes standard property repairs associated with the commercial space being occupied.

No, lease agreements do not need to be notarized in California. As long as the criteria for a legally binding lease are met, it is not required to have the lease notarized. A tenant and landlord can agree to have the lease notarized if they wish, but it is not required by California state law.

How to negotiate a commercial lease for your retail store: 15 tipsSettle ahead of time on your budget, your must-haves, and your nice-to-haves.Get an agent or lawyer to negotiate for you.Do negotiate on more than one location at the same time.Don't pay asked base rent.Check the square footage yourself.More items...?

Yes, a commercial lease needs to be notarized in California. If there are any additions to, or modifications of, the commercial lease, those must also be notarized. The lease should be notarized before the commercial tenant moves into the rental space.

A Triple Net Lease (NNN Lease) is the most common type of lease in commercial buildings. In a NNN lease, the rent does not include operating expenses. Operating expenses include utilities, maintenance, property taxes, insurance and property management.

Minimum legal components of a lease are a statement of the parties, a description of the property, the duration of the lease, the amount of the rental, and the time and manner of the rental payment. Leases usually require a great more than just those terms however. What extra terms are included are up to the parties.