California Affidavit by an Attorney-in-Fact in the Capacity of an Administrator of an Estate

Description

How to fill out Affidavit By An Attorney-in-Fact In The Capacity Of An Administrator Of An Estate?

Are you in a situation where you require documents for potential organizational or personal purposes almost every workday.

There are numerous legal document templates accessible online, but locating ones you can rely on is not simple.

US Legal Forms offers thousands of form templates, including the California Affidavit by an Attorney-in-Fact in the Role of an Administrator of an Estate, which can be designed to comply with federal and state regulations.

Once you find the appropriate form, click Purchase now.

Select the payment plan you prefer, provide the necessary details to set up your payment, and complete your transaction using your PayPal or credit card.

- If you are already acquainted with the US Legal Forms website and possess an account, simply Log In.

- Then, you may download the California Affidavit by an Attorney-in-Fact in the Role of an Administrator of an Estate template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

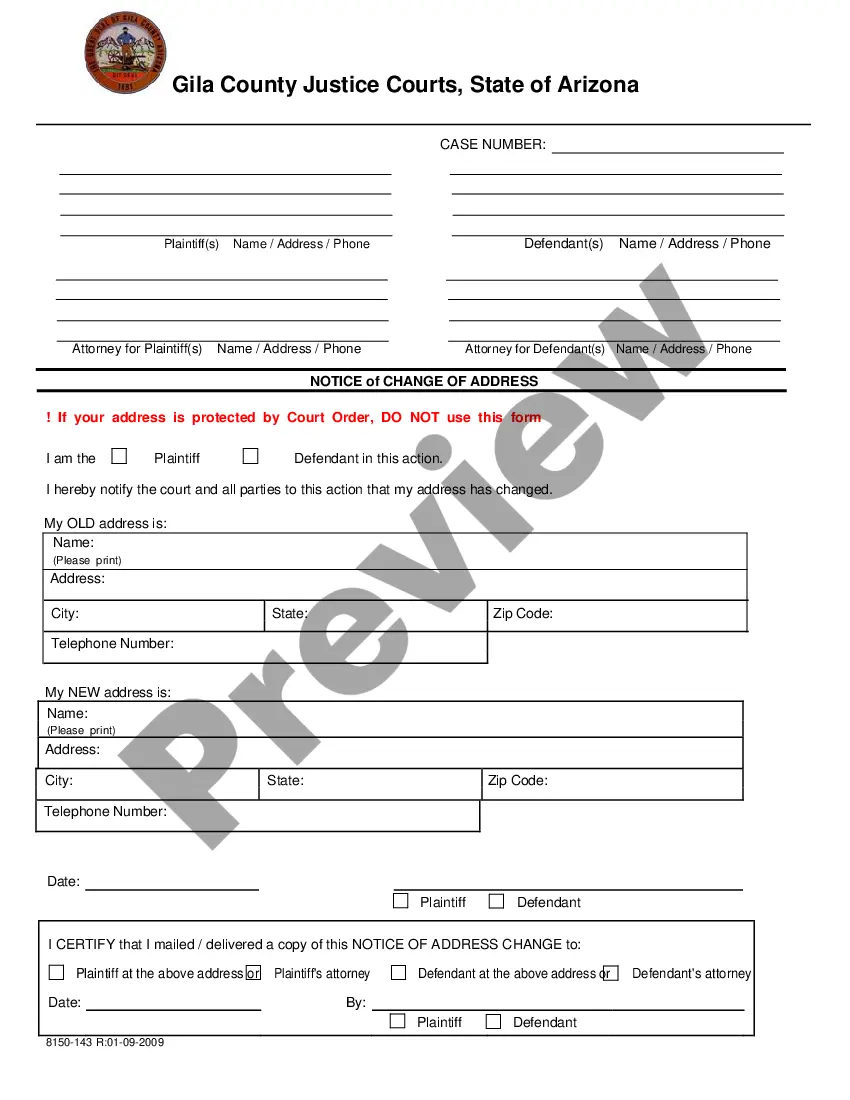

- Obtain the form you need and ensure it is for your correct area/county.

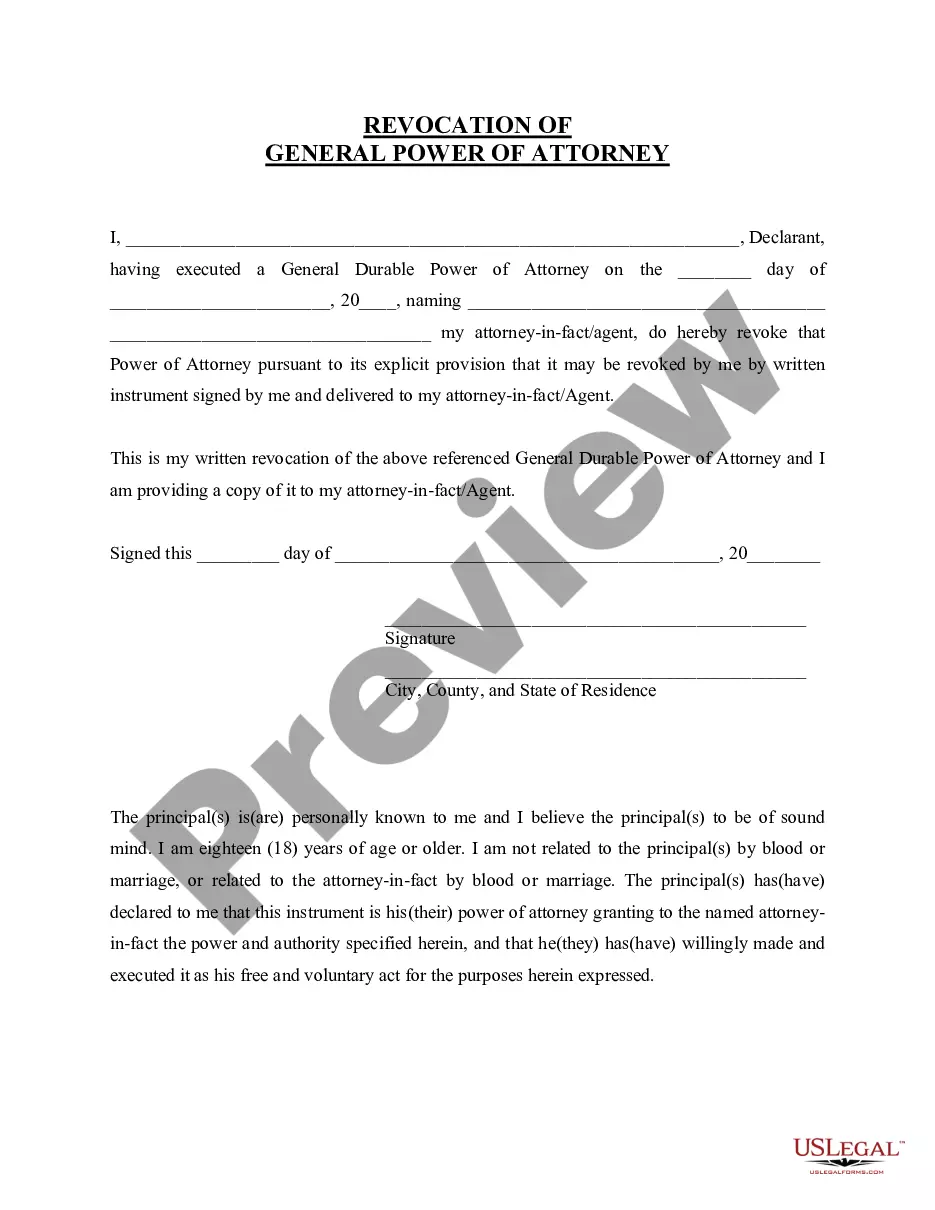

- Utilize the Review button to examine the form.

- Check the description to confirm that you have chosen the right form.

- If the form is not what you are looking for, use the Search box to find the form that meets your needs and requirements.

Form popularity

FAQ

Under Probate Code section 8465, the court may appoint as the administrator a person ?nominated by a person otherwise entitled to appointment.? However, Probate Code section 8402(a)(4) provides that a person who is not a resident of the United States is not competent to act as a personal representative (and therefore ...

(Revised: 01/2021) Probate Code section 13100 provides for the collection or transfer of a decedent's personal property without the administration of the estate or probate of the will.

DE-121 NOTICE OF PETITION TO ADMINISTER ESTATE (PROBATE - DECEDENTS' ESTATES)

Hear this out loud PauseCalifornia Probate Code § 810-13 defines incapacity as when someone is 'without understanding,' 'of unsound mind,' or 'suffers from mental deficits so substantial that they lack the legal capacity' to take care of themselves and make appropriate decisions.

Hear this out loud PauseThe trustee cannot assign his or her powers to someone else, although he or she is allowed to delegate the duty to invest to others. Also, a trustee may rely on professionals to properly advise. Avoidance of conflicts.

Hear this out loud PauseWhen a revocable trust has one grantor, the trust turns irrevocable when the grantor dies or becomes incapacitated. A legal issue arises with a joint trust that determines whether a revocable trust becomes an irrevocable trust.

Hear this out loud PauseTypically, the settlor (i.e., the person who created and funded the trust) is the trustee until incapacity or death. Upon the settlor's incapacity, the successor trustee will need to obtain whatever certificates the trust document requires in order to establish incapacity and take authority.

The affidavit of successor trustee for California specifically requires that you provide proof of incapacity (most commonly a death certificate) and evidence that you have the authority to act as successor trustee (the Trust with any amendments).