California Employment Application for Sole Trader

Description

How to fill out Employment Application For Sole Trader?

You can spend hours online attempting to locate the legal document template that meets the federal and state requirements you need.

US Legal Forms provides a vast array of legal forms that can be assessed by experts.

You can easily download or print the California Employment Application for Sole Trader from my service.

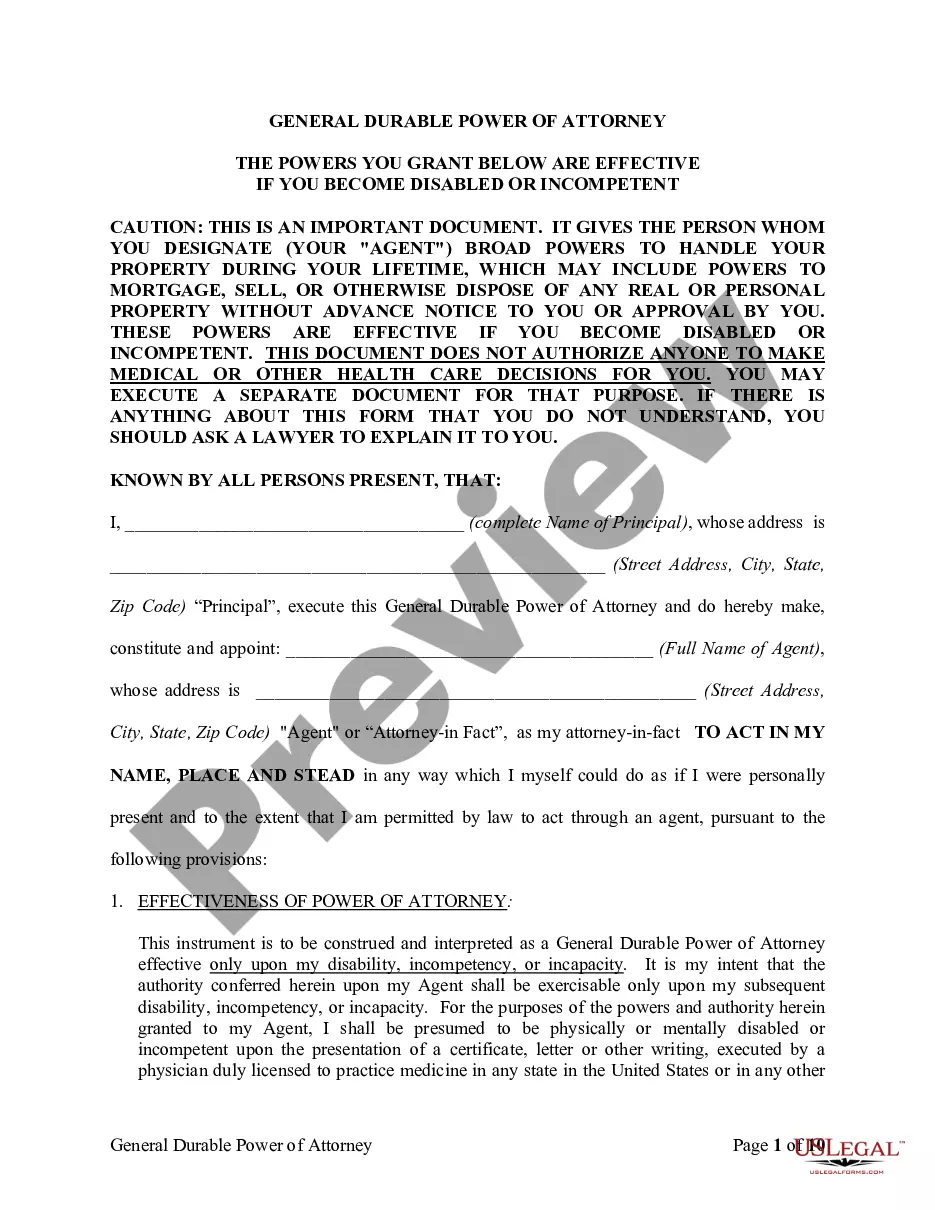

If available, use the Preview option to review the document template as well.

- If you already have a US Legal Forms account, you may sign in and click on the Obtain button.

- Next, you may complete, edit, print, or sign the California Employment Application for Sole Trader.

- Every legal document template you purchase is yours indefinitely.

- To request another copy of any purchased form, navigate to the My documents tab and click on the appropriate option.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure that you have selected the correct document template for the county/town of your choice.

- Review the form details to confirm that you have chosen the right template.

Form popularity

FAQ

The following were eligible for PUA: Business owners. Self-employed workers. Independent contractors.

"Whether you're in the gig economy, whether you're an independent contractor, everyone who is out of work is eligible for unemployment insurance," said Rep.

After a lengthy delay, California's gig workers, the self-employed, independent contractors and freelancers can now apply for unemployment insurance benefits. On April 28, the state started accepting their unemployment applications under a new program called Pandemic Unemployment Assistance (PUA).

A sole proprietor isn't required to file a California withholding registration for an EDD (Employment Development Department) account number. That requirement is reserved for businesses who hire employees.

There are four simple steps you should take:Choose a business name.File a Fictitious Business Name Statement with the county recorder.Obtain licenses, permits, and zoning clearance.Obtain an Employer Identification Number.

Eligibility RequirementsOwn your own business, be self-employed, or working as an independent contractor.Have a minimum net profit of $4,600 annually.Have a valid license, if required by your occupation.Be able to perform all of your normal duties on a full-time basis at the time your application is submitted.More items...?

While unemployment benefits are created specifically for employees, not business owners, you may be eligible if you're an employee within your own business.

Under normal circumstances, businesses structured as sole proprietorships aren't able to collect unemployment benefits because unemployment taxes aren't paid if you don't have employees.

You are likely self-employed if you did not receive a W-2....Generally, you are self employed if:You are in business for yourself (including a part-time business)You work as a sole proprietor or an independent contractor.You are a partner of a partnership that carries on a trade or business.

The HMRC recommends that you register your business as soon as it is possible for you to do so. However, there is a cut off involved with registering your business, and it is 5 October after the end of the tax year that you began your self-employment.