California Affidavit - Death of Trustee

Form popularity

FAQ

Filling out an Affidavit of Heirship form involves several straightforward steps to ensure accuracy. You will need to provide essential details such as the deceased's information, your relationship with the deceased, and any other pertinent information about the heirs. We recommend using uslegalforms, as they offer helpful resources and templates to guide you through the process of completing the Affidavit of Heirship seamlessly.

In California, a trustee generally has a reasonable timeframe to settle an estate, often ranging from six months to a year after the trustee's appointment. However, this duration may vary based on the complexity of the estate and any potential disputes among beneficiaries. Prompt actions are encouraged to comply with the obligations outlined in the California Affidavit - Death of Trustee.

After the death of a trustee, the newly appointed trustee has several important responsibilities in California. This includes gathering and managing the trust's assets, paying off debts, and distributing assets to beneficiaries in accordance with the trust's provisions. Knowing the duties that come with the California Affidavit - Death of Trustee ensures that the trust is handled appropriately and efficiently.

An Affidavit of successor trustee for California serves as a legal document that designates a new trustee when the original trustee has passed away. This affidavit allows the successor trustee to assume control over the trust, ensuring that the assets are managed according to the trust's terms. It's a crucial step in the estate planning process, especially in light of the California Affidavit - Death of Trustee.

If a trustee passes away, the trust administration process should proceed according to the trust's terms. The designated successor trustee will typically assume control over the trust and its assets to maintain its integrity. In the absence of a named successor, beneficiaries might require a court-appointed trustee, which can lead to delays. Utilizing a California Affidavit - Death of Trustee can help clarify the situation and assist beneficiaries in navigating these transitions efficiently.

When a trustee dies in California, the trust administration process must continue according to the trust document. The successor trustee then needs to submit a California Affidavit - Death of Trustee to confirm the trustee's passing. This document allows the new trustee to manage trust property, make distributions, and carry out their duties without delay.

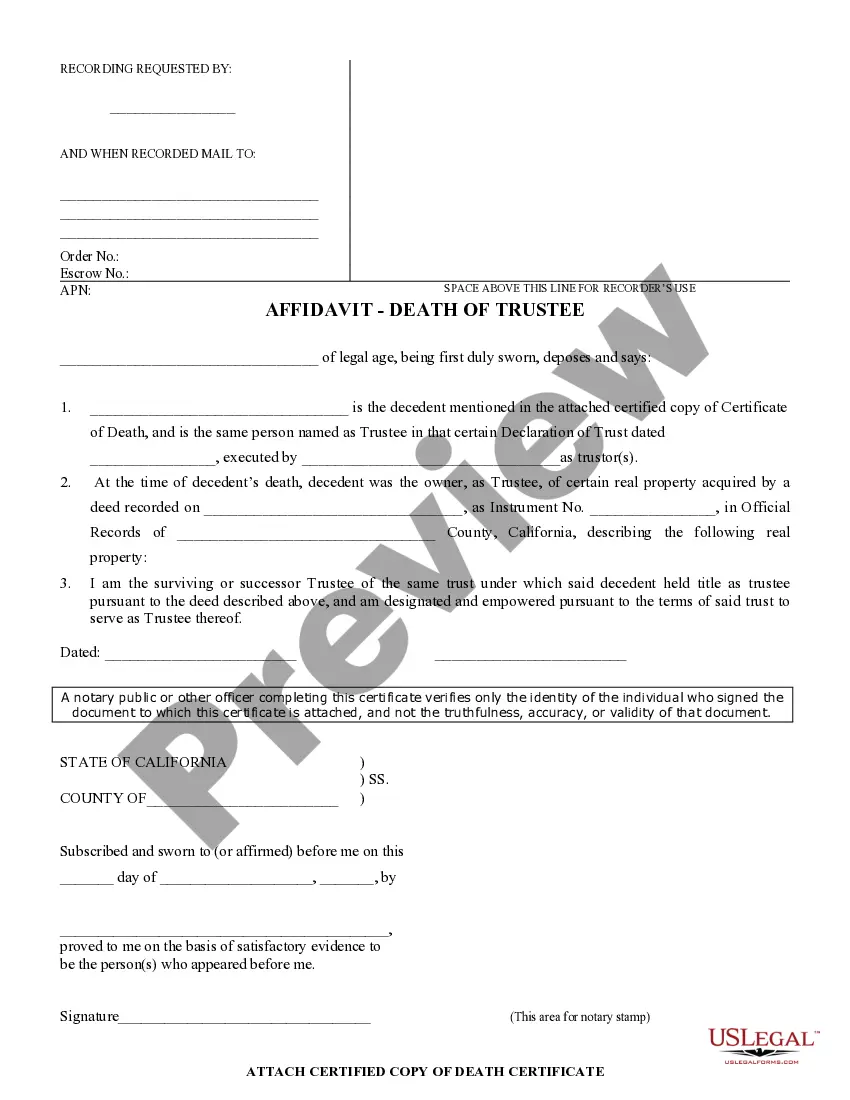

To fill out an Affidavit of death of trustee in California, start by gathering essential information, such as the trustee's full name, the date of death, and the trust details. Follow the format required by California law, ensuring all sections are completed accurately. For assistance, consider using the US Legal Forms platform, which provides templates and guidance tailored to your needs regarding the California Affidavit - Death of Trustee.

An Affidavit for death of a trustee is a legal document that confirms the passing of the designated trustee in a trust. This affidavit provides necessary information, such as the date of death and the details of the trust, ensuring a smooth transition to a successor trustee. Utilizing the California Affidavit - Death of Trustee is vital for keeping the trust administration process moving forward.

When a trustee dies, the first step is to locate the trust documents and confirm the provisions for succession. You will need to obtain a California Affidavit - Death of Trustee to officially document the trustee's passing. This affidavit allows the successor trustee to assume control and fulfill their responsibilities regarding the trust.

The purpose of the California Affidavit - Death of Trustee is to formally confirm the death of a trustee, which is a critical step in the trust administration process. This affidavit allows the successor trustee to step into the role of managing the trust assets. By filing this document, you help ensure the trust is properly administered and beneficiaries receive their rightful distributions.