California Special Durable Power of Attorney for Bank Account Matters

What this document covers

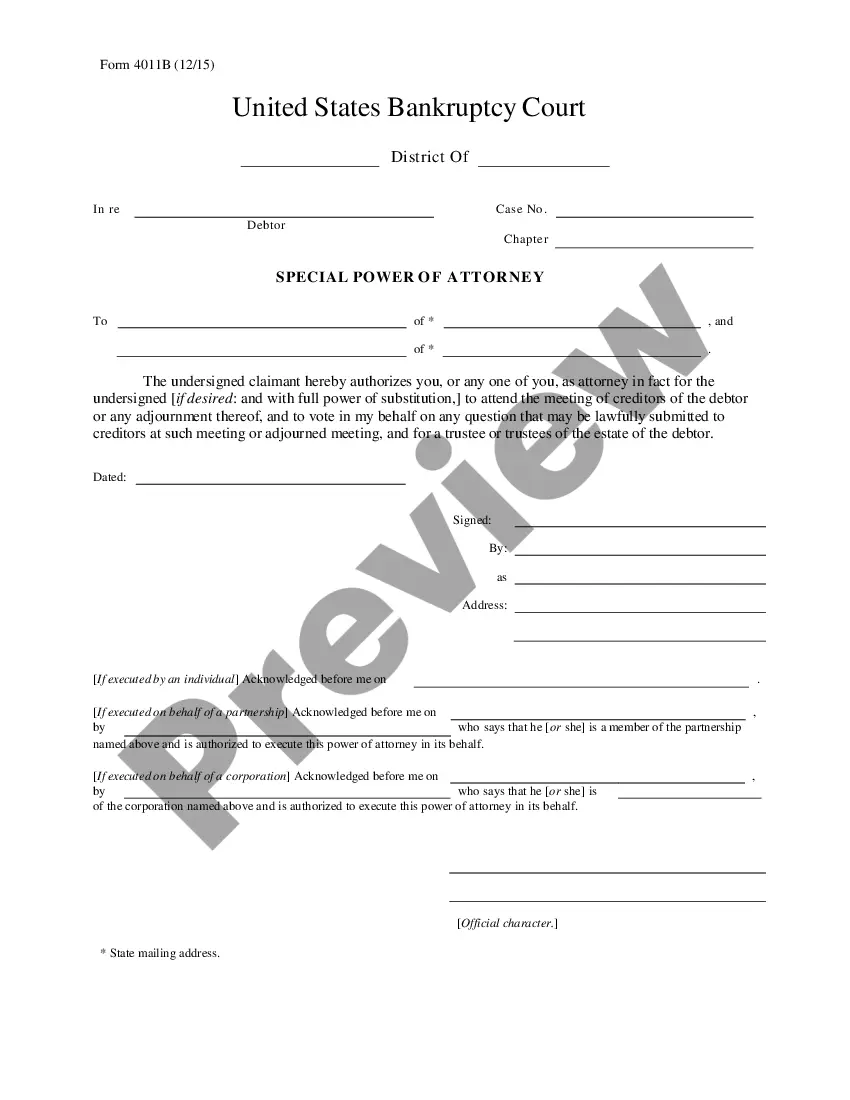

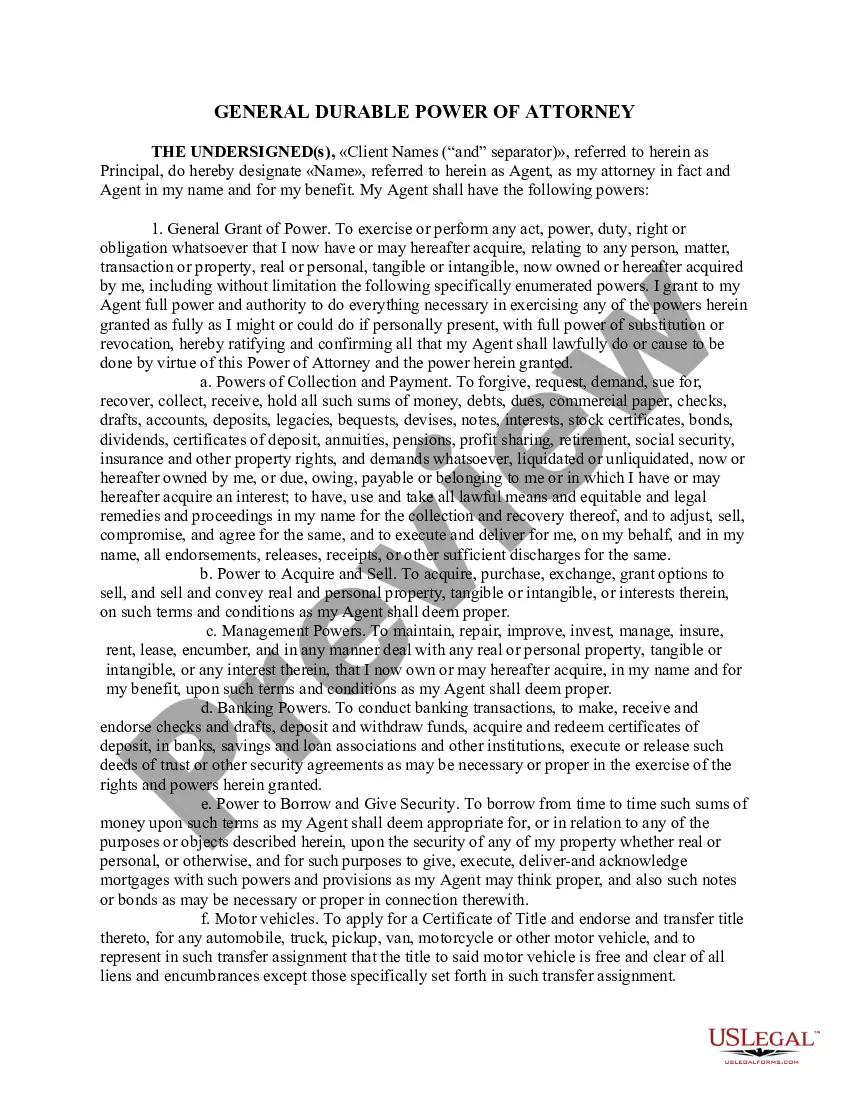

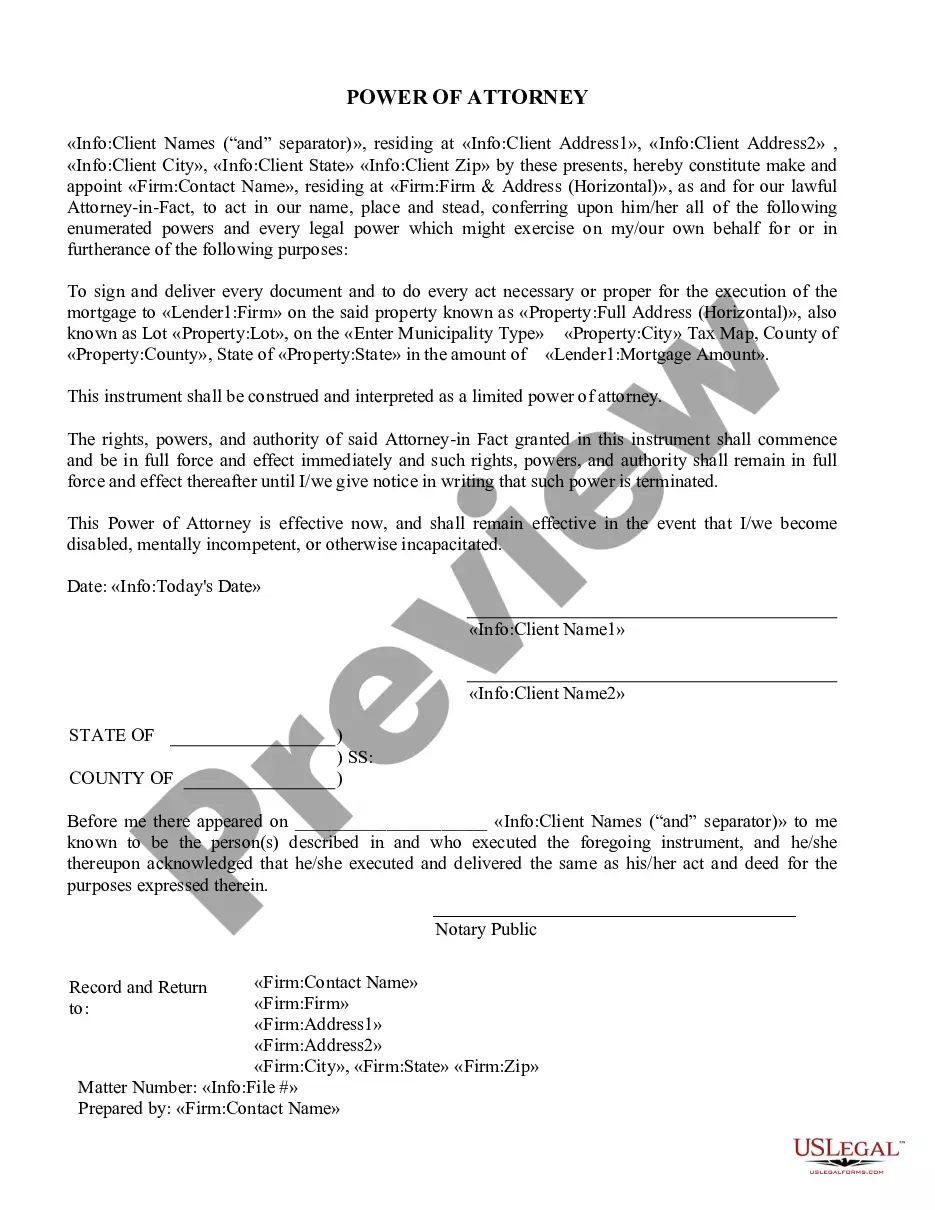

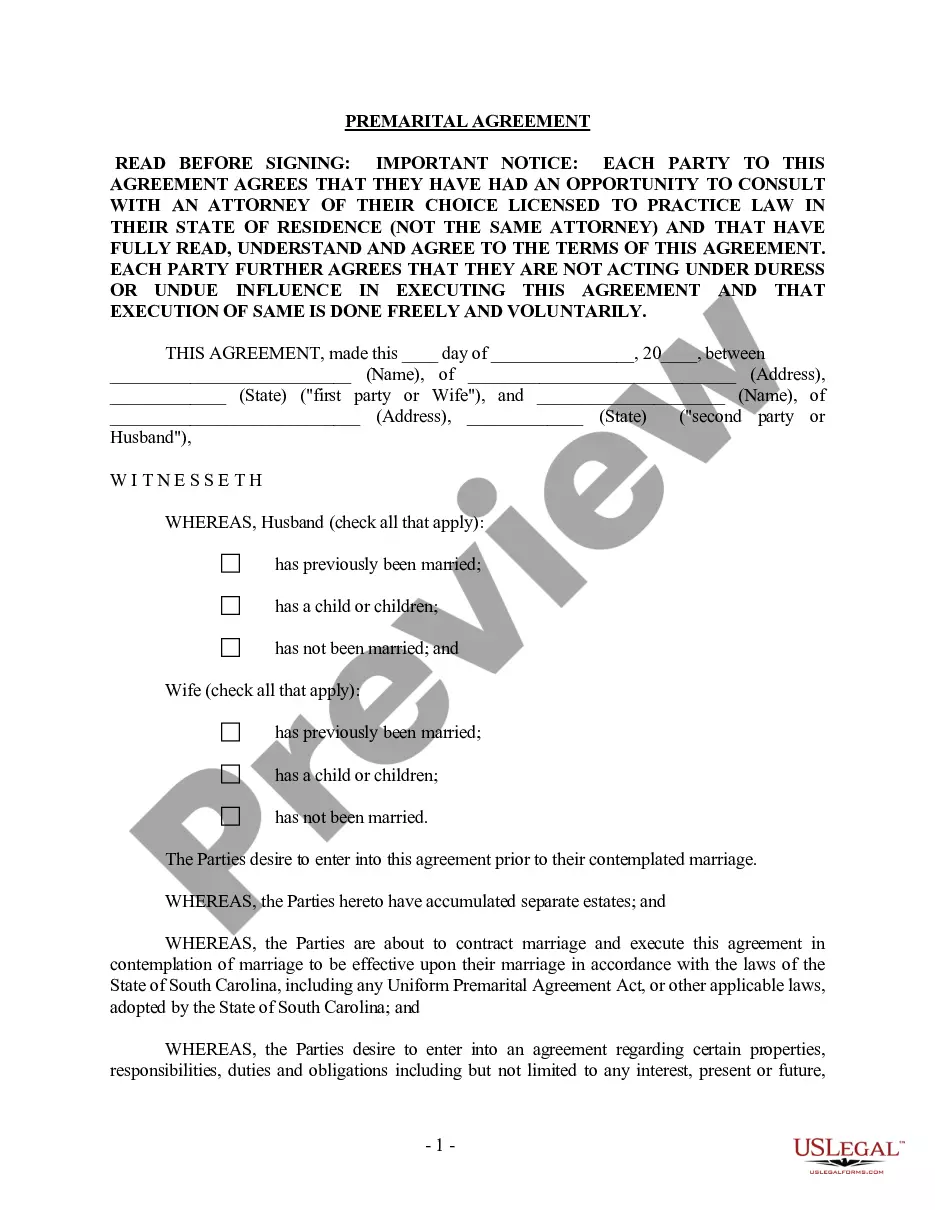

The Special Durable Power of Attorney for Bank Account Matters is a legal document that allows you, the principal, to appoint an agent to handle specific banking transactions on your behalf. Unlike a general power of attorney, this form is limited to banking matters, such as making deposits, writing checks, and managing accounts. It is designed to ensure that your banking affairs can be managed even if you become unable to do so due to incapacity.

Main sections of this form

- Designation of an agent to manage banking matters.

- Specific powers granted, including making deposits and writing checks.

- Clause specifying the durability of the powers even if the principal becomes incapacitated.

- Provision for revocation and amendment of the power of attorney.

- Requirement for notarization or witnesses to validate the document.

Common use cases

This form is useful when you need someone to manage your bank accounts in situations where you may not be available or capable of handling your financial affairs. Common scenarios include hospital stays, travel, or if you are experiencing cognitive decline. This allows your chosen agent to perform banking operations on your behalf without delay.

Intended users of this form

- Individuals who want to ensure their banking affairs are managed in case of incapacity.

- People who travel frequently or spend extended time away from home.

- Those who anticipate temporary or long-term medical issues affecting their ability to manage finances.

How to prepare this document

- Identify yourself as the principal, providing your personal details.

- Select an agent whom you trust to handle your banking matters.

- Specify the bank and detail the powers you wish to grant to your agent.

- Sign the document in front of a notary public or witnesses as required.

- Make sure to date the document before submission to the bank.

Notarization guidance

This document requires notarization to meet legal standards. US Legal Forms provides secure online notarization powered by Notarize, allowing you to complete the process through a verified video call, available 24/7.

Mistakes to watch out for

- Failing to notarize or witness the document as required, which can invalidate it.

- Not clearly defining the powers granted to the agent, leading to confusion.

- Using general terms instead of specific banking terms relevant to the powers required.

Summary of main points

- The Special Durable Power of Attorney for Bank Account Matters allows you to designate an agent for specific banking transactions.

- This document remains effective even if you become incapacitated.

- Completion requires careful attention to detail, especially with notarization and clarity in powers granted.

Form popularity

FAQ

Yes, a power of attorney can take over a bank account if it is properly established through a California Special Durable Power of Attorney for Bank Account Matters. This document allows you to designate someone to manage your financial affairs, including bank transactions. However, ensure that the document clearly outlines the specific powers granted, as this clarity is essential for effective management.

Filling out a financial power of attorney form involves several key steps. First, identify the individual you wish to invest with your authority and discuss your intentions with them. Then, you will need to complete the form with accurate personal details and specify the powers you grant, particularly for a California Special Durable Power of Attorney for Bank Account Matters. Lastly, ensure the document is signed and notarized according to California law to validate your wishes.

A legal power of attorney cannot make decisions regarding the principal's personal care, such as medical treatment, or make changes to the principal's will. Additionally, a legal power of attorney cannot authorize anyone else to act on behalf of the principal unless specifically stated. Therefore, it is crucial to understand the limitations of a California Special Durable Power of Attorney for Bank Account Matters.

In California, a durable power of attorney does not need to be recorded. However, for a California Special Durable Power of Attorney for Bank Account Matters to be effective, it should be presented to your bank or financial institution when needed. Each bank has its own policies regarding the acceptance of these documents, so it is wise to check with them directly. Using ulegalforms can help you easily create a compliant document to ensure your bank matters are properly managed.

Typically, a power of attorney cannot make themselves a joint owner of someone else's bank account unless explicitly permitted in the document. The California Special Durable Power of Attorney for Bank Account Matters should clearly outline your powers. Misunderstanding this can lead to legal complications, so it’s essential to consult with legal experts or platforms like uslegalforms to ensure compliance with the law.

Banks are cautious about powers of attorney due to the need for security and verification. They want to ensure that no unauthorized transactions occur that could harm the account holder. When you present a California Special Durable Power of Attorney for Bank Account Matters, it's crucial to provide all necessary documentation, as banks require clear and specific instructions to prevent fraud and protect their clients' assets.

A power of attorney grants you specific authority to act on someone else's behalf. This authority can include managing bank accounts, paying bills, or making financial decisions. When dealing with a California Special Durable Power of Attorney for Bank Account Matters, your powers may focus on banking transactions and account management, ensuring that the principal's financial needs are met effectively.

Being a power of attorney comes with significant responsibilities and potential downsides. You manage someone else's financial and legal affairs, which can lead to stress and accountability issues. If you misuse this authority, you may face legal consequences. Utilizing a California Special Durable Power of Attorney for Bank Account Matters clarifies your role, but be aware of the trust involved in this position.

The main difference between a power of attorney and a financial power of attorney lies in the scope of authority. A general power of attorney may cover a range of decisions, while a financial power of attorney specifically focuses on financial matters. For those interested in managing bank accounts, a California Special Durable Power of Attorney for Bank Account Matters is essential for clear and effective financial management.

While there are many benefits to creating a durable power of attorney, there are some disadvantages to consider. For instance, you risk giving someone significant control over your finances. It is crucial to choose a trustworthy individual for your California Special Durable Power of Attorney for Bank Account Matters to avoid potential misuse of authority.