This form is an official California Judicial Council form which complies with all applicable state codes and statutes. USLF updates all state forms as is required by state statutes and law.

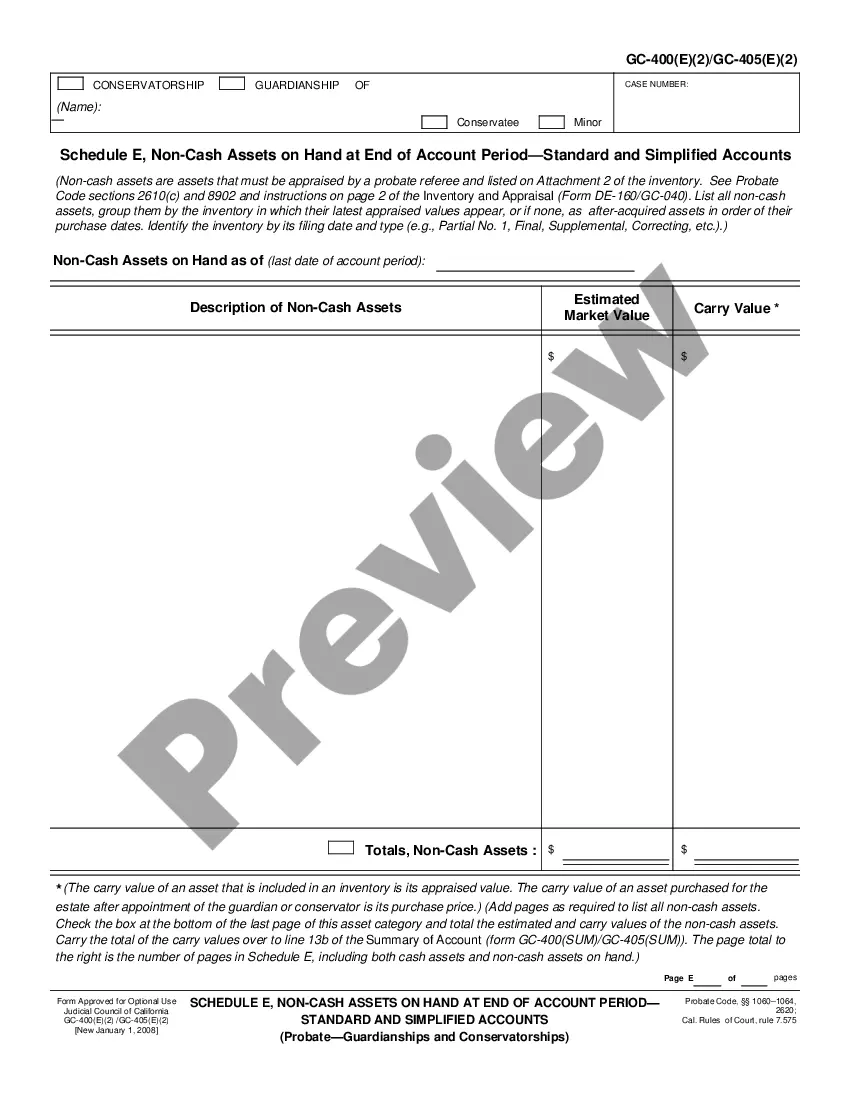

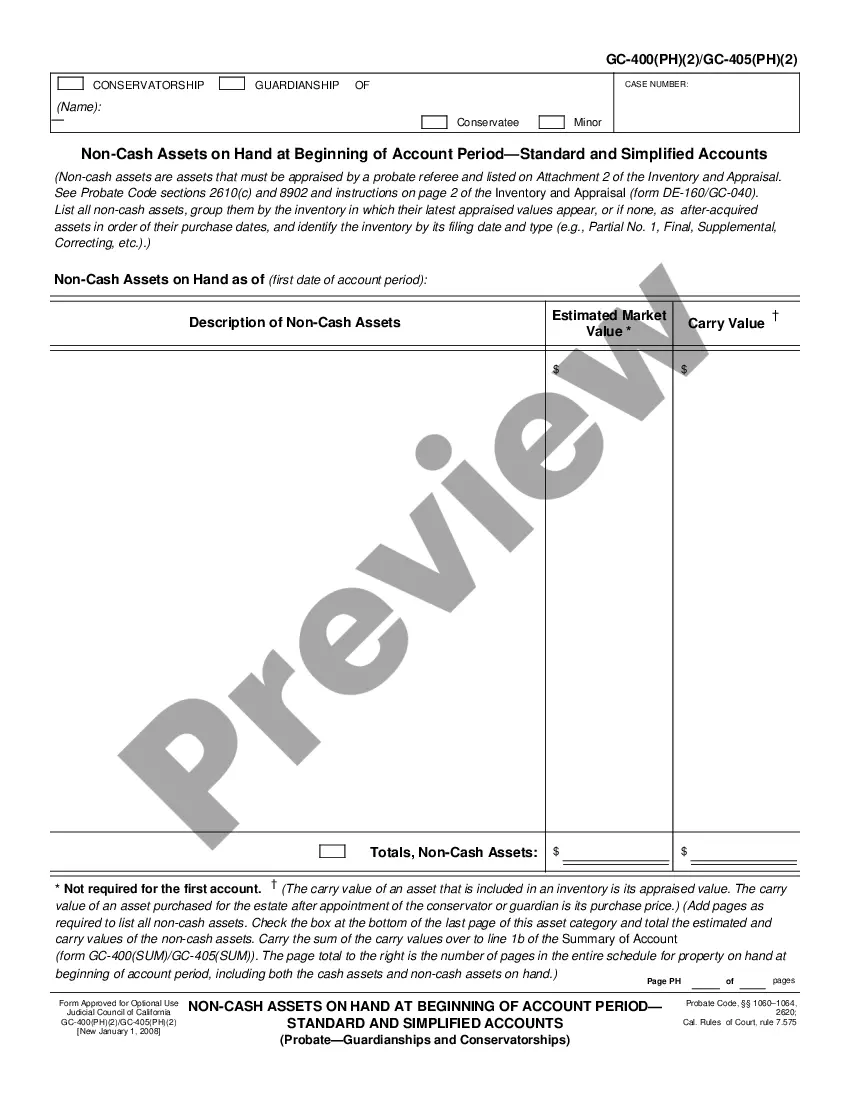

California Non-Cash Assets on Hand at End of Account Period-Standard and Simplified Accounts

Description

How to fill out California Non-Cash Assets On Hand At End Of Account Period-Standard And Simplified Accounts?

If you're looking for accurate California Non-Cash Assets on Hand at End of Account Period-Standard and Simplified Accounts web templates, US Legal Forms is exactly what you require; find documents generated and validated by state-certified lawyers.

Utilizing US Legal Forms not only spares you from concerns regarding legal documents; additionally, you conserve time, effort, and money! Downloading, printing, and filling out a legal form is far more economical than hiring an attorney to do it for you.

And that's it. In just a few simple steps, you receive an editable California Non-Cash Assets on Hand at End of Account Period-Standard and Simplified Accounts. Once you set up an account, all subsequent purchases will be much simpler. With a US Legal Forms subscription, just Log In to your account and click the Download button available on the form’s page. Then, anytime you need to access this template again, you'll always find it in the My documents section. Don’t waste your time and effort sifting through countless forms on various sites. Acquire accurate documents from a single secure platform!

- To get started, complete your registration process by entering your email and creating a password.

- Follow the steps below to set up an account and obtain the California Non-Cash Assets on Hand at End of Account Period-Standard and Simplified Accounts template to fulfill your needs.

- Utilize the Preview option or check the document description (if provided) to ensure that the template is the one you need.

- Verify its suitability in your location.

- Click Buy Now to place your order.

- Choose a preferred pricing plan.

- Create an account and make a payment with a credit card or PayPal.

- Select a convenient format and save the document.

Form popularity

FAQ

Unlike a SNT, which classifies food expenses as income, an ABLE account can be used to pay for food without impacting means-tested Supplemental Security Income (SSI) benefits.

A CalABLE account is an investment and savings account available to Eligible Individuals with disabilities.ABLE Accounts allow individuals with disabilities to save and invest money without losing eligibility for certain means-tested public benefits programs, like Medicaid and Social Security Income (SSI).

The ABLE Act limits eligibility to individuals with significant disabilities with an age of onset of disability before turning 26 years of age. If you meet this age criteria and are also already receiving benefits under SSI and/or SSDI, you are automatically eligible to establish an ABLE account.

You can withdraw money from the account and use it for eligible expenses which cover most costs associated with living with a disability.

The purpose of an ABLE Account is to help individuals with disabilities maintain or improve their health, independence, and quality of life. ABLE Account earnings are not subject to federal income tax when used for Qualified Disability Expenses (QDEs).

ABLE accounts are bank accounts that allow people with special needs to save money without jeopardizing their disability benefits.The program is open to residents and nonresidents, and California residents can open ABLE accounts in other states that allow it.

California's ABLE account program is CalABLE. You can choose to open an account in another state's ABLE program.

Contributions to an ABLE account are not tax-deductible, but all investment earnings remain untaxed as long as money taken from the account is used for "qualified disability expenses." Such expenses include, among other things: Medical treatment.

You will also need two pieces of identification to open an account, at least one of which should be a government issued identification, such as a passport, driver's license, or state-issued identification card. You can find out about getting a California photo identification card at DMV website.