This is an official form from the California Judicial Council, which complies with all applicable laws and statutes. USLF amends and updates the forms as is required by California statutes and law.

California Retirement Plan Joinder - Information Sheet

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out California Retirement Plan Joinder - Information Sheet?

If you are seeking precise California Retirement Plan Joinder - Information Sheet models, US Legal Forms is precisely what you require; access documents created and verified by state-certified attorneys.

Using US Legal Forms not only spares you from the troubles associated with legal documents; it also saves you time, effort, and money! Downloading, printing, and completing a professional document is considerably more economical than hiring a legal advisor to do it for you.

And that’s all. In just a few straightforward steps, you obtain an editable California Retirement Plan Joinder - Information Sheet. Once you establish an account, all future purchases will be processed even more easily. If you have a US Legal Forms subscription, simply Log In and click the Download button on the form’s page. Then, when you need to use this blank form again, you will always be able to find it in the My documents section. Don't waste your time searching through numerous forms on different sites. Obtain professional documents from a single trusted source!

- To begin, finalize your registration by submitting your email and creating a secure password.

- Follow the steps below to set up an account and obtain the California Retirement Plan Joinder - Information Sheet template to address your needs.

- Use the Preview feature or check the document details (if available) to ensure that the form is what you need.

- Verify its authenticity for your location.

- Click Buy Now to place your order.

- Select a recommended pricing plan.

- Create an account and pay using your credit card or PayPal.

- Choose a suitable format and download the document.

Form popularity

FAQ

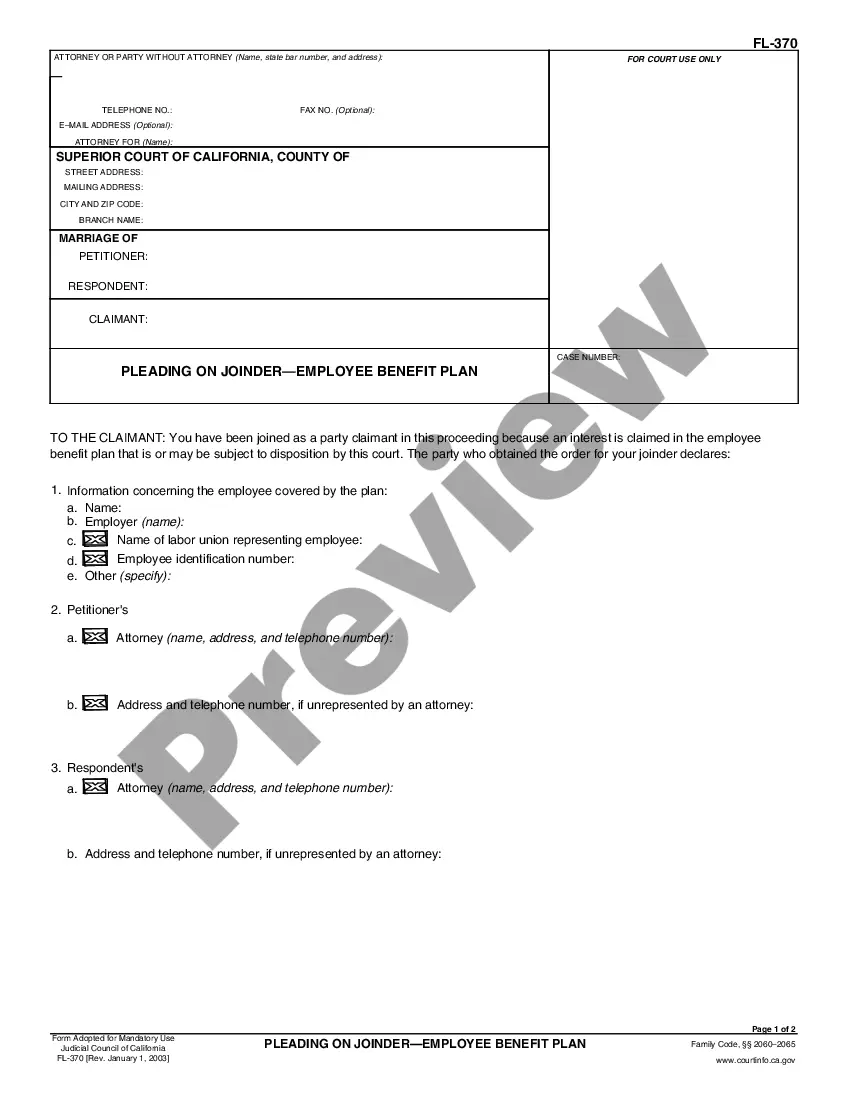

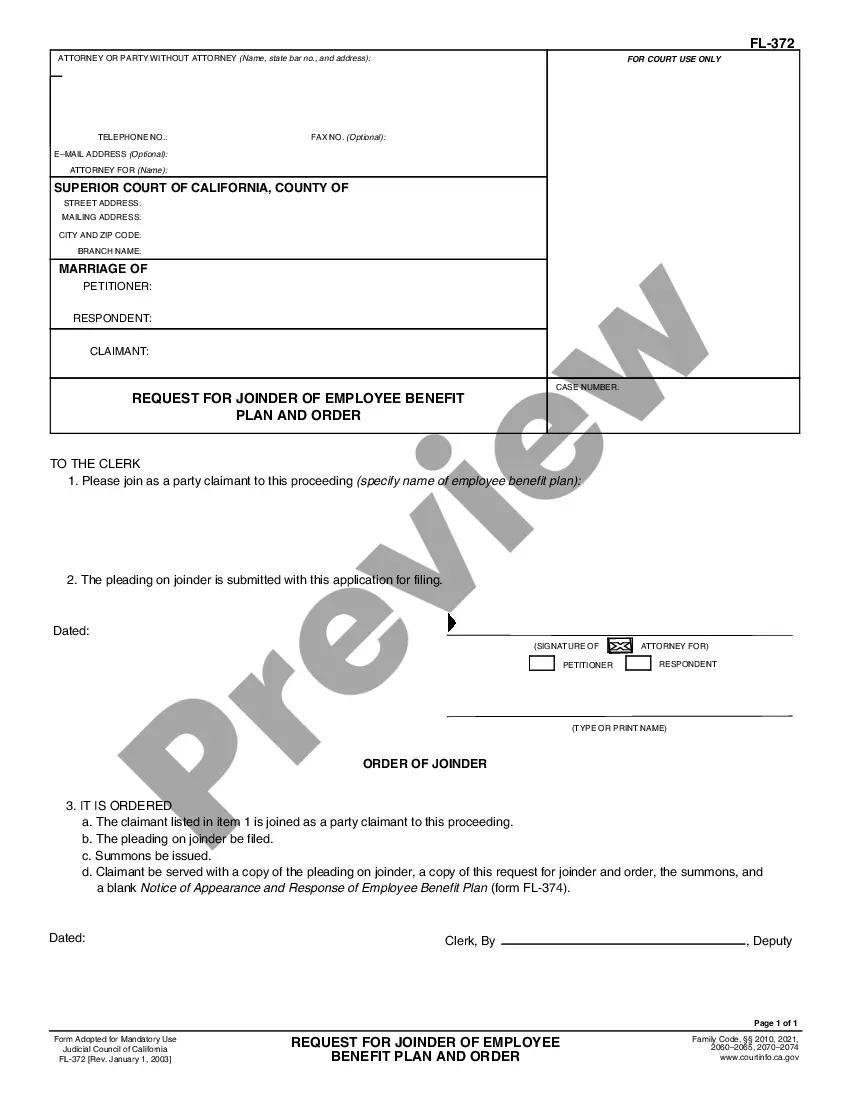

Serving a joinder on CalPERS requires following specific procedures to ensure compliance with California regulations. This typically involves delivering the documents to the appropriate CalPERS office along with all necessary forms. The California Retirement Plan Joinder - Information Sheet provides valuable insights to ensure you serve CalPERS correctly and efficiently.

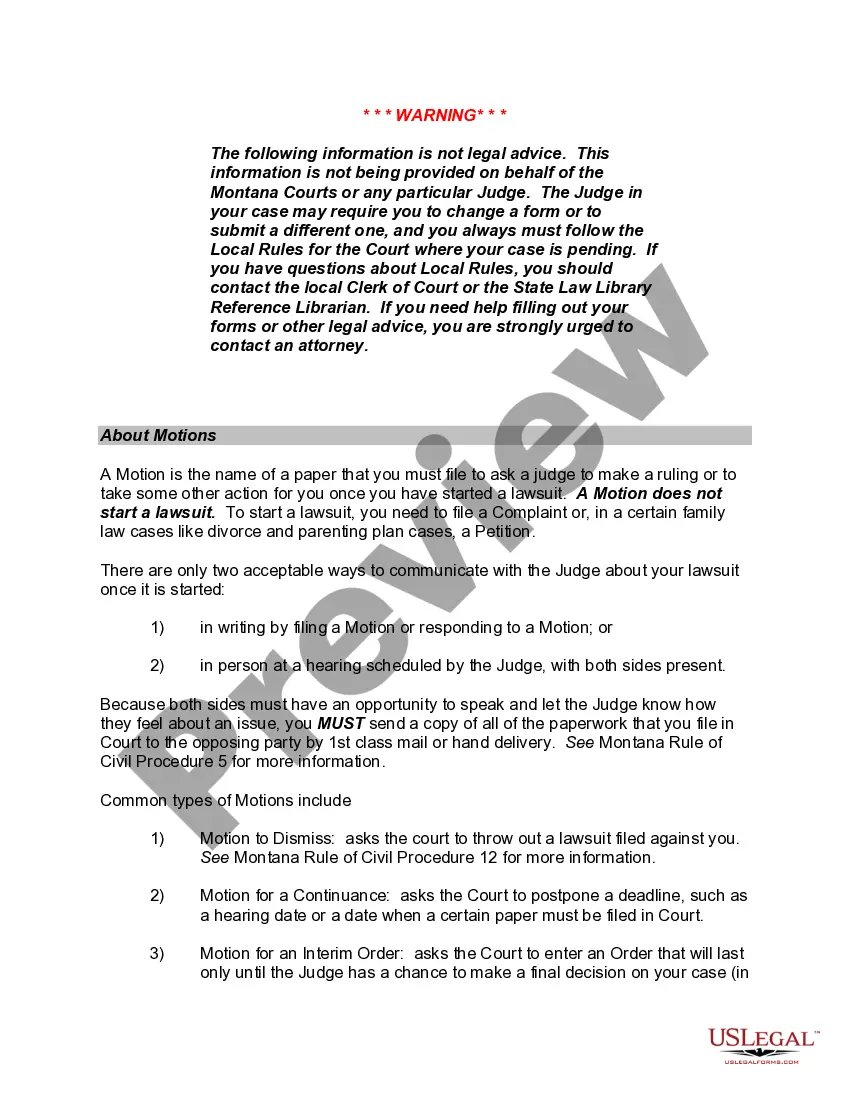

Filing a joinder in California typically involves preparing the appropriate legal documents and submitting them to the relevant court. It is crucial to follow local rules and procedures, as these can vary by jurisdiction. You can find detailed steps and templates in the California Retirement Plan Joinder - Information Sheet on platforms like uslegalforms.

The purpose of a joinder agreement is to facilitate the addition of new parties to an existing agreement or plan. It formalizes the relationship and obligations of those being added, thereby creating clarity and security. When dealing with a California Retirement Plan Joinder - Information Sheet, this document is essential for establishing rights to retirement benefits.

A retirement plan joinder is a legal document that ensures a person is included in a retirement plan. This inclusion typically denotes their rights to receive benefits upon retirement. Understanding the components of a California Retirement Plan Joinder - Information Sheet can help you navigate these legal waters effectively.

In California, the division of retirement benefits during a divorce generally follows the principle of community property. This usually means that your ex-wife may be entitled to half of the pension benefits accrued during the marriage. The California Retirement Plan Joinder - Information Sheet provides detailed insights on this topic, helping you understand fair entitlements.

A 401k joinder agreement is a legal document that facilitates a division of retirement assets between parties following a divorce. It ensures that each party maintains their rights to their portion of the retirement fund. Referencing the California Retirement Plan Joinder - Information Sheet helps clarify how these agreements function and what to include.

To serve a joinder on CalPERS, you must prepare specific documentation that outlines the details pertinent to the case. Ensure that you include necessary identifiers like member information and relevant court documents. Utilizing the California Retirement Plan Joinder - Information Sheet will guide you in understanding the precise steps needed for effective service.

The new retirement law in California introduces changes designed to enhance retirement security for employees. It aims to ensure that workers can access their pension benefits more efficiently. By understanding these changes through the California Retirement Plan Joinder - Information Sheet, you can better navigate your retirement options.

A retirement plan disclosure provides vital information about a retirement plan's terms and conditions. This disclosure includes details about benefits, investment options, and the rights of participants. Understanding this information is crucial as it equips you with the knowledge necessary to navigate your retirement plan effectively. For comprehensive insights, you can refer to the California Retirement Plan Joinder - Information Sheet.

The six-month rule for CalPERS refers to the period within which certain employment-related decisions and actions need to be made regarding retirement benefits. Specifically, this rule can affect how and when members can withdraw their contributions without penalties. Understanding this rule is critical for effective financial planning and ensuring you receive the maximum benefits from your California Retirement Plan Joinder. For more clarity, consult the California Retirement Plan Joinder - Information Sheet or access templates on the US Legal Forms platform.