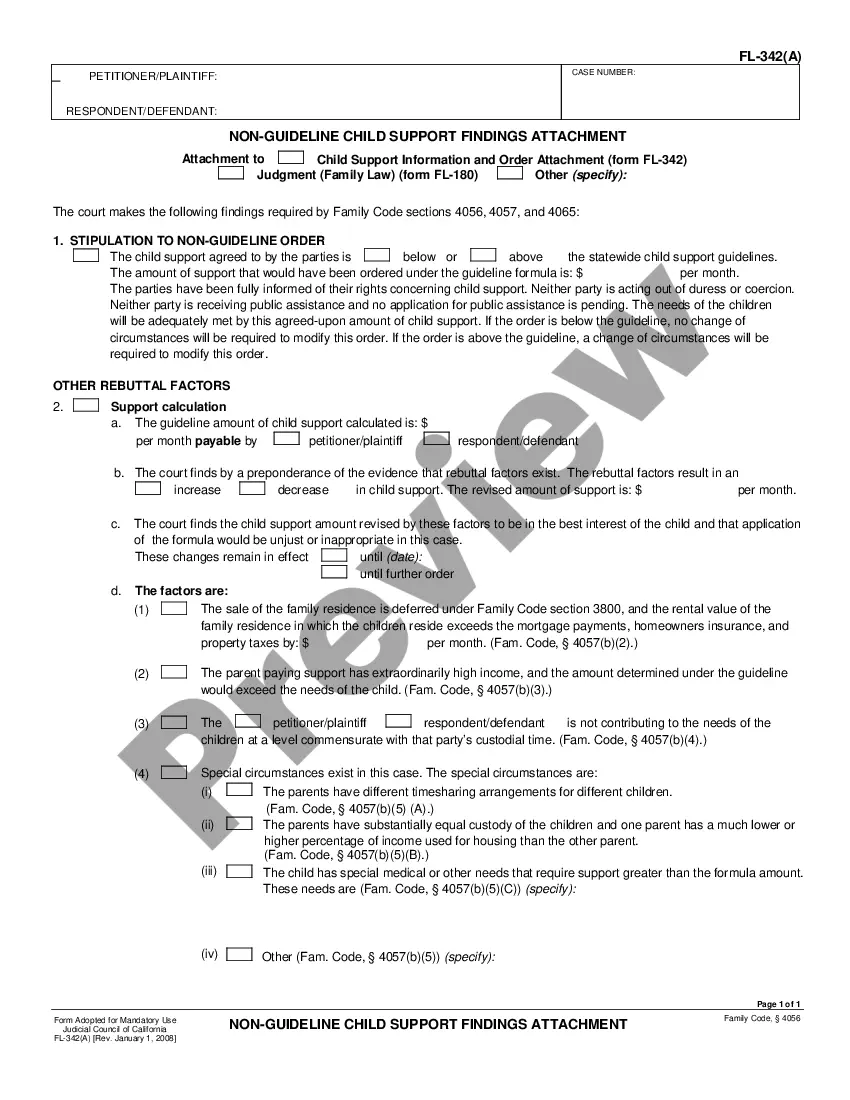

This is an official California Judicial Council family law form, which may be used in domestic litigation in California. Enter the information as indicated on the form and file with the court as appropriate.

California Schedule of Assets and Debts - Family Law

Description

How to fill out California Schedule Of Assets And Debts - Family Law?

If you are looking for precise California Schedule of Assets and Debts - Family Law examples, US Legal Forms is exactly what you require; obtain papers supplied and confirmed by state-certified attorneys.

Using US Legal Forms not only shields you from concerns related to legal documents; but you also conserve time and effort, as well as money!

And that's it. With just a few simple clicks, you have an editable California Schedule of Assets and Debts - Family Law. After you create an account, all subsequent requests will be processed even more easily. When you hold a US Legal Forms subscription, simply Log In to your profile and then click the Download button you see on the form's page. Then, when you need to use this template again, you will always find it in the My documents menu. Don’t waste your time searching through countless forms on different web sources. Acquire accurate copies from one reliable service!

- Downloading, printing, and submitting a professional template is significantly more economical than hiring an attorney to do it for you.

- To begin, complete your registration process by entering your email and creating a password.

- Follow the steps below to establish your account and acquire the California Schedule of Assets and Debts - Family Law template to resolve your issues.

- Utilize the Preview feature or review the document description (if available) to confirm that the form is what you desire.

- Verify its applicability in your residing state.

- Click Purchase Now to place your order.

- Choose a suggested pricing plan.

- Set up an account and pay using your credit card or PayPal.

- Select a convenient format and save the document.

Form popularity

FAQ

A PDD, or Preliminary Declaration of Disclosure, is a legal document required in California divorce proceedings. It involves sharing financial information, including the California Schedule of Assets and Debts - Family Law. This process promotes transparency between both parties and ensures equitable asset division. Utilizing platforms like US Legal Forms can streamline the preparation of your PDD.

Yes, you must disclose all assets during a divorce in California. This includes listing your property, bank accounts, and investments on the California Schedule of Assets and Debts - Family Law. Providing a complete and accurate picture of your finances is essential for fair division. Failing to disclose can lead to serious legal consequences.

In California, a 401(k) is considered community property if contributions were made during the marriage. Consequently, your spouse may be entitled to a portion of this retirement account depending on the length of the marriage. To manage this process correctly, utilize resources like the California Schedule of Assets and Debts - Family Law to evaluate your assets accurately. This approach can streamline negotiations regarding your 401(k) during the divorce.

In California, certain assets are generally not subject to division during a divorce. For instance, personal gifts and inheritances received by one spouse typically remain with that spouse. Additionally, any property owned before the marriage usually does not get divided. Crafting a detailed California Schedule of Assets and Debts - Family Law can help you identify which assets can and cannot be split, helping you prepare for the divorce proceedings.

In California, certain properties may be exempt from division during a divorce, such as inheritances and gifts given specifically to one spouse. Moreover, any property acquired before the marriage tends to remain with its original owner. To clarify which of your assets might be exempt, developing a comprehensive California Schedule of Assets and Debts - Family Law is essential. This will help protect your personal belongings during the divorce.

The schedule of assets and debts in California is a crucial document during a divorce process. It outlines all property and liabilities held by both spouses. This document plays a significant role in determining how assets and debts will be divided. By creating an accurate California Schedule of Assets and Debts - Family Law, you provide a clear picture of your financial situation, making the process smoother.

In California, certain assets may be protected during a divorce, such as inheritance and gifts received by one spouse. Additionally, pre-marital assets that were not commingled with community property can also be exempt from division. It's important to prepare a clear California Schedule of Assets and Debts - Family Law to identify which assets you can protect. This will help ensure a fair division process.

In California, the duration of your marriage impacts asset division during a divorce. Generally, if you are married for at least 10 years, the court considers you to have a lengthy marriage, which can influence the division of assets. Regardless of marriage length, California follows a community property law, which means you typically share equally in assets and debts acquired during the marriage. To understand your specific situation, refer to the California Schedule of Assets and Debts - Family Law for detailed guidance.

The FL 141 form, also known as the Schedule of Assets and Debts, outlines all your financial obligations and properties in a family law case. This form complements FL140 by providing more detailed insights into your finances, which is crucial for a fair division of assets during divorce or separation. Utilizing the FL 141 ensures that you maintain transparency about your financial situation, which is vital in court decisions. The uslegalforms platform can assist you in completing this form correctly and efficiently.

FL 141 is a form related to the California Schedule of Assets and Debts - Family Law, specifically used for detailing the financial disclosures in divorce cases. It is often utilized to support the information provided in FL140, serving as an additional means of clarity regarding the division of assets and debts. Completing FL 141 accurately plays a vital role in the fair resolution of financial matters. It contributes to the transparency necessary for a smooth legal process.