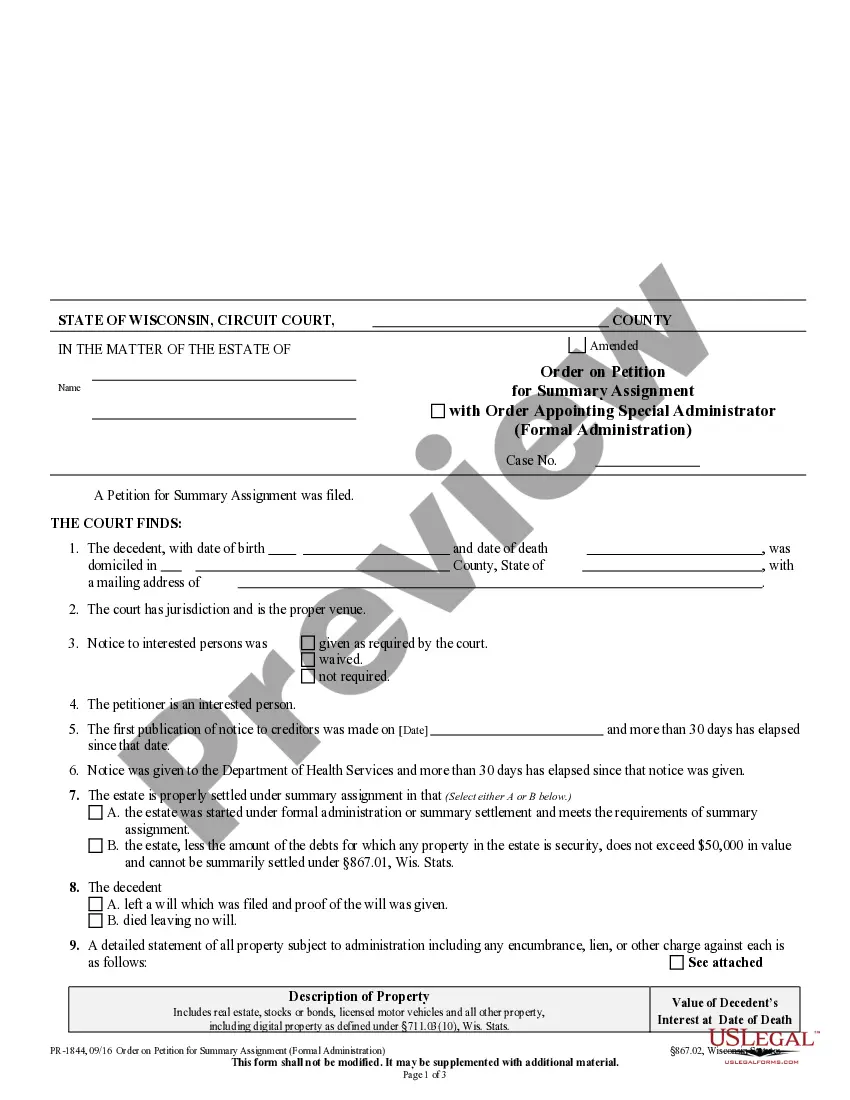

California Maximum Values for Small Estate Set Aside and Disposition of Estate without Administration is a process that allows an estate with a value of less than $166,250 to be settled without having to go through the probate court. This process is also known as a simplified probate procedure. The estate must meet certain requirements in order to qualify for this process. The two types of California Maximum Values for Small Estate Set Aside and Disposition of Estate without Administration are: 1. Set Aside: This process allows for the estate assets to be set aside for the benefit of the decedent’s heirs or beneficiaries without going through the probate court. In order to qualify for this process, the estate must have a value of less than $166,250 and the assets must be transferred within one year of the decedent’s death. 2. Disposition of Estate without Administration: This process allows for the estate to be settled without going through the probate court. In order to qualify for this process, the estate must have a value of less than $166,250 and the assets must be transferred within one year of the decedent’s death. The assets can be transferred to the decedent’s heirbeneficiaryriodoror they can be sold and the proceeds distributed according to the decedent’s wishes.

California Maximum Values for Small Estate Set Aside and Disposition of Estate without Administration

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out California Maximum Values For Small Estate Set Aside And Disposition Of Estate Without Administration?

How much duration and resources do you generally allocate for creating formal documentation.

There’s a better alternative to obtaining such documents than employing legal professionals or spending extensive time searching online for an appropriate template.

Download your California Maximum Values for Small Estate Set Aside and Disposition of Estate without Administration on your device and fill it out on a printed hard copy or electronically.

Another benefit of our library is that you can access previously downloaded documents that you securely store in your profile in the My documents tab. Retrieve them at any time and redo your paperwork as often as needed.

Save time and energy preparing official documents with US Legal Forms, one of the most reliable online services. Sign up with us today!

- US Legal Forms is the leading online repository that offers expertly crafted and verified state-specific legal forms for any purpose, including the California Maximum Values for Small Estate Set Aside and Disposition of Estate without Administration.

- To obtain and finalize an appropriate California Maximum Values for Small Estate Set Aside and Disposition of Estate without Administration template, follow these straightforward procedures.

- Review the document content to ensure it complies with your state regulations. For this, verify the document description or utilize the Preview option.

- If your legal template does not fulfill your requirements, seek a different one using the search bar located at the top of the page.

- If you are already registered with our platform, Log In and download the California Maximum Values for Small Estate Set Aside and Disposition of Estate without Administration. Otherwise, move on to the next steps.

- Click Buy now once you identify the correct document. Select the subscription plan that best suits you to access the full capabilities of our library.

- Register for an account and make the payment for your subscription. You can process payment using your credit card or through PayPal - our service is completely secure for this.

Form popularity

FAQ

In California, the limit for a small estate affidavit is $166,250 as of 2022. This means that if the total value of the estate is below this amount, you can use the California Maximum Values for Small Estate Set Aside and Disposition of Estate without Administration process. Utilizing this method can simplify the transfer of assets without going through the lengthy probate process. If you have questions about how to properly file a small estate affidavit, consider using USLegalForms to access resources and guidance tailored for California residents.

A DE 300 form is another name referring to the California Small Estate Affidavit form. It allows heirs to transfer property without going through probate, provided the estate meets the maximum values set by California law. By leveraging the benefits of the DE 300 form under California Maximum Values for Small Estate Set Aside and Disposition of Estate without Administration, you can facilitate a smooth transition of assets.

The maximum amount for a small estate affidavit in California is $166,250 as of the latest regulations. This limit allows for a more streamlined process for those dealing with smaller estates, reducing the burden of probate. Understanding this amount is crucial when you need to utilize the California Maximum Values for Small Estate Set Aside and Disposition of Estate without Administration for estate settlement.

The FL 300 form is a motion form generally used in family law cases in California. While not related specifically to small estates, understanding various court forms can be beneficial if your estate includes family law matters. To efficiently manage estates and navigate forms like those under California Maximum Values for Small Estate Set Aside and Disposition of Estate without Administration, consider utilizing uslegalforms for guidance.

A DE 300 form is the California Request for Special Notice form that allows interested parties to request notifications in probate matters. This form does not directly relate to small estate affidavits but can be crucial if you are dealing with more complex estate issues. It's always best to clarify your needs regarding the California Maximum Values for Small Estate Set Aside and Disposition of Estate without Administration when seeking advice on which forms to use.

The duration to obtain a small estate affidavit in California can vary, but it typically takes a few days to a couple of weeks. This timeframe depends on the court's processing speed and the accuracy of the submitted documents. By ensuring your paperwork is complete and applying under the California Maximum Values for Small Estate Set Aside and Disposition of Estate without Administration, you can minimize delays.

The 13101 form, known as the California Small Estate Affidavit, enables heirs to claim property without formal probate. It is designed for estates that fall under the California Maximum Values for Small Estate Set Aside and Disposition of Estate without Administration regulations. By using this form, you can quickly access the assets of the decedent without lengthy court proceedings.

Yes, in California, you must file a small estate affidavit with the court when the total value of the estate is below a specified amount. This document allows you to settle the deceased's affairs without a full probate process. The California Maximum Values for Small Estate Set Aside and Disposition of Estate without Administration streamline this process, making it easier for you to handle the estate efficiently.

To require probate, an estate in California generally must be valued above $166,250. This limit ensures that smaller estates can avoid the complexities of probate, saving time and expenses for the heirs. If your estate's value is below this amount, exploring options like California Maximum Values for Small Estate Set Aside and Disposition of Estate without Administration is beneficial. This can help simplify asset distribution, making the process more efficient for all involved.

In 2025, the small estate threshold in California is expected to be adjusted, so it’s wise to keep an eye on legislative developments. This threshold determines whether an estate can avoid probate, facilitating a smoother transition of assets. By being aware of these potential changes, you can prepare your estate planning strategies effectively. Utilizing available resources like California Maximum Values for Small Estate Set Aside and Disposition of Estate without Administration can also provide clarity and guidance in this process.