This Operating Agreement is for a Limited Liability Company with only one Member. This form may be perfect for an LLC started by one person. You make changes to fit your needs and add description of your business. Approximately 10 pages. It allows for eventual adding of new Members to LLC.

California Single Member Limited Liability Company LLC Operating Agreement

Description

Key Concepts & Definitions

Single Member Limited Liability Company (LLC): A business structure allowed by state statute that is owned by one person or entity, providing liability protection while allowing for pass-through taxation. Disregarded Entity: For tax purposes, a single-member LLC is treated as a disregarded entity, meaning its financial activities are reported on the owner's personal tax returns. Operating Agreement: A document that outlines the management structure and operational guidelines of an LLC.

Step-by-Step Guide to Forming a Single Member LLC

- Choose a unique name for your LLC compliant with your state's regulations.

- Appoint a registered agent who will handle legal and tax documents on behalf of the LLC.

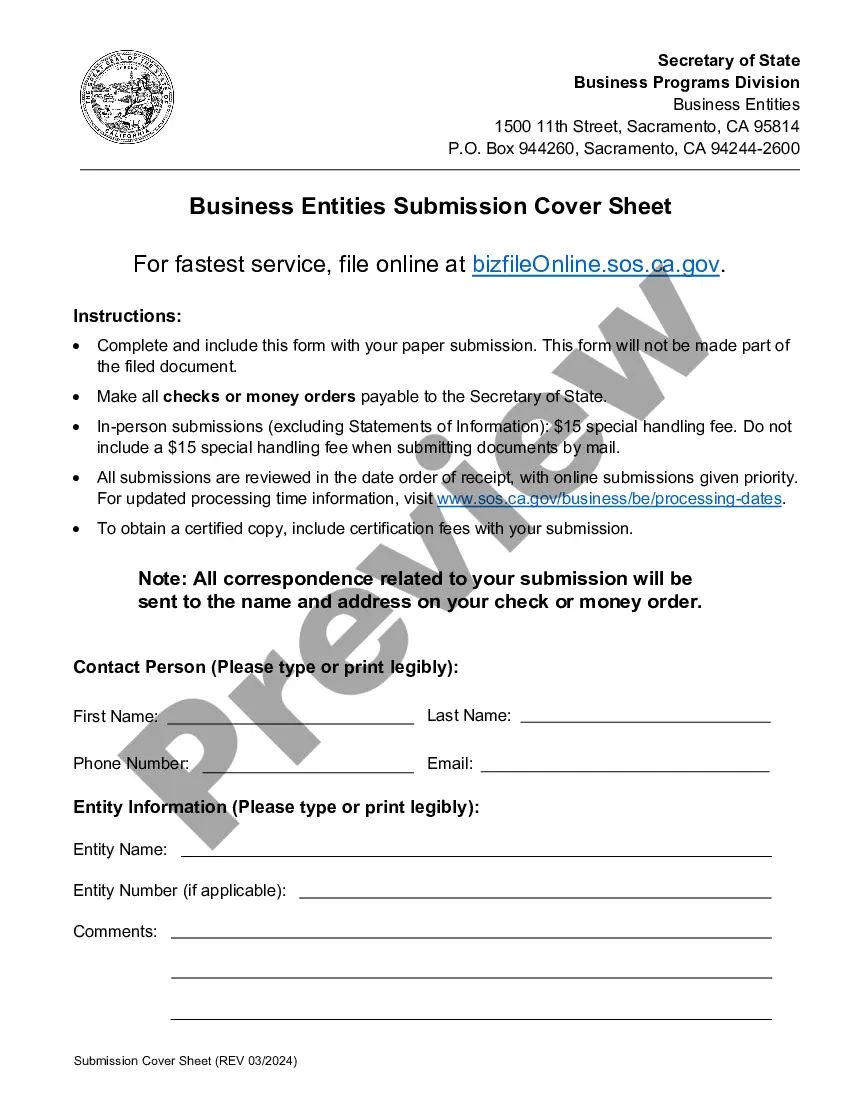

- File the Articles of Organization with your state's Secretary of State office.

- Draft an operating agreement to establish the structure and rules of the business.

- Obtain necessary licenses and permits as required for your industry and location.

- Open a business bank account and consider applying for business credit cards to separate personal and business finances.

- Keep consistent financial records by understanding bookkeeping basics to streamline tax reporting and compliance.

Risk Analysis for Single Member LLCs

Single member LLCs offer liability protection, but they also expose the owner to risks such as personal asset vulnerabilities if the LLC's corporate veil is pierced through malpractice or non-compliance. Additionally, reliance on single ownership may limit financial and strategic opportunities as compared to multi-member LLCs which can attract more diverse investment.

Pros & Cons

- Pros:

- Limited liability protection

- Simplified tax reporting as a disregarded entity

- Operational flexibility with fewer formalities than a corporation

- Cons:

- Potential for personal liability in cases of negligence

- Limited growth potential due to single-member ownership

- Can be seen as less credible by some suppliers and financiers

FAQ

- What is the difference between a single-member LLC and a sole proprietorship? The key difference is that a single-member LLC provides liability protection separating the owner's personal assets from the business debts and obligations, unlike a sole proprietorship.

- Can a single-member LLC hire employees? Yes, single-member LLCs can hire employees, and they must comply with all relevant local, state, and federal employment laws.

- How does a single-member LLC impact personal credit? If not separated properly, business debts and transactions may affect the owner's personal credit score.

Key Takeaways

Forming a single-member LLC effectively separates personal liabilities from business activities while maintaining tax simplicity. It's crucial to adhere to legal and operational rules to protect this structure and benefit from its advantages.

How to fill out California Single Member Limited Liability Company LLC Operating Agreement?

If you are looking for precise California Single Member Limited Liability Company LLC Operating Agreement examples, US Legal Forms is exactly what you require; find documents crafted and reviewed by state-authorized lawyers.

Using US Legal Forms not only alleviates your concerns related to legal paperwork; you also save time, effort, and money! Downloading, printing, and completing a professional template is far less expensive than hiring a lawyer to do it for you.

And that's it. In just a few simple clicks, you obtain an editable California Single Member Limited Liability Company LLC Operating Agreement. After setting up your account, all future orders will be even easier to process. Once subscribed to US Legal Forms, simply Log In to your account and click the Download button visible on the form's page. Then, whenever you need to use this template again, you'll always be able to find it in the My documents section. Don't waste your time searching through countless forms on various online sources. Order accurate templates from one secure service!

- To begin, complete your registration process by providing your email and creating a secure password.

- Follow the steps below to set up an account and acquire the California Single Member Limited Liability Company LLC Operating Agreement template to address your needs.

- Utilize the Preview feature or examine the document description (if available) to ensure that the template is what you need.

- Verify its validity in your region.

- Click Buy Now to place your order.

- Choose a suggested pricing plan.

- Create an account and pay with your credit card or PayPal.

- Select a suitable format and save the documents.

Form popularity

FAQ

While California law does not require a single member LLC to have an operating agreement, it is highly recommended. A California Single Member Limited Liability Company LLC Operating Agreement helps outline ownership, management responsibilities, and operational processes. This document is crucial for establishing clear rules and protecting your personal assets. Using services like uslegalforms can assist you in creating a customized operating agreement.

Yes, you can form a single member LLC in California. A California Single Member Limited Liability Company LLC provides the same liability protection as multi-member LLCs. It offers simplicity in management since you control all aspects of the business. Many entrepreneurs benefit from this structure as it combines organizational flexibility with personal liability protection.

If a California Single Member Limited Liability Company LLC does not have an operating agreement, it may face ambiguity regarding management and operational procedures. This lack of documentation can lead to confusion and disputes over decisions and responsibilities. Moreover, having an operating agreement clarifies the company's structure and can prevent potential legal issues. It is advisable to create one to formalize these vital aspects.

While California does not legally require an operating agreement for LLCs, including one for your California Single Member Limited Liability Company LLC is highly recommended. An operating agreement establishes clear guidelines for your business operations and can help avoid potential disputes. By using a reliable service like US Legal Forms, you can easily craft an agreement that suits your needs.

California does allow single-member LLCs, making it an excellent option for entrepreneurs seeking liability protection without the complexities of a corporation. This structure simplifies management and taxation, providing you with flexibility in running your business. Therefore, you can confidently proceed with your California Single Member Limited Liability Company LLC.

Certain individuals and entities may not form an LLC in California, including banks, insurance companies, and specific professional service providers like lawyers and accountants who must follow different regulations. Moreover, anyone who has been convicted of a felony related to fraud may face restrictions. Be sure to check legal requirements while establishing your California Single Member Limited Liability Company LLC.

Yes, California does recognize single-member LLCs, giving them the same legal standing as multi-member LLCs. This structure allows you to benefit from limited liability protection while having full control over your business operations. Thus, you can confidently operate under your California Single Member Limited Liability Company LLC.

To avoid the $800 minimum franchise tax for your California Single Member Limited Liability Company LLC, consider opting for tax exemptions available to new businesses during their first year. Additionally, it's crucial to consult with a tax professional to explore valid deductions and ensure compliance with state regulations. Always stay informed about ongoing tax laws and policies affecting your LLC.

To create an operating agreement for your California Single Member Limited Liability Company LLC, start by outlining the purpose and management structure of your LLC. Include details such as ownership rights, responsibilities, and procedures for decision-making. Utilizing a template can streamline this process, and platforms like US Legal Forms offer customizable agreements tailored to your specific needs.

A single member LLC is a distinct business structure that combines the liability protection of a corporation with the tax flexibility of a partnership. This structure allows a single individual to own and operate the LLC while shielding personal assets from business debts. Furthermore, when you establish a California Single Member Limited Liability Company (LLC), you create a separate legal entity, which can enhance credibility and streamline business processes.