Arizona Assignment of After Payout Interest

Description

How to fill out Assignment Of After Payout Interest?

Discovering the right authorized record format can be quite a have a problem. Obviously, there are plenty of web templates available on the net, but how can you discover the authorized develop you will need? Utilize the US Legal Forms internet site. The assistance offers 1000s of web templates, for example the Arizona Assignment of After Payout Interest, which can be used for company and personal demands. All the varieties are examined by professionals and fulfill federal and state requirements.

When you are presently registered, log in in your bank account and click on the Obtain option to get the Arizona Assignment of After Payout Interest. Make use of bank account to appear from the authorized varieties you might have acquired formerly. Go to the My Forms tab of your own bank account and obtain yet another version in the record you will need.

When you are a brand new customer of US Legal Forms, listed below are simple guidelines for you to comply with:

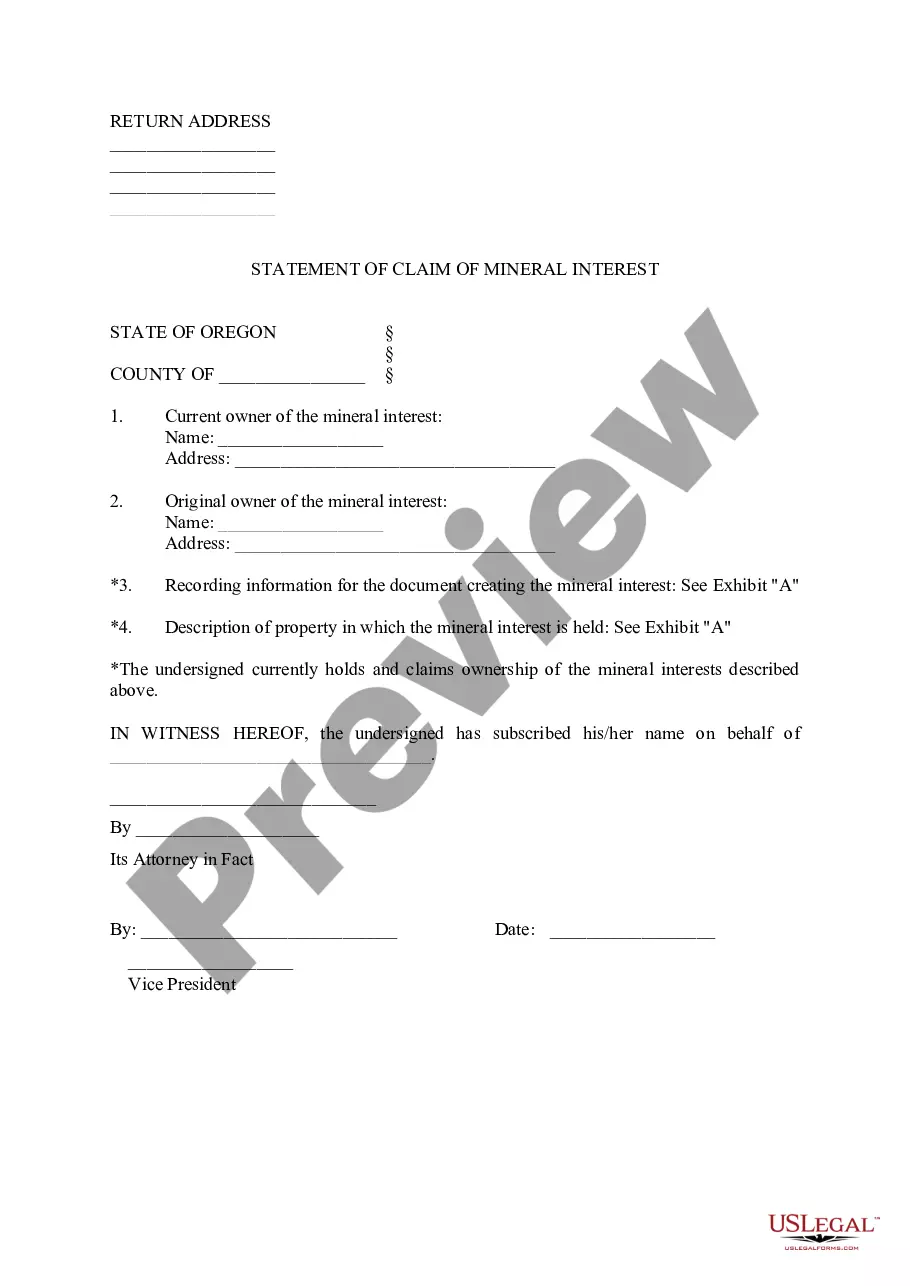

- Initial, make certain you have chosen the correct develop to your metropolis/state. You can look through the shape using the Review option and browse the shape information to ensure this is basically the best for you.

- In case the develop will not fulfill your needs, use the Seach field to find the proper develop.

- When you are positive that the shape is proper, go through the Purchase now option to get the develop.

- Select the costs strategy you want and enter the required information. Design your bank account and buy an order with your PayPal bank account or Visa or Mastercard.

- Opt for the document format and download the authorized record format in your gadget.

- Comprehensive, edit and printing and signal the received Arizona Assignment of After Payout Interest.

US Legal Forms may be the most significant local library of authorized varieties in which you can find a variety of record web templates. Utilize the company to download professionally-made papers that comply with express requirements.

Form popularity

FAQ

The lessee of an oil or gas lease can assign the entire lease or part of it. In other words, the lessee can sell or transfer part of the estate or the entire estate to which they have the working rights. The assignee is assigned the working interest and lease obligations, including override royalty.

You may convey overriding royalty interest on either an Assignment of Record Title Interest (Form 3000-3), a Transfer of Operating Rights (Form 3000-3a), or on a private assignment. We only require filing of one signed copy per assignment plus a nonrefundable filing fee found at 43 CFR 3000.12.

ORRIs are created out of the working interest in a property and do not affect mineral owners. An overriding royalty interest (ORRI) is often kept or assigned to a geologist, landman, brokerage, or any entity that was able to reserve an interest in the properties.

An overriding royalty interest (ORRI) is an undivided interest in a mineral lease giving the holder the right to a proportional share (receive revenue) of the sale of oil and gas produced. The ORRI is carved out of the working interest or lease.

An overriding royalty interest (ORRI) is an undivided interest in a mineral lease giving the holder the right to a proportional share (receive revenue) of the sale of oil and gas produced. The ORRI is carved out of the working interest or lease.

Overriding Royalty Interest Conveyance means an assignment, in form and substance acceptable to Lender, pursuant to which Borrower grants in favor of Lender an overriding royalty interest equal to six and one-fourth percent (6.25%) of Hydrocarbons produced, saved and sold or used off the premises of the relevant Lease, ...