Arizona Letter for Account Paid in Full

Description

How to fill out Arizona Letter For Account Paid In Full?

If you need to full, down load, or printing authorized file web templates, use US Legal Forms, the biggest collection of authorized types, that can be found online. Use the site`s easy and handy look for to discover the files you will need. A variety of web templates for company and individual functions are sorted by categories and states, or search phrases. Use US Legal Forms to discover the Arizona Letter for Account Paid in Full with a few click throughs.

If you are already a US Legal Forms customer, log in in your account and then click the Obtain button to find the Arizona Letter for Account Paid in Full. You can even gain access to types you formerly acquired in the My Forms tab of the account.

If you work with US Legal Forms the first time, refer to the instructions beneath:

- Step 1. Be sure you have chosen the form to the proper metropolis/country.

- Step 2. Make use of the Review solution to look over the form`s content material. Don`t forget about to see the outline.

- Step 3. If you are unsatisfied using the kind, take advantage of the Look for discipline at the top of the monitor to locate other versions of the authorized kind web template.

- Step 4. Upon having located the form you will need, select the Get now button. Pick the prices strategy you like and include your qualifications to sign up to have an account.

- Step 5. Method the purchase. You should use your bank card or PayPal account to accomplish the purchase.

- Step 6. Select the file format of the authorized kind and down load it in your device.

- Step 7. Complete, change and printing or indication the Arizona Letter for Account Paid in Full.

Every single authorized file web template you buy is yours eternally. You have acces to every kind you acquired within your acccount. Click the My Forms section and decide on a kind to printing or down load again.

Compete and down load, and printing the Arizona Letter for Account Paid in Full with US Legal Forms. There are many expert and express-distinct types you can use to your company or individual requires.

Form popularity

FAQ

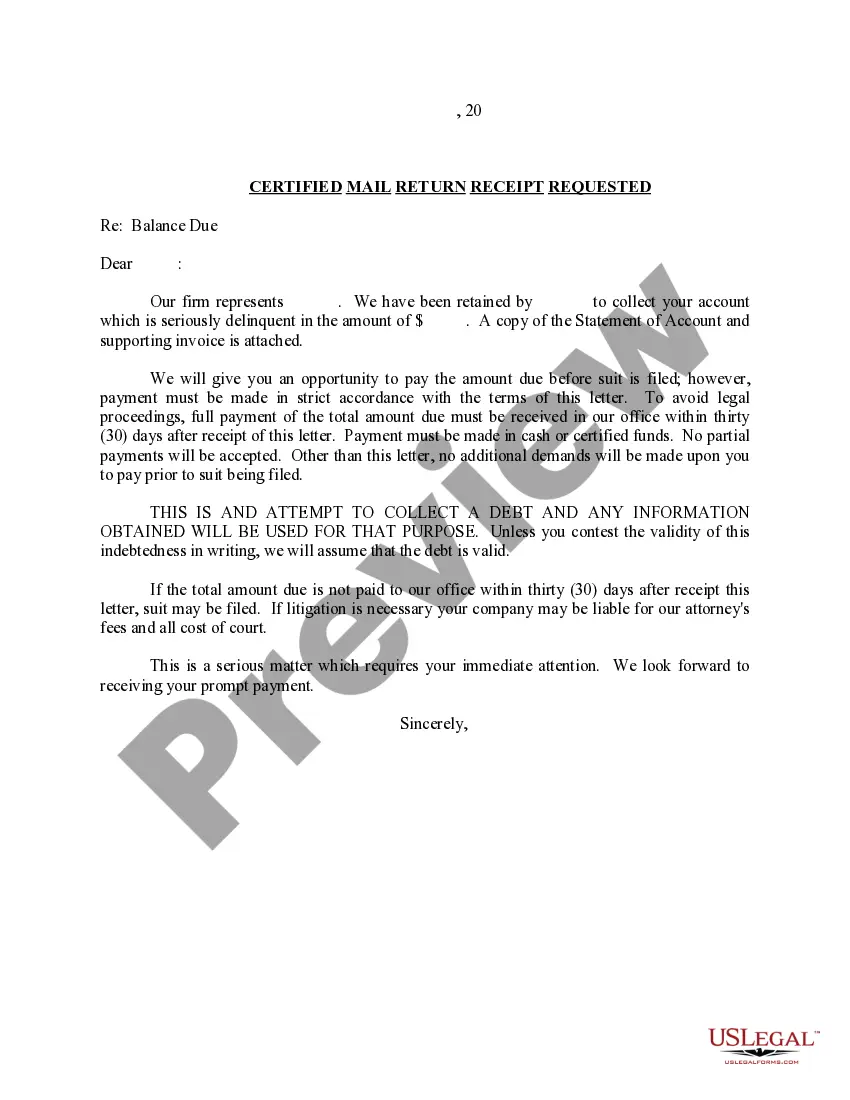

A settlement letter is a written offer from a creditor to settle a debt, and serves as legal documentation of this arrangement. A settlement letter is a legally binding agreement on both you and the creditor, and technically replaces your original contract with them.

What is a Paid in Full Letter? A paid in full letter states that you finished payments, and you want acknowledgment from the collector that they agree and won't continue collection efforts. It serves three purposes.

A Debt Release Letter is a letter written by a creditor to a debtor when their debt has been recouped in full. It establishes that a financial obligation no longer exists between the creditor and debtor.

A debt settlement letter is a written proposal for you to offer a specific amount of money in exchange for forgiveness of your debt. These letters address why you're unable to pay the debt, how much you're willing to pay now, and what you would like from the creditors in return.

Full and final settlement means that you ask your creditors to let you pay a lump sum instead of the full balance you owe on the debt. In return for having a lump-sum payment, the creditor agrees to write off the rest of the debt.

How to Write a Paid-in-Full LetterWrite the date on the top of the page.Next, include your personal contact details: your name, address, and phone number.Write the creditor or debt collection agency's contact details next.Write the heading of the letter.Write an introduction.Write the body of the letter.More items...?

A final demand letter is a letter sent in an attempt to collect a debt or repayment. The letter is sent prior to a collector or financial institution filing legal action against a debtor.

I am requesting that you provide verification of this debt. Please send the following information: The name and address of the original creditor, the account number, and the amount owed. Verification that there is a valid basis for claiming I am required to pay the current amount owed.

The language can be as simple as: In order to settle this matter amicably, I offer you the sum of amount (inclusive of interests and costs) as the full and final settlement of the above claim/debt.

Your debt settlement proposal letter must be formal and clearly state your intentions, also as what you expect from your creditors. you ought to also include all the key information your creditor will got to locate your account on their system, which includes: Your full name used on the account. Your full address.