Arizona Self-Employed Wait Staff Services Contract

Description

How to fill out Self-Employed Wait Staff Services Contract?

It is feasible to dedicate numerous hours online looking for the legal document template that fulfills the federal and state requirements you require. US Legal Forms offers thousands of legal forms that are reviewed by experts.

It is easy to download or print the Arizona Self-Employed Wait Staff Services Contract from the platform. If you already possess a US Legal Forms account, you can Log In and then click the Download button. After that, you can complete, modify, print, or sign the Arizona Self-Employed Wait Staff Services Contract.

Every legal document template you obtain is yours for an extended period. To acquire another copy of any purchased form, navigate to the My documents tab and click the corresponding button.

Complete the transaction. You can use your credit card or PayPal account to pay for the legal form. Choose the file format from the document and download it to your device. Make modifications to your document if necessary. You can complete, edit, sign, and print the Arizona Self-Employed Wait Staff Services Contract. Download and print thousands of document templates using the US Legal Forms website, which offers the largest selection of legal forms. Utilize professional and state-specific templates to address your business or personal needs.

- If you are using the US Legal Forms site for the first time, follow the simple instructions below.

- First, ensure that you have chosen the correct document template for your state/region of preference.

- Review the form summary to confirm you have selected the correct type.

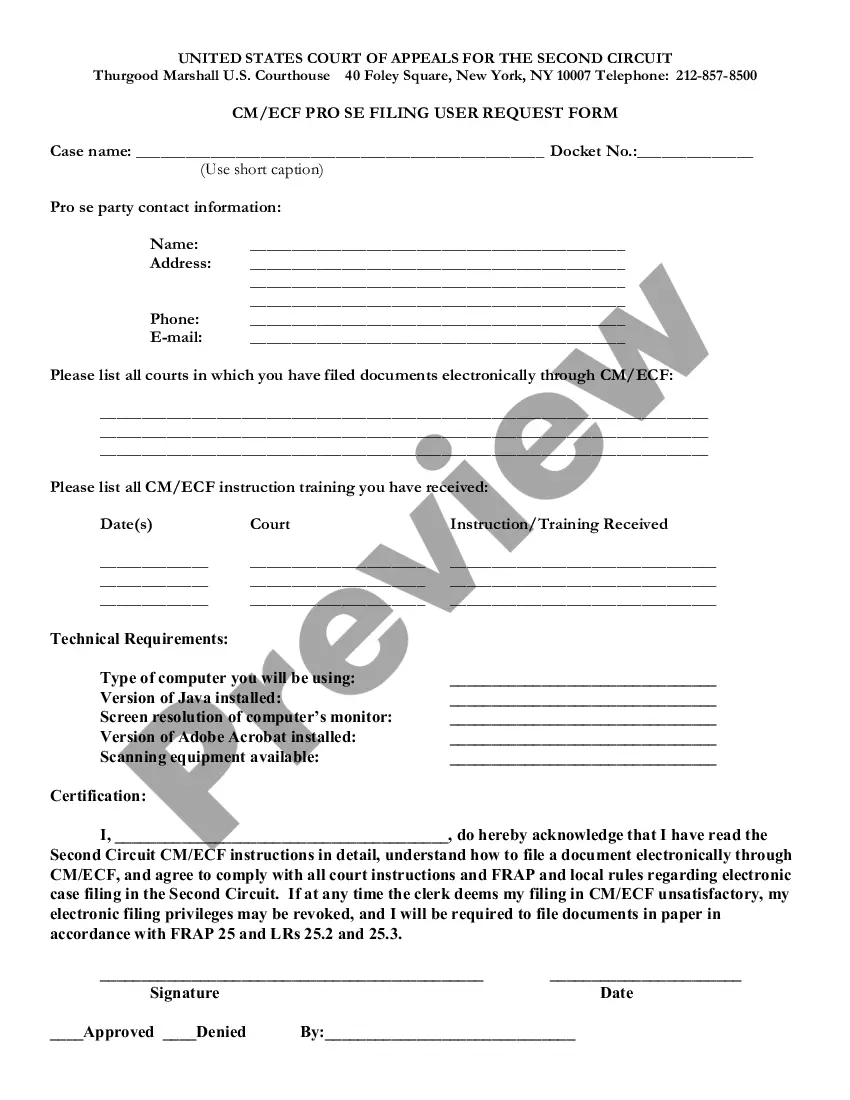

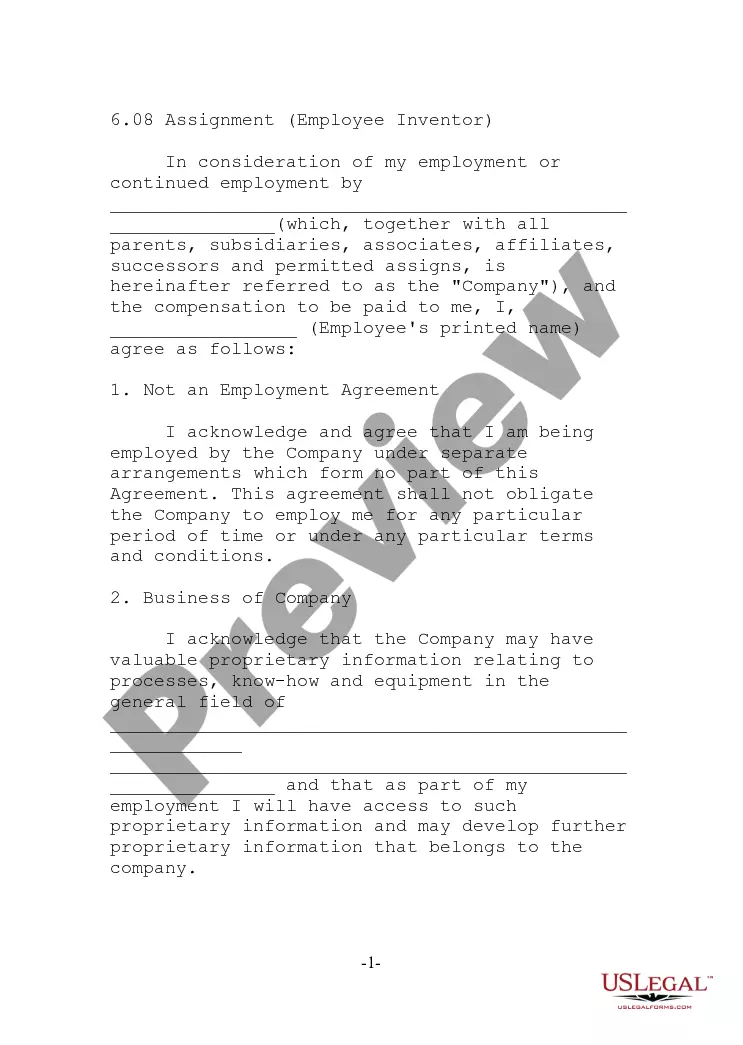

- If available, utilize the Review button to examine the document template as well.

- If you wish to obtain another version of the form, use the Lookup field to find the template that satisfies your requirements.

- Once you have found the template you desire, click on Buy now to proceed.

- Select the pricing plan you prefer, enter your credentials, and register for your account on US Legal Forms.

Form popularity

FAQ

To work as an independent contractor in the US, you typically need to obtain an Employer Identification Number (EIN) and possibly a business license, depending on your location. In Arizona, having an Arizona Self-Employed Wait Staff Services Contract can streamline this process by providing a formal agreement with your clients. This contract will also help you maintain compliance with local laws and regulations.

Independent contractors in Arizona must meet certain legal criteria to ensure compliance. You need to have a signed contract that outlines the services you provide, payment terms, and other essential details. An Arizona Self-Employed Wait Staff Services Contract can help you establish these legal requirements clearly. This way, both you and your client understand the expectations.

As a 1099 employee, you are classified as an independent contractor. This means you have more flexibility in how you manage your work. However, it also means you must handle your own taxes and may not receive benefits like health insurance. Understanding the specifics of an Arizona Self-Employed Wait Staff Services Contract can help clarify your responsibilities.

Yes, contract work can indeed count as self-employment, especially if the individual operates independently and manages their own business. However, the specifics can depend on the nature of the work agreement and the level of control exercised by the client. For those in the wait staff sector, having an Arizona Self-Employed Wait Staff Services Contract can help define your status and responsibilities clearly. It's vital to understand these distinctions for proper legal and tax purposes.

Self-employed individuals in Arizona must adhere to several legal requirements, such as obtaining necessary licenses and permits. Additionally, they should maintain accurate financial records and understand their tax obligations. An Arizona Self-Employed Wait Staff Services Contract can help clarify your business arrangement and ensure compliance with local regulations. For detailed guidance, consider using uslegalforms to navigate the legal landscape.

Absolutely, having a contract is not only possible but recommended for self-employed individuals. A contract provides legal protection and clarifies the expectations between you and your clients. When working as a self-employed wait staff member, an Arizona Self-Employed Wait Staff Services Contract ensures that all terms are documented and agreed upon. Utilizing uslegalforms can help you create a contract that meets your professional requirements.

Not necessarily. Contract employees may be classified as self-employed if they operate independently and manage their own business activities. However, if they work under a contract that defines an employer-employee relationship, they may not be self-employed. Understanding the classification is essential, especially when drafting an Arizona Self-Employed Wait Staff Services Contract. This clarity helps protect your rights and responsibilities.

Yes, a self-employed person can absolutely have a contract. This contract serves to outline the terms of their services, payment, and expectations with clients. For those offering services as wait staff in Arizona, an Arizona Self-Employed Wait Staff Services Contract is an effective way to formalize the arrangement. Using uslegalforms can simplify the process of creating a tailored contract that meets your specific needs.

Self-employed individuals work for themselves, providing services directly to clients without a formal employer-employee relationship. In contrast, contracted individuals may work under a contract that outlines specific terms and conditions, possibly for a particular duration. An Arizona Self-Employed Wait Staff Services Contract can help clarify the nature of the work arrangement while ensuring both parties are on the same page regarding responsibilities. Understanding these distinctions is important for proper classification.

In Arizona, a contract becomes legally binding when it contains several essential elements: an offer, acceptance, consideration, and mutual intent to enter into the agreement. These elements ensure that both parties understand their obligations and the terms of the contract. For an Arizona Self-Employed Wait Staff Services Contract, having clear terms about the services provided and payment details is crucial. You can rely on uslegalforms to create a contract that meets all legal requirements.