Arizona Self-Employed Paving Services Contract

Description

How to fill out Self-Employed Paving Services Contract?

If you require to accumulate, acquire, or print legal document templates, utilize US Legal Forms, the largest collection of legal forms available online.

Take advantage of the site’s straightforward and user-friendly search to find the documents you need.

A variety of templates for business and personal purposes are organized by categories and states, or keywords.

Step 4. Once you find the form you need, click on the Get now button. Choose your preferred pricing plan and enter your details to register for an account.

Step 5. Complete the payment. You can use your credit card or PayPal account to finalize the transaction.

- Utilize US Legal Forms to access the Arizona Self-Employed Paving Services Agreement in just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click the Download option to obtain the Arizona Self-Employed Paving Services Agreement.

- You can also access forms you have previously saved in the My documents tab of your account.

- If this is your first time using US Legal Forms, follow the instructions below.

- Step 1. Confirm you have selected the form for the correct city/state.

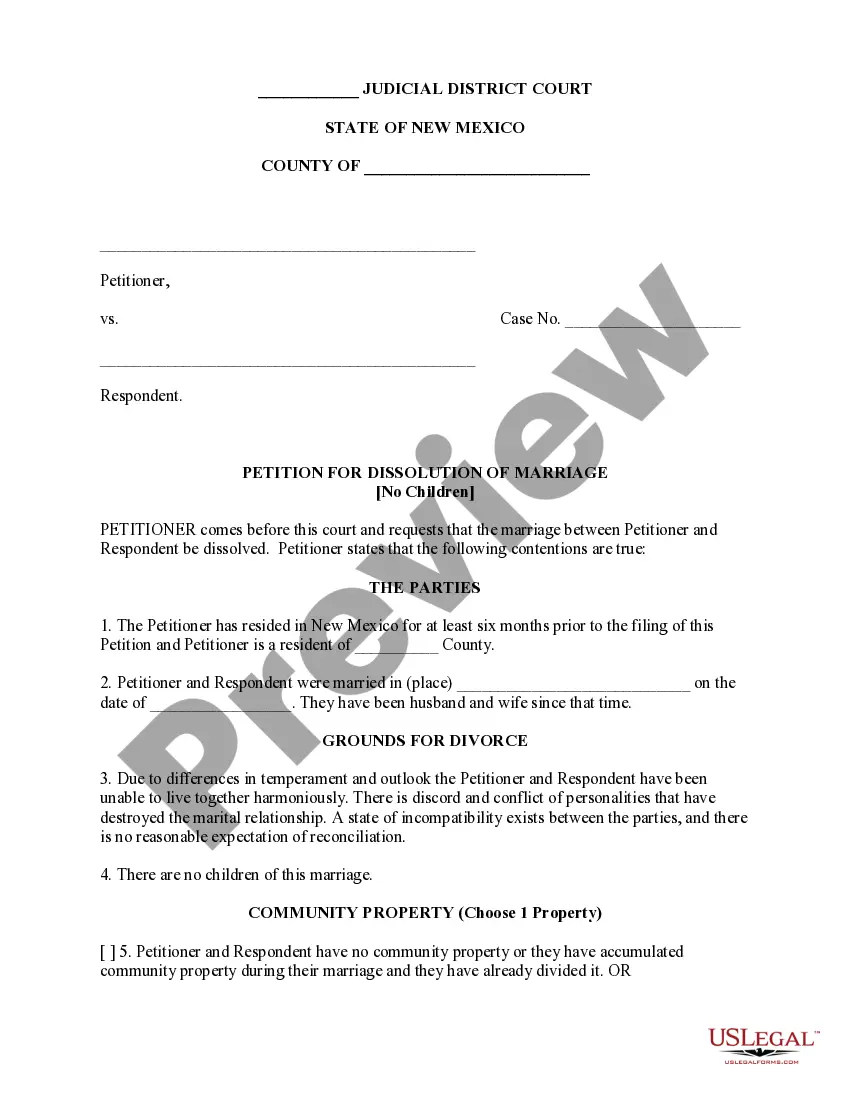

- Step 2. Use the Review option to examine the form’s content. Remember to read through the summary.

- Step 3. If you are unsatisfied with the form, use the Search box at the top of the screen to find alternative versions of the legal form template.

Form popularity

FAQ

Under Arizona's statutory sales tax structure, prime contractors are liable for sales tax on their gross contracting receipts minus the standard 35% labor deduction. Subcontractors, if they can establish that they were working for a taxable prime contractor, will be exempt from the sales tax.

The sale of tangible personal property is subject to tax but the installation labor is exempt if it is separately stated on the invoice and in the company's books and records.

Elements of a Construction ContractName of contractor and contact information.Name of homeowner and contact information.Describe property in legal terms.List attachments to the contract.The cost.Failure of homeowner to obtain financing.Description of the work and the completion date.Right to stop the project.More items...

What Should Be in a Construction Contract?Identifying/Contact Information.Title and Description of the Project.Projected Timeline and Completion Date.Cost Estimate and Payment Schedule.Stop-Work Clause and Stop-Payment Clause.Act of God Clause.Change Order Agreement.Warranty.More items...

5 Key Elements Every Construction Contract Should Contain1) The project's scope.2) The cost and payment terms.3) The project's time frame.4) Protection against lien law.5) Dispute resolution clauses.

How do I create an Independent Contractor Agreement?State the location.Describe the type of service required.Provide the contractor's and client's details.Outline compensation details.State the agreement's terms.Include any additional clauses.State the signing details.

What should be included in a Contractor Agreement?Statement of Relationship.Project Description.Payment and Billing Terms.Responsibilities of Each Party.Project Timeline and Deadlines.Termination Conditions.Nondisclosure Terms, and Confidentiality and Non-Compete Clauses.

The 4 Different Types of Construction ContractsLump Sum Contract. A lump sum contract sets one determined price for all work done for the project.Unit Price Contract.Cost Plus Contract.Time and Materials Contract.

A construction contractor is taxable on the gross income derived from construction contracting performed within the City of Phoenix. A contractor who furnishes labor only (such as a handyman) is subject to the same provisions as a contractor who furnishes both labor and materials.