Arizona Hauling Services Contract - Self-Employed

Description

How to fill out Hauling Services Contract - Self-Employed?

Are you currently in a circumstance where you need documents for either corporate or personal purposes almost every time.

There are numerous legal document templates available online, but finding reliable ones is not simple.

US Legal Forms offers thousands of template options, including the Arizona Hauling Services Contract - Self-Employed, designed to meet federal and state requirements.

Once you find the right template, click Purchase now.

Select the pricing plan you prefer, provide the necessary information to create your account, and complete the purchase using your PayPal or credit card. Choose a suitable format and download your copy. Access all the document templates you have purchased in the My documents section. You can obtain another copy of the Arizona Hauling Services Contract - Self-Employed anytime if needed. Just click on the desired template to download or print the document design. Use US Legal Forms, the most extensive collection of legal templates, to save time and avoid errors. The service provides professionally crafted legal document templates that you can use for various purposes. Create your account on US Legal Forms and start making your life a bit easier.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Arizona Hauling Services Contract - Self-Employed template.

- If you do not have an account and want to start using US Legal Forms, follow these steps.

- Find the template you need and ensure it corresponds to the appropriate city/state.

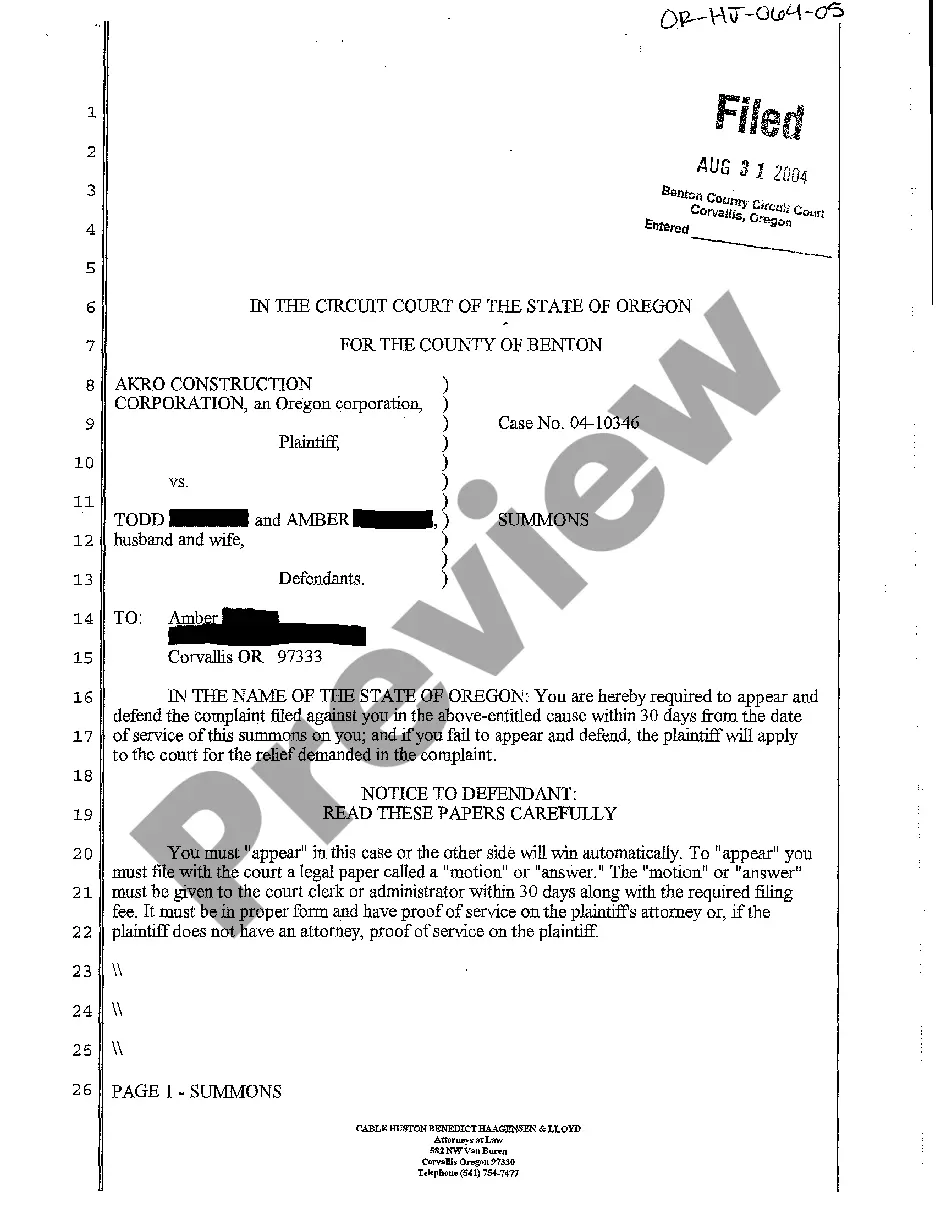

- Use the Preview button to examine the form.

- Review the description to ensure you have selected the correct template.

- If the template is not what you are looking for, utilize the Search field to locate the template that meets your needs.

Form popularity

FAQ

As an independent contractor offering Arizona hauling services, you will need to complete several important forms. Typically, you should fill out a W-9 form to provide your taxpayer information, which is crucial for tax purposes. Additionally, drafting an Arizona Hauling Services Contract - Self-Employed is essential to outline the terms of your work with clients clearly. Utilizing platforms like US Legal Forms can simplify this process, providing you with templates and guidance to ensure all documentation is correct and legally sound.

Both terms convey a similar meaning, yet 'independent contractor' often implies a specific type of work agreement. Choosing 'self-employed' might resonate more with clients seeking flexibility and autonomy in your services. Regardless of your choice, ensure your Arizona Hauling Services Contract - Self-Employed clearly outlines your role and responsibilities.

In Arizona, you can generally perform small tasks without a contractor license, but the limits depend on the nature and scope of the work. If you plan on handling larger projects, it is wise to obtain a contractor license for coverage. Using an Arizona Hauling Services Contract - Self-Employed can also protect you in these circumstances.

In many cases, independent contractors in Arizona should obtain a business license to operate legally. The requirements can vary by city or county, so check local regulations. By having proper licensing and an Arizona Hauling Services Contract - Self-Employed, you ensure a professional image and gain trust from your clients.

Yes, registering your business as an independent contractor in Arizona is generally required, especially if you operate under a business name different from your legal name. This registration provides legitimacy and allows you to open a business bank account. Consider creating an Arizona Hauling Services Contract - Self-Employed for clarity with your clients.

In Arizona, 1099 employees, often classified as independent contractors, must complete a W-9 form for tax purposes. You are responsible for paying your own taxes and should file a Schedule C with your federal tax return. Keep in mind, understanding your obligations under the Arizona Hauling Services Contract - Self-Employed will help you stay compliant and avoid penalties.

Subcontractor vs Independent contractor is a difference in an employment relationship with a laborer. Independent contractors are employed and paid directly by the employer while subcontractors are employed by an independent contractor and are paid by them.

Typically, a contractor works under a contractual agreement to provide services, labor or materials to complete a project. Subcontractors are businesses or individuals that carry out work for a contractor as part of the larger contracted project.

Becoming an independent contractor is one of the many ways to be classified as self-employed. By definition, an independent contractor provides work or services on a contractual basis, whereas, self-employment is simply the act of earning money without operating within an employee-employer relationship.

The three types of self-employed individuals include:Independent contractors. Independent contractors are individuals hired to perform specific jobs for clients, meaning that they are only paid for their jobs.Sole proprietors.Partnerships.